94 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

Credit lines

In 2015 NH Hotel Group, S.A. and NH Finance, S.A. obtained authorisation from credit institutions participating in the syndicated loan described

above to formalise additional debt to improve the liquidity of the Group.

At 31 December 2015, the balances under this item include the amount drawn down from several loan agreements and credit facilities. The joint limit

of loan agreements and credit facilities as at 31 December 2015 amounts to 69,550 thousand euros. This amount includes a mortgage-backed line

of credit for 6,000 thousand euros. At 31/12/2015, the available amount corresponding to these credit lines amounted to 30,833 thousand euros.

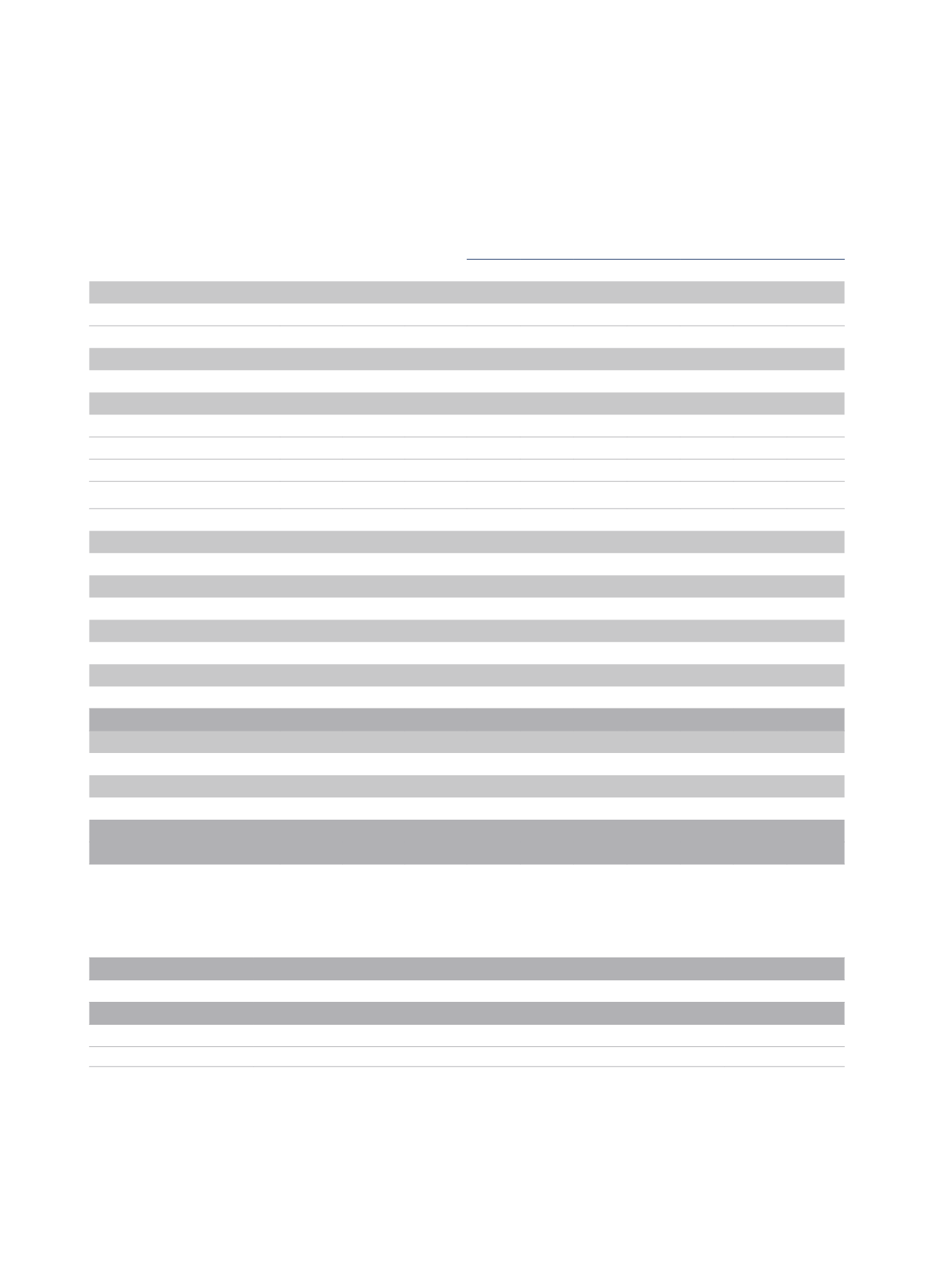

The detail, by maturity, of the items included under “Non-Current and Current Payables” is as follows (in thousands of euros):

Maturity

Instrument

Limit

Available Disposed 2015

2016

2017

2018

2019 2020 Remainder

Mortgages

43,590

-

43,590

-

11,328 12,509 6,684 1,884 1,450 9,735

Fixed rate

20,884

-

20,884

-

1,321

8,284 642

663

687

9,287

Variable interest

22,706

-

22,706

-

10,007 4,225 6,042

1,221

763

448

Subordinated loans

75,000

-

75,000

-

-

-

-

-

-

75,000

Variable interest

75,000

-

75,000

-

-

-

-

-

-

