70

2.5.4 Changes in the scope of consolidation

The most significant changes in the scope of consolidation during 2015 and 2014 that affect the comparison between financial years were the

following:

a.1 Changes in the scope of consolidation in 2015

a.1.1 Disposals

On January 14, 2015, the Group sold its subsidiary NH Parque de la 93, S.A. The net consideration received amounted to 23 million euros, of which

3.5 million euros are pending payment (updated at closing, it amounted to 3 million euros).

Part of balance of the outstanding amount, amounting to 0.4 million euros, was to guarantee working capital in the transaction, and it has been

settled in on February 2016 The outstanding amount corresponds to the deductions made by the National Directorate of Taxes and Customs of

Colombia at the time of the transaction, amounting to 3.1 million euros, whose payment will take effect in March 2016. These amounts have been

recorded under current assets on the consolidated balance sheet in the lines of commercial receivables “Other non-commercial receivables” and

“Public administration receivables”, respectively.

The Group earned a net gain of 4.7 million euros from this transaction.

The effect of the exit from the scope of that company in the consolidated financial position statement at 31 December 2015 is as follows:

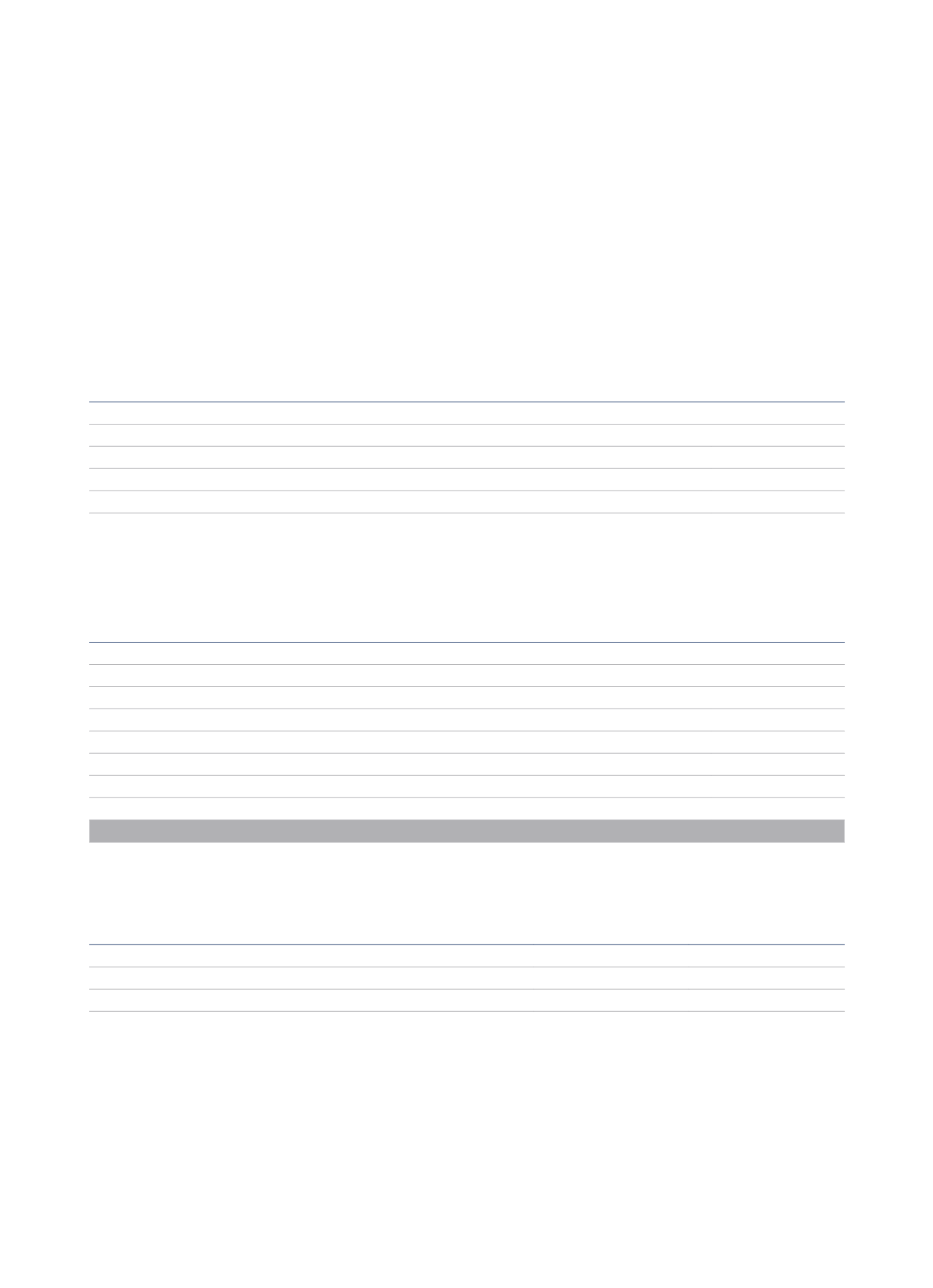

Thousands of euros

Property, plant and equipment

16,430

Working capital

1,956

Net assets disposed of

18,386

Net Consideration received

23,094

Consolidated benefit (Income)

(4,708)

There is also a negative effect of 620 thousands euros owing to the conversion differences associated with the aforementioned shareholding, which

is entered in the net exchange difference item of the 2015 consolidated comprehensive results.

As of 31 July 2015, the Group had sold its affiliate Donnafugata Resort S.r.l., of which it had a 95.26% shareholding. The net remuneration received

was one euro. The result of the transaction is as follows:

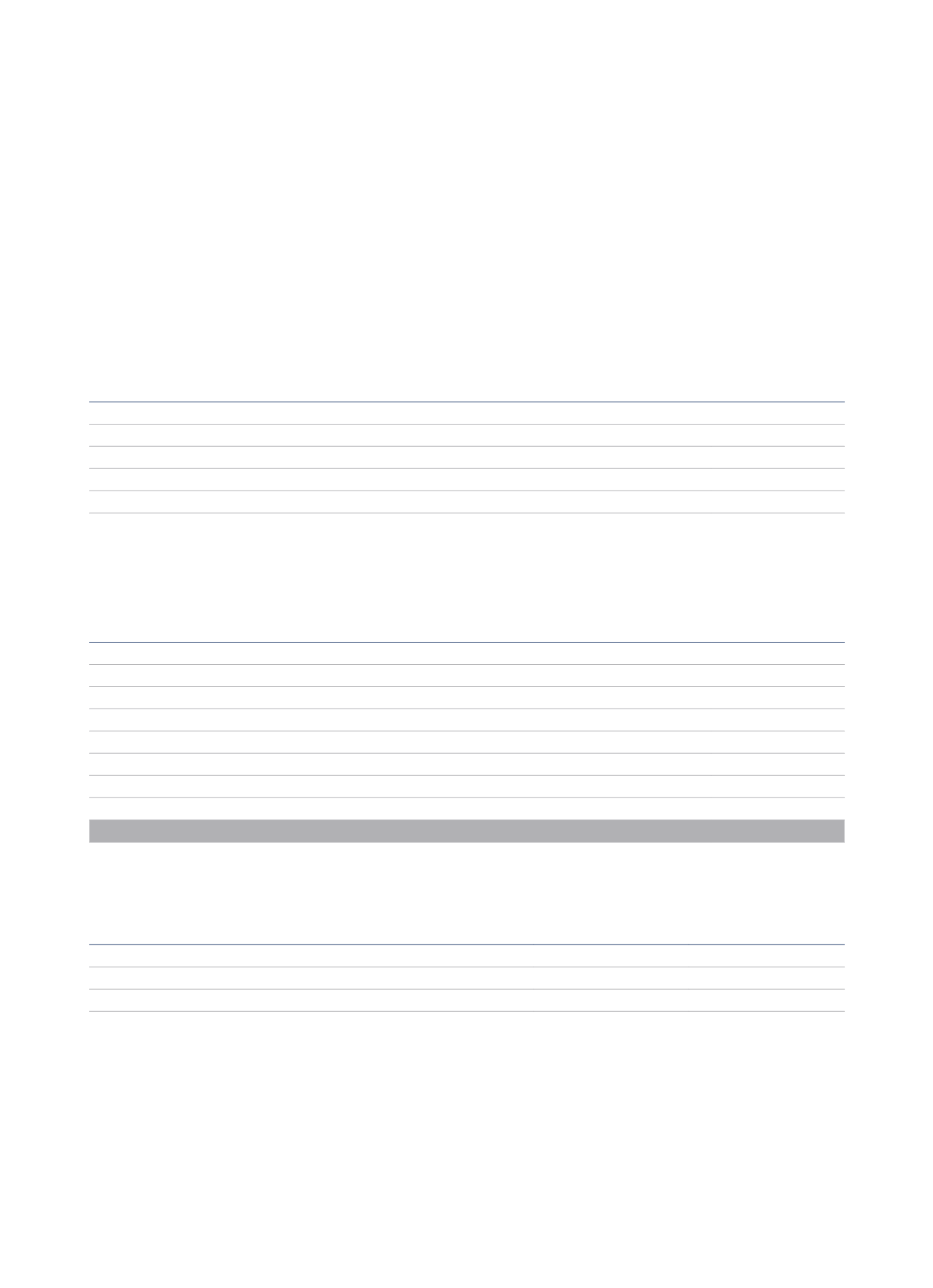

Thousands of euros

Non-Current Assets

45,630

Long-term liabilities

(56,930)

Inter-company losses

3,406

Net assets disposed of

(7,894)

Net Consideration

1

Transaction costs

647

Profit of the transaction

(7,246)

Result until sale

(1,911)

Total Profit (Loss) (Note 11)

(9,157)

a.1.2 Additions to the consolidation scope

The companies which were incorporated into the scope of consolidation in 2015, along with method of consolidation employed were the following:

Company

Consolidation method

Effective date of acquisition

Hoteles Royal, S.A. and dependent companies (see Appendix I)

Full consolidation

04/03/2015

Beijing NH Grand China Hotel Management Co, Ltd

Equity method

09/09/2015

Hotel & Congress Technology, S.L.

Equity method

15/04/2015

On 4 March 2015, the Group acquired a shareholding of 97.47%, amounting to a total of 2,969,668 shares, in the share capital of Hoteles Royal, S.A.,

a Colombian company which is the parent of Hoteles Royal, the Latin American hotel management group. The amount of the remuneration was 94.8

million euros, with 77.1 million euros paid and 17.7 million euros pending payment (updated at year-end it amounted to 19.2 million euros, payable in

March 2017), recorded under the “Other noncurrent liabilities” heading (see Note 16).

REPORT ON THE CONSOLIDATED FINANCIAL STATEMENTS