In accordance with IFRS 5, Non-current assets classified as held for sale and discontinued operations (see Note 4.7), the group has classified non-strategic assets under this heading which are undergoing divestment with committed sales plans.

The assets classified as held for sale, after deducting their liabilities, were measured at the lower of their carrying amount and the expected sales price minus costs.

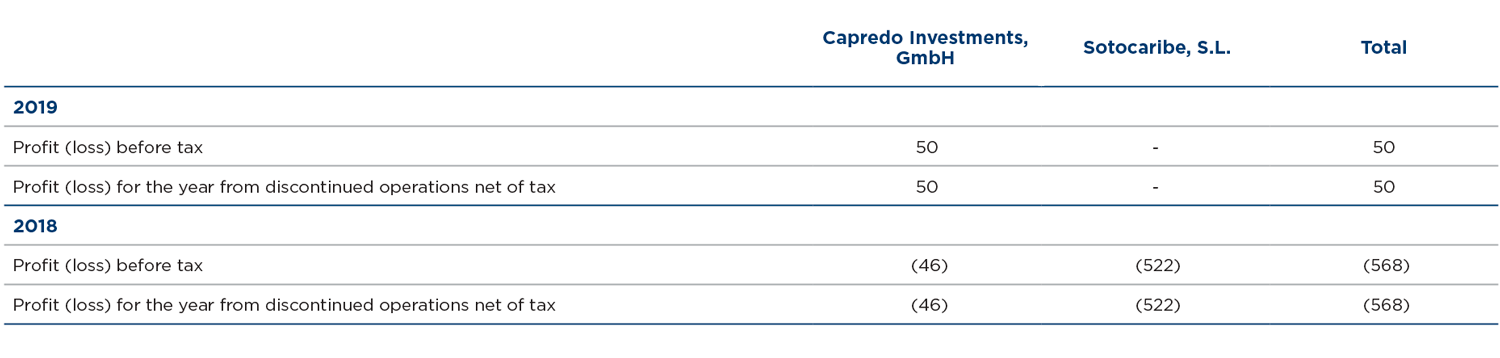

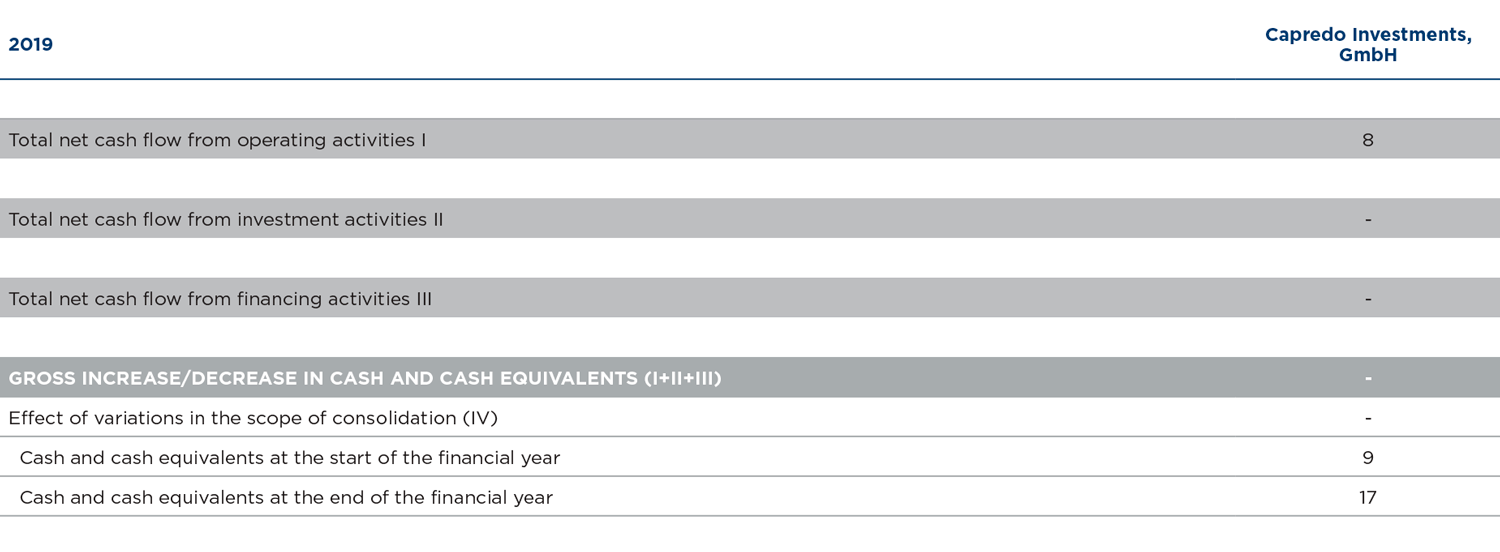

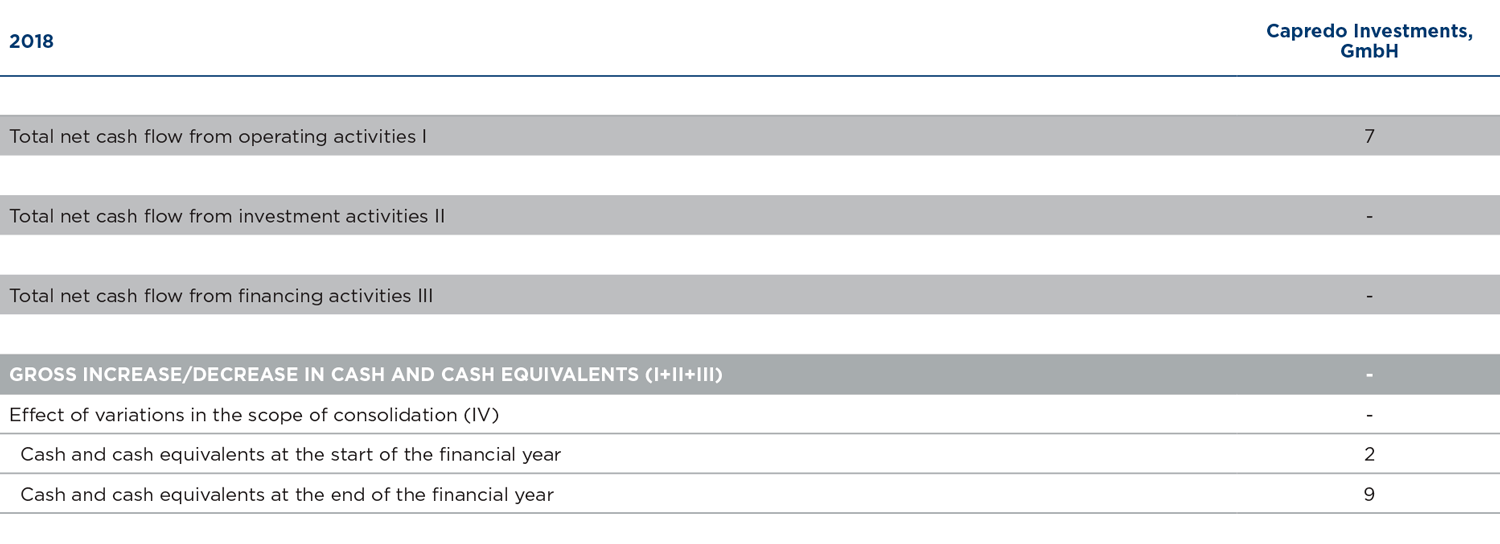

Specifically, the shareholdings in Sotocaribe, S.L and Capredo Investments GmbH are classified as discontinued operations; these companies represented the entirety of the Group’s property activity. Sotocaribe, S.L. was consolidated by the equity method, while Capredo Investments, GmbH was consolidated by the global method.

Additionally, in 2018, the land and property in which the NH Málaga II hotel is located, the sale of which was formalised in February this year, was recognised as available for sale. This transaction represented an asset de-recognition of 12,758 thousand euros and a positive pre-tax result of 2,874 thousand euros recorded under “Net result on disposal of assets”.

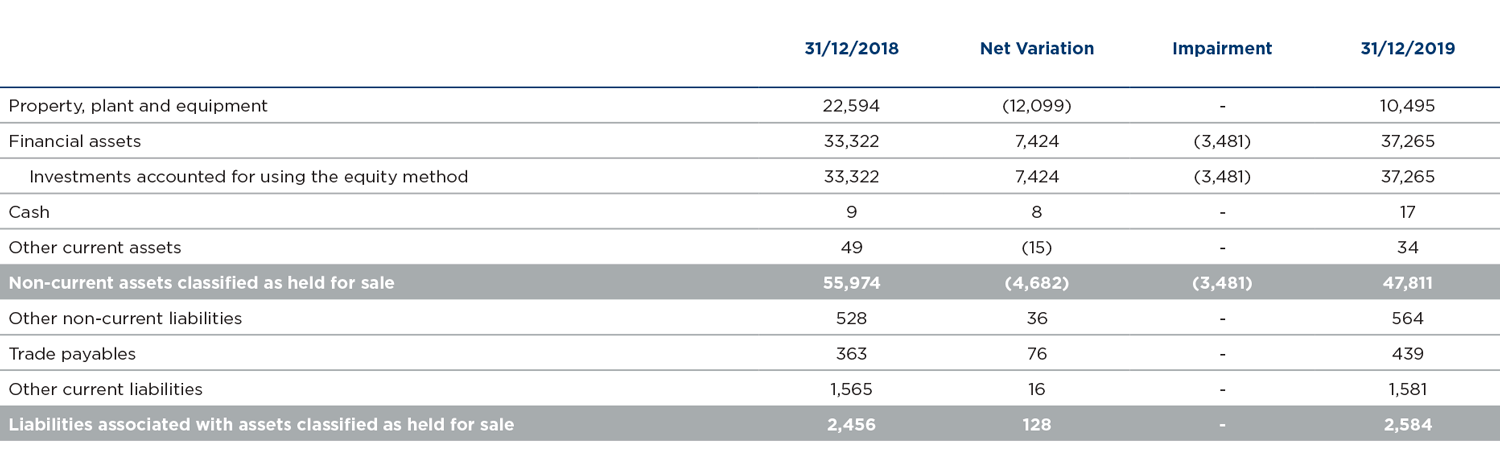

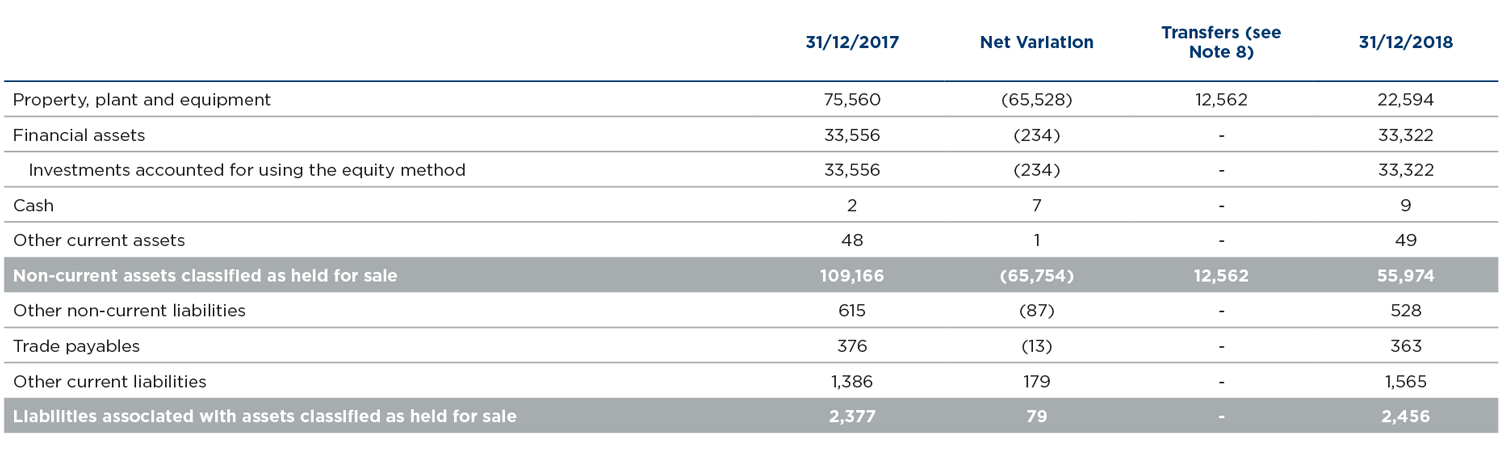

Consolidated balance sheets . Headings of Non-current assets and liabilities classified as held for sale:

A movement by balance headings of the assets and liabilities presented under the corresponding Held for Sale headings at 31 December 2019 and 2018 is shown below (in thousands of euros):