95

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

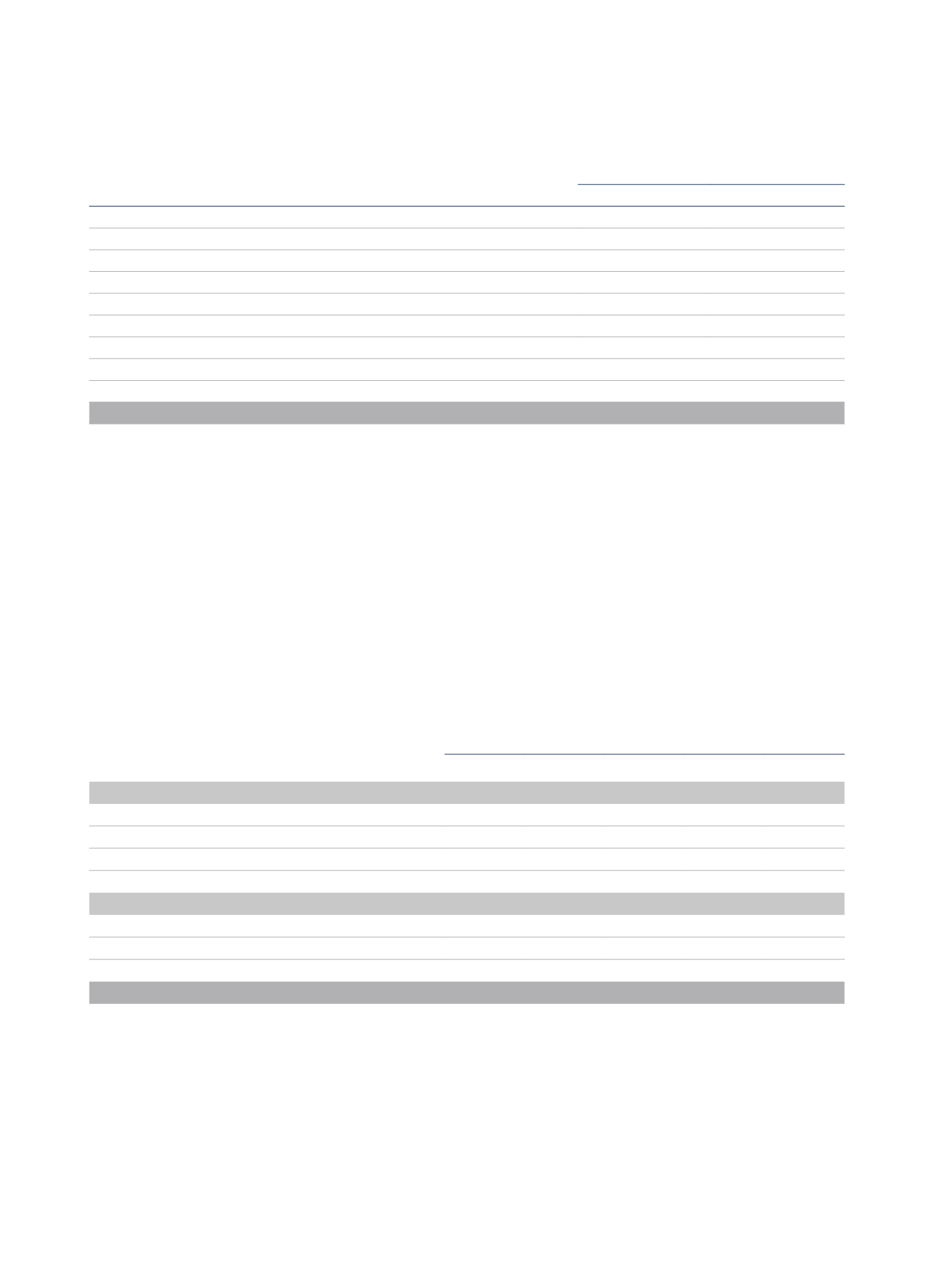

16.- OTHER NON-CURRENT LIABILITIES

The breakdown of the “Other non-current liabilities” item in the accompanying consolidated balance sheets, at 31 December 2015 and 2014, is as

follows:

Thousands of euros

2015

2014

At fair value:

Put option for Donnafugata Resort, S.r.l.

-

10,670

_

At amortised cost:

Purchase option on Sotocaribe, S.L. (see note 2.5.4)

58,250

58,250

Linearisation of revenue

14,946

15,895

Issue of promissory notes

-

1,810

Acquisition of Hoteles Royal, S.A.

19,238

-

Loans from shareholders

550

533

Other liabilities

6,196

1,326

99,180

88,484

On 26 October 2012 the arbitration tribunal ratified the valuation of Donnafugata Resort, S.r.l. made by an independent valuer in response to the

communication made by the non-controlling interests of said company in 2010 of their intention to exercise the put option (at 31 December 2012

they represented 8.81% of the share capital). As a result of this decision, the Parent recognised the put option of the non-controlling interests

in accordance with said valuation, which amounted to 9,900 thousand euros. In December 2014, an arbitration ruling set the costs and financial

expenses payable by the Group at 770 thousand euros. The change in the fair value of this option was recognised under the heading “Change in

fair value of financial instruments” in the accompanying comprehensive consolidated profit and loss statement for 2014. On 22 October 2015, a

reverse factoring solution was issued to settle the liability that eventually amounted to 10,335 thousand euros, 165 thousand euros was reverted to

the heading “Change in fair value of financial instruments” in the comprehensive consolidated profit and loss statement for 2015 and the remaining

amount covered the reverse factoring expenses, and all liabilities had been reclassified under “Other current liabilities” (see note 21).

With the acquisition of Hoteles Royal, S.A., the amount of 77.1 million euros is paid, while 17.7 million euros (19.2 million euros with the updated

exchange date) remains pending, payable in two years (see Note 2.5.4).

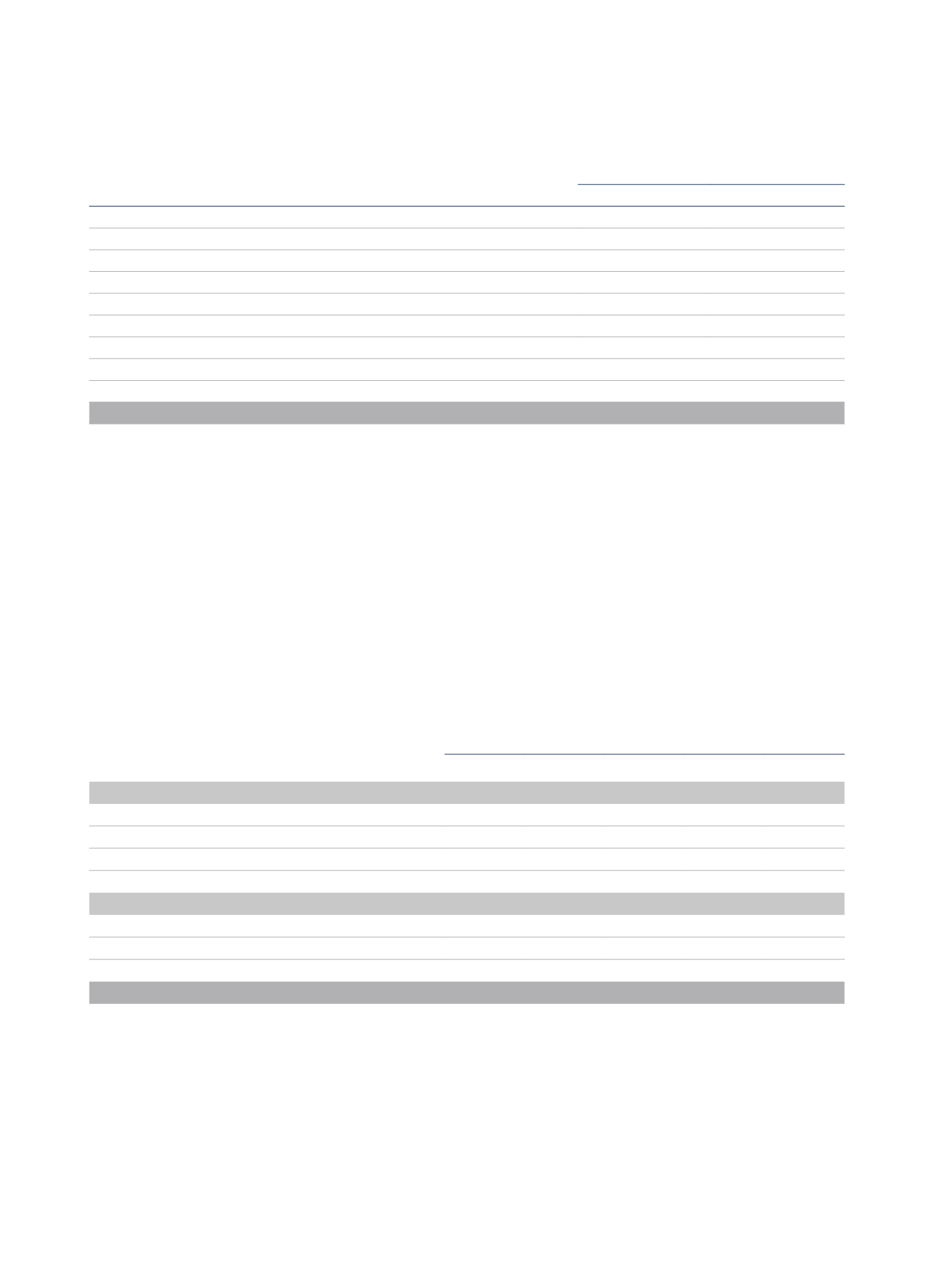

17.- PROVISIONS FOR RISKS AND CHARGES

The breakdown of “Provisions for risks and charges” at 31 December 2015 and 2014, together with the main movements recognised in those years

were as follows:

Thousands of euros

Balance at

31/12/2014 Additions

Applications/

Reductions

Transfers

Balance at

31/12/2015

Provisions for contingenciesand extraordinary costs:

Onerous contracts

26,986

12,993

(19,258)

(4,174)

16,547

Provisions for pensions and similar obligations

13,797

1,792

(1,387)

-

14,202

Other claims

16,147

4,959

(4,486)

1,331

17,951

56,930

19,744

(25,131)

(2,843)

48,700

Provisions for contingencies and current expenses:

Onerous contracts

10,114

-

(10,114)

4,793

4,793

Restructuring provisions

4,721

-

(4,184)

-

537

14,835

-

(14,298)

4,793

5,330

Total

71,765

19,744

(39,429)

1,950

54,030