n

108

The term of the operating lease agreements signed by the Group ranges from 5 to 40 years. Agreements likewise include several methods to

determine the rent to be paid. Basically, the methods for determining rentals can be summarised as fixed rentals indexed to a consumer price index;

fixed rentals complemented by a variable part, indexed to the property’s operating profits; or completely variable rentals, determined by business

performance during the year. In some cases, variable rentals are set with a minimum profitability threshold for the owners of the property under

operation.

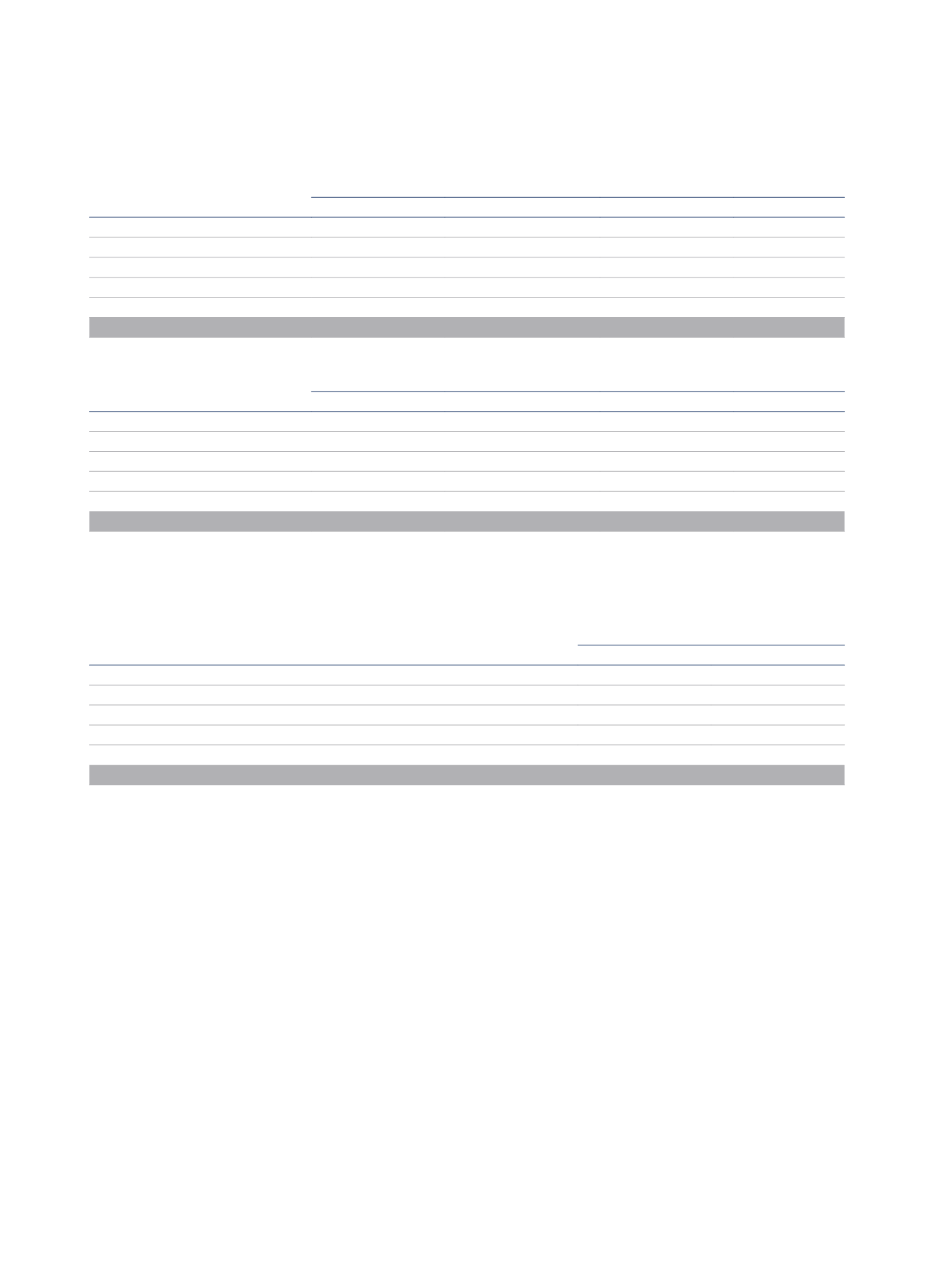

The breakdown by business unit at 31 December 2015 of the present value of the lease payments is as follows (thousands euros):

Less than one year

Between two and five years

More than five years

Total

Spain

75,521

248,127

193,219

516,867

Germany and Central Europe

104,970

355,749

418,190

878,909

Italy

43,858

114,397

77,936

236,191

Benelux

45,559

178,986

364,851

589,396

Latin America

s

2,962

3,649

2,148

8,759

Total

272,870

900,908

1,056,344

2,230,122

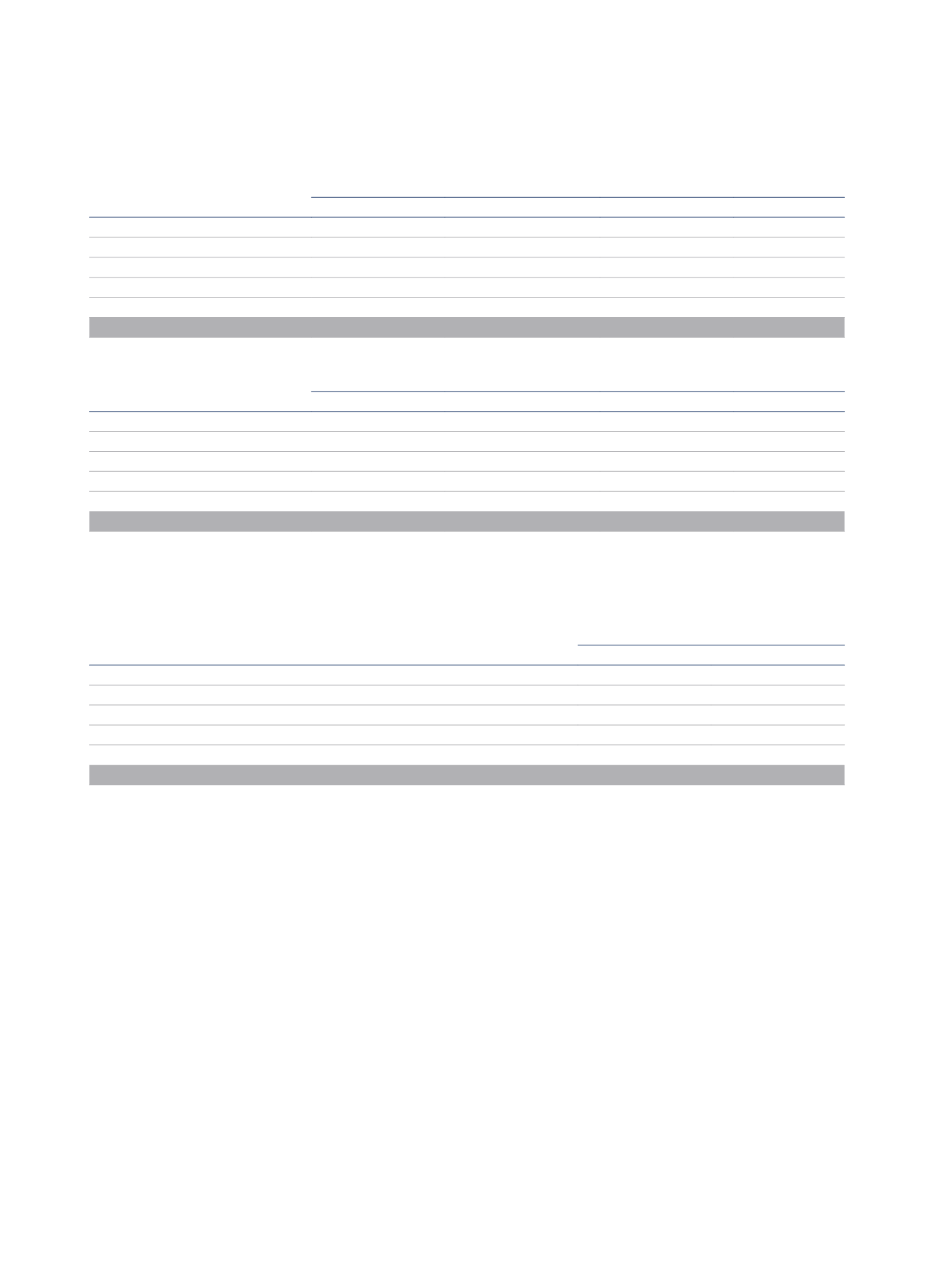

The breakdown by business unit at 31 December 2014 of the present value of the lease payments is as follows (thousands euros):

Less than one year

Between two and five years

More than five years

Total

Spain

80,742

267,633

208,860

557,235

Germany and Central Europe

109,344

352,090

368,046

829,480

Italy

40,692

113,226

75,307

229,225

Benelux

44,678

155,757

328,617

529,052

Latin America

3,219

5,243

3,094

11,556

Total

278,675

893,949

983,924

2,156,548

24.6 Finance costs

The detailed balance of this chapter of the consolidated statement of comprehensive income for 2015 and 2014 is as follows:

Thousands of euros

2015

2014

Expenses for interest

53,927

53,488

Financial expenses for means of payment

11,610

10,354

Financial effect portfolio exit NH Alcalá

4,394

-

Financial effect relating to updating of provisions (Note 17)

2,609

3,456

Other financial expenses

1,175

1,531

Total financial expenses

73,715

68,829

25.- RELATED PARTY TRANSACTIONS

In addition to its subsidiaries, associates and joint ventures, the Group’s “related parties” are considered to be the “key management personnel” of

the Parent Company (Board Members and Directors, along with their immediate relatives), as well as organisations over which key management

personnel may exert significant influence or control.

Transactions carried out by the Group with its related parties during 2015 are stated below, distinguishing between major shareholders, members

of the Board of Directors and Directors of the Parent Company and other related parties. The conditions of the related-party transactions are

equivalent to those of transactions carried out under market conditions:

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS