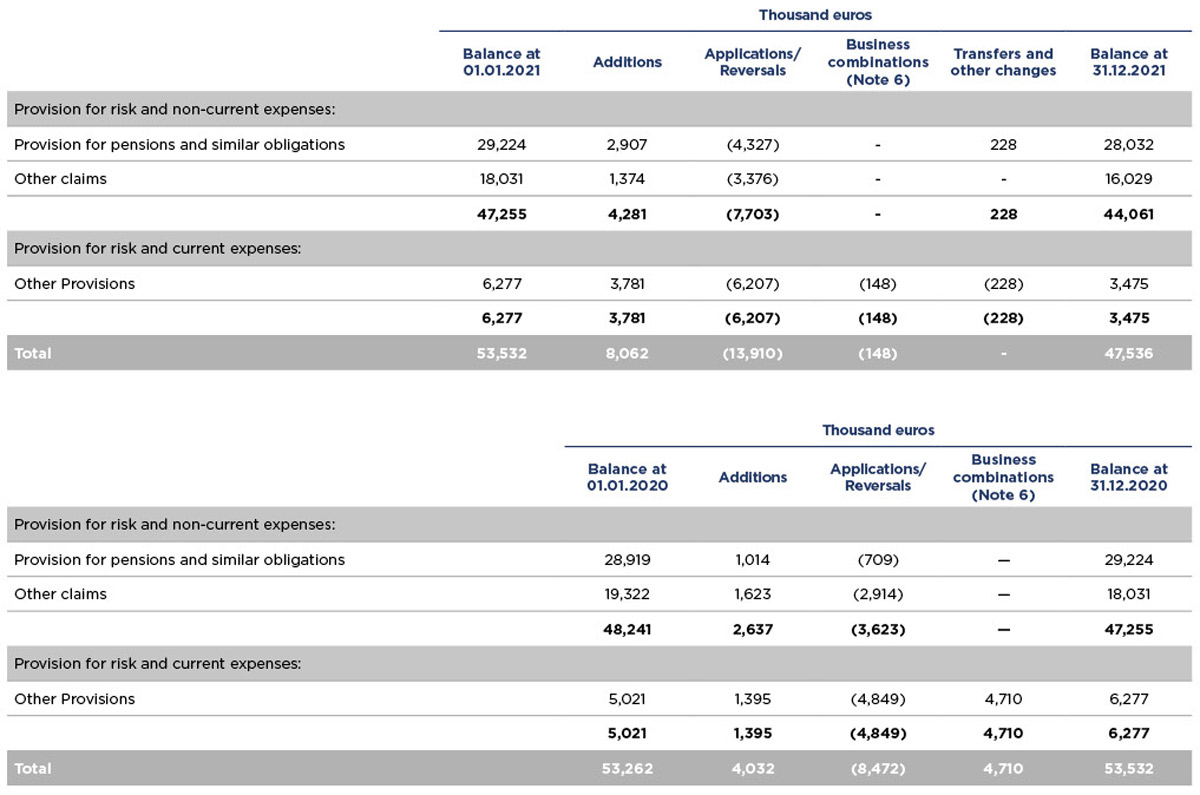

The breakdown of “Provisions” for the financial year, together with the main movements recognised were as follows:

Provision for pensions and similar obligations

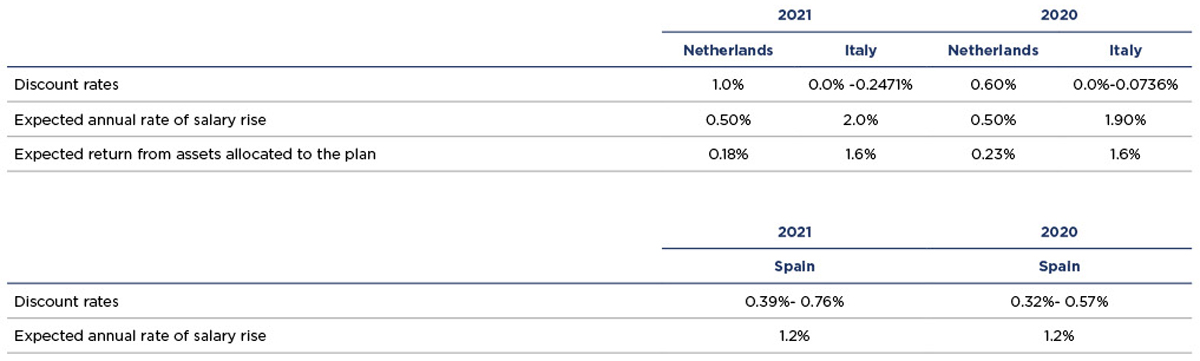

The “Provisions for pensions and similar obligations” account mainly includes the pension fund of a certain number of employees of the Netherlands business unit, and the T.F.R. “Trattamento di fine rapporto” in Italy, an amount paid to all workers in Italy at the moment they leave the company for any reason. This is another remuneration element, whose payment is deferred and annually allocated in proportion to fixed and variable remuneration both in kind and in cash, which is valued on a regular basis. The annual amount to be reserved is equivalent to the remuneration amount divided by 13.5. The annual cumulative fund is reviewed at a fixed interest rate of 1.5% plus 75% of the increase in the consumer price index (CPI).

This section also includes various retirement, performance related and/or long-stay awards considered in the Collective Bargaining Agreements that are applicable in Spain.

At the end of 2021, the liabilities entered against this item were of 28,032 thousand euros (29,224 thousand euros at 31 December 2020).

The breakdown of the main assumptions used to calculate actuarial liabilities is as follows:

Other claims

The “Other claims” item includes provisions for disputes and risks that the Group considers likely to occur. Among the most significant are the provisions created on the basis of the action brought in the proceedings claiming breach of contract in a property development, as well as other claims received in relation to the termination of certain leases where certain amounts are claimed (Note 23).