80

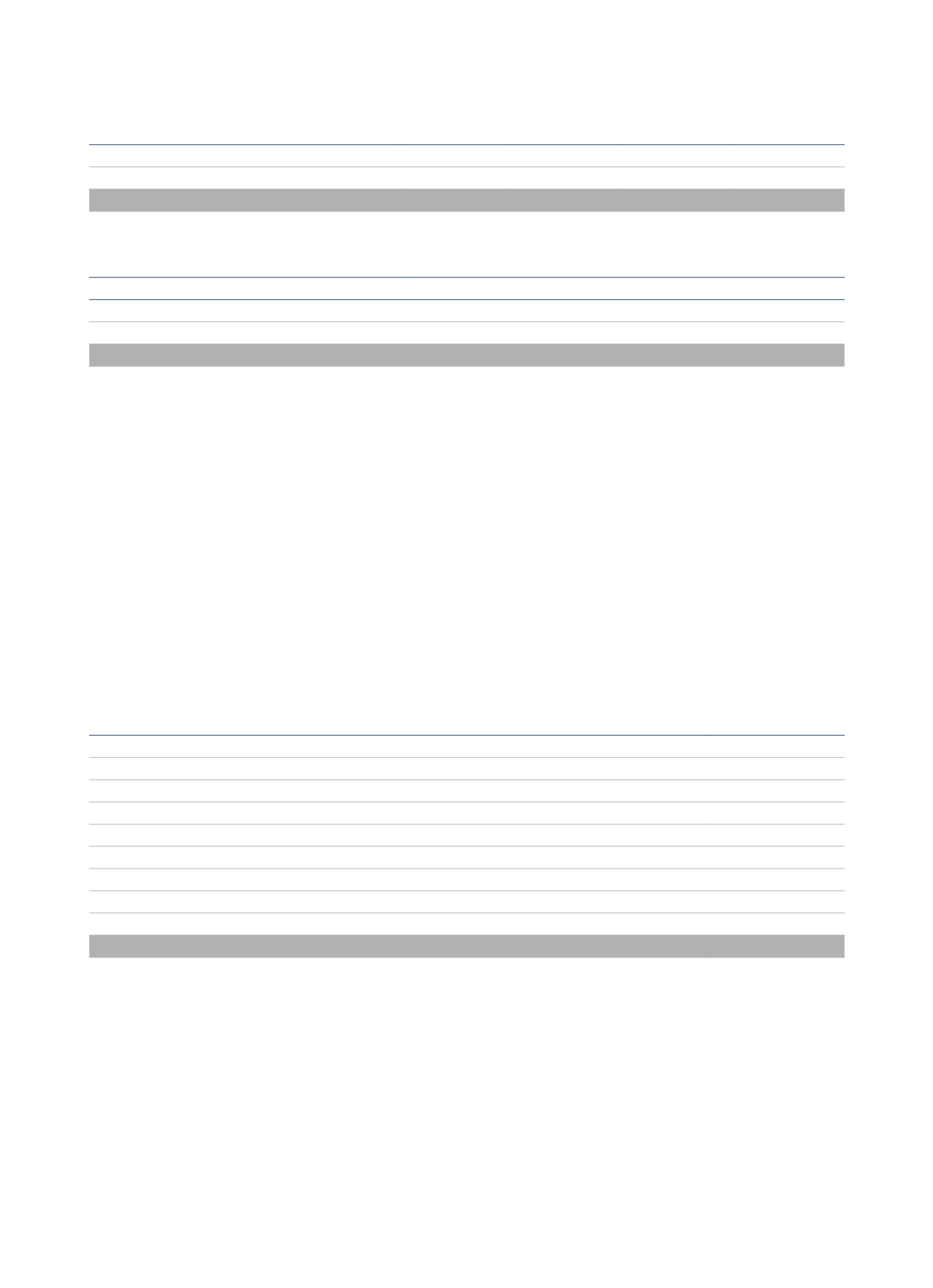

The movements in this heading of the consolidated balance sheet in 2015 and 2014 were as follows (in thousands of euros):

Company

Goodwill

31.12.13

Currency

translation differences

Impairment

Goodwill

31.12.14

NH Hoteles Deutschland, GmbH and NH Hoteles Austria GmbH

94,710

-

(4,765)

89,945

Others

2,511

1,467

-

3,978

Total

97,221

1,467

(4,765)

93,923

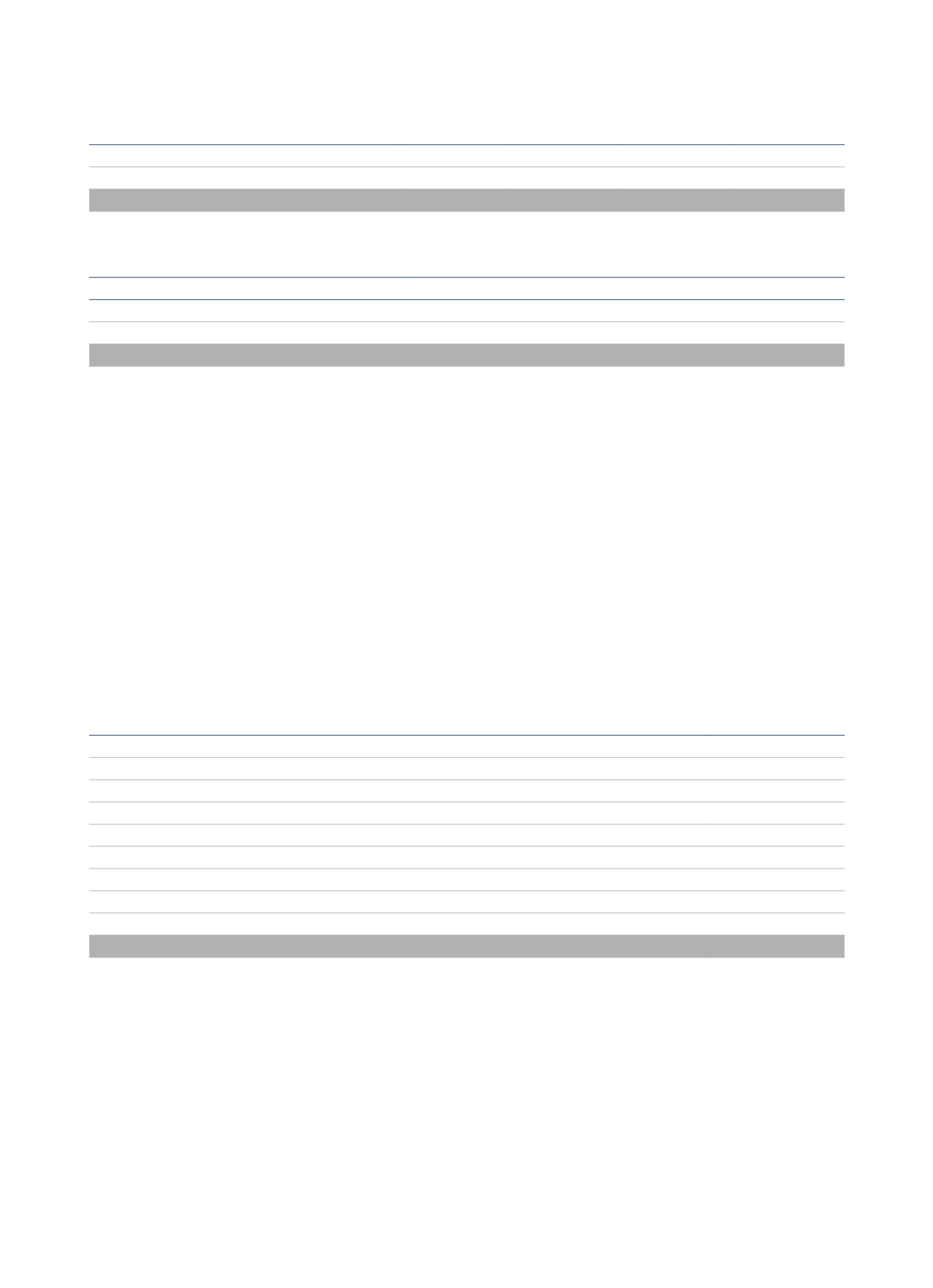

Company

Goodwill

31.12.14

Additions

Currency

translation

differences

Impairment

Goodwill

31.12.15

NH Hoteles Deutschland, GmbH and NH Hoteles Austria GmbH

89,945

-

-

(4,765)

85,180

Hoteles Royal, S.A.

-

36,430

(6,779)

-

29,651

Others

3,978

-

(16)

-

3,962

Total

93,923

36,430

(6,795)

(4,765)

118,793

The acquisition of Hoteles Royal, S.A. gives a first consolidation negative difference of 36.4 million euros. This difference constitutes goodwill of

Royal Hotel, S.A. and it emerges as the difference between the purchase price of 94.8 million euros, and the value of net assets acquired, amounting

to 58.4 million euros, and has been recorded according to the report “Purchase Price Allocation “drawn up by an independent third party.

In addition, the valuation of the net assets acquired has been carried at fair value, in compliance with IFRS 3 “Business Combinations” and IFRS 13

“Fair Value Measurement”. To do this, the Group has based its findings on appraisal reports of independent experts on material fixed assets and the

methodologies “Multi-Period Earnings Method” for the assessment of hotel operating rights, and “Relief from Royalty” for the registration of Hoteles

Royal trademarks.

The discount rates used in the projections for the valuation of intangible assets of Hoteles Royal were 10.77% for hotels in Colombia and Ecuador,

and 11% for hotels in Chile.

At 31 December 2015 the goodwill generated with the acquisition of Grupo Royal has not been subjected to an impairment test because it is valued

according to a transaction with independent third parties at a market value and backing up the “Purchase price allocation” with a report of an

independent third party.

The recoverable value of the operating rights of Grupo Royal hotels has been assigned to each cash-generating units using projections on results,

investments and working capital according to the term of the contracts.

Recoverable goodwill values of the rest have been allocated to each cash-generating unit, mainly rental agreements, by using projections on results,

investments and working capital, according to the terms of the contract.

Details of the cash-generating units to which such goodwill arising on consolidation has been allocated are shown below:

Thousands of euros

CGU’s Grupo Royal

29,651

CGU 6

15,934

CGU 21

10,392

CGU 22

7,977

CGU 12

7,400

CGU 5

6,456

CGU 13

5,916

CGU 2

5,276

CGUs with goodwill allocated individually < €4 M

29,791

118,793

The basic assumptions used to estimate future cash flows of the CGUs, except for the Grupo Royal aforementioned, are detailed below:

• Discount rate: 6.45% and 6.81%, since these are CGUs subject to the same risk (German and Austrian market).

• Terminal value growth rate (g): 2%

The allocation of the impairment of the financial year, amounting to 4,765 thousand euros, took place as a result of the failure to consider perpetual

income in the case of cash-generating units whose leases do not ensure renewal. Thus the projections are for the term of these contracts.

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS