The Group financial risk management is centralised at the Corporate Finance Division. This Division has put the necessary measures in place to control exposure to changes in interest and exchange rates on the basis of the Group’s structure and financial position, as well as credit and liquidity risks. If necessary, hedges are made on a case-by-case basis. The main financial risks faced by the Group’s policies are described below:

Credit risk

The Group main financial assets include cash and cash equivalents (see Note 14), as well as trade and other accounts receivable (see Note 13). In general terms, the Group holds its cash and cash equivalents in entities with a high credit rating and part of its trade and other accounts receivable are guaranteed by deposits, bank guarantees and advance payments by tour operators.

The Group has no significant concentration of third-party credit risk due to the diversification of its financial investments as well as to the distribution of trade risks with short collection periods among a large number of customers.

Interest rate risk

The Group’s financial assets and liabilities are exposed to fluctuations in interest rates, which may have an adverse effect on its results and cash flows. In order to mitigate this risk, the Group has established policies and has refinanced its debt at fixed interest rates through the issuance of convertible bonds and guaranteed convertible senior bonds. At 31 December 2019, approximately 81.3% of the gross borrowings was tied to fixed interest rates.

In accordance with reporting requirements set forth in IFRS 7, the Group has conducted a sensitivity analysis on possible interest-rate fluctuations in the markets in which it operates, based on these requirements.

Through the sensitivity analysis, taking as a reference the outstanding amount of that financing that has variable interest, we estimated the increase in the interest that would arise in the event of a rise in the reference interest rates.

If the increase in interest rates were 25 bp, the financial expense would increase by 219 thousand euros plus interest.

If the increase in interest rates were 50 bp, the financial expense would increase by 438 thousand euros plus interest.

If the increase in interest rates were 100 bp, the financial expense would increase by 876 thousand euros plus interest.

The results in equity would be similar to those recorded in the income statement but taking into account their tax effect, if any.

Lastly, the long-term financial assets set out in Note 11 of this annual report are also subject to interest-rate risks.

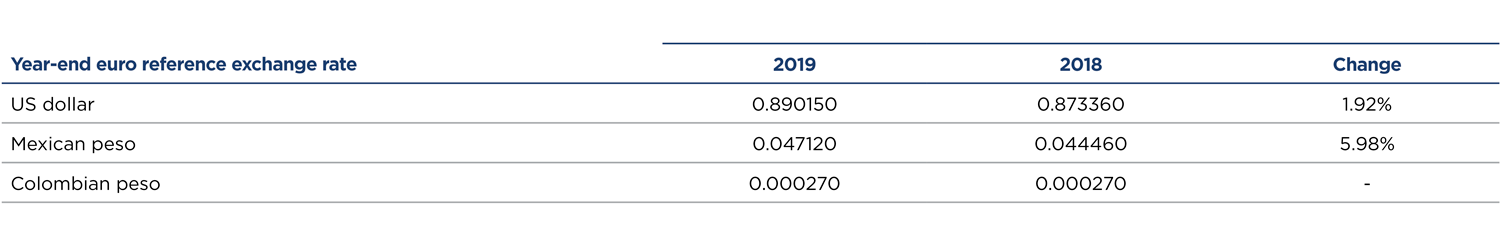

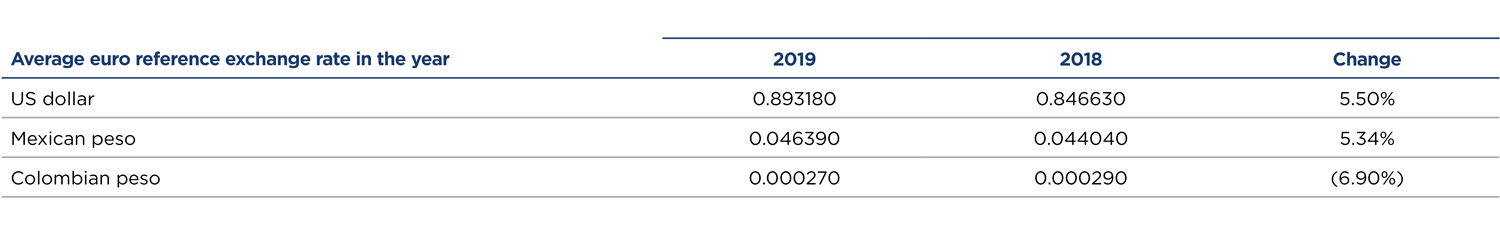

Exchange rate risk

The Group is exposed to exchange-rate fluctuations that may affect its sales, results, equity and cash flows. These mainly arise from:

– Investments in foreign countries (essentially Mexico, Argentina, Colombia, Chile, Ecuador, the Dominican Republic, Brazil, Panama and the United States).

– Transactions made by Group companies operating in countries whose currency is other than the euro (essentially Mexico, Argentina, Colombia, Chile, Ecuador, the Dominican Republic, Venezuela, Brazil, the United States and the United Kingdom).

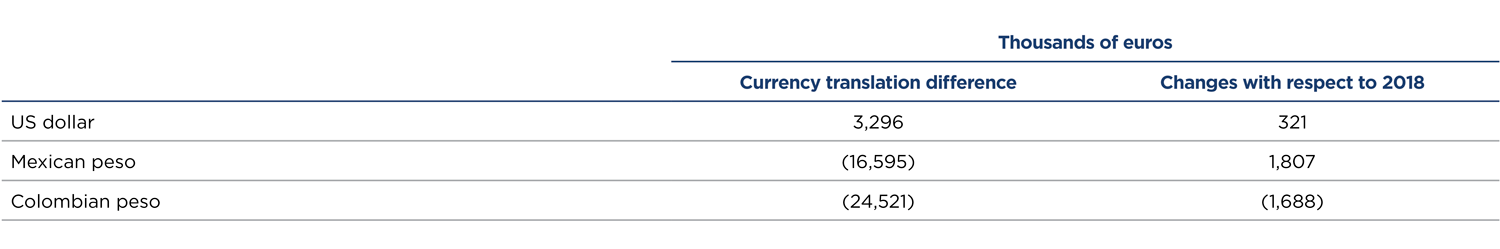

In this respect, the detail of the effect on the currency translation difference of the main currencies in 2019 was as follows: