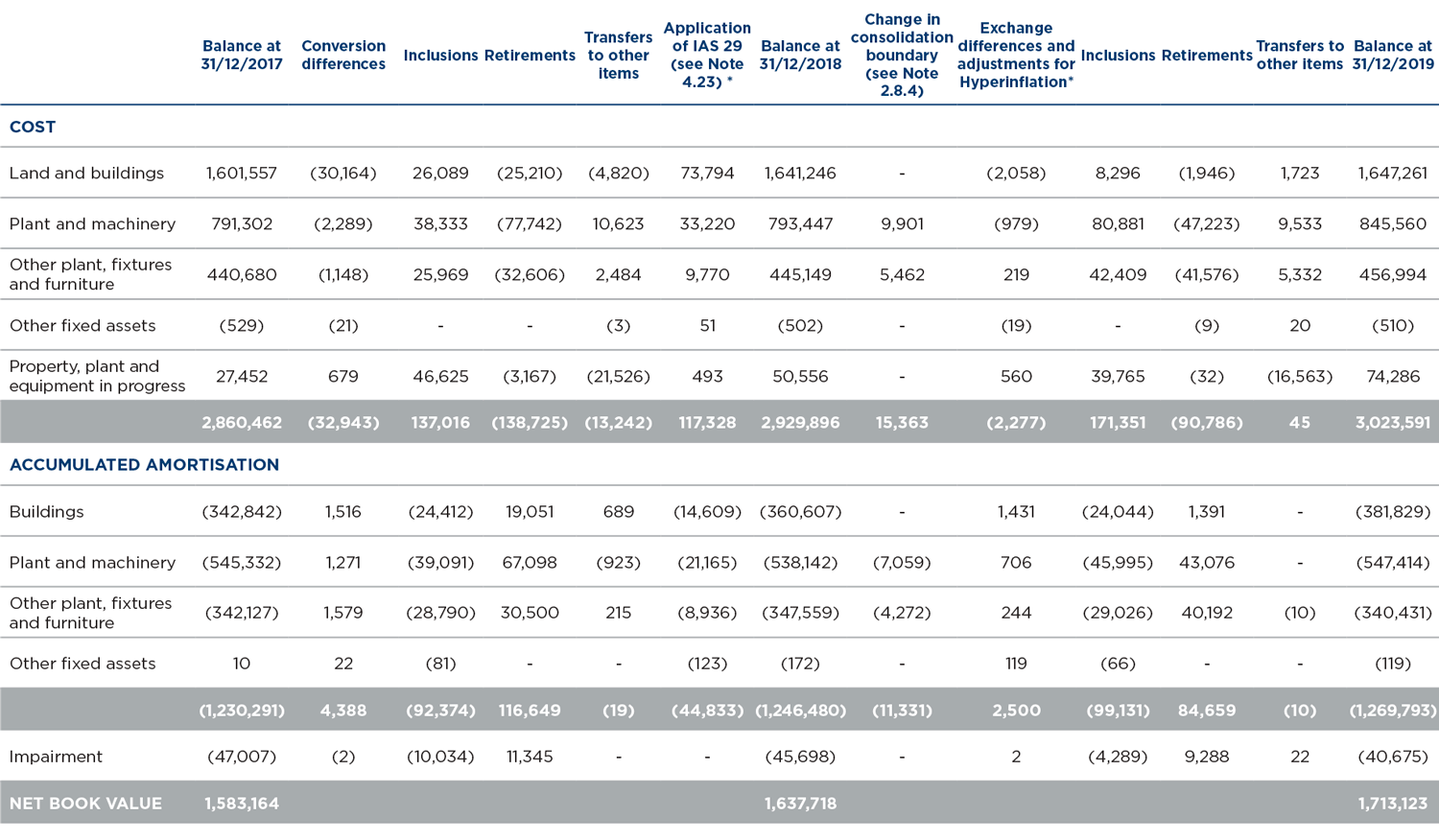

The breakdown and movements under this heading during 2019 and 2018 were as follows (in thousands of euros):

*Includes the net impact of the application of the criteria for hyperinflationary economies (Argentina).

The main additions and reductions in 2019 are due to the repositioning plan carried out by the Group, with refurbishments in all Business Units. Of note are the works of the NH Luz de Huelva and NH Malaga in Spain, the renovation of the NH Palermo and NH Ambassador in Italy, the works of the NH Vienna Airport and the NH Hamburg Altona and the new opening of the NH Leipzig Zentrum in Central Europe, the works of the NH Conference Centre Leeuwenhorst and the NH Collection Flower Market in Benelux. Finally, in New York, refurbishment of the NH New York Jolly Madison Towers.

The effect on the profit and loss account of assets de-recognised, replaced or disposed of to third parties outside the Group was and expense of 4,627 thousand euros, recognised under “Gain/(loss) on the disposal of non-current assets” in the 2019 consolidated comprehensive profit and loss statement.

The net additions in the year in the column “Changes in the scope of consolidation” come from the purchase of the company Anantara The Marker Ltd (see Note 2.8.4).

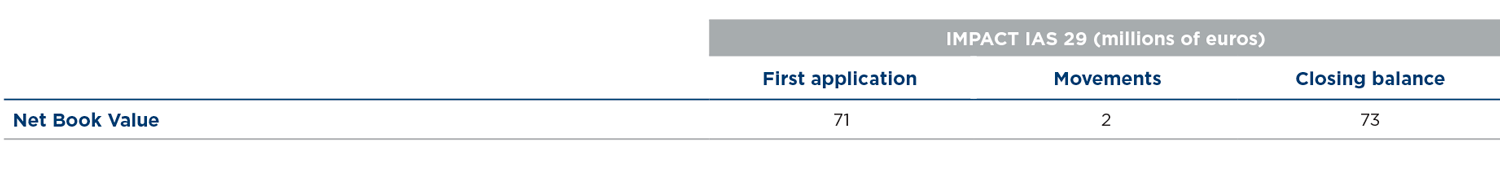

The net effect from applying IAS 29 in 2019 was the 1.5 million euro increase in assets recorded in the “Exchange differences and adjustments for hyperinflation” column. In 2018, the first year of application, the impact was as follows( See Note 2.4):

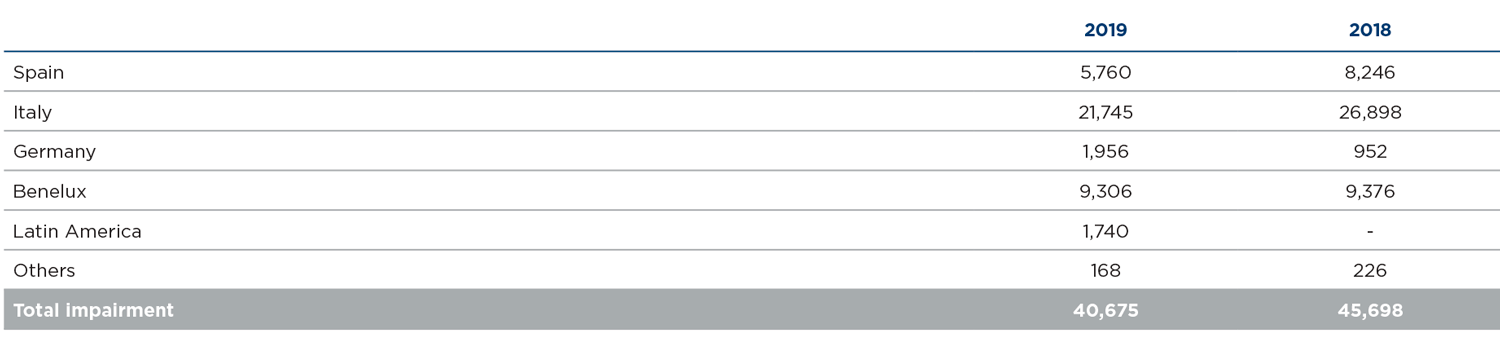

In 2019, and impairment amounting to 4,289 thousand euros has been recognised for certain assets; this impairment mainly corresponds to real estate and is a result of the worsening of future expectations of cash flows for different reasons, including the opening of competitors’ hotels or the loss of an important customer (10,034 thousand euros in 2018). On the other hand, there was a reversal of 9,288 thousand euros resulting from the improvement in future cash flows expectations of some hotels. The net effect recorded under the heading “Profits/(Net losses) due to impairment of assets” on the consolidated comprehensive profit and loss statement for 2019, has been an income of 4,999 thousand euros.

The breakdown of impairment by country is as follows (in thousands of euros):

At 31 December 2019, there were tangible fixed asset elements with a net book value of 232 million euros (237 million euros in 2018) to guarantee several mortgage loans and secured senior bonds maturing 2023 (see Note 16).

