88 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

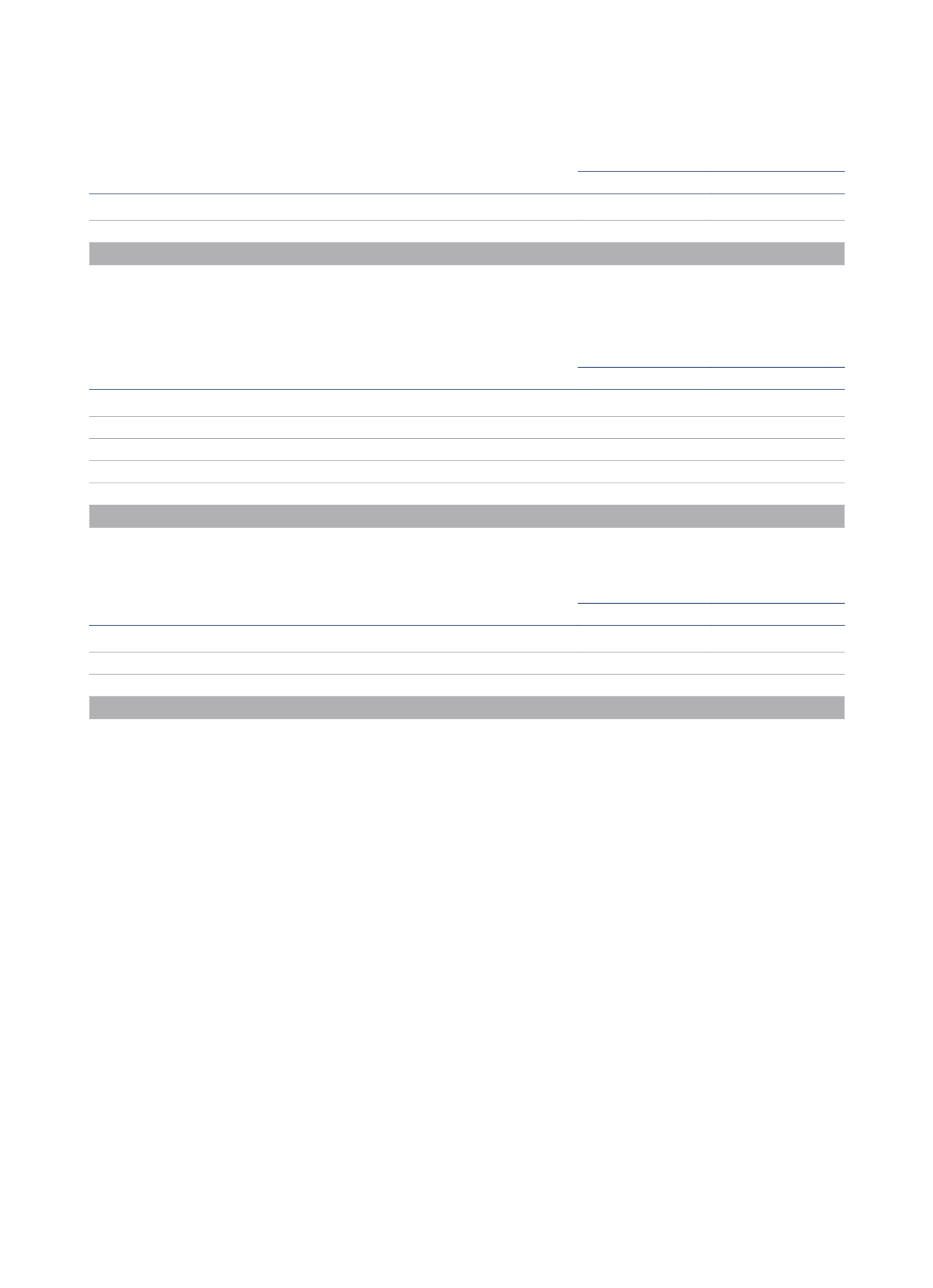

12.- TRADE RECEIVABLES

This item reflects different accounts receivable from the Group’s operations. The breakdown at 31 December 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Trade receivables for services provided

181,523

149,054

Provision for bad debts

(12,254)

(13,042)

Total

169,269

136,012

As a general rule, these receivables do not accrue interest and are due at less than 90 days with no restrictions on how they may be availed.

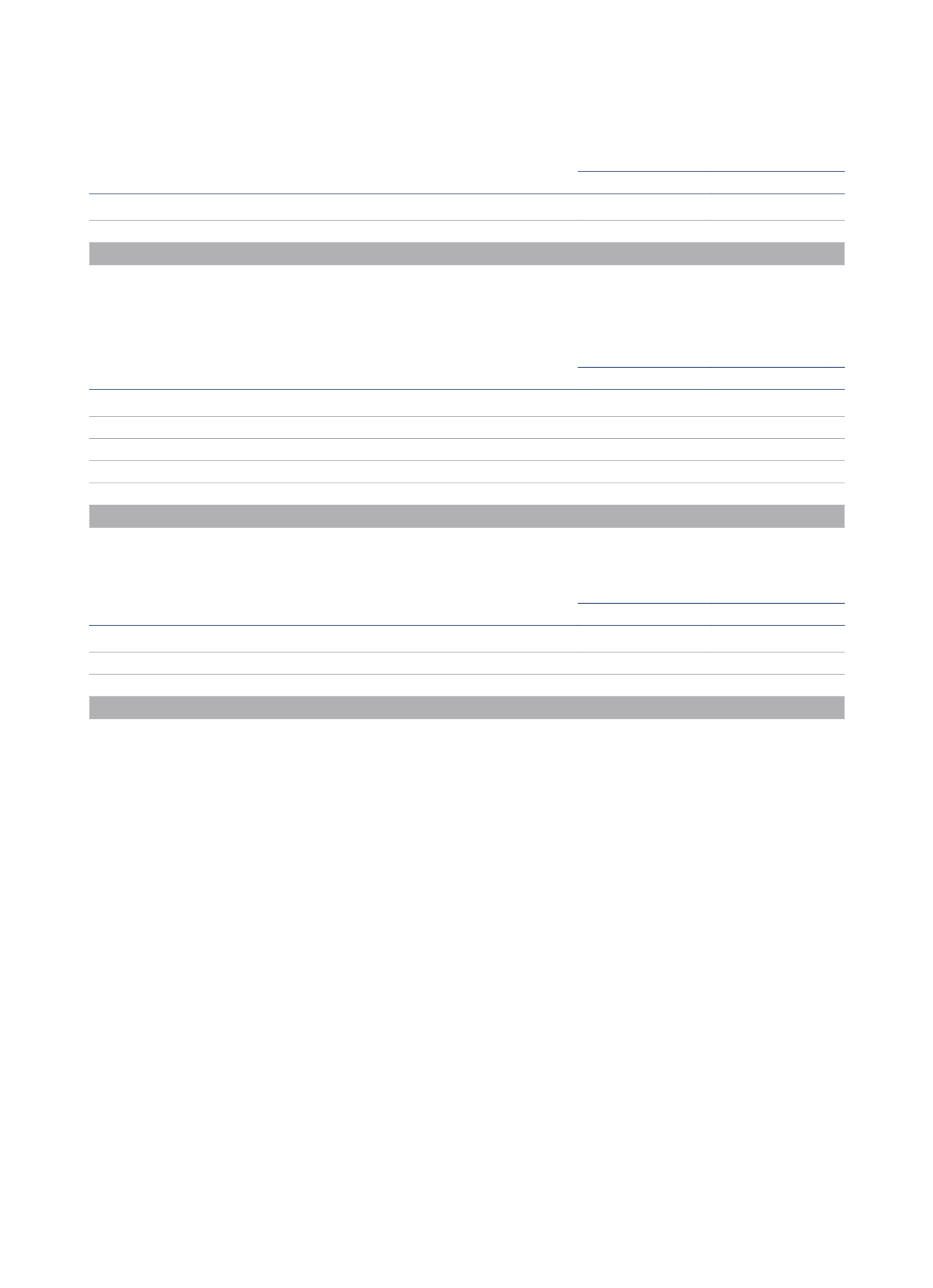

Movements in the provision for bad debts during the years ending 31 December 2015 and 2014 were as follows:

Thousands of euros

2015

2014

Balance at 1 January

13,042

15,649

Changes in scope

73

(4,271)

Exchange differences

(88)

(19)

Additions

2,605

2,852

Applications

(3,378)

(1,169)

Balance at 31 December

12,254

13,042

The analysis of the ageing of financial assets in arrears but not considered impaired at 31 December 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Less than 30 days

21,786

27,828

From 31 to 60 days

11,034

15,726

More than 60 days

41,881

28,721

Total

74,701

72,275

13.- CASH AND CASH EQUIVALENTS

This item essentially includes the Group’s cash position, along with any loans granted and bank deposits that mature at no more than three months.

The average interest rate obtained by the Group for its cash and cash equivalents balances during 2015 and 2014 was a variable Euribor-indexed

rate. These assets are recognised at their fair value.

There are no restrictions on how cash may be used, except for an amount of 1,575 thousand euros reserved, according to a commitment with Hoteles

Royal co-proprietors, for future hotel capex investments.

As a result of the enactment of Royal Decree 1558/2012 of 15 November, of Article 42 bis of Royal Decree 1065/2007 of 27 July, approving the

General Regulations on tax management, inspection and procedures, and implementing the common rules of the procedures for applying taxes,

which establishes certain reporting obligations with regard to overseas assets and rights, among others, it is disclosed that some members of the NH

Hotel Group S.A. Board of Directors have the right, as representatives or authorised officials, to dispose of bank accounts located abroad, which are

in the name of Group companies. The reason certain Board members have the right to dispose of overseas bank accounts is that they are Directors

or board members of said subsidiaries.

NH Hotel Group S.A. holds other accounting documents, namely the consolidated annual accounts, from which sufficient data can be extracted in

relation to the aforementioned accounts.