101

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

During 2015, NH Hotel Group, S.A., as head of Consolidation Groups of Corporate Tax and VAT, NH Hoteles España, S.A. and NH Europa S.L., were

inspected by the Spanish tax authorities in relation to Corporate Income Tax (years 2010-2013), Value Added Tax, Personal Income Tax and Non-

resident Income Tax (years 2011-2013).

In the last quarter of 2015, agreements were signed in compliance with all taxes and years mentioned above, as well as an agreement regarding

the area of transfer pricing for Corporate Income Tax purposes. None of these yielded fines. The total of the regularization, including payment and

interest, amounted to a cash outflow of 363 thousand euros.

The Directors believe that the adaptation of the Parent Company with the criteria set by the Administration for inspection generated liabilities for

the parent company amounting to 794 thousand euros, which has been provisioned for in the year’s profits and losses.

Regarding the financial years open to inspection, contingent liabilities not susceptible to objective quantification may exist, which are not significant

in the opinion of the Group’s Directors.

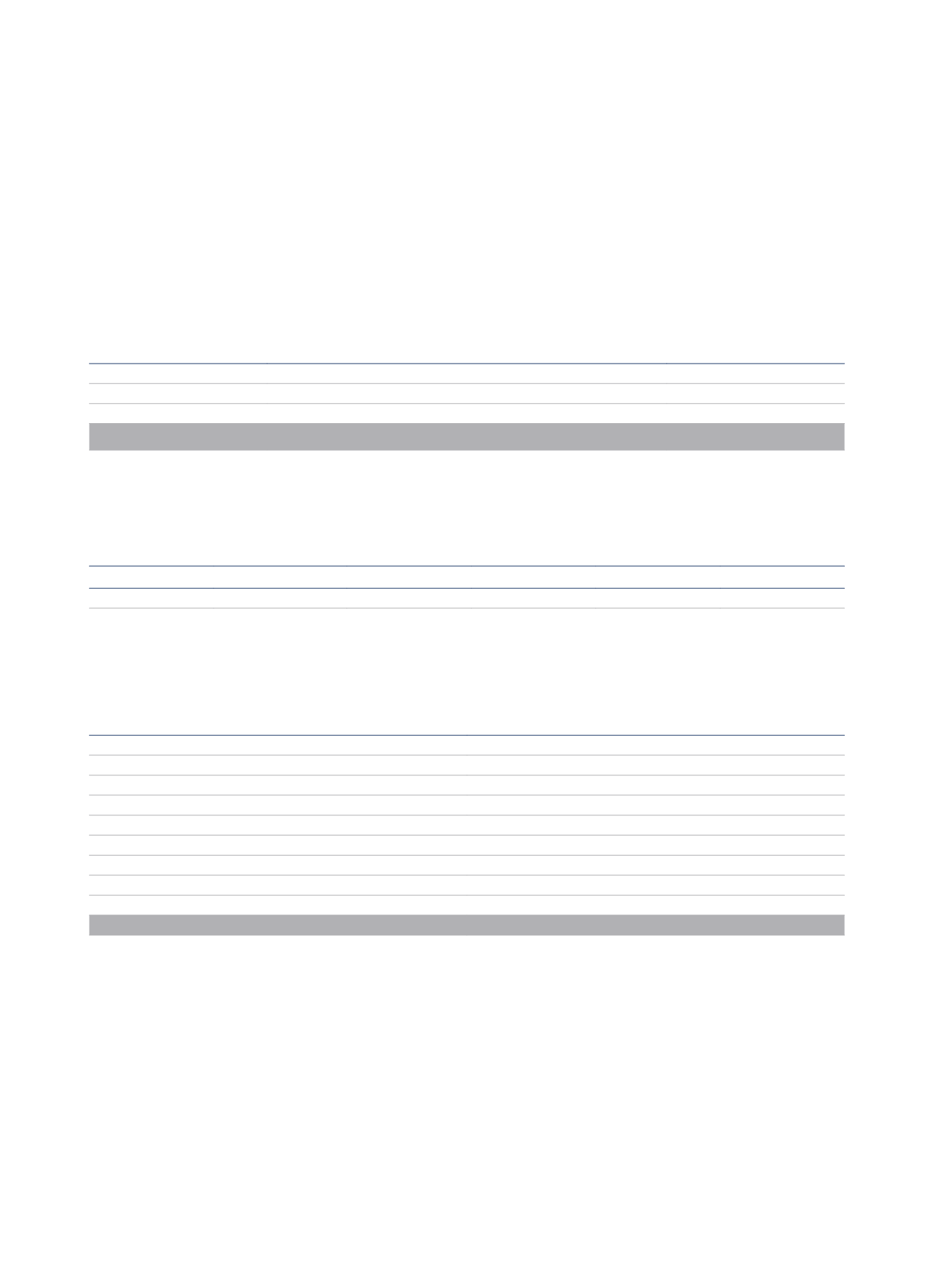

Deductions generated by the consolidated tax group of the Parent Company

At 31 December 2015, the Tax Group held the following tax credit carry-forward (Thousands of euros):

Year Origin

Deduction pending application

Amount

2002 to 2010

Investment in export activity

29,047

2008 to 2014

Tax deduction to avoid double taxation

11,267

2002 to 2014

Other

1,021

41,335

Of this amount, 11 million euros have been capitalized during 2015.

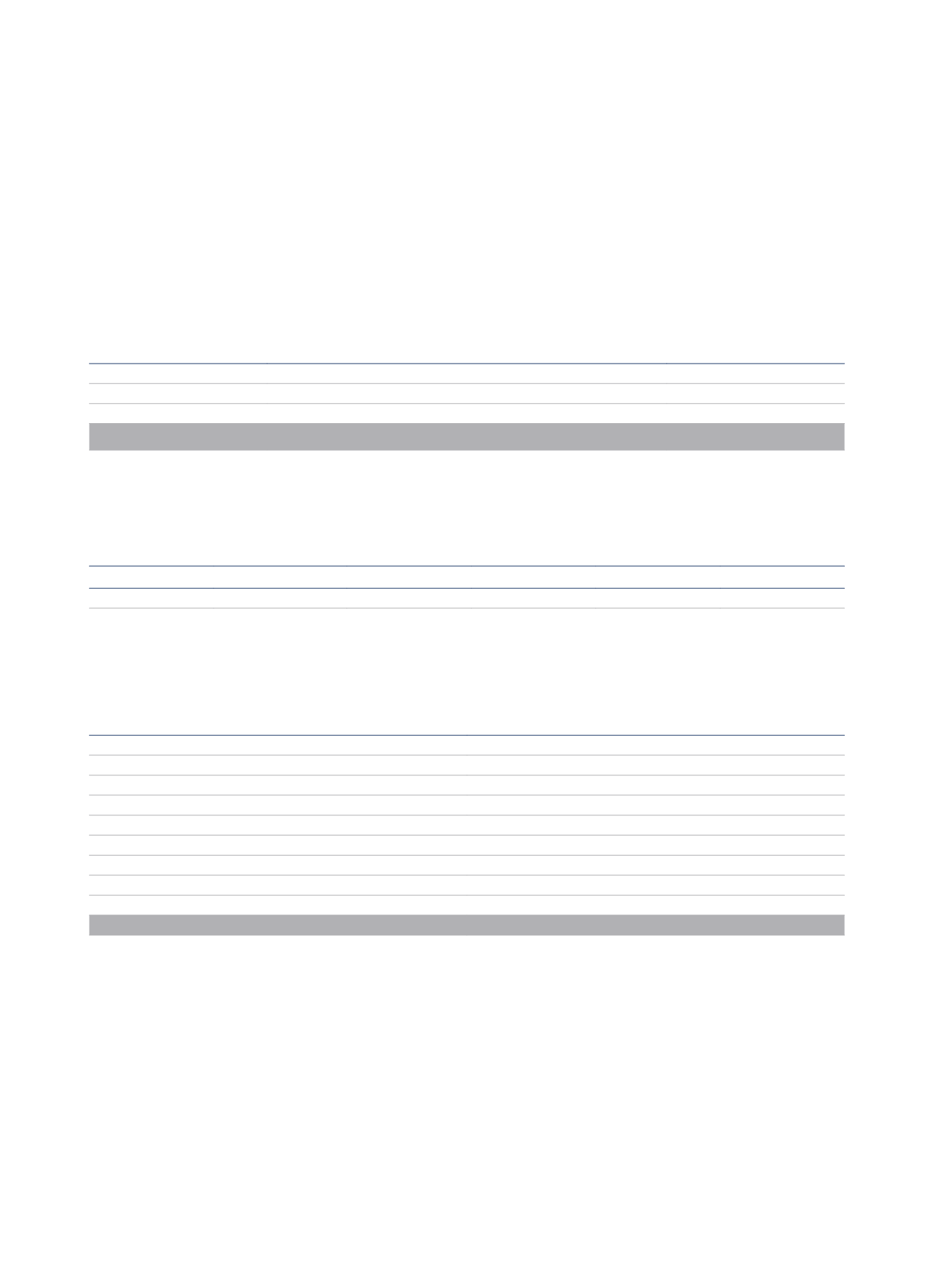

Similarly, the consolidated tax group of the Parent Company took advantage in prior years of the “Deferral of extraordinary profits for reinvestment”

scheme. The essential characteristics of such reinvestment are as follows (Thousands of euros):

Amount offset

Year of origin

Revenue Qualifying for

deferral

Previous years

Year 2015

Amount Outstanding Last year of deferral

1999

75,145

51,439

682

23,024

2049

This income was reinvested in the acquisition of buildings.

Negative tax bases

At 31 December 2015, the Consolidated Tax Group headed by NH Hotel Group, S.A. has the following tax loss carry-forwards:

Financial year

Amount

2007

8,835

2008

17,711

2009

85,995

2010

18,606

2011

26,294

2012

131,708

2013

11,907

2014

51,208

2015

39,478

Total

391,742

All the negative tax bases generated by the Consolidated Tax Group are recorded in the consolidated profit and loss statement, related to Spain are

98 million euros and 5 million euros to the rest of countries.