The Group has taken out insurance policies to cover any possible risks to which the different elements of its tangible fixed assets are subject, and to cover any possible claims that may be filed against it in the course of its activities. It is understood that such policies sufficiently cover the risks to which the Group is exposed.

At 31 December 2019, firm purchase undertakings amounted to 37.8 million euros. These investments will be made between 2010 and 2021 (66.7 million euros in 2018).

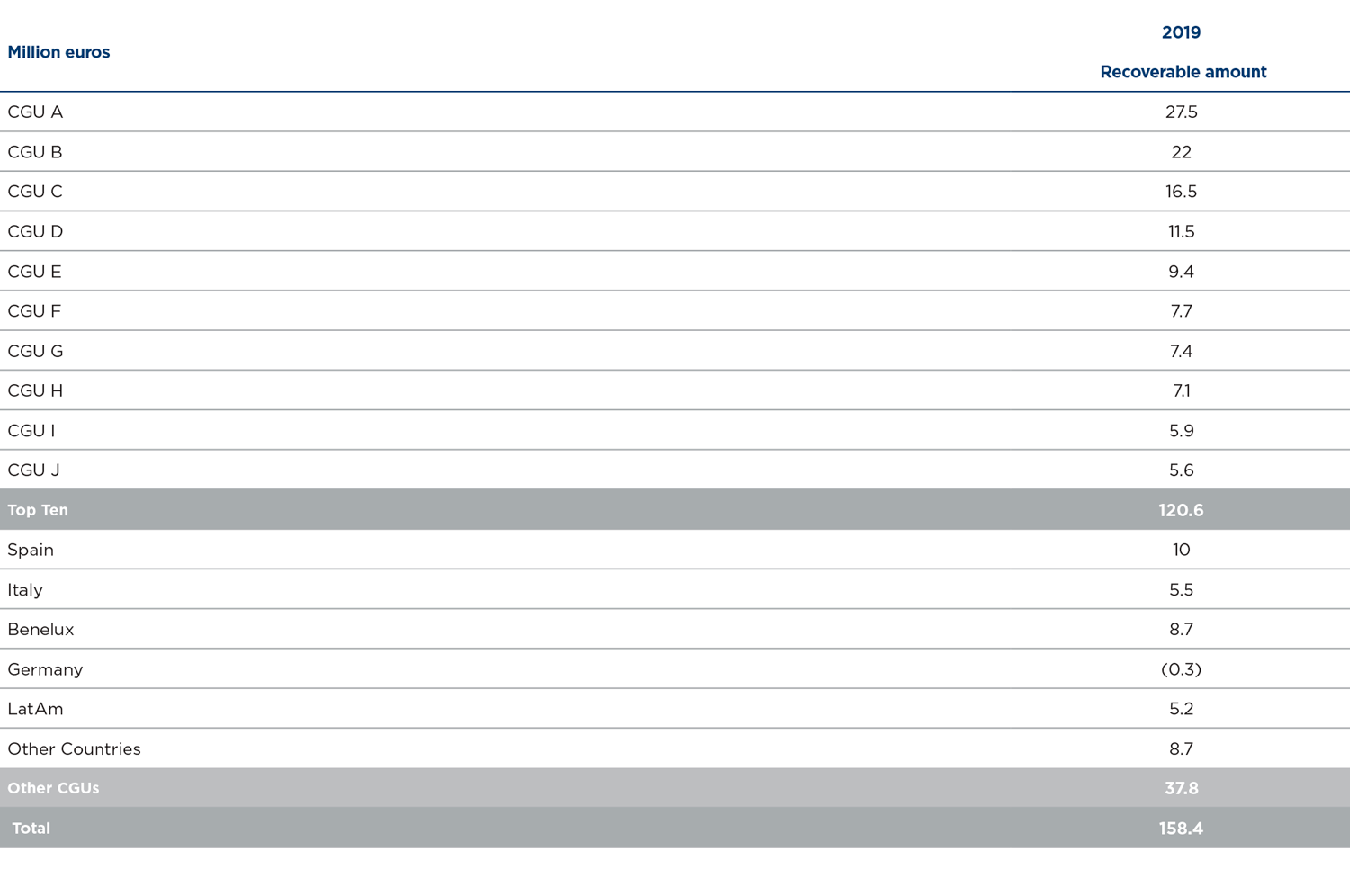

The recoverable amount of the CGUs subject to impairment or reversal (not the entire portfolio of the Group) is as follows: