11.1 Loans and accounts receivable not available for trading

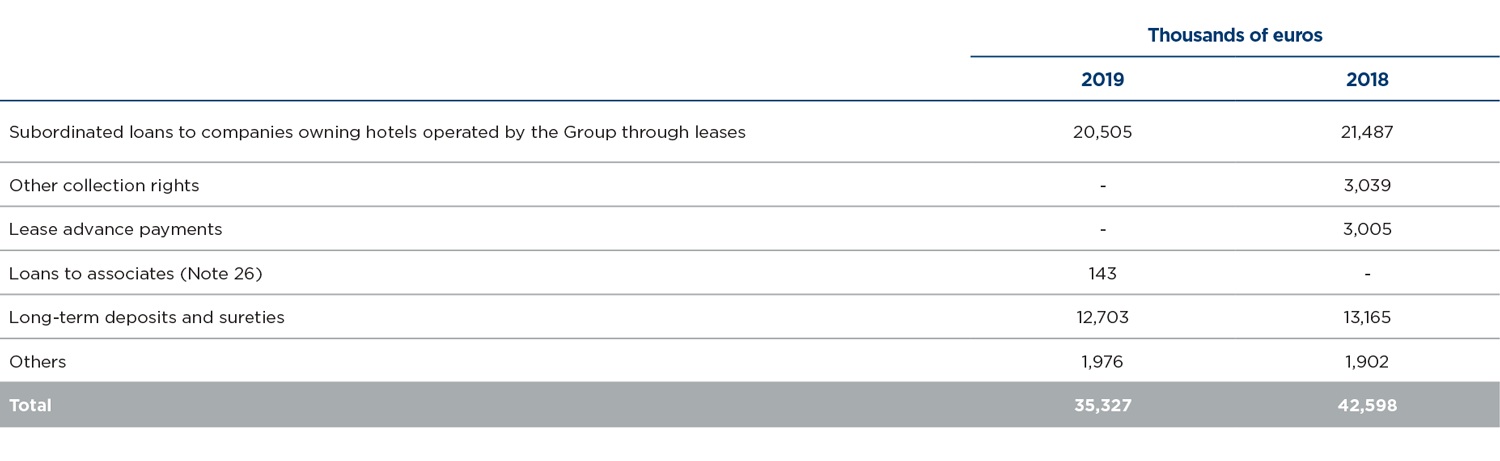

The breakdown of this item at 31 December 2019 and 2018 is as follows:

English

English Spanish

Spanish English

English Spanish

SpanishThe breakdown of this item at 31 December 2019 and 2018 is as follows:

The “Subordinated loans to companies owning hotels operated by the Group through leases” item includes a series of loans granted by the Group to companies which own hotels in countries such as Germany, Austria, the Netherlands, Italy and Spain, and which are operated by the Group under a leasing agreement.

The main features of these agreements are as follows:

– Hotel rentals are not subject to evolution of the inflation rate or to that of any other index.

– The aforementioned subordinated loans accrue interest at a fixed rate of 3% per annum.

– Lease agreements establish a purchase right on properties subject to agreements that, as a general rule, may be executed in the fifth, tenth and fifteenth year from the entry into force of the agreement.

– The model used for these lease agreements has been analysed and independent experts consider them to be operating leases.

At year-end 2018 , “Other collection rights” included the claim for the sale of fifteen commercial premises. During 2019, an agreement was reached to deliver the aforementioned premises by cancelling the recorded accounts receivable and incorporating these premises in the “Investment Property” line.

The “Lease advance payments” item includes the advance payments made to the owners of certain hotels operated under a lease arrangement for the purchase of decoration and furniture; these are discounted from future rental payments. Resulting from the application of the new lease standard IFRS 16, there is no concept of linearisation (See Note 2.1.1).

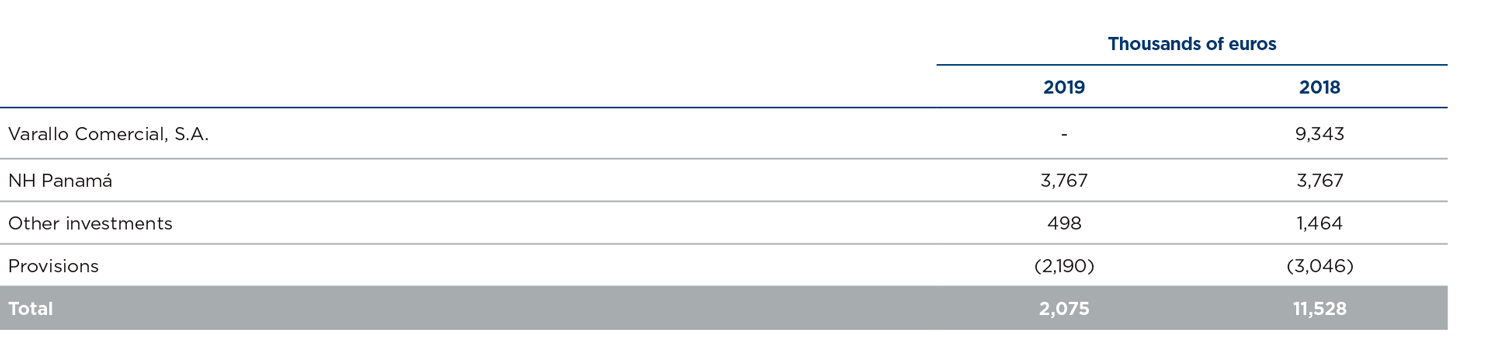

This heading of the consolidated balance sheet comprised, at 31 December 2019 and 2018, the following equity interests, valued at cost:

In December 2019, the Group sold its 9.87% shareholding in Varallo Comercial, S.A. and its 13.6% shareholding in Adquisiciones e Inversiones Europeo, S.L. The result of the operation was a consolidated gain of 8,525 thousand euros recorded under “Gains on financial and other operations”. At year-end 2019, the Group had an account receivable under “Other non-trade debtors” for 17,017 thousand euros related to said sale. This amount has been collected in full the 2nd of January 2020.

In regard to the fair value of financial assets, it does not differ significantly from its book value.