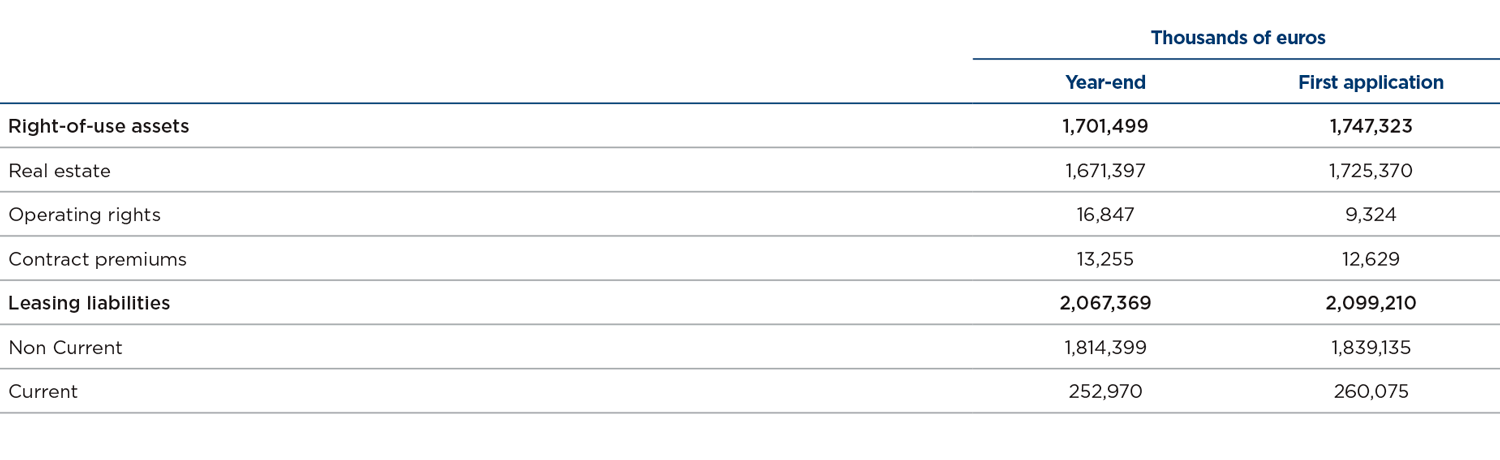

The “Contract premiums” and “Operating rights” headings are intangible assets related to lease contracts that were recorded as such in 2018 and that, with the application of IFRS 16, were reclassified at 1 January 2019 to right-of-use assets.

Additions to right-of-use assets during 2019 amounted to 131,428 thousand euros, offset by the amortisation expense recorded for the year amounting to 181,079 thousand euros.

The main additions for the year are due to the incorporation of several hotels on a lease basis. Of note is the incorporation of the Anantara Villa Padierna and the NH Collection Finisterre in Spain; NH Collection Fori Imperiali in Italy; and NH Collection Antwerp Centre in Belgium.

Likewise, among the additions for the year is the acquisition of GCS Hotel Limited operating the Anantara The Marker hotel in Dublin under lease and whose first consolidation difference was assigned to the lease contract of said property recording it as a right-of-use asset under the heading “Operating rights” for an amount of 9,428 thousand euros (See Note 2.8.4).

The movement in both right-of-use assets and leasing liabilities is mainly non-cash given that the asset is modified based on the variations produced in the liability, either due to changes in the contract’s payment structure or by the update in accordance with revenues benchmarks.

The main impacts on the consolidated comprehensive profit and loss statement related to the application of IFRS 16 are a higher financial expense of 89,620 thousand euros, a net gain of the disposal of non-current assets of 1,044 thousand euros, due mainly to cancellations of contracts that had no cash impact and net gains on asset impairment of 2,175 thousand euros.

The amounts recorded as right-of-use assets correspond to properties where the NH Group is a lessee for its operation as a hotel.

Short-term leases and low-value leases are recognised as an expense in the consolidated profit and loss statement on a straight line basis. A short-term lease contract is one where the period is less than or equal to 12 months. A “low value contract” is one whose underlying asset assigned in use would have a new value of under 5,000 euros.