75,000

Syndicated loans

242,800

-

242,800

-

21,200 37,200 180,200 700

700 2,800

Tranche A (floating rate)

104,833

-

104,833

-

9,500 9,500 85,833

-

-

-

Tranche B (floating rate)

66,667

-

66,667

-

-

-

66,667

-

-

-

Syndicated NH Europa (floating rate)

6,300

-

6,300

-

700

700

700

700

700 2,800

Syndicated refi. Germany (floating

rate)

33,000

-

33,000

-

3,000 3,000 27,000

-

-

-

Syndicated refi. Italy (floating rate)

32,000

-

32,000

-

8,000 24,000

-

-

-

-

Morgate credit line

6,000

4,144

1,855

-

1,855

-

-

-

-

-

Variable interest

6,000

4,144

1,855

-

1,855

-

-

-

-

-

Convertible bonds

233,251

-

233,251

-

-

-

233,251

-

-

-

Fixed rate

233,251

-

233,251

-

-

-

233,251

-

-

-

Guaranteed senior notes

250,000

-

250,000

-

-

-

250,000 -

-

Fixed rate

250,000

-

250,000

-

-

-

250,000 -

-

Equity loans

15,332

-

15,332

-

3,596 7,539 2,168

1,763

266

-

Variable interest

15,332

-

15,332

-

3,596 7,539 2,168

1,763

266

-

SUBTOTAL

865,973

4,144 861,828

-

37,979 57,248 422,303 254,347 2,416 87,535

Credit lines

63,550 26,689

36,861

-

36,861

-

-

-

-

-

Variable interest

63,550 26,689

36,861

-

36,861

-

-

-

-

-

Arrangement expenses

-

-

(16,873)

-

(1,060)

(868)

(8,693) (5,995)

(39)

(218)

Borrowing costs

-

-

5,105

-

5,105

-

-

-

-

-

Borrowing situation at 31/12/2015

929,523 30,833 886,921

-

78,885 56,380 413,610 248,352 2,377 87,317

Borrowing situation at 31/12/2014

887,928 65,600 807,354 74,428 67,469 110,186 229,480 242,626 1,645 81,520

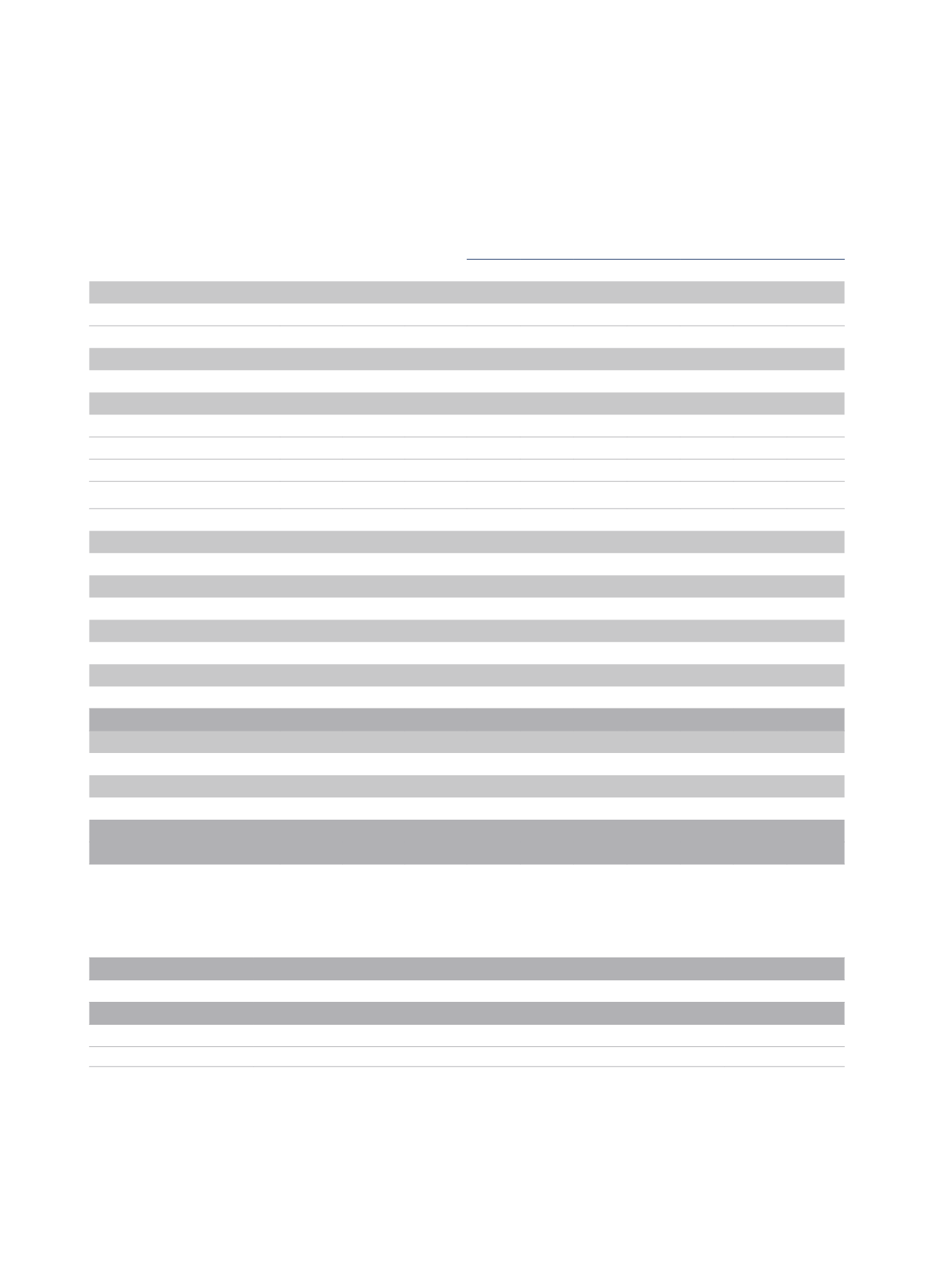

Details of the asset granted as mortgage security against the guaranteed line of credit of 6,000 thousand euros are as follows (thousands of euros):

Mortgaged asset

Net value

value

mortgaged asset

Total The Netherlands

NH Atlanta Rotterdam

13,795

Net value of assets assigned as mortgage collateral

13,795

Value of guaranteed debt

6,000

Fixed interest

-

Variable interest (amount used plus amount available)

6,000