For the financial year ending 31 December 2019

EVOLUTION OF BUSINESS AND GROUP’S SITUATION

NH Hotel Group is an international hotel operator and one of the leading urban hotel companies worldwide in terms of number of rooms. The Group operates 368 hotels and 57,466 rooms in 30 countries, and has a significant presence in Europe.

The centralised business model allows it to offer a consistent level of service to its customers in different hotels in different regions. The corporate headquarters and regional offices offer hotels a wide range of functions such as sales, reservations, marketing and systems.

In 2019, world economic activity grew at a pace of +2.9% (Data and estimates provided by the E.C. “European Economic Forecast Autumn 2019” November 2019), lower than the previous year (+3.6%). The European Union has estimated +3.0% growth of world economic activity in 2020, slightly greater than the growth of 2019. More specifically in the Eurozone, the provisional growth rate for 2019 was 1.1% (+2.1% in 2018) and growth is expected to be +1.2% in 2020. Global growth has led to a positive cycle of trade and investment. In addition, European economies continue to grow, although with more moderate growth rates. In line with the above data, when comparing the growth rates of the four countries that bring together the largest proportion of sales and results of the Group, it is observed that in Spain (+1.9% in 2019 vs. +2.4% in 2018), Holland (+1.7% in 2019 vs. +2.6% 2018), Germany (+0.4% in 2019 vs. +1.5% in 2018), and Italy (+0.1% in 2019 vs. (+0.8% in 2018) lower growth rates than the previous year were recorded. On the other hand, growth in Latin America is expected to be +1.1% in 2020 (vs. -0.1% in 2019), given that almost all economies as a whole have been revised down substantially since Spring due to both cyclical and structural factors that have affected the growth previously expected in these economies.

According to the World Tourism Organization (“UNWTO”) in 2019, international tourist arrivals globally reached 1.5 billion, representing an increase of +4% over the previous year, clearly above the growth of 2.9% of the world economy. International arrivals in 2019 grew in all regions. However, the uncertainty surrounding Brexit, the collapse of Thomas Cook, geopolitical and social tensions and the slowdown of the global economy made growth slower in 2019 compared to the exceptional growth rates of 2017 and 2018. This slowdown mainly affected advanced economies, especially Europe and Asia and the Pacific. Whilst growth in Europe was lower than in previous years (+4%), it continues to lead in terms of the number of international arrivals with 743 million international tourists last year (51% of the world market). In this European context, Spain has established itself as the tourist power in the world, along with France and the United States, and managed to break its record with more than 83 million foreign tourists, an increase of 1% in the number of international arrivals. On the other hand, the Americas (+2%) offered mixed results as, although many Caribbean islands consolidated their recovery after the 2017 hurricanes, the number of arrivals to South America fell, in part due to social and political unrest.

In this context, in 2019, the Group, as a result of the favourable evolution of hotel activity throughout the year, surpassed the targets set thanks to greater positioning in the top brand segment, an improved customer experience, an increase in operating and commercial efficiency and the first milestones of integrating with Minor Hotels, among others, the access to the luxury segment with the Anantara brand.

During 2019, the value of the price strategy continued to be enhanced, greater Group growth being obtained in the top cities compared to direct competitors, where there are market measures in place. At Group level, the evolution of the RevPAR in the top destinations was superior to that of its competitors.

In 2018 new selective repositioning opportunities were identified to be executed in the period 2018-2020, having used a significant part of said investment in 2018 and 2019. In this new phase, there will also be contributions from the owners of hotels under a rental regime.

Among the main milestones reached over the last years of transformation, the appearance of NH Hotel Group value proposition stands out based on the improvement of the quality, experience and the brand architecture with the NH Collection, NH Hotel and nhow brands. In this vein, the Group improved the customer experience thanks to implementing a solid operational vision, including the new elements making up the hotels’ basic product range, known as Brilliant Basics, which are already in place in all of the establishments and which are contributing to a better experience and higher average score of the customers. In this ongoing improvement of the customer experience, worthy of note was the launch of “Fastpass”, a combination of three innovative services (Check-in Online, Choose Your Room and Check-out Online), which gives the customer full control over their stay. In this respect, NH Hotel Group has become the first European chain to offer these three services simultaneously. A new service, “City Connection”, has been launched where you can enjoy the city without limits. Under the slogan “Stay in one hotel, enjoy them all”, the NH Hotel Group offered a range of services that allow customers to enjoy them in any hotel in the city they are in, regardless of the hotel they are staying in for the duration of their stay.

The NH Hotel Group continues to be at the forefront of innovation. This last year ended up being very important in the Company’s digital transformation project to make processes and systems more efficient, increase the capacity to differentiate from the competition, and continue improving the Company’s basic processes. One of the great achievements therefore has been to centralise all its properties and functions into a single integrated system. This allows the NH Hotel Group to have a fully-integrated digital platform: NH Digital Core Platform. A pioneering technological solution in the sector that has allowed all the Group’s hotel’s systems to be integrated which has become the basis for the NH Hotel Group to expand its customer knowledge, maximise its efficiency and innovate on a large scale in all its value areas.

In its use of quality indicators, the NH Hotel Group considers as a priority on measuring quality using new sources of information and surveys with a significant increase in the volume of reviews and number of assessments received. Its average score on TripAdvisor in 2019 was 8.4, the same level as in December 2018. Additionally, its average Google Reviews score was 8.6, compared with 8.5 in December 2018. These average scores demonstrate the high levels of quality perceived by customers and the positive growth trend that the NH Hotel Group has had throughout the year.

Also, the NH Rewards loyalty programme has now reached 9.5 million members (8.6 million members in 2018), 15% of whom are active, i.e. have made at least one booking in the last 12 months.

On the other hand, in 2019, the Group started operating 13 new hotels in the following destinations: Mannheim, Valencia, Mérida, Marbella, Santiago de Chile, Leipzig, La Coruña, Porto, Rome, Andorra la Vella, Amberes, Dublin and Cancún. In addition, following the agreement reached with Minor, 3 hotels have begun operations under a rental agreement, nine under management and one franchise with the brands Tivoli, Avani and Anantara in Portugal. As a whole, all the openings in the year contribute 4,038 rooms and, as a result, the Group now has 368 hotels with 57,466 rooms at 31 December 2019.

In addition to the Portuguese signings and the agreements to operate 8 hotels (formely known as “Boscolo”) that respectively provide 2,452 and 1,115 rooms, the Group signed up 12 new hotels in 2019 with 1,262 rooms. These signings have been under rentals in La Coruña, Marbella, Rome, Verona, Hamburg, Dublin, Alicante and Cagliari and management in Aguascalientes, Andorra la Vella, Porto and Malaga. In addition, two of the signing were made under the luxury brand Anantara, 6 NH Collection and one nhow.

Revenues in 2019 totalled 1,708.1 million euros, an increase of +5.9% (+94.7 million euros). The Profit for the year attributable to the Parent was 90.0 million euros compared with 101.6 million euros in 2018. This decrease was affected by the application of IFRS 16 accounting regulations since 1 January 2019, which reduced the Profit for 2019.

In this year gross borrowing increased from 418.9 million euros in December 2018 to 455.6 million euros in December 2019. At 31 December 2019, cash and cash equivalents amounted to 289.3 million euros (265.9 million euros at 31 December 2018). Additionally, this liquidity was complemented by credit lines at the end of the year amounting to 303.5 million euros, of which 250 million euros corresponded to a long-term syndicated credit line, compared to 350.4 million euros at 31 December 2018.

The Group’s operating and financial transformation has been reflected in the corporate credit outlooks assigned by the main ratings agencies. In May 2019, Moody’s confirmed the rating of ‘B1’ reflecting some excellent results. In December 2019, Fitch lowered the corporate rating to ‘B’ from ‘B+’ in line with the application of its subsidiary connection criteria which reflects a change in the overall assessment of the strength of the connection by the agency on this point.

At the General Shareholders’ Meeting in May 2019, shareholders approved the payment of an interim dividend from 2018 results amounting to approximately 59 million euros, representing fifteen cents per outstanding share (gross). Said dividend was disbursed on 14 June 2019. The Group also established a medium term shareholder remuneration policy of nearly 50% of recurring net profit.

As a result of the public offering on 31 October 2018, Minor currently owns 369,165,609 shares in NH Hotel Group, S.A. representing 94.13% of its share capital. Since then, both companies have begun to explore joint value creation opportunities for the coming years.

Minor Hotels and NH Hotel Group have integrated their brands under a single corporate umbrella present in more than 50 countries around the world. In this way, a portfolio of more than 500 hotels under eight brands is organised: NH Hotels, NH Collection, nhow, Tivoli, Anantara, Avani, Elewana and Oaks, which completes a wide and diverse spectrum of hotel proposals connected to the needs and desires of global travellers.

Both groups currently share their knowledge base and experience in the sector in order to materialise short-term opportunities, taking advantage of the complementarity of their hotel portfolios to define a global sales strategy, the implementation of economies of scale with a broader customer base, explore development pathways for all their brands in different geographical areas and access to shared talent.

As a first milestone in the integration and sampling the alignment of interests, June 2019 saw the announcement of the transfer to the NH Hotel Group of the operation of a portfolio of 13 Minor Hotels in Portugal. This agreement was reached under market conditions, following a favourable report from the Audit and Control Committee assisted by external advisors, and the approval of the NH Board of Directors, without the participation of the Proprietary Directors in both bodies on behalf of the shareholder Minor. Thus, Minor International has agreed to the sale of three hotels in Lisbon to funds managed by Invesco Real Estate, which will simultaneously be operated by the NH Hotel Group through a long-term sustainable rental contract with the new ownership. At the same time, the NH Hotel Group reached an agreement with Minor International to operate another nine hotels in Portugal under a management regime plus a franchise contract.

At 31 December 2019, the NH Hotel Group had also reached an agreement with Covivio, one of the leading European real estate investors, to operate a unique portfolio of eight high-end hotels previously belonging to the renowned Boscolo portfolio, located in privileged locations in Rome, Florence, Venice, Nice, Prague and Budapest. This portfolio will be operated by the NH Hotel Group under a sustainable variable rental contract with a guaranteed minimum that includes a loss protection mechanism and extension rights at NH’s option. Most of the hotels will be converted to the Anantara and NH Collection brands after carrying out a in-depth repositioning programme in all properties promoted by Covivio over the coming months. It is estimated that the transaction will be completed by the end of the first half of 2020.

Analysis of first application of IFRS 16

From 1 January 2019, the new accounting regulation establishes the recognition of operating leases on the balance sheet through a financial liability equal to the current value of the fixed lease amounts, and an asset for the right to use the underlying asset. Therefore, the interest expense of the lease liability from the amortisation expense of the right of use is recorded separately.

The Group has adopted the amended retrospective method, calculating the asset at the start date of each contract and the liability at the changeover date using an incremental interest rate calculated for each agreement at the date of application of the regulations. The difference between both items is recorded as an adjustment to the opening balance of the consolidated reserves. The effects of initial application of the standard have been recognised on the date of initial application and, therefore, the comparative information has not been restated.

Given the nature of the leased assets, which represent 61% of the Group’s rooms, and the term of these contracts, the impact on the Group’s financial statements is significant.

ETHICS

Compliance System

Since 2014, NH Hotel Group has deployed a Compliance unit whose scope includes the following key areas:

- Code of Conduct.

- Criminal Risk Prevention Plan.

- Internal Rules of Conduct.

- Procedure for Conflicts of Interest.

Code of conduct

In line with its ethical commitment and the best practices of corporate governance, NH Hotel Group has carried out communication, awareness and training campaigns on Compliance since the last update to the Code of Conduct in 2015. The Group’s Board of Directors is responsible for approving the Code of Conduct.

This document affects everybody working at the NH Hotel Group, applicable to employees, managers and members of the Board of Directors of both the Company and its group of companies, and also in certain cases to other stakeholders such as customers, suppliers, competitors and shareholders, and to the communities where NH operates its hotels.

The Code of Conduct summarises the professional behaviour expected of employees, senior management and Board Members of the NH Hotel Group and its group of companies, who commit to acting with integrity, honesty, respect and professionalism in the performance of their work.

The NH Group is committed to compliance with the laws and regulations of the countries and jurisdictions where it operates. This includes, amongst other things, laws and regulations on health and safety, discrimination, taxation, data privacy, competition, prevention of corruption and money laundering, and commitment to the environment.

The Code of Conduct is published in six languages on the official website of the NH Hotel Group, available to all stakeholders. Also, since 2017, NH employees can use the “My NH” app to access the code of conduct from their mobile devices. The staff at centres operating under NH Hotel Group brands also have a handbook and an FAQs document.

The head of Internal Audit manages the Confidential Channel for Complaints and Queries relating to the Code of Conduct. The procedure for managing complaints received via the complaints channel are specified in detail in the Code of Conduct. This procedure guarantees confidentiality and respect in every phase, and protects against retaliation.

Over the course of 2019, there were 45 reports of alleged breaches of the Code of Conduct, all of which were investigated, with appropriate disciplinary measures being taken in 32 cases.

Compliance Committee

In 2014 the NH Hotel Group created a Compliance Committee consisting of certain members of the Management Committee and senior directors. This body is empowered to supervise compliance with the Group’s Internal Rules of Conduct, Procedure for Conflicts of Interest, Code of Conduct and Criminal Risk Prevention Plan.

The Compliance Committee supervises the management of the Compliance Office and is empowered to impose disciplinary measures on employees in matters within its scope.

In the course of 2019, there were three meetings of the Compliance Committee.

The Company has decided to roll out its crime prevention model to other countries (Germany, Holland, Belgium, United Kingdom, Colombia, Mexico and Argentina), having constituted local Compliance Committees in the Business Units covering the aforementioned countries.

Compliance Office

The Compliance Office, led by the Group’s head of Compliance, is responsible for disseminating and supervising compliance with the Code of Conduct and for drafting the Criminal Risk Prevention Plan. The Compliance Office reports directly to the Compliance Committee.

Conversely, and as mentioned above, in 2019 the Compliance Office started actions aimed at rolling out its function in crime prevention to other NH Business Units.

Drafting the anti-corruption and anti-fraud policy

On 31 January 2018, NH’s Board of Directors approved the Anti-Corruption Policy, in its commitment to detect and prevent the commission of corruption offences in business within the company. In order to reduce exposure to regulatory risks of a criminal nature, specifically to the risk of crimes related to corruption, bribery and fraud, in December 2018, the Compliance Committee approved an update of the Anti-Corruption and Fraud Policy, which was approved by the Board of Directors on 13 May 2019.

The general principles of the Anti-Corruption and Fraud Policy are:

- Zero tolerance of bribery and corruption in the private and public sectors

- Behaviour must be appropriate and legal

- Transparency, integrity and accuracy in financial information

- Regular internal control

- Local legislation shall take precedence if stricter

Drawing up of the anti-money laundering policy

NH’s Code of Conduct reflects a commitment to respect the applicable regulations on anti-money laundering policy, with special attention to diligence and care in the processes of evaluating and selecting suppliers, and in payments and collections in cash. Therefore, the Compliance Committee meeting of 19 December 2018 approved a policy that reinforces NH Hotel Group’s commitment to anti-money laundering and combating the financing of terrorism, with the aim of detecting and preventing NH Hotel Group, S.A. and its group companies from being used in money laundering or terrorist financing operations. Said Policy was approved by the Board on 13 May 2019.

