2.8.1 Subsidiaries (See Appendix I)

Subsidiaries are considered as any company included within the scope of consolidation in which the Parent Company directly or indirectly controls their management due to holding the majority of voting rights in the governance and decision-making body, with the ability to exercise control. This ability is shown when the Parent Company has the power to direct an investee entity’s financial and operating policy in order to obtain profits from its activities.

The financial statements of subsidiaries are consolidated with those of the Parent Company by applying the full consolidation method. Consequently, all significant balances and effects of any transactions taking place between them have been eliminated in the consolidation process. If necessary, adjustments are made to the financial statements of the subsidiaries to adapt the accounting policies used to those used by the Group.

Stakes held by non-controlling shareholders in the Group’s equity and results are respectively presented in the “Non-controlling interests” item of the consolidated balance sheet and of the consolidated comprehensive profit and loss statement.

The profit or loss of any subsidiaries acquired or disposed of during the financial year are included in the consolidated comprehensive profit and loss statement from the effective date of acquisition or until to the effective date of disposal, as appropriate.

2.8.2 Associates (See Appendix II)

Associates are considered as any companies in which the Parent Company has the ability to exercise significant influence, though it does not exercise either control or joint control. In general terms, it is assumed that significant influence exists when the percentage stake (direct or indirect) held by the Group exceeds 20% of the voting rights, as long as it does not exceed 50%.

Associates are valued in the consolidated financial statements using the equity method; in other words, through the fraction of their net equity value the Group’s stake in their capital represents once any dividends received and other equity retirements have been considered. In the case of transactions with an associated company, the corresponding losses or gains are eliminated in the percentage of the Group’s stake in its capital.

The profit (loss) net of tax of the associate companies is included in the Group’s consolidated comprehensive profit and loss statement, in the item “Profit (Loss) from entities valued through the equity method”, according to the percentage of the Group’s stake.

If, as a result of the losses incurred by an associate company, its equity were negative, in the Group’s consolidated balance sheet it would be nil; unless there were an obligation on the part of the Group to support it financially.

2.8.3 Foreign currency translation

The following criteria have been applied for converting into euros the different items of the consolidated balance sheet and the consolidated comprehensive profit and loss statement of foreign companies included within the scope of consolidation:

- Assets and liabilities have been converted by applying the effective exchange rate prevailing at year-end.

- Equity has been converted by applying the historical exchange rate. The historical exchange rate existing at 31 December 2003 of any companies included within the scope of consolidation prior to the transitional date has been considered as the historical exchange rate.

- The consolidated comprehensive profit and loss statement was translated at the average exchange rate for the year, except for the companies in Argentina whose economy was declared hyperinflationary in 2018 and therefore, in accordance with IAS 29, their consolidated comprehensive profit and loss statement was translated at the 2019 year-end exchange rate (see Note 4.23).

Any difference resulting from the application these criteria have been included in the “Translation differences” item under the “Equity” heading (except for those arising from the translation of hyperinflationary economies).

Any adjustments arising from the application of IFRS at the time of acquisition of a foreign company with regard to market value and goodwill are considered as assets and liabilities of such company and are therefore converted using the exchange rate prevailing at year-end.

2.8.4 Changes in the scope of consolidation

The most significant changes in the scope of consolidation during 2019 and 2018 that affect the comparison between financial years were the following:

a.1 Changes in the scope of consolidation in 2019

a.1.1 Additions to the scope of consolidation

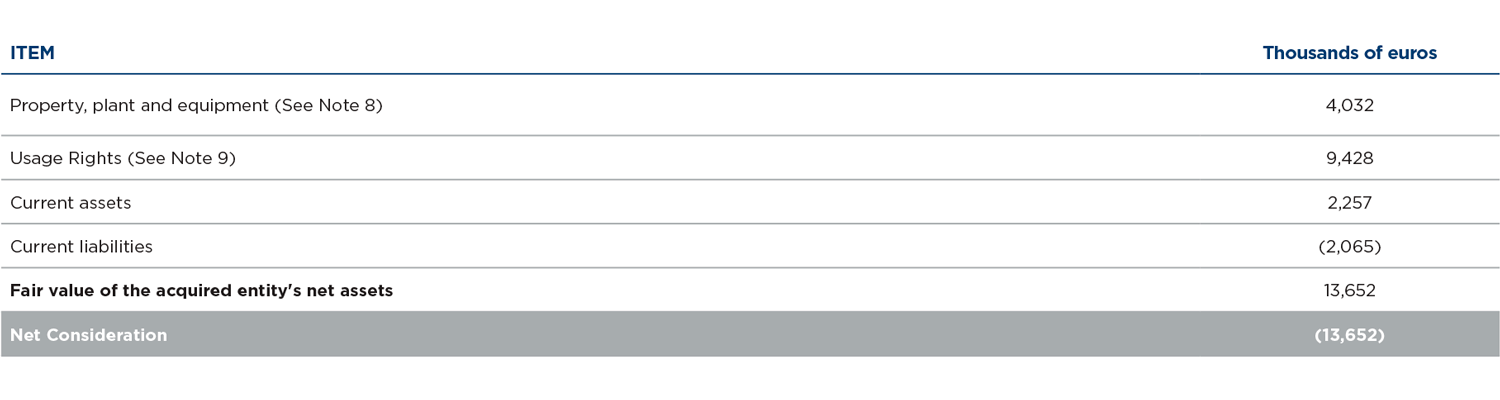

In October, the Group formed the company Anantara The Marker Ltd to acquire the company GCS Hotel Limited, operator of The Marker hotel in Dublin. The acquisition cost was 13,652 thousand euros and the inclusion of these companies has had the following effects on the consolidated balance sheet: