98 REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

In accordance with the results of the recovery plan, the tax credits will be fully offset in 2023. The analysis of sensitivity to a reduction in the tax base

used in said recovery plan yields the following results:

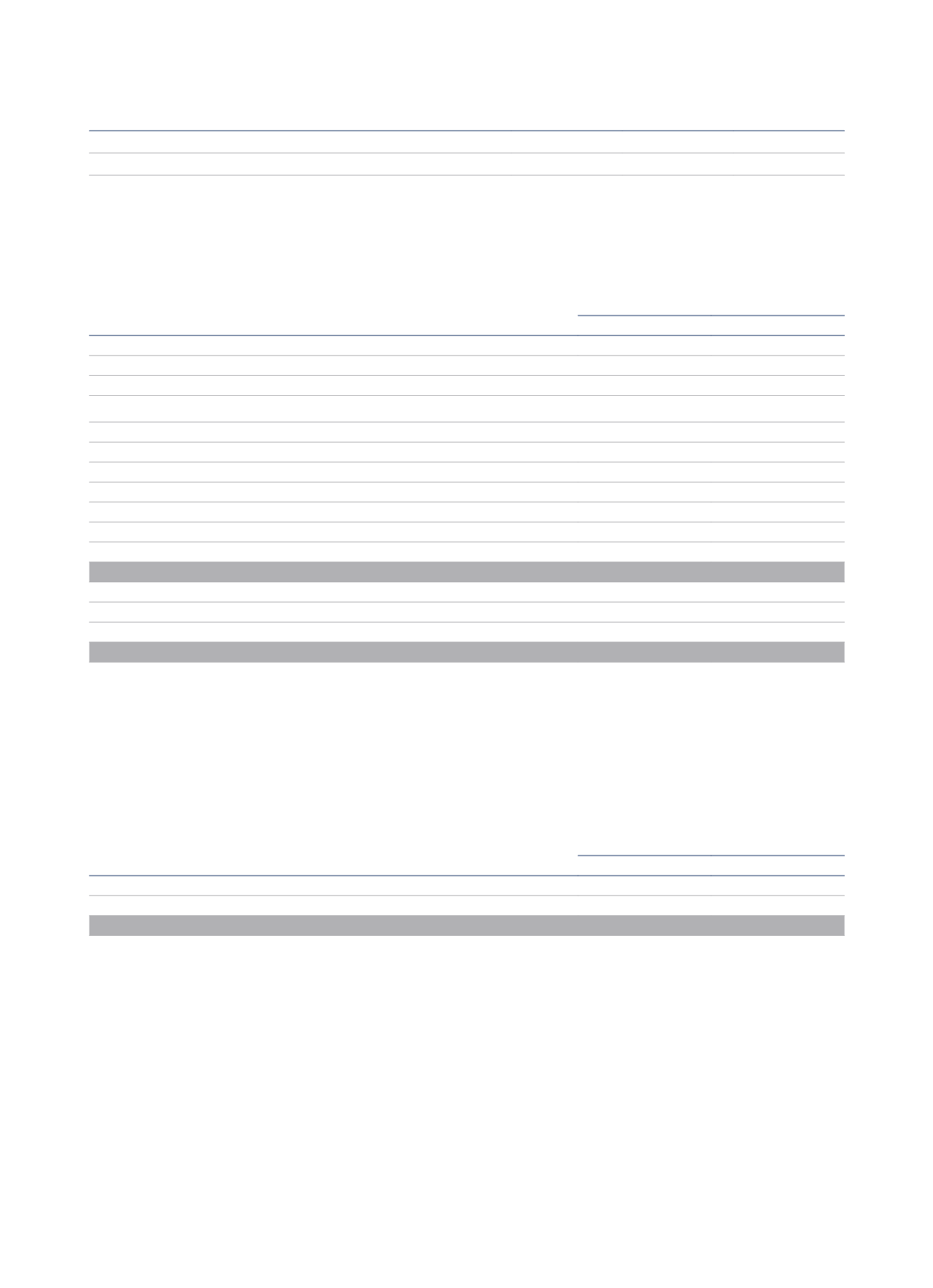

Annual Tax Base Variation

(10.0%)

(20.0%)

(30.0%)

Year of Recovery

2024

2025

2027

Given that the results of the tax credit recovery plan are satisfactory, the Directors of the Parent Company have decided to activate the tax losses

recorded during the year by the Spanish tax group.

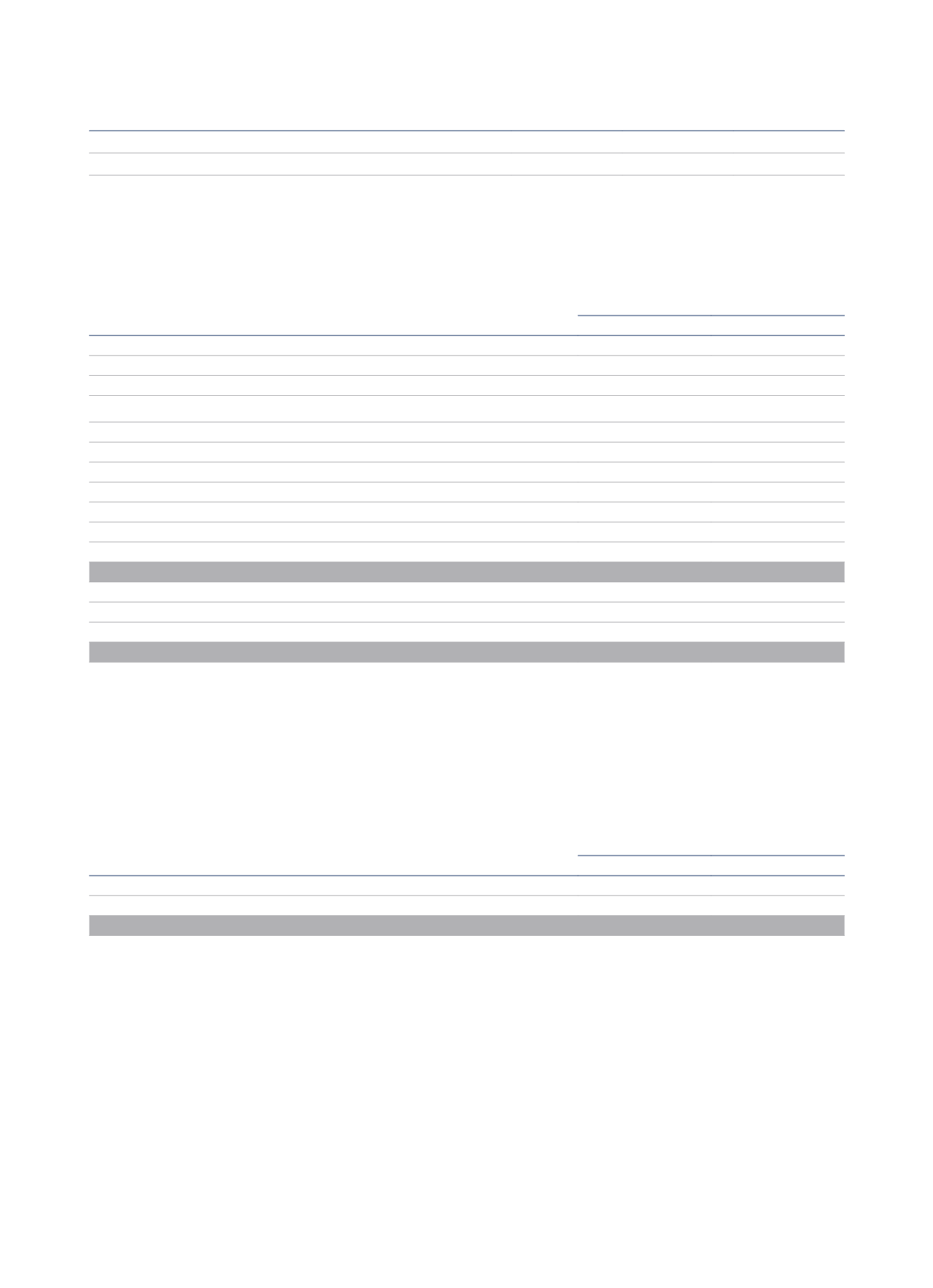

At 31 December 2015 the Group had tax credits worth 607,525 thousand euros (636,963 thousand euros at 31 December 2014) that had not been

n

entered in the accompanying consolidated profit and loss statement because the Directors considered they did not to meet accounting standard

requirements. These assets are grouped as follows:

Thousands of euros

2015

2014

Finance costs and negative tax bases

Non-deductible financial expenses in Spain

180,467

130,840

Non-deductible financial expenses in Italy

17,243

28,519

Non-deductible financial expenses in Germany

12,900

12,900

Tax losses generated by the Spanish entities before tax consolidation

108,750

108,750

Tax losses generated in Austria

23,400

23,400

Tax losses generated in Latin America

2,765

2,765

Tax losses generated in Luxembourg

53,231

70,250

Tax losses generated in Spain

-

31,213

Tax losses generated in Italy

13,801

22,091

Tax losses generated in Germany

164,900

164,900

Total

577,457

595,628

Deductions

Deductions generated in Spain

30,068

41,335

Total

30,068

41,335

Total

607,525

636,963

Finance costs, which are not considered deductible in the Spanish corporate income tax when exceeding 30% of the operating revenue of the tax

group calculated in accordance with Article 16 of Law 27/2014 of 27 December, on Corporate Income Tax, amount to 49,627 thousand euros in 2015

(36,645 thousand euros in 2014). There is no deadline for offsetting non-deductible finance costs. Regarding Italian and German Corporate Income

Tax, tax regulations in those countries are similar to those of Spain on the deductibility limit of financial expenses. In accordance with Italian and

German legislation, there is no deadline for offsetting non-deductible finance costs.

The variation of unregistered credits results from, in Italy, offsetting losses and deducting finance costs during the year 2015, and, in Spain, registering

negative taxable bases and deductions to avoid the double taxation that passed the tax credit recovery test.

The composition of the credit balances with Public Administrations at 31 December 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Deferred tax liabilities

Revaluation of assets and other valuation differences

196,711

179,730

Total

196,711

179,730