The aforementioned Policies have been duly communicated to all Group employees and the corresponding online training has been made available to ensure their disclosure and understanding.

RISK MANAGEMENT MODEL

Risk management governance

The Company’s Board of Directors is responsible for overseeing the risk management system, in line with the provisions of Article 5 of the Regulation of the Board of Directors. As regulated by Section 3 of article 25 b) of the Regulation of the Company’s Board of Directors, the Audit and Control Committee supports the Board of Directors in supervising the effectiveness of the internal control, internal audit and the risk management systems, including tax risks. In this regard, carried out during the various meetings held in 2019 were control and monitoring of the Company’s main risks, their evolution in recent years and the main mitigation and response measures.

On the other hand, amongst other functions, the Company’s Management Committee manages and controls risks based on risk tolerance, assigns ownership of the main risks, periodically monitors their evolution, identifies mitigation actions as well as defining response plans. For these purposes, the Executive Risk Committee, made up from members of the Management Committee and Senior Executives, supports the Management Committee in such oversight, as well as promoting a culture of risks in the Company. For them, the Company has an internal risk management manual that details the principles, processes and controls in place.

Risk Management, integrated into the Internal Audit department, is responsible for ensuring the risk management and control system in the Company functions properly and is linked to the strategic objectives. To ensure that there are no conflicts of independence and that the NH risk management and control system works as set out in the Corporate Risk Management Policy, an independent third party has reviewed its operation annually for the last two years.

As an additional guarantee of independence, Risk Management is independent of the Business Units and, as with Internal Audit, it maintains a functional reporting line to the Audit and Control Committee.

In line with the above, NH follows the Three Lines of Defence model (‘The three lines of defence for effective risk management and control’ Position Paper issued by the Institute of Internal Auditors in January 2013):

- First line of defence: carried out by each function (business and corporate units) that owns the risk and its management (Operations, Commercial, Marketing, etc.).

- Second line of defence: performed by the functions responsible for risk supervision (Risk Management, Compliance, Data Protection, Internal Control, etc.)

- Third line of defence: carried out by Internal Audit that affords independent assurance.

The NH Hotel Group’s Corporate Risk Management Policy (approved by the Board of Directors in 2015), as well as the internal manual that implements it, aim to define the basic principles and the general framework of action to identify and control all types of risks that may affect the companies over which the NH Hotel Group has effective control, as well as ensuring alignment with the Company’s strategy.

Risk management model

The risk management system of the NH Hotel Group, which is rolled out in both the Group’s corporate head office and its Business Units, aims to identify events that may negatively affect achievement of the objectives of the Company’s Strategic Plan, providing the maximum level of assurance to shareholders and stakeholders and protecting the group’s revenue and reputation.

The risk management model is based on the integrated COSO IV ERM (Enterprise Risk Management) framework, is managed through SAP GRC and includes a set of methodologies, procedures and support tools that allow the NH Hotel Group:

1. To adopt adequate governance in relation to the Company’s risk management, as well as promoting an appropriate risk management culture.

2. To ensure that the Company’s defined objectives are aligned with its strategy and risk profile.

3. To identify, evaluate and prioritise the most significant risks that could affect achievement of strategic objectives To identify measures to mitigate these risks, as well as establish action plans and Key Risk Indicators based on the Company’s tolerance to risk.

4. To follow-up on the action plans and the key indicators established for the main risks, within a continuous improvement model framework.

5. Periodic reporting in SAP GRC by risk managers about the status of their respective risks and, in turn, reporting to the Company’s main governing bodies.

The Group’s Risk Map is updated annually and approved by the Board of Directors once reviewed and validated by the Audit and Control Committee. The Company updated its Risk Map in 2019 through a process in which 37 Senior Executives identified and assessed the main risks faced by the Company. This Map was approved by the Board of Directors at its meeting on 25 July 2019.

For the main risks of the Risk Map, the Audit and Control Commission receives a report every six months detailing the operation of the risk management and control system and includes conclusions on it. The measurement of the key indicators is included for this, stating if they are kept within the set tolerance values or if they need to be adjusted. The implementation status of the previously agreed action plans is also included in the report.

Each of the main risks on the Company’s Risk Map is assigned a Risk Owner who, in turn, is a member of the Management Committee. Each risk manager reports periodically to the Audit and Control Committee (according to an established schedule) to present the existing or ongoing mitigation measures for its risks, the state of implementation of action plans and the measurement of key indicators in accordance with established tolerances. During 2019, the Owners of the main risks attended the Audit and Control Committee to present their corresponding risks and made a formal validation in SAP GRC.

Each year, coinciding with the update of the Risk Map, Risk Management is responsible for reassessing the risk catalogue, both financial and non-financial. The final catalogue is validated with the Senior Executives who take part in the process, as well as with the bodies involved in its validation (Management Committee, Executive Risk Committee and Audit and Control Committee) and approval (Board of Directors). Additionally, Risk Owners can report/suggest a new risk to the Risk Office through SAP GRC during the year.

In general, the risks to which the Group is exposed can be classified into the following categories.

a) Financial Risks: events that affect financial variables (interest rates, exchange rates, inflation, liquidity, debt, credit, etc.).

b) Compliance Risks: arising from possible regulatory changes as well as non-compliance with internal and external regulations.

c) Business Risks: generated by inadequate management of procedures and resources, whether human, material or technological.

d) Risks from External Factors: arising from natural disasters, political instability or terrorist attacks.

e) Systems Risks: events that could affect the integrity, availability or reliability of operational and financial information.

f) Strategic Risks: produced by difficulty accessing markets and difficulties in asset disinvestment.

New data protection plan

Due to the mandatory application of the General Data Protection Regulation (GDPR) in the European Union from May 2018, NH Hotel Group has launched a plan to guarantee compliance with the regulation, included in and aligned with the Transformation Plan.

This new plan includes general privacy measures by default, so that all the company’s activities, applications, processes, and projects will take privacy matters into account. The plan includes key initiatives such as the effective management of personal data infringements, the data subject’s consent to the gathering and use of their data, and a policy for the destruction of physical or virtual data. The plan also provides for the creation of a Data Protection Officer within the NH Hotel Group.

NH ROOM 4 SUSTAINABLE BUSINESS PILLARS AND COMMITMENT

The NH Hotel Group performs its hotel activity with the ambition of leading responsible behaviours, and creating shared value at an economic, social and environmental level wherever it operates. With this philosophy, the Company worked on the development of the new Strategic Plan in 2019, giving continuity to the previous one, in which one of the pillars is NH ROOM4 Sustainable Business; a key part of the Company’s global strategy.

The strategic vision of NH ROOM4 Sustainable Business is, in turn, based on three fundamental management levers: NH ROOM4 People, NH ROOM4 Planet and NH ROOM4 Responsible Shared Success, all of which are framed under the same premise of sustainable and ethical principles, responsible culture and spirit of citizenship.

Convinced it is moving in the right direction to achieve the next sustainability challenges, the Company is aligned with the Sustainable Development Goals (SDGs) to which it can contribute and undertakes to continue creating long-term and global value within the framework of the 2030 Agenda.

NH ROOM4 Sustainable Business, which is deployed alongside the Group’s global strategy, includes its main commitments on sustainability and the development of lines of action in the priority areas for the company: commercial, employee commitment, investment, brand purpose, corporate governance, and supplier assessment.

Since 2013, the NH Hotel Group has been listed on the FTSE4GOOD index and renews its presence year after year thanks to the responsible management of the business and the improvements implemented. The index was created by the London Stock Exchange to help investors include environmental, social and governance (ESG) factors into their decision making.

At the same time, the Company has been listed on the Ethibel Sustainability Index since 2015. Ethibel is an index that unites companies from different sectors who are leaders in Corporate Social Responsibility. The presence of the NH Hotel Group demonstrates the Company’s good performance and encourages Socially Responsible Investment (SRI) among investors and funds.

Finally, the NH Hotel Group has been included on Bloomberg’s gender equality index 2020 for the first time; it being the only Spanish hotel company among the index’s 325 companies.

Human Resources strategy

The average number of people employed by the Parent Company and consolidated companies in 2019 is 11,464 employees.

The corporate culture of the NH Hotel is also based on the cornerstones of diversity and equality. At 31 December 2019, women made up 50.9% of the total workforce.

Also, the average age of employees at 31 December 2019 is 38.9 years old, and their average time with the company is 8.7 years.

Over this year, as part of the company’s 2017-2019 Strategic Plan, the Human Resources strategy has continued, based on three main commitments:

- Global leadership and talent management: Ensuring the company’s future by involving the best employees, and identifying and developing the most talented people in the NH Hotel Group, using competitive tools and mechanisms to ensure their retention and commitment.

- Maximum performance and better workplaces: Becoming a company recognised as a Best Place to Work, based on the high level of commitment amongst employees, active contribution to this goal, rigour in differentiating and recognising high performance, and increasing its recognition as an attractive employer.

- Transformation and reinvention: Searching for, assessing and leveraging opportunities to be more efficient (outsourcing, digitisation, etc.), evolving our working environment and acquiring advanced analytical and predictive skills.

All the above must be based on and solidly backed by Operational Excellence in Human Resources and Internal Communication, with clear policies and processes, meeting commitments proactively, continuing to support, develop and implement the operational model of the NH Hotel Group, and controlling payroll costs and related budget items.

Environmental sustainability

For the NH Hotel Group, environmental sustainability drives innovation, seeking to surprise our guests as well as achieving efficiencies in the use of natural resources, particularly water and energy. In our responsible commitment to the Planet, we work to minimise our impact on Climate Change, increase the efficiency of resources and develop more sustainable services. All this minimises our environmental footprint with responsible consumption of natural resources.

Continuity was given to the environmental achievements of recent years in 2019. Thus, compared to 2007, consumption per occupied room is reduced by: 31% for energy consumption, 23 % for water and the carbon footprint by 61%. NH Hotel Group is committed to renewable energy, which reduces its carbon footprint. This consumption of green energy, certified as renewable, is available in 99% of our consolidated hotels in Spain, Italy, the Netherlands, France and Luxembourg, covering 67% of the total electricity consumed in Europe.

NH Hotel Group works with the ISO 14.001 environmental management system and ISO 50.001 for energy efficiency in accommodation, catering, meetings and events. In total, the Company has 149 individual sustainability certifications in hotels such as BREEAM, LEED, Green Key, Hoteles+Verdes, ISO 14.001 Environmental Management System and/or ISO 50.001 Energy Management System. These environmental certifications are internationally recognised (ISO 14.001 and ISO 50.001) and those from the hotel sector itself such as Hoteles+Verdes and Green Key are recognised by the GSTC (Global Sustainable Tourism Council). The NH Hotel Group has reported its commitment to and strategy against climate change to CDP Climate Change since 2010 and received a B in its annual ranking.

It is also noteworthy that, in 2019, the NH Hotel Group became the first Spanish hotel company to establish emission reduction targets that are scientifically validated by the Science Based Targets initiative (SBTi) – a leading alliance in the promotion of the business sector against climate change in which CDP, the United Nations Global Compact, World Resources Institute and World Wide Fund for Nature are a part. With this formalisation, the NH Hotel Group is committed to reducing its carbon emissions by 20% throughout its value chain before 2030. This objective marks the Company’s roadmap towards a significant reduction in its activity’s carbon footprint in the coming years, aligned with the purpose set in the Paris Agreement to limit the increase in the global temperature to less than 2ºC, and join the efforts that are being made globally towards the transition to a low carbon economy.

SHARES AND SHAREHOLDERS

NH Hotel Group, S.A. share capital at the end of 2019 comprised 392,180,243 fully subscribed and paid up bearer shares with a par value of €2 each. All these shares carry identical voting and economic rights and are traded on the Continuous Market of the Spanish Stock Exchanges.

According to the latest notifications received by the Company and the notices given to the National Securities Market Commission before the end of every financial year, the most significant shareholdings at 31 December 2019 and 2018 were as follows:

(1) MINT is the indirect shareholder through MHG Continental Holding (Singapore) Pte Ltd

(1) MINT is the indirect shareholder through MHG Continental Holding (Singapore) Pte Ltd

The aforementioned (indirect) shareholding of MINT in NH Hotel Group, S.A. is the result of the IPO made by MHG Continental Holding (Singapore) Pte Ltd. on 11 June 2018 for 100% of the shares that were part of the share capital of NH Hotel Group, S.A., the result of which was that MINT acquired, through its wholly owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd, shares representing 94.13% of the share capital of NH Hotel Group, S.A.

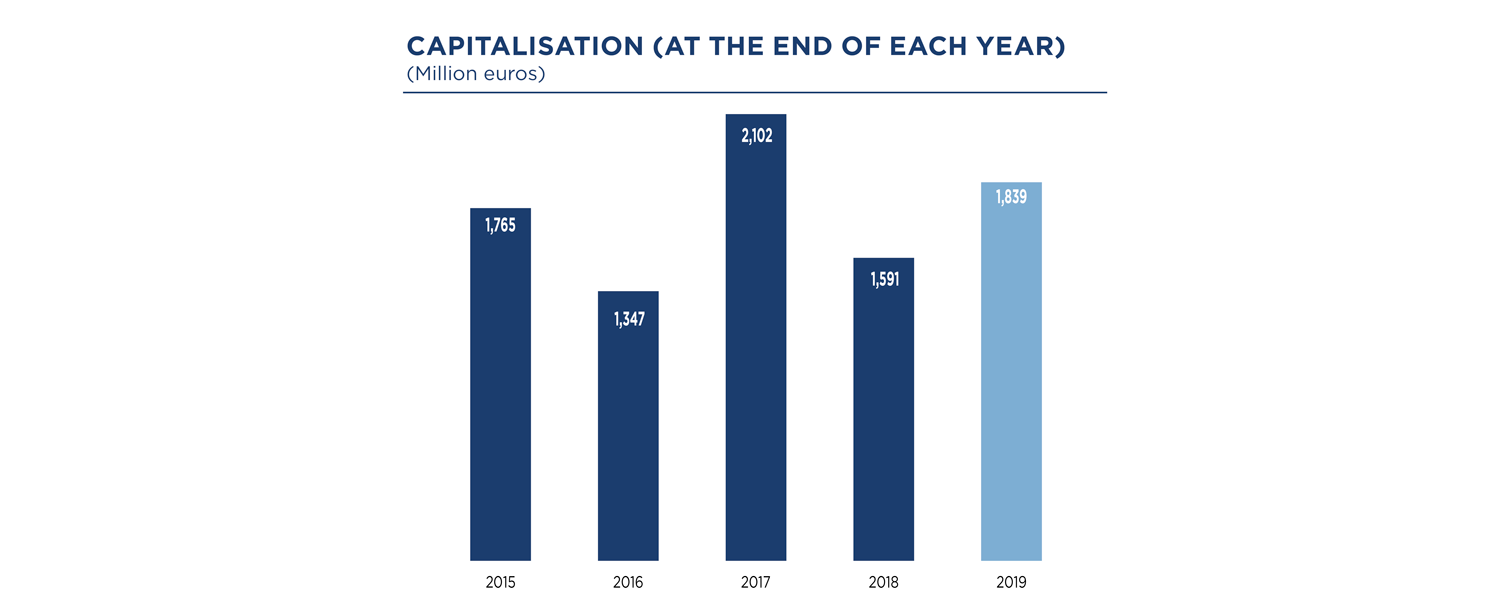

The average share price of NH Hotel Group, S.A. in 2019 was 4.57 euros per share (6.18 euros in 2018). The lowest share price of 3.89 euros per share was recorded in January (3.82 euros in December 2018) and the highest share price of 5.28 euros per share in March (6.82 euros in July 2018). The market capitalisation of the Group at the close of 2019 stood at 1,839.33 million euros.

At 31 December 2019, the Group had 374,464 own shares (it includes 83,176 shares related to the Liquidity contract) 600,000 own shares at 31 December 2018. The reduction of treasury shares in the period is explained by the delivery of 226,067 shares to NH employees under the Long-term Incentive Plan.

Liquidity contract for treasury shares management

On 10 April 2019, the NH Board of Directors entered into a liquidity contract to manage its treasury shares with Banco Santander, S.A. The Contract became effective on 11 April 2019.

This contract is in accordance with the liquidity contract model in Circular 1/2017 of 26 April from the National Securities Market Commission on liquidity contracts for the purpose of its acceptance as a market practice.

The total number of shares allocated to the securities account associated with the new Liquidity Contract is 82,645 shares and the amount allocated to the cash account is 400,000 euros.

The Liquidity Contract was agreed upon by the Board of Directors at the proposal of the Proprietary Directors on behalf of the shareholder Minor as a measure to encourage and favour the liquidity of the Company’s shares taking the current market conditions into account.

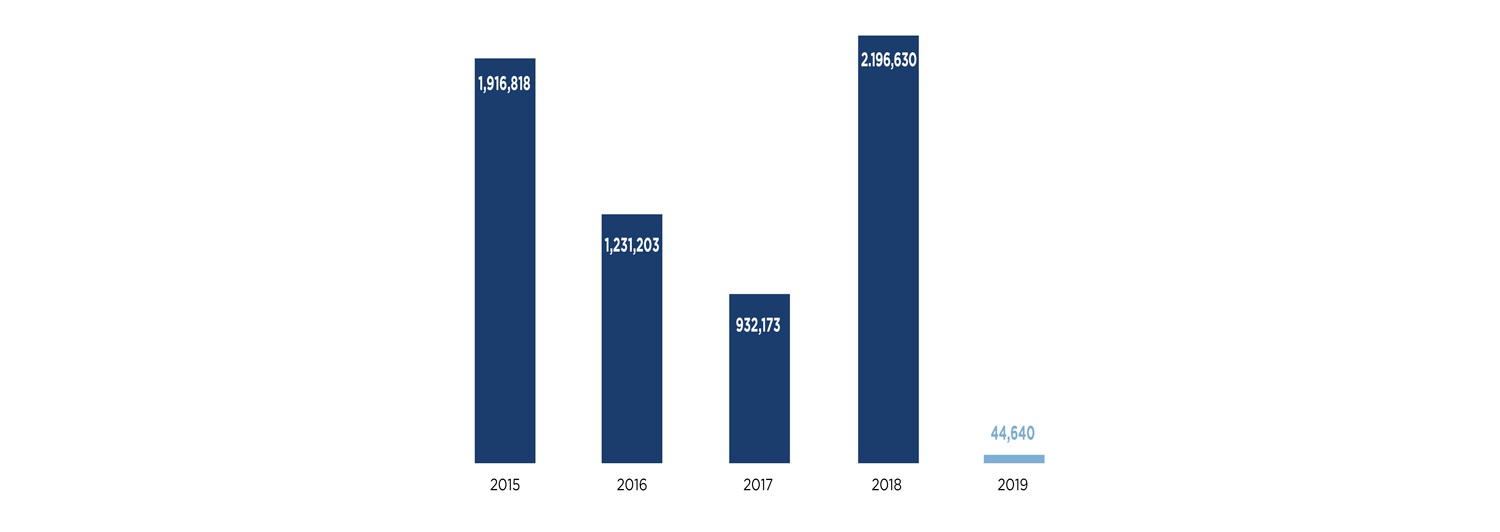

During 2019, 11,383,314 shares in NH Hotel Group, S.A. were traded on the Continuous Market (560,140,781 shares in 2018) with average daily share trading on the Continuous Market of 44,640 shares (2,196,630 shares in 2018).

During 2019, 11,383,314 shares in NH Hotel Group, S.A. were traded on the Continuous Market (560,140,781 shares in 2018) with average daily share trading on the Continuous Market of 44,640 shares (2,196,630 shares in 2018).

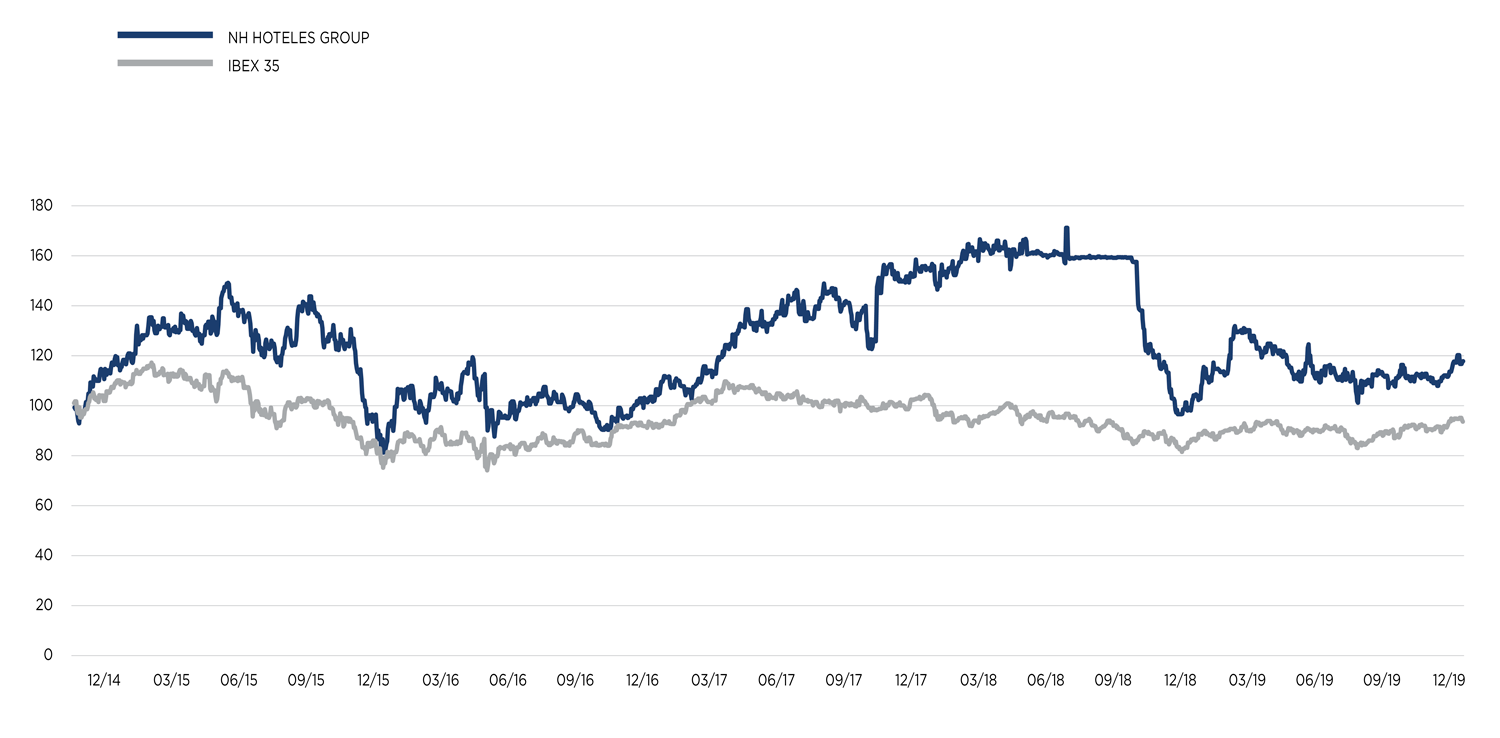

EVOLUCIÓN NH HOTEL GROUP vs. IBEX 35

1 JANUARY 2015-31 DECEMBER 2019

FUTURE OUTLOOK

The Forecasts of the European Union for November month indicate that this growth will be moderate in 2020, although at a more sustainable pace after ten years of constant expansion following the economic and financial crisis of 2009. World growth of between 3% and 4% is expected in 2020, an outlook that is reflected in the last UNWTO Confidence Index which shows prudent optimism: 47% of participants believe that Tourism will offer better results than in 2019 and 43% believe it will remain the same. It is expected that some major sporting events, including the Olympic Games in Tokyo, and other cultural events, such as the Dubai Expo 2020, will have a positive impact on the hotel sector.

On the other hand, GDP growth in the Eurozone is expected to be +1.2% in 2020 (Data and estimates provided by the E.C. “European Economic Forecast – Autumn 2019” November 2019).

It is worth mentioning regarding volatility and macroeconomic situation and social instability the evolution that currencies may have in Latin America over the coming months and their impact on the economic growth of that region.

In this economic environment, the Group expects to benefit from the increase in sales associated with GDP growth expectations in 2020, together with the positive impact of the repositioning investments made in recent years and supported by the implementation of price management tools which will allow us to continue to optimise this strategy.

Non-financial Information Statement

The 2019 consolidated Non-Financial Information Statement, issued by the Board of Directors on 25 February 2020, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This document is presented as a separate report, is part of this Consolidated Management Report and is available on the corporate website of the NH Group (https://www.nh-hoteles.es/corporate), within the section on Annual reports included in financial information.

EVENTS AFTER THE REPORTING PERIOD

On 22 January 2020, the last payment of a syndicated loan granted by two banking entities was paid to a company in which an NH Group company is a minority shareholder. This company, which consolidates into the NH Group, using the equity method had an outstanding principal of 15,742 thousand euros (equivalent to 17,685 thousand dollars), thereby releasing the guarantees that had been granted for the fulfilment of payment of said loan.

In order to carry out such payment, the Group has made a contribution of 6,315 thousand euros (5,588 thousand euros at 31 December 2019 (See Note 26)) corresponding to the proportional part of NH Hotel Group as a guarantor.

At a date subsequent to the year-end, a claim against a Group company was filed; it is pending processing and in no case will have a significant adverse effect.