The Group evaluates the possible existence of a loss of value each year that would oblige it to reduce the carrying amounts of its tangible and intangible assets. A loss is deemed to exist when the recoverable value is less than the carrying amount.

The recoverable amount is determined as the value in use, with the sole exception of two cases, not significant in the context of the assets as a whole, in which the valuation of an independent third party was used as the recoverable amount. The value in use is calculated from the estimated future cash flows, discounted at a discount rate after tax that reflects the current market valuation with respect to the value of money and the specific risks associated with the asset, covering a five-year period and a perpetual value, except in the case of leased hotels that correspond to the lease period, a perpetual value therefore not being considered in the latter.

As a general rule, the Group has defined each of the hotels it operates as cash-generating units, according to the real management of their operations.

In the case of Hoteles Royal, S.A., where the whole business of Grupo Royal was acquired and whose purchase was effective in 2015, the cash-generating unit corresponds to the Group as a whole (Colombian, Chilean and Ecuadorian market).

For each CGU (hotel or Royal Group) the operating result is obtained at the end of the year without taking into account non-recurring results (if any) or financial results.

Once the operating result is obtained for each CGU, the impairment test is performed for those in which there are indications of impairment. Among others, the Group considers that a CGU has indications of impairment if it meets the following conditions: it has negative operating results and its business is stable (that is to say, they are not recently opened hotels until, generally speaking, they have been open for 3 years).

In addition, for all those CGUs in which impairment was recognised in previous years, an individual analysis and, therefore, an impairment test is performed for them.

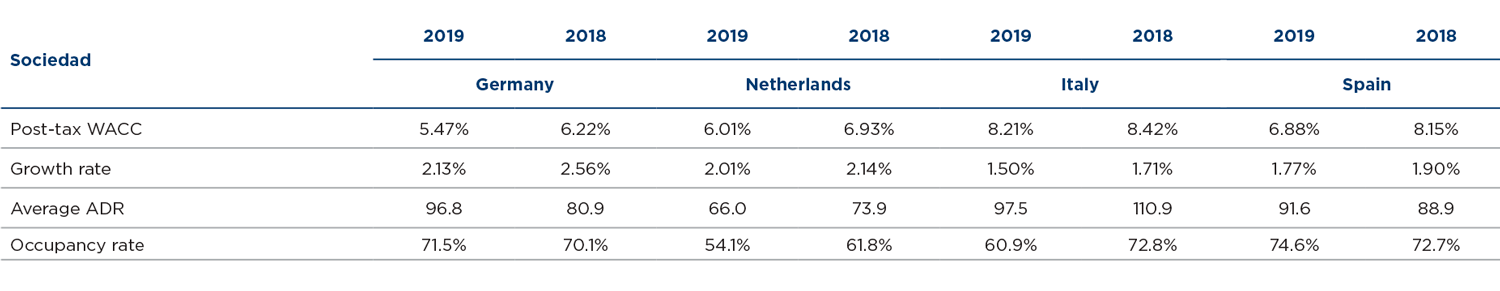

Future cash flows are estimated based on the result for the year and the records of at least five previous years. The first projected year corresponds to the budget prepared by Management for the year following the impairment test. The projections for the following years are consistent with the macroeconomic information from external information sources and the knowledge of the business by the Group’s Operations Department.

There are a number of factors that are considered by the Group’s Management to make the projections, which are:

– Estimate of GDP (Gross Domestic Product) growth issued by the International Monetary Fund (IMF) in its report published in October of each year for the next five years.

– Knowledge of the business/asset/local situation of the local Management of each Business Unit to which each CGU belongs.

– Historical results obtained by the CGUs.

– Investments in repositioning the CGUs.

These factors are reflected in the cash flows through the following working hypotheses used to obtain the projections:

– Income from accommodation is projected as the product of the occupancy percentage, the average daily rate (ADR) per room, and the total available rooms per year.

– The other revenues are projected based on the average of the relationship between the revenue from accommodation and those revenues.

– Staff costs are calculated based on the average staff costs with a growth in the inflation index (CPI).

– For its part, tax is calculated from the tax rates applicable in each country.

– Direct expenses are directly associated with each of the revenues and are projected on the basis of an average ratio, while undistributed expenses are projected based on the average ratio between these and direct expenses.

For the calculation of the discount rate the Weighted Average Cost of Capital (WACC) methodology has been applied: Weighted Average Cost of Capital (WACC), as follows:

WACC=Ke*E/(E+D) + Kd*(1-T)*D/(E+D)

Where:

Ke: Cost of Equity

Kd: Cost of Financial Debt

E: Own Funds

D: Financial Debt

T: Tax Rate

The Capital Asset Pricing Model (CAPM) is used to estimate the cost of equity (ke).

The main variables used to calculate the discount rate are as follows:

- Risk-free rate: using the average long-term interest rates of a 10-year bond over the last 12 months for each country, in the local currency.

- Market risk premium: defined as 6.8% (6.6% in 2018), based on market reports.

- Beta or systematic risk: Used as outside sources of information, this information is gathered from independent databases and concerns the ratio between the risk of companies and overall market risk. The re-leveraged beta coefficient has been estimated on the basis of 72% de-leveraged betas (83% in 2018), the debt structure of comparable companies (Debt / (Debt + Equity) of 35% (26% in 2018) and the corresponding tax rate in each country.

- Market value of debt, amounting to 4.58% (4.11% in 2018).

- Premium by size: based on recent expert reports.

The after-tax discount rates used by the Group for these purposes range in Europe from 5.5% to 8.2% (6.2% and 9.0% in 2018) and in Latin America from 9.4% to 14.6% (10.6% and 18.4% in 2018) without taking into account Argentina, whose after-tax discount rate has been calculated taking into account its hyperinflationary economic situation (see Note 4.23) and varies between 47.1% in 2020 and 23.5% in 2024, based on the estimate of inflation. In this regard, the cash flows resulting from the impairment tests were also calculated after tax. In addition, the book value to which the value-in-use is compared does not include any deferred tax liabilities which could be associated with the assets.

Using a post-tax discount rate and post-tax cash flows is consistent with paragraph 51 of IAS 36, which states that “estimated future cash flows will reflect assumptions that are consistent with the manner of determining the discount rate”. In addition, the result of the post-tax flows updated at a post-tax discount rate would obtain uniform results with respect to the impairment test if a pre-tax rate were used and, therefore, the impairment and reversion accounting records would be uniform.

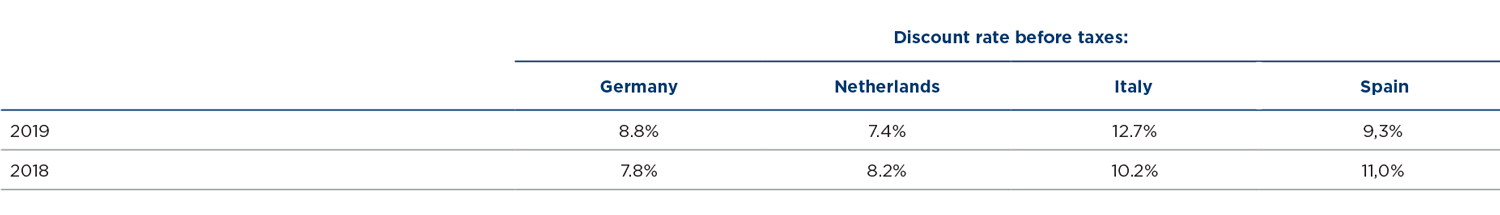

Below are the pre-tax discount rates of the major countries: