83

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS

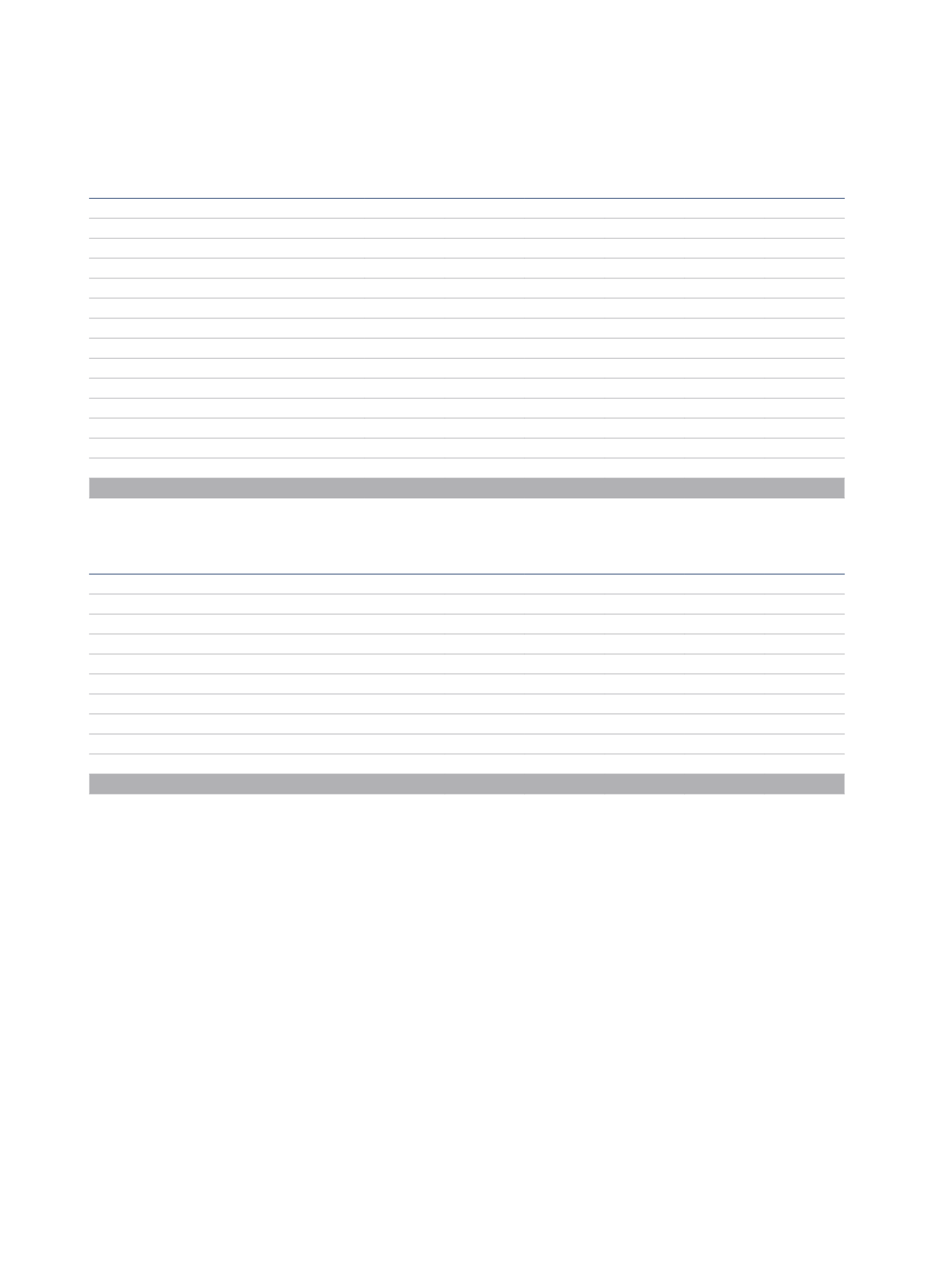

9.- INVESTMENTS VALUED USING THE EQUITY METHOD

The movements under this heading of the consolidated balance sheet during 2015 and 2014 were as follows:

Company

Net balance at

31/12/2013

Retirements

Transfers

Profit (Loss)

2014

Currency

translation

differences

Net balance at

31/12/2014

Sotocaribe, S.L.

41,941

-

(41,941)

-

-

-

Capredo Investments GmbH

6,348

-

(6,348)

-

-

-

Varallo Comercial, S.A.

9,693

-

-

(1,717)

(564)

7,412

Inmobiliaria 3 Poniente, S.A. de C.V.

1,542

-

-

218

419

2,179

Palacio de la Merced, S.A.

1,396

-

-

52

-

1,448

Mil Novecientos Doce, S.A. de C.V.

1,787

-

-

87

208

2,082

Consorcio Grupo Hotelero T2, S.A. de C.V.

374

-

-

121

382

877

Hotelera del Mar, S.A.

214

-

-

-

2,170

2,384

Fonfir1, S.L.

20

(20)

-

-

-

-

Residencial Marlin, S.L.

19,328

-

(19,328)

-

-

-

Borokay Beach, S.L.

1,536

-

-

(102)

-

1,434

Los Alcornoques de Sotogrande, S.L.

-

-

-

-

-

-

Losan Investment Ltd.

-

-

-

-

-

-

Harrington Hall Ltd.

-

-

-

-

-

-

Total

84,179

(20)

(67,617)

(1,341)

2,615

17,816

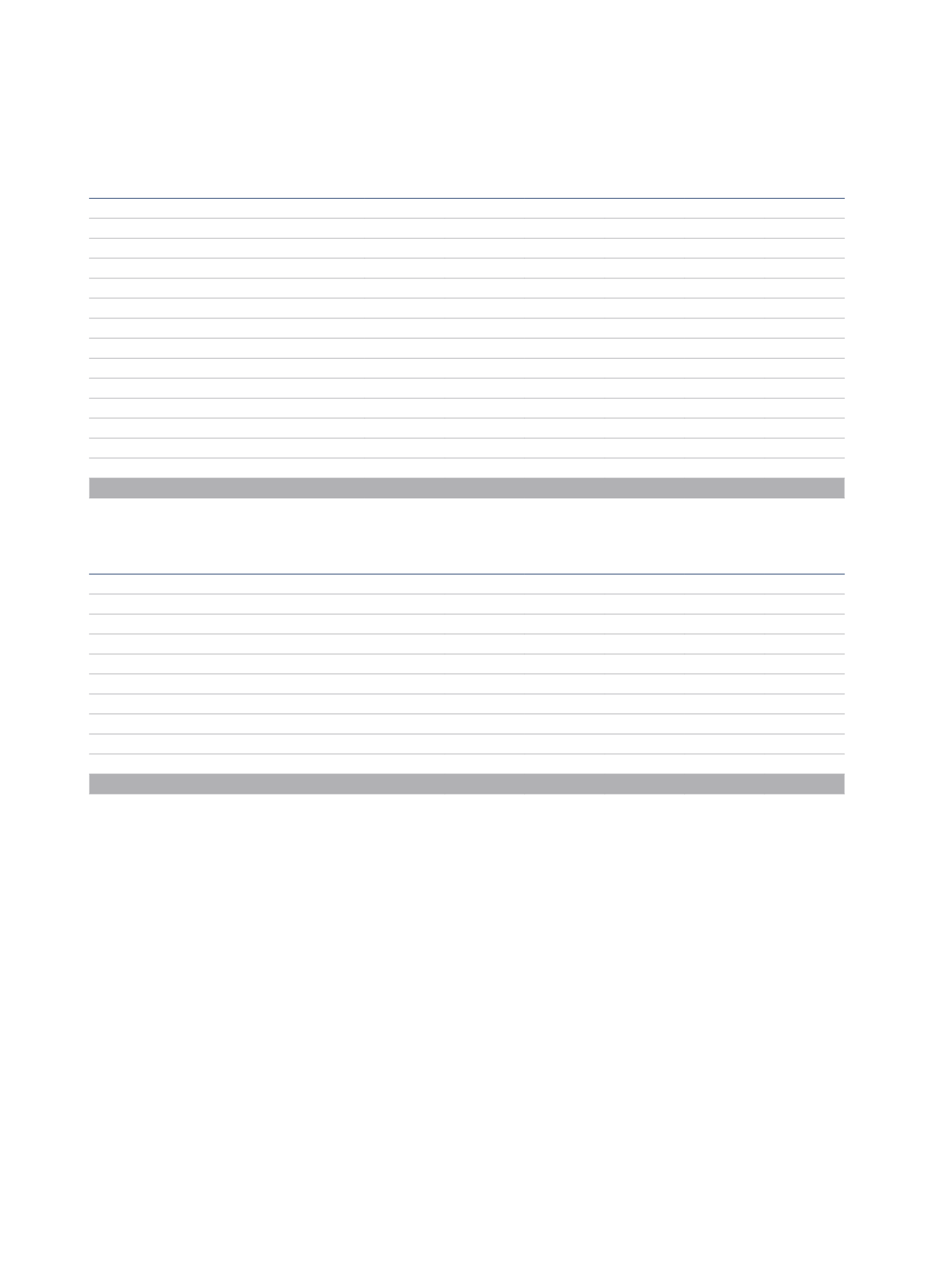

Company

Net balance at

31/12/2014

Additions

Profit (Loss)

2015

Currency

translation

differences

Net balance at

31/12/2015

Varallo Comercial, S.A.

7,412

-

(1,107)

881

7,186

Inmobiliaria 3 Poniente, S.A. de C.V.

2,179

-

186

(397)

1,968

Palacio de la Merced, S.A.

1,448

-

94

-

1,542

Mil Novecientos Doce, S.A. de C.V.

2,082

-

91

(238)

1,935

Consorcio Grupo Hotelero T2, S.A. de C.V.

877

-

158

(198)

837

Hotelera del Mar, S.A.

2,384

-

133

(800)

1,717

Borokay Beach, S.L.

1,434

-

(14)

-

1,420

Beijing NH Grand China Hotel Management Co, Ltd

-

270

(276)

6

-

Hotel & Congress Technology, S.L.

-

1

72

-

73

Losan Investment Ltd.

-

-

-

-

-

Total

17,816

271

(663)

(746)

16,678

On 9 September 2015, the Joint Venture with the shareholding group HNA Hospitality Group Co, Ltd. was formalised, creating Beijing NH Grand

China Hotel Management Co, Ltd in which the Group is a 49% shareholder.

On 15 April 2015, the contract for the Joint Venture between the Group and the company MDH Hologram, S.A. was formalised, in virtue of which 25%

of the company Hotel & Congress Technology, S.L. was sold, resulting in a 50% shareholding for the NH Hotel Group. The company was incorporated

into the consolidation upon commencing activity in 2015, having been previously inactive, with shares accounted for under the heading “Other non-

current financial assets” in the year 2014.

NH Hotel Group’s policy on interests in associates consists in the Group ceasing to recognise losses in these companies if the associate’s consolidated

losses attributable to the Group are equivalent to or exceed the cost of its interest in them, provided there are no additional contingencies or

guarantees connected with already incurred losses. This is the situation of the stake in Losan Investment, Ltd.

On 12 August 2014 the NH Group sold its shares in Harrington Hall, Ltd. for 13,292 thousand euros, generating a net gain of 13,292 thousand euros

registered in line “ Profit (loss) on disposal of financial investments” and a result of 370 thousand euros for the exchange rates associated of the

participation(see Note 2.5.4).

The most significant financial information related to the main ownership interests in joint ventures is detailed in Appendix II to this consolidated

annual report.