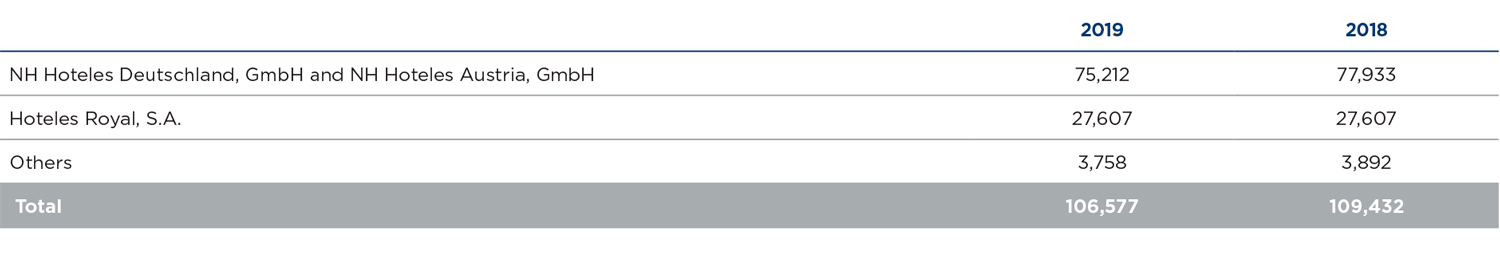

The balance included under this item corresponds to the net goodwill arising from the acquisition of certain companies, and breaks down as follows (thousands of euros):

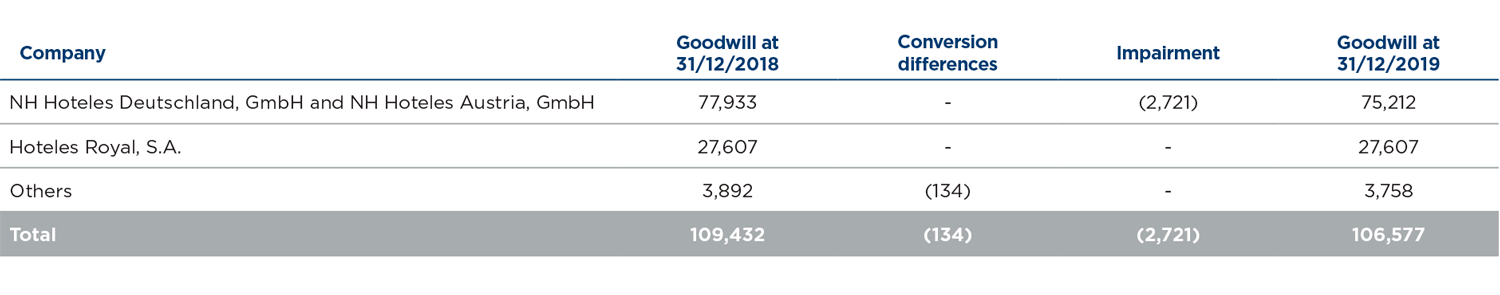

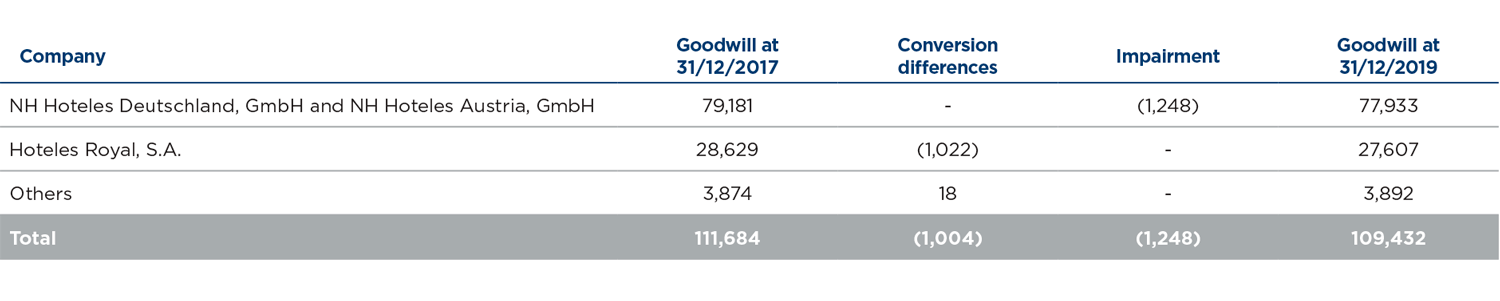

The movements in this heading of the consolidated balance sheet in 2019 and 2018 were as follows (in thousands of euros):

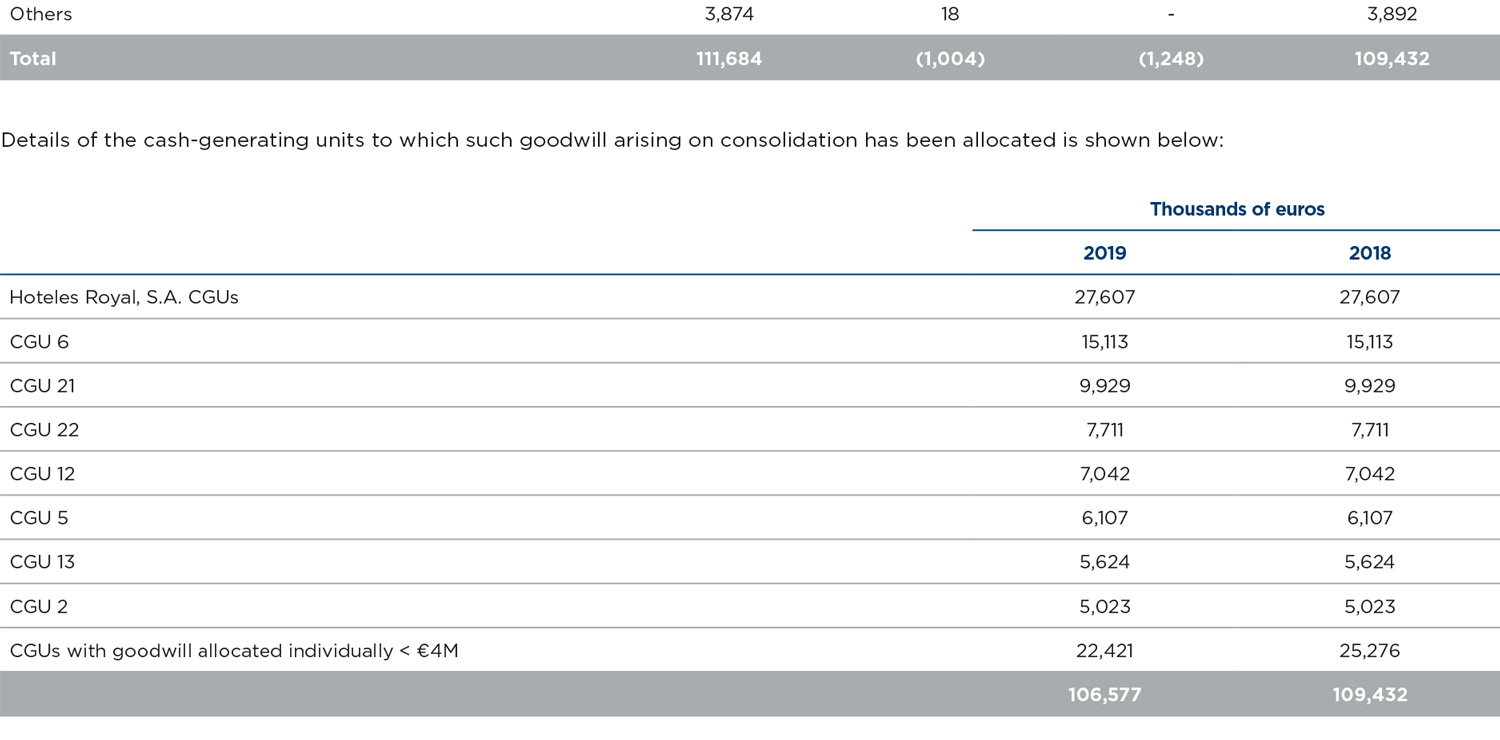

Details of the cash-generating units to which such goodwill arising on consolidation has been allocated is shown below:

At 31 December 2019, Goodwill was subject to an impairment test which showed impairment of 2,721 thousand euros for certain CGUs with individually assigned goodwill of less than 4 million euros. This impairment arises from their worsening expectations of future cash flows mainly due to the opening of competitor hotels or the loss of a major customer.

The basic assumptions used to estimate future cash flows of the CGUs mentioned above are detailed below:

- After-tax discount rate: 5.47% and 6.44% (6.22% and 7.86% respectively in 2018) for CGUs subject to the same risks (German and Austrian market); and for Grupo Royal CGUs, rates of 12.86% (Colombian and Ecuadorian markets) and 9.39% (Chilean market) (14.64% and 10.56% respectively in 2018).

- Terminal value growth rate (g): 2.13% and 2.00% (2.01% and 2.56% in 2018) for Germany and Austria and 1.10%, 3% and 3.04% (1.22%, 3% and 3.04% in 2018) for Grupo Royal CGUs (Ecuador, Chile and Colombia).

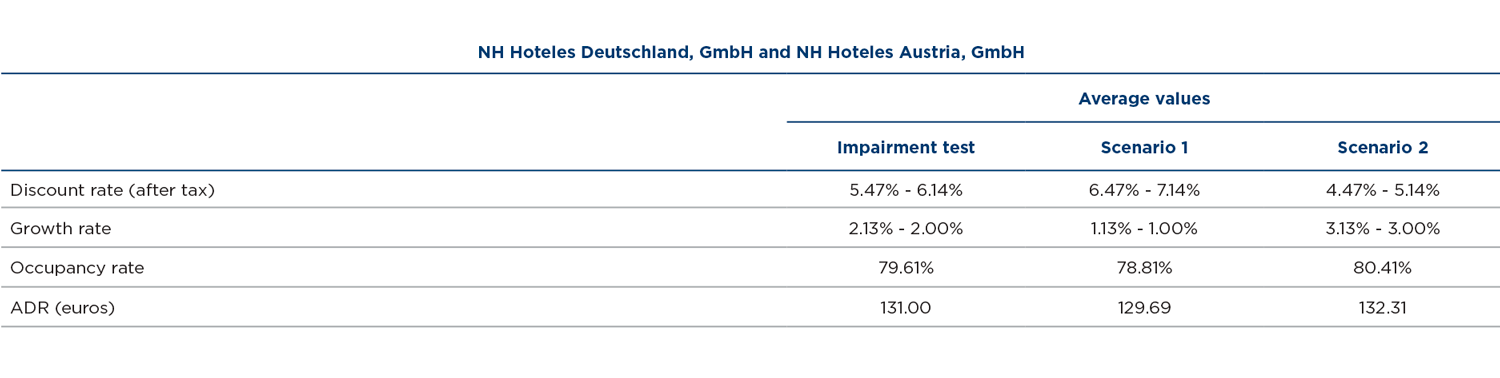

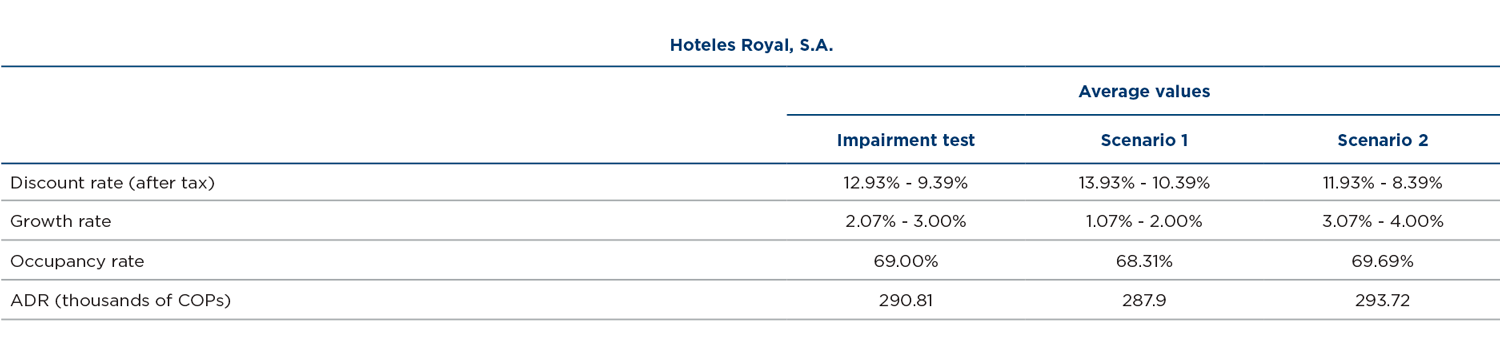

- Additionally, and considering the assumption implied in the preceding paragraph, the Group has conducted a sensitivity analysis of the result of the impairment test to changes in the following situations:

“Average Daily Rate” (ADR): is the quotient of total room revenue for a specific period divided by the rooms sold in that specific period. This indicator is used to compare with companies in the sector the average prices per room of the hotels.

Scenario 1 is a negative one where the discount rate is raised 1 b.p. above the rate used in the test and a growth rate lower by 1 b.p., i.e. with minimum growth, and falls in occupancy and ADR of 1% which would lead to an additional impairment to that registered in 2019 for an amount of 0.8 million euros with respect to the goodwill of NH Hotels Deutschland, Gmbh and NH Hoteles Austria, Gmbh, and 10.5 million euros with respect to the goodwill of Hoteles Royal, S.A.

In the case of scenario 2, an impairment had been recorded for 0.79 thousand euros less than that recorded at 31 December 2018 with respect to the goodwill of NH Hotels Deutschland, Gmbh and NH Hoteles Austria, Gmbh, and no impairment in regard to the goodwill of Hoteles Royal, S.A. was registered.