ANNEX I TEMPLATE ANNUAL REPORT ON DIRECTOR REMUNERATION OF LISTED COMPANIES

End date of the reference financial year: 31/12/2021

Tax id code (CIF): A28027944

Company name: NH Hotel Group, S.A.

Registered office: Santa Engracia 120, 28003 Madrid.

ANNUAL REPORT ON DIRECTOR REMUNERATION OF LISTED COMPANIES

A – REMUNERATION POLICY OF THE COMPANY FOR THE CURRENT FINANCIAL YEAR

A.1.1 Explain the current director remuneration policy applicable to the year in progress. To the extent that it is relevant, certain information may be included in relation to the remuneration policy approved by the General Shareholders’ Meeting, provided that these references are clear, specific and concrete.

Such specific determinations for the current year as the board may have made in accordance with the contracts signed with the executive directors and with the remuneration policy approved by the General Shareholders’ Meeting must be described, as regards directors’ remuneration both in their capacity as such and for executive functions carried out.

In any case, the following aspects must be reported, as a minimum:

a) Description of the procedures and company bodies involved in determining, approving and applying the remuneration policy and its terms and conditions.

b) IIndicate and, where applicable, explain whether comparable companies have been taken into account in order to establish the company’s remuneration policy.

c) Information on whether any external advisors took part in this process and, if so, their identity.

d) Procedures set forth in the current remuneration policy for directors in order to apply temporary exceptions to the policy, conditions under which those exceptions can be used and components that may be subject to exceptions according to the policy.

General Principles and Grounds

The Directors’ Remuneration Policy for NH Hotel Group S.A. (hereinafter referred to as “NH”, the “Company” or the “Group”) for the three-year period 2021-2023 was approved by Board of Directors at its meeting held on 12 May 2021 and submitted for a binding vote as a separate item on the agenda at the General Shareholders’ Meeting held on 30 June 2021.

The Remuneration Policy follows in line with the previous policy, including the same principles and concepts of remuneration, while adjusting its contents to new regulatory developments. It should be noted that NH pre-empted the new requirements set out in Act 5 of 12 April 2021 amending the redrafted text of the Spanish Capital Companies Act, and that the aforementioned Remuneration Policy already includes the new provisions introduced in Article 529 Nineteen of such Act, which relate to the content and procedure for the approval of the directors’ remuneration policy.

The fundamental aim of the Remuneration Policy is to reward the commitment, responsibility and talent of NH’s directors, always taking into consideration the economic situation, the company’s earnings, the Group’s strategy and the best market practices.

According to the foregoing, the principles that will govern the Remuneration Policy are as follows:

- Alignment with the investors: The design of the Remuneration Policy is regularly reviewed to ensure its alignment between achieving profits and creating value for the shareholder.

- Proportionality: The remuneration is in a suitable proportion to the company’s features and business model.

- Balance: The Directors’ remuneration should strike a balance between the different components of remuneration.

- Suitability: The Remuneration Policy is adapted to the composition of the Board and the amounts are sufficient to remunerate the directors’ qualifications, their time spent and their responsibility, guaranteeing their required loyalty and allegiance to the company, but without compromising the members’ independence.

- Non-discrimination: NH’s Remuneration Policy will be respectful of non-discrimination due to gender, age, culture, religion or race.

- Alignment with strategy: The Directors’ remuneration must be consistent with the Group’s strategy, including any elements of remuneration that may be necessary for such purpose. It must also contribute to the long-term interests and sustainability of the Company.

- Transparency: The information published about the remuneration is in line with the best corporate governance practices.

Regarding the remuneration items contained in the Remuneration Policy, pursuant to the provisions in Article 42 of NH’s Articles of Association and Article 36 of the Board of Directors’ Regulations, NH differentiates between the remuneration policy applicable to the Non-Executive Directors, in which their joint supervisory and decision-making duties are remunerated, and the policy for the Executive Directors, which rewards the senior management duties they perform, as shown below:

- Remuneration items for the Non-Executive Directors:

− A fixed annual amount that depends on the post or posts the directors hold on the Board or on its committees.

− Expenses for attending the Board of Directors’ committee meetings. The total annual amount for this item will vary depending on the number of meetings held by each committee and the director attending them.

- Remuneration items for the Executive Directors:

− Fixed remuneration, sufficient for their services and duties.

− Short- and long-term variable remuneration linked to the company’s results and creating value for the shareholder.

− Remuneration in kind.

Description of the procedures and company bodies involved in determining, approving and applying the remuneration policy and its terms and conditions.

The company’s main bodies involved in determining and approving the Remuneration Policy are as follows:

- The General Shareholders’ Meeting:

According to the Spanish Capital Companies Act, the General Shareholders’ Meeting is competent for approving the following matters related to the Directors’ remuneration:

− The Remuneration Policy at least every three years.

− Possible amendments to the Remuneration Policy in force from time to time.

− The maximum amount of the annual remuneration payable to all the Directors in their positions as such.

− The remuneration system, including the award of shares or stock options or share-linked remuneration.

− The Annual Remuneration Report (advisory ballot).

- The Board of Directors:

This is the competent body for proposing the Remuneration Policy to the General Shareholders’ Meeting. The Board is also responsible for adopting decisions related to the directors’ remuneration within the scope of the Articles of Association and the Remuneration Policy.

Moreover, the Board of Directors determines the basic terms and conditions for the contracts, including the remuneration for the executives that directly report to the Board or any of its members.

The Board of Directors is informed of all the actions performed by the Appointment, Remuneration and Corporate Governance Committee, as explained below, providing it with the relevant documents in order to be informed of such actions to perform its duties.

As a precautionary measure, in order to avoid any conflict of interests, at the Board’s meetings that deal with proposals related to the specific remuneration of the Directors, the latter may not be present nor take part in the deliberations or decision-making process.

- The Appointment, Remuneration and Corporate Governance Committee (hereinafter referred to by its initials in Spanish “ARCGC”):

This is the main body for determining and applying the Remuneration Policy. In this respect, the ARCGC is competent to propose the Directors’ Remuneration Policy and the remuneration for those who perform senior management duties directly reporting to the Board, Executive Committees or Executive Directors, and the individual remuneration and other contractual terms and conditions for the Executive Directors, ensuring such terms and conditions are observed.

Specifically, the ARCGC performs the following duties:

− Determining the Policy

· It develops the contents of the Directors’ Remuneration Policy and proposes its final approval to the Board of Directors.

· It proposes to the Board of Directors the allotment, among the different items, of the maximum remuneration amount approved by the General Shareholders’ Meeting for the Directors in their positions as such.

· It determines and proposes to the Board of Directors the amount and, if need be, the adjustment of the Executive Directors’ fixed salary.

− Application of the Policy

· Every year it proposes to the Board of Directors the objectives for the Annual Variable Remuneration and the relevant cycle for the multi-annual variable remuneration applicable to the Executive Directors.

· It assesses achievement of the objectives after the end of the measurement period for the variable remuneration and proposes to the Board of Directors the amount or number of shares to be received by the Executive Directors.

− Review of the Policy

· It reviews the amount of the various remuneration components for the Directors in their positions as such; bearing in mind market practices and submits its conclusions to the Board of Directors.

· It reviews the structure and level of the Executive Directors’ remuneration to ensure it is competitive.

− Transparency of the Policy

· The ARCGC decides on the contents of the Annual Directors’ Remuneration Report and proposes it to the Board of Directors for the final approval thereof.

For the current financial year (2022), it is estimated that the Committee will hold 4 meetings; however, as many meetings as deemed necessary may be summoned apart from those initially planned. Up to the time this Report was approved, the ARCGC has discussed the following matters, among others:

− Approval of the objectives linked to the Executive Directors’ annual variable remuneration for 2022.

− Proposal and approval of this Report.

− Approval of the settlement of the third long-term variable remuneration cycle for the accrual period from 1 January 2019, which ended on 31 December 2021.

− Proposal and approval of the launch of a new long-term incentive plan to begin retroactively from 1 January 2021.

− Proposal and approval of the launch of a biennial long-term incentive for the Executive Directors in 2022.

− Assessment and approval of the Executive Directors’ annual variable remuneration based on the results achieved in 2021.

− Proposal and approval of an extraordinary bonus for one of the members of the Board as compensation for the high level of dedication during the last financial year.

Information on whether any external advisors took part in this process and, if so, their identity details.

Willis Towers Watson (WTW) regularly provides advice to the ARCGC on the following matters:

- Drawing up this Annual Directors’ Remuneration Report.

- Study of the senior executives’ salaries.

Procedures set out in the existing directors’ remuneration policy for applying temporary exceptions to the policy, conditions under which such exceptions may be invoked and components that may be subject to exception under the policy.

The Remuneration Policy does not include any procedure for temporary exceptions to the Remuneration Policy.

A.1.2 Relative importance of variable remuneration items vis-à-vis fixed remuneration (remuneration mix) and the criteria and objectives taken into consideration in their determination and to ensure an appropriate balance between the fixed and variable components of the remuneration. In particular, indicate the actions taken by the company in relation to the remuneration system to reduce exposure to excessive risks and to align it with the long-term objectives, values and interests of the company, which will include, as the case may be, mention of the measures taken to ensure that the long-term results of the company are taken into account in the remuneration policy, the measures adopted in relation to those categories of personnel whose professional activities have a material impact on the risk profile of the company and measures in place to avoid conflicts of interest. Furthermore, indicate whether the company has established any period for the accrual or vesting of certain variable remuneration items, in cash, shares or other financial instruments, any deferral period in the payment of amounts or delivery of accrued and vested financial instruments, or whether any clause has been agreed reducing the deferred remuneration not yet vested or obliging the director to return remuneration received, when such remuneration has been based on figures that have since been clearly shown to be inaccurate.

The remuneration mix:

The Non-Executive Directors receive remuneration based on the best corporate governance practices. Such remuneration is only composed of a fixed amount and attendance expenses, with no amount being payable whatsoever for variable remuneration.

However, the total remuneration of the Executive Directors (CEO and COO) is mainly composed of (i) fixed remuneration, (ii) annual variable remuneration and (iii) multi-annual variable remuneration.

In this respect, the percentage that the ordinary (annual and multi-annual) variable remuneration represents of the total remuneration in 2022, in a situation in which 100% of the objectives are achieved (target scenario), is approximately:

- CEO: 62% (target scenario) – 66% (maximum scenario).

- COO: 53% (target scenario) – 57% (maximum scenario).

Measures adopted to adapt the Remuneration Policy to the company’s long-term goals, values and interests. Reference to the measures adopted to guarantee that the long-term results of the company are taken into account in the Remuneration Policy

The measures adopted by the company related to the remuneration system to reduce exposure to excessive risks and to adapt it to the company’s long-term objectives, values and interests are as follows:

a) Balance in the total remuneration:

The remuneration package of the Executive Directors includes short- and long-term variable parts, both parts being balanced. In this respect, the relative weight of the long-term variable remuneration, in annual terms, is equivalent to that of the short-term variable remuneration.

b) Formulating the variable remuneration objectives:

The variable remuneration takes into account the financial quantitative objectives included in the Group’s strategic plan; hence contributing to creating a business model that promotes balanced and sustainable development. In this sense, part of the annual variable remuneration depends on specific objectives related to the Company’s progress in terms of sustainability.

On an annual basis, the ARCGC analyses the components of the short-term variable remuneration that it submits for the final approval by the Board of Directors. The variable components of the remuneration are designed with sufficient flexibility so that no amount whatsoever is paid if the minimum objectives are not achieved.

In addition, in order for short-term or long-term variable remuneration to accrue, the Group’s recurring Net Profit must be positive. If this is not the case, no remuneration shall be payable.

Regarding the multi-annual variable remuneration, it is ensured that the evaluation process is based on the company’s long-term sustainable results and it may be adjusted depending on the company’s economic cycle.

Actions carried out by the company to reduce exposure to excessive risks and avoid conflicts of interest and clawback clauses that reduce the deferred remuneration or oblige the director to reimburse the remuneration received.

a) Clawback clauses:

The Long-Term Incentive Plan 2022-2026, referred to as the “Performance Cash Plan”, which the Company is currently implementing, will include clawback clauses in line with market standards and the recommendations of proxy advisors and institutional investors. It includes clawback clauses in line with those included in the Performance Shares Plan 2017-2022 as described in the Remuneration Policy.

b) Additional requirements for holding shares:

The Executive Directors must hold shares related to their multi-annual variable remuneration for a value equivalent to at least one year of their fixed remuneration and, when this obligation is fulfilled, the price is determined as the share price on the date the shares were acquired.

c) Minimum period for holding the shares:

However, the Performance Shares Plan 2017-2022 specifies a minimum retention period for the assigned shares of at least one year for the Executive Directors and Executive Committee.

The new Long-Term Incentive Plan 2022-2026 is granted and will be paid in cash, so no share retention periods will be included.

d) Measures to avoid conflicts of interest:

At the Board’s meetings that deal with proposals related to the specific remuneration of the Executive Directors, the latter may not be present or take part in the deliberations or decision-making process.

Regarding measures to avoid conflicts of interest by the directors, according to the Spanish Capital Companies Act, Articles 29-33 of the Board of Directors’ Regulations provide the obligations of the directors regarding their duties of diligence, faithfulness, secrecy, loyalty and prohibition of competition.

Clauses to reduce deferred remuneration not yet vested or requiring the director to repay remuneration received, where such remuneration has been based on information that is subsequently clearly proven to be inaccurate.

Should certain circumstances arise that show, even a posteriori, that objectives have not been met, the Board, at the proposal of the ARCGC, may reclaim some or all of the long-term incentives already paid. These clauses are applicable to all Beneficiaries for a term of two years from the end of the measurement period of each plan cycle. Specifically, and among other circumstances, the incentive paid may be required to be returned in the following cases:

i. Reformulating the Company’s financial statements without being based on changes in the applicable accounting standards or interpretations.

ii. Sanctions against the Beneficiary for serious breaches of the code of conduct and other applicable internal regulations.

iii. Where the settlement and payment of the Incentive has taken place in whole or in part on the basis of information that is subsequently proven to be clearly false or seriously inaccurate.

In addition, the ARCGC may propose to the Board of Directors adjustments of the elements, criteria, thresholds and limits of the annual or multi-annual variable remuneration, under exceptional circumstances caused by extraordinary internal or external factors or events. The details and justification for such adjustments would be included in the relevant Annual Directors’ Remuneration Report.

A.1.3 Amount and nature of fixed components that are due to be accrued during the year by directors in their capacity as such.

The maximum amount of the remuneration that could be paid every year by the Company to all its Directors, in their positions as such is €800,000, which was approved by the Ordinary General Shareholders’ Meeting held on 30 June 2021.

The remuneration system for the Non-Executive Directors for their supervisory and joint decision-making duties, as specified above in this Report, consists of an annual fixed amount and expenses for attending the meetings of the Board of Directors and its committees.

In this respect, the maximum planned amounts for the aforementioned items in 2022 will be as follows:

• Annual fixed amount:

− Chairperson of the Board of Directors: €200,000. No amount will be payable for expenses to attend the meetings of the Board or the Committees.

− Chairpersons of the Auditing Committee and/or the ARCGC: €90,000. No amount will be payable for expenses to attend the committee meetings that they chair.

− The other members of the Board of Directors: €50,000 for each director.

• Attendance expenses:

− Expenses for attending the Audit and Supervisory Committee Meetings: €1,000.

− Expenses for attending the ARCGC Meetings: €1,000.

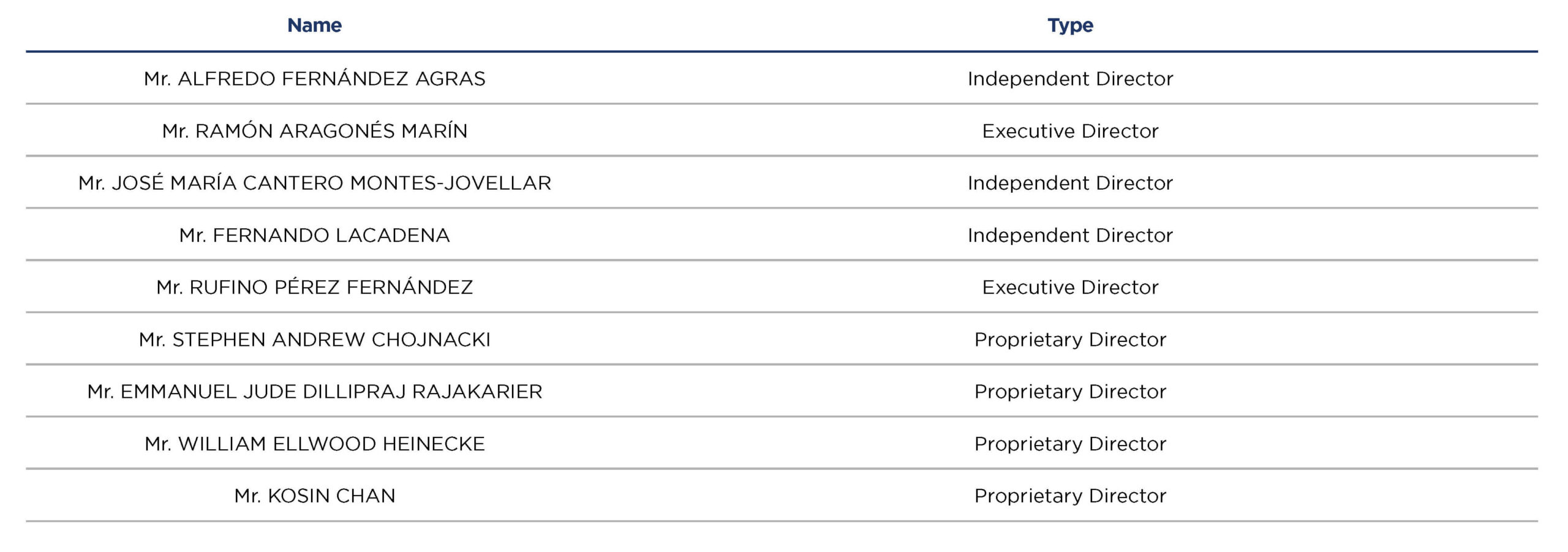

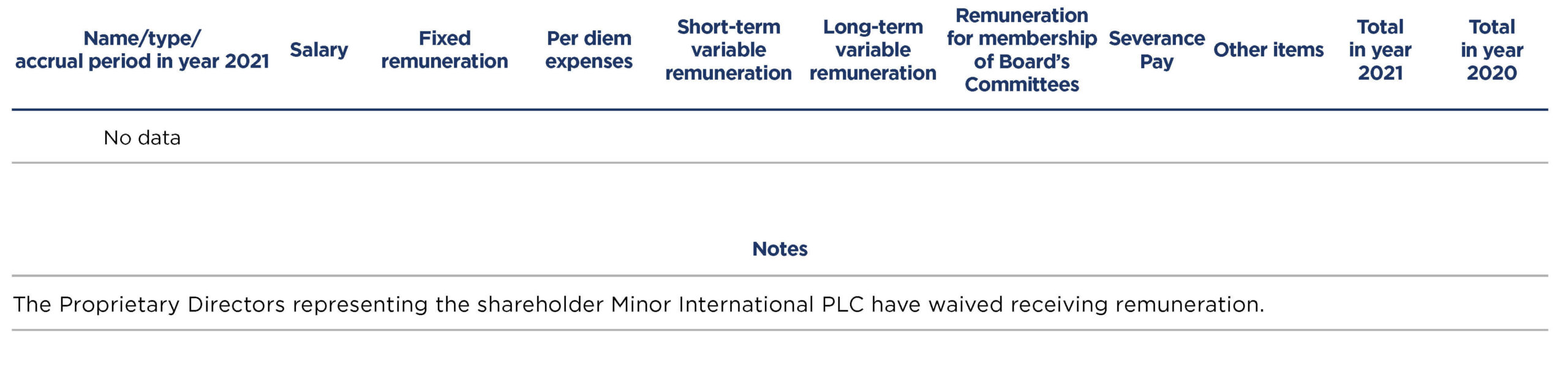

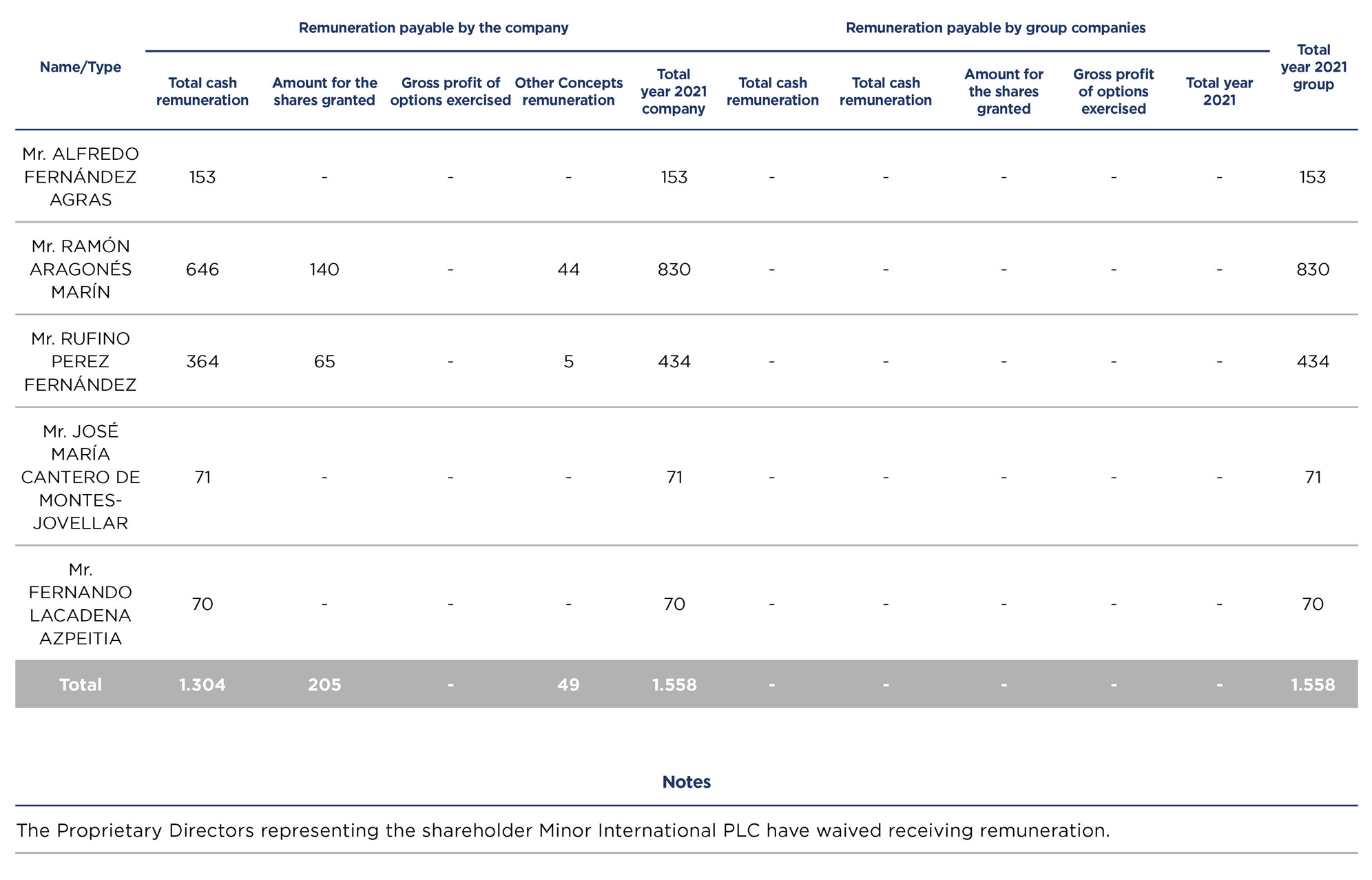

Nevertheless, the Proprietary Directors representing the shareholder, Minor International PLC, have waived payment of the aforementioned remuneration.

The amounts payable to the Non-Executive Directors may vary from year to year within the maximum amounts approved by the General Shareholders’ Meeting with the prior approval of the Board of Directors.

Moreover, the Executive Directors will not be entitled to receive the aforementioned remuneration.

A.1.4 Amount and nature of fixed components that are due to be accrued during the year for the performance of senior management functions of executive directors.

According to the Articles of Association, the Executive Directors are entitled to be paid remuneration for the executive duties they perform, apart from their duties as Directors within the scope of their labour or commercial relationship with the Company. Such remuneration includes both their executive duties and their duties as Director.

The amount of the aforementioned fixed remuneration planned for each of the Executive Directors in 2022 is €700,000 for the CEO and €400,000 for the COO.

A.1.5 Amount and nature of any component of remuneration in kind that will accrue during the year, including, but not limited to, insurance premiums paid in favour of the director.

The Directors do not receive any remuneration in kind for being members of the Board of Directors.

The Executive Directors are beneficiaries of a health care insurance policy for them and their first-degree relatives, a life and accident insurance policy and a company car. It is estimated that the cost for this remuneration in 2022 will amount to €59,000 for the CEO and €9.000 for the COO. However, the final amount could vary depending on the changes taking place in the prices or premiums of the aforementioned remuneration.

A.1.6 Amount and nature of variable components, differentiating between those established in the short and long terms. Financial and non-financial, including social, environmental and climate change parameters selected to determine variable remuneration for the current year, explaining the extent to which these parameters are related to performance, both of the director and of the company, and to its risk profile, and the methodology, necessary period and techniques envisaged to be able to determine the effective degree of compliance, at the end of the year, with the parameters used in the design of the variable remuneration, explaining the criteria and factors applied in regard to the time required and methods of verifying that the performance or any other conditions linked to the accrual and vesting of each component of variable remuneration have effectively been met.

Indicate the range, in monetary terms, of the different variable components according to the degree of fulfilment of the objectives and parameters established, and whether any maximum monetary amounts exist in absolute terms.

The Executive Directors are the only members of the Board of Directors that are entitled to be paid variable remuneration. The Executive Directors’ variable remuneration is structured as additional and supplementary to their fixed remuneration and consists of a short-term annual variable and a long-term variable.

The main features of the variable remuneration components for the Executive Directors are described below:

1. ANNUAL VARIABLE REMUNERATION

The short-term variable remuneration is linked to achieving the corporate objectives determined by the ARCGC and approved by the Board of Directors at the beginning of each financial year.

The functioning of the annual variable remuneration for NH’s Executive Directors is the same as for the company’s other employees. It is determined based on the Management by Objectives Programme (MBO) for the following purposes:

a. To compensate performance, bearing in mind the achievement of the company’s quantitative objectives.

b. To link the achievement of the annual objectives set by the company to its medium- and long-term strategy.

c. To align the individual objectives with those of the company.

The ARCGC approved the following objectives with their corresponding weightings for the financial year 2022:

CEO:

• 50% Corporate Objectives: Group EBITDA

• 10% Performance assessment.

• 40% of strategic indicators related to the position.

COO:

• 50% Corporate Objectives: Group EBITDA

• 10% Performance assessment.

• 40% of strategic indicators related to the position.

The functioning of each of the aforementioned objectives is described below, along with the specified scales of achievement:

a. Group EBITDA: The target initially set for Group recurrent EBITDA is compared with actual Group EBITDA, with the following payout levels established based on the scale of achievement:

• If the level of achievement of the Group’s recurrent EBITDA target is lower than 90%, no amount whatsoever is payable as annual variable remuneration.

• If the level of achievement of the Group’s recurrent EBITDA target is between 90% and 100%, 100% of the target annual variable remuneration will be paid.

• If the level of achievement of the Group’s recurrent EBITDA target is 120% or higher, a maximum of 120% of the target annual variable remuneration is payable.

When the achievement level of the target is between 100% and 120%, the payout is calculated by linear interpolation.

b. Performance assessment: The performance assessment system for the Executive Directors has the same structure as for NH’s other employees.

In order to promote the Company’s sustainability, by evaluating the system and procedures apart from the results obtained, the performance evaluation is included within the annual variable remuneration.

An overall assessment will be conducted based on the evaluation of the eight skills, which will be equivalent to a percentage that the target is achieved, according to the following scheme:

Performance will be evaluated according to the following scale made up of five levels: Underperforming, Needs Improvement, Well Done, Very Good, and Outstanding. Each one of the levels will be equivalent to a percentage of achievement of the objective following the following scheme.

− “Underperforming”. Equivalent to 0% achievement.

− “Needs Improvement”. Equivalent to 50% achievement.

− “Well Done”. Equivalent to 100% achievement.

− “Very Good”. Equivalent to 125% achievement.

− “Outstanding”. Equivalent to 200% achievement.

c. Individual Objectives (indicators related to the post): Maximum achievement is set for the rest of the objectives, which could imply up to 125% of the payment level for this objective.

The ARCGC determines the specific amount payable depending on the achievement level of the targets.

In addition, in order to guarantee that the annual variable remuneration is aligned with the company’s results, there is a key objective based on the Group’s Net Recurrent Profit. In this respect, in order to accrue annual variable remuneration, the Group’s recurring Net Profit must be positive. If this is not the case, no remuneration shall be payable.

The target annual variable remuneration is set at 65% of the CEO’s fixed remuneration (€455,000) and 45% of the COO’s fixed remuneration (€180,000), providing 100% of the objectives set by the Board of Directors are achieved.

The maximum amount the Executive Directors can reach, if the maximum score is obtained in the performance assessment and an extraordinary percentage is obtained in their individual objectives is 130% for both directors, equivalent to €591.500 for the CEO and €234.000 for the COO.

If the aforementioned minimum targets are not achieved, the Executive Directors will not be paid any amount whatsoever as variable remuneration.

In order to calculate the amount of the annual variable remuneration, the ARCGC will first and foremost consider the individual level of achievement and weighting of each of the targets and subsequently the level of overall achievement of the targets as a whole, along with the key objectives for the Group’s Net Recurrent Profit. This assessment will be conducted based on the results audited by the company’s external auditor. Both for determining the objectives and assessment of their being achieved, the Committee also takes into consideration any associated risk and can rely on the support of the Audit and Supervisory Committee.

In this respect, any positive or negative economic impact caused by extraordinary events that could distort the findings of the assessment are disregarded and the quality of the long-term results and any associated risk in the proposal for annual variable remuneration is taken into consideration.

The annual variable remuneration is fully paid in cash, providing the objectives set for such purpose are achieved. This remuneration will not be paid until the ARCGC has carried out the aforementioned actions in the first quarter of the year.

2. LONG-TERM INCENTIVES PLANS

– Long Term Incentive Plan 2022-2027-

The Company plans to implement the Long-Term Incentive Plan 2022-2027 (“Performance Cash Plan”) in 2022. This plan grants a cash amount to be paid out if the targets set in this respect are met. The Plan has a term of five years, divided into three cycles of three years each one:

a. First cycle 2022-2024 to be paid in 2025.

b. Second cycle 2023-2025 to be paid in 2026.

c. Third cycle 2024-2026 to be paid in 2027.

Before the start of each of the cycles, the Board of Directors is authorised to decide on its effective implementation depending on the Group’s economic situation at the time.

The main features of the first cycle of the Plan applicable to the Executive Directors are set out below:

Purpose: To reward the achievement of NH’s long-term strategic goals and the creation of sustainable shareholder value.

Amount: The target incentive in the first cycle is set at 65% of the CEO’s fixed remuneration (€455,000) and 45% of the COO’s fixed remuneration (€180,000), providing 100% of the objectives set by the Board of Directors are achieved.

The maximum amount of the incentive can be up to 120% of the target amount, i.e. 78% of the fixed remuneration for the CEO (€546,000) and 54% of the fixed remuneration for the COO (€216,000).

Performance period: Years 2022, 2023 and 2024.

Objectives: 100% of the incentive will be linked to the Group’s recurring EBITDA for the financial years 2022, 2023 and 2024. However, the Group’s recurring Net Profit must be positive in each of the aforementioned years in order to accrue the full incentive. If not, the portion of the target incentive linked to the year in which the recurring Net Profit target is not met will be forfeited.

Performance Scale: The incentive for the first cycle 2022-2024 is determined as follows:

- If the level of achievement of the Group’s recurrent EBITDA target is lower than 90%, no amount whatsoever is payable for the long-term incentive.

- If the level of achievement of the Group’s recurring EBITDA target is between 90% and 100%, 100% of the long-term incentive will be paid.

- If the level of achievement of the Group’s recurrent EBITDA target is 120% or higher, a maximum of 120% of the long-term incentive is payable.

When the achievement level of the objective is between 100% and 120%, the level of achievement of the Group’s recurrent EBITDA is calculated by linear interpolation.

Functioning: the ARCGC will consider the level of achievement of the recurring EBITDA target based on the results audited by the Company’s external auditor in each of the cycles included in the performance period. Both for determining the targets and assessment of their being achieved, the Committee also takes into consideration any associated risk and can rely on the support of the Audit and Supervisory Committee.

In this respect, any positive or negative economic impact caused by extraordinary events that could distort the findings of the assessment are disregarded and the quality of the long-term results and any associated risk in the proposal for incentive to be paid is taken into consideration.

The incentive for the first cycle 2022-2024 will be fully paid in cash, providing that the objectives set for such purpose are achieved. This remuneration will not be paid until the ARCGC has carried out the aforementioned actions in the first quarter of the year 2025.

– Long Term Incentive Plan 2022-2023-

This biennial long-term incentive would have the following general and specific features:

Purpose: To adapt the remuneration package of the Company’s executives to incentivise the extra effort they are making to recover NH’s business volume and results within the economic context of the COVID-19 pandemic.

Amount: The target in the biennial long-term incentive is set at 65% of the CEO’s fixed remuneration (€455,000) and 45% of the COO’s fixed remuneration (€180,000), providing 100% of the objectives set by the Board of Directors are achieved.

Performance Period: Years 2022 and 2023

Objectives: 100% of the biennial long-term incentive will be linked to the Group’s recurring EBITDA for the financial year 2022 and 2023. However, for this remuneration to accrue, the Group’s recurring Net Profit must be positive. If this is not the case, no remuneration shall be payable

Performance scale: The biennial long-term incentive is determined as follows:

- If the level of achievement of the Group’s recurrent EBITDA target is lower than 90%, no amount whatsoever is payable as biennial long-term incentive.

- If the level of achievement of the Group’s recurring EBITDA target is between 90% and 100%, 100% of the target biennial long-term incentive will be paid

- If the level of achievement of the Group’s recurrent EBITDA target is 120% or higher, a maximum of 120% of the target biennial long-term incentive is payable.

When the achievement level of the target is between 100% and 120%, the level of achievement of the Group’s recurrent EBITDA is calculated by linear interpolation.

Functioning: the ARCGC will consider the level of achievement of the recurring EBITDA target based on the results audited by the Company’s external auditor. Both for determining the targets and assessment of their being achieved, the Committee also takes into consideration any associated risk and can rely on the support of the Audit and Supervisory Committee.

In this respect, any positive or negative economic impact caused by extraordinary events that could distort the findings of the assessment are disregarded and the quality of the long-term results and any associated risk in the proposal for annual variable remuneration is taken into consideration.

The biennial long-term incentive is fully paid in cash, providing the targets set for such purpose are achieved. This remuneration will not be paid until the ARCGC has carried out the aforementioned actions in the first quarter of the year 2024.

In any case, the sum of the long-term incentive payments in annualised terms shall not exceed the maximum stipulated in the current Remuneration Policy.

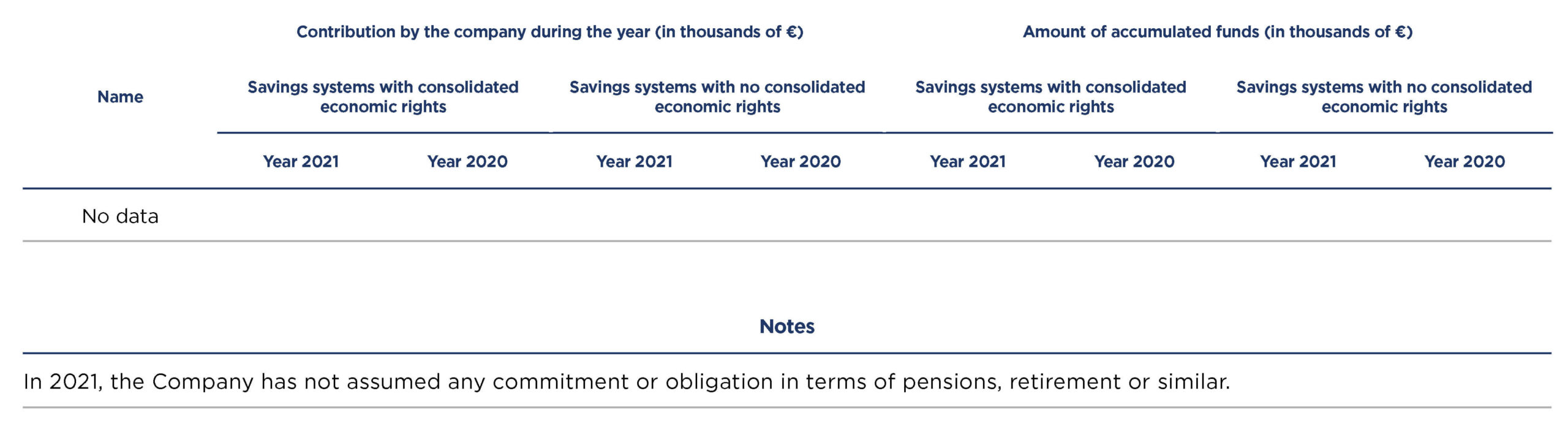

A.1.7 Main characteristics of long-term savings schemes. Among other information, indicate the contingencies covered by the scheme, whether it is a defined contribution or a defined benefit scheme, the annual contribution that has to be made to defined contribution schemes, the benefits to which directors are entitled in the case of defined benefit schemes, the vesting conditions of the economic rights of directors and their compatibility with any other type of payment or indemnification for early termination or dismissal, or deriving from the termination of the contractual relationship, in the terms provided, between the company and the director.

Indicate whether the accrual or vesting of any of the long-term savings plans is linked to the attainment of certain objectives or parameters relating to the director’s short- or long-term performance.

The company does not plan to undertake any obligation or commitment whatsoever with the directors in 2022 related to pensions, retirement or similar items.

A.1.8 Any type of payment or indemnification for early termination or dismissal, or deriving from the termination of the contractual relationship, in the terms provided, between the company and the director, whether at the company’s or the director’s initiative, as well as any type of agreement reached, such as exclusivity, post-contractual noncompetition, minimum contract term or loyalty, that entitles the director to any kind of remuneration.

The directors of the company, in their positions as such, are not entitled to any severance pay or compensation in the event of dismissal or resignation.

The terms and conditions included in the Executive Directors’ contracts in this respect are described below:

• CEO: Under no circumstances will the CEO be entitled to any severance pay due to resignation or termination of his commercial relationship. However, the terms and conditions regulating his suspended labour relationship stipulate that the period of time in which the Executive Director holds his commercial relationship must be acknowledged as seniority for the purpose of possible severance pay due to termination of such labour relationship.

In this respect, once the commercial relationship has been terminated, the labour relationship that was in force between the Company and the Executive Director will become valid again until he takes up his new position, unless gross and wilful breach of contract is ruled by the courts. If, at the time of termination of the commercial relationship and, apart from the aforementioned exception, the company refuses to reinstate the Executive Director in his previous labour relationship, this fact will be considered unfair dismissal. In such case, the Executive Director will be entitled to the relevant severance pay according to applicable labour regulations. In order to calculate the severance pay, the compensation basis will be determined according to the full salary paid and received thereby over the twelve months prior to the termination including, if any, those paid and received in his position as Executive Director.

If the termination of the labour relationship is due to serious and wilful breach of the Executive Director’s essential obligations and this is ruled by the competent court, all rights to receive any kind of severance pay will be deemed null and void.

• COO: The COO is not entitled to receive any severance pay whatsoever if the Company decides to terminate his contract by virtue of a resolution adopted by the General Shareholders’ Meeting or Board of Directors, which implies the COO being dismissed from his post as Executive Director, regardless of the fact his seniority in the position is acknowledged for all purposes (even for the purpose of severance pay that could be implied in the event of termination) in the previous labour relationship between the parties, which will be resumed after the aforementioned termination of the commercial relationship.

If the Company refuses to reinstate the COO in his previous labour relationship, the COO will be entitled to severance pay according to the applicable labour regulations and his acknowledged seniority, the Company undertaking to pay him severance pay at least equivalent to one year of his fixed salary and the last variable remuneration he was paid. However, if the termination of the commercial relationship between the parties is due to serious and wilful breach of the Executive Director’s essential obligations and this is ruled by the competent court, all rights to receive any kind of severance pay will be deemed null and void.

In order to calculate the severance pay that could be received by the COO in the event of termination of his ordinary labour relationship, the basis for the severance pay will be calculated regarding the whole remuneration payable and received thereby in the twelve months prior to such termination, even if it were payable by virtue of a commercial relationship.

A.1.9 Indicate the conditions that the contracts of executive directors performing senior management functions should contain. Among other things, information must be provided on the duration, limits on amounts of indemnification, minimum contract term clauses, notice periods and payment in lieu of these notice periods, and any other clauses relating to signing bonuses, as well as compensation or golden parachute clauses for early termination of the contractual relationship between the company and the executive director. Include, among others, the pacts or agreement on noncompetition, exclusivity, minimum contract terms and loyalty, and post-contractual non-competition, unless these have been explained in the previous section.

The contract of NH’s Executive Directors is of a commercial nature and includes the duties and obligations they hold within the scope of their posts and their remuneration.

The most significant clauses in both contracts are described below:

- Permanent term.

- Full-time commitment and non-competition. They may not perform the following duties without the company’s prior consent during the period they render their services within the scope of their valid contracts:

− Hold an indirect or direct stake of any kind in companies that perform activities that are in competition with or are similar or related to the company’s activities or that are suppliers and/or customers of NH. Any part-time teaching activities that could be performed by the Executive Directors shall be deemed excluded from the previous point.

This condition will remain in force, in the case of the CEO, until twelve months have elapsed after the termination of his commercial agreement or employment contract with NH, whatever the reason for such termination may be.

The gross annual fixed remuneration of the Executive Directors already includes compensation for the non-competition clause.

- Both Executive Directors must provide at least two months’ prior notice of their decision to terminate their commercial relationship with NH and may choose to renew their ordinary labour relationship.

- Severance pay: See the previous section.

- Confidential information: During the valid term of the commercial agreement and after the termination thereof for any reason, the Executive Directors must not indirectly or directly disclose or disseminate to third parties not associated with NH any commercial or industrial secrets, processes, methods, information or data related to the activities, business or finances of NH or any company in its Group.

A.1.10 The nature and estimated amount of any other supplementary remuneration that will be accrued by directors in the current year in consideration for services rendered other than those inherent in their position.

The directors have not received, nor is it planned they will receive, any other supplementary remuneration for services apart from those inherent to their posts and that have not already been described in this Report.

A.1.11 Other items of remuneration such as any deriving from the company’s granting the director advances, loans or guarantees or any other remuneration.

The Directors have not been granted any advances, loans, guarantees or other remuneration.

A.1.12 The nature and estimated amount of any other planned supplementary remuneration to be accrued by directors in the current year that is not included in the foregoing sections, whether paid by the company or by another group company

The directors have not received, nor is it planned they will receive, any other supplementary remuneration for services apart from those inherent to their posts and that have not already been described in this Report.

A.2 Explain any significant change in the remuneration policy applicable in the current year resulting from:

a. A new policy or an amendment to a policy already approved by the General Meeting.

b. Significant changes in the specific determinations established by the board for the current year regarding the remuneration policy in force with respect to those applied in the previous year.

c. Proposals that the Board of Directors has agreed to submit to the general shareholders’ meeting to which this annual report will be submitted and for which it is proposed that they be applicable to the current year.

No significant changes have been made to the Remuneration Policy that could seriously affect the Remuneration Policy for this year.

A.3 Identify the direct link to the document containing the company’s current remuneration policy, which must be available on the company’s website.

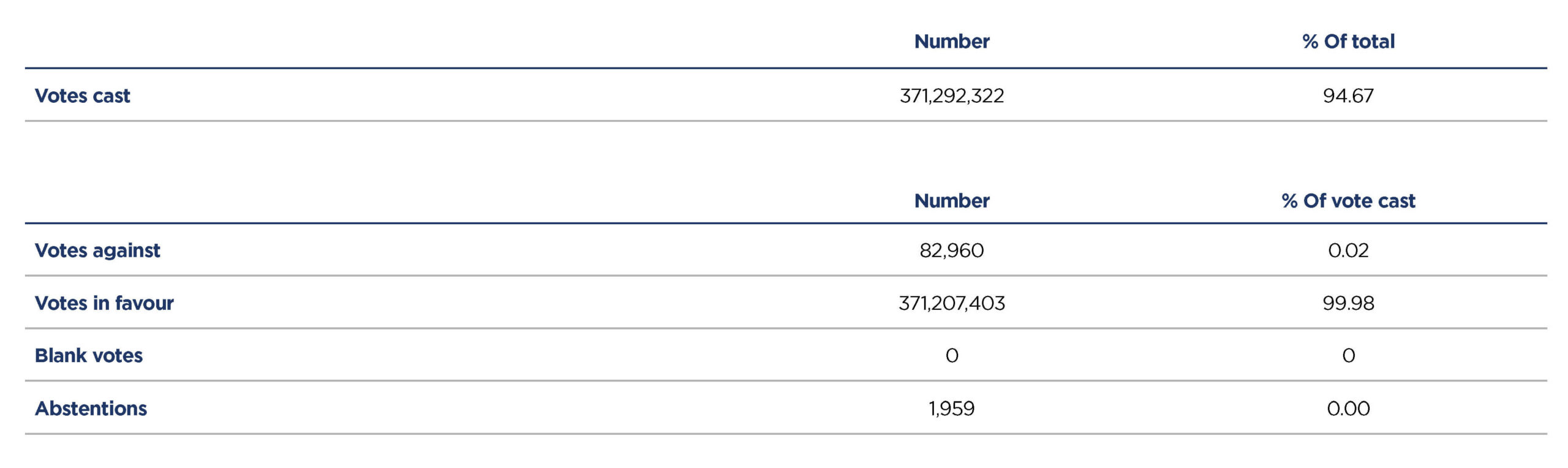

A.4 Explain, taking into account the data provided in Section B.4, how account has been taken of the voting of shareholders at the General Shareholders’ Meeting to which the annual report on remuneration for the previous year was submitted on a consultative basis.

The last General Shareholders’ Meeting held on 30 June 2021 approved the Annual Directors’ Remuneration Report by 99.98% of the votes, the majority supporting the remuneration policy for the company’s directors described above.

B – OVERALL SUMMARY OF HOW REMUNERATION POLICY WAS APPLIED DURING THE YEAR LAST ENDED

B.1.1 Explain the process followed to apply the remuneration policy and determine the individual remuneration contained in Section C of this report. This information will include the role played by the remuneration committee, the decisions taken by the Board of Directors and the identity and role of any external advisors whose services may have been used in the process of applying the remuneration policy in the year last ended.

Process used to apply the Remuneration Policy

The main bodies for creating the company’s Remuneration Policy are the General Shareholders’ Meeting, the Board of Directors and the ARCGC.

The role played by the ARCGC

The ARCGC is the body competent for proposing the Directors’ Remuneration Policy and the remuneration for those who perform senior management duties, directly reporting to the Board, Executive Committees or Executive Directors, and the individual remuneration and other contractual terms and conditions for the Executive Directors, ensuring such conditions are observed.

As explained in the Remuneration Policy, the ARCGC may hold meetings as often as (i) considered necessary by its Chairperson, (ii) required by the Board of Directors or (iii) requested by two or more of its members with voting rights, to correctly fulfil its duties. In 2021, the ARCGC held 4 meetings that all its members attended.

The items related to remuneration that were discussed by the ARCGC in 2021 are explained below:

- Proposal and approval of the Annual Directors’ Remuneration Report for the financial year 2020.

- Proposal and approval for payment of the second cycle of the Long-Term Incentive Plan or Performance Shares Plan 2017-2022, the accrual period of which began on 1 January 2018 and ended on 31 December 2020.

- Assessment and approval of the annual variable remuneration for the CEO and COO (Executive Directors) for the results achieved in 2020.

- Approval of the objectives linked to the annual variable remuneration of the Executive Directors in 2021.

- Information about the CEO to the ARCGC on the assessment of the variable remuneration in 2020 for the Executive Committee, along with the objectives linked to the annual variable remuneration in 2021.

- Proposal and approval of the NH Hotel Group Directors’ Remuneration Policy with retroactive validity from 1 January 2021 to 31 December 2023.

When setting the budget for 2021, there were very strong indications of recovery from the beginning of the year. Due to the length of the pandemic and a much slower and lower than expected recovery in the middle of the year, the variable remuneration scheme was reviewed, and a new variable remuneration scheme was again proposed and approved as set out in point B.7 below.

Composition of the ARCGC

According to Article 47 of the Articles of Association, the Committee is comprised of a minimum of three and a maximum of six directors and solely consists of Non-Executive Directors appointed by the Board of Directors, at least two of which must be independent directors.

On 31 December 2021, the Committee was composed of three non-executive members, two of whom were independent directors:

- Mr. José María Cantero de Montes-Jovellar; Chairman and Independent Director since 21/06/2016.

- Mr. Alfredo Fernández Agras; Member and Independent Director since 10/04/2019.

- Mr. Stephen Andrew Chojnacki; Member and Proprietary Director since 07/02/2019.

B.1.2 Explain any deviation from the procedure established for the application of the remuneration policy that has occurred during the year.

There has been no deviation from the established procedure for the application of the Remuneration Policy approved at the General Shareholders’ Meeting held on 12 May 2021. Notwithstanding the foregoing, within the scope of this Policy, certain exceptional decisions have been taken as a result of the uncertainty caused by COVID-19.

Section B.3 explains how the Executive Directors had their fixed remuneration reduced by 20% from January to June 2021, which coincided with the termination of the Temporary Layoff Plan (ERTE).

With regard to the annual variable remuneration, specific objectives were set for the second half of 2021, as the financial forecasts made at the beginning of the year were outdated. However, the objectives set for the second half of the year were not achieved and, as a result, no amount was paid as annual variable remuneration. Further details on this point can be found in section B.7.

B.1.3 Indicate whether any temporary exception has been applied to the remuneration policy and, if so, explain the exceptional circumstances that have led to the application of these exceptions, the specific components of the remuneration policy affected and the reasons why the entity believes that these exceptions have been necessary to serve the long-term interests and sustainability of the society as a whole or ensure its viability. Similarly, quantify the impact that the application of these exceptions has had on the remuneration of each director over the year.

No temporary exceptions to the Remuneration Policy were applied in 2021.

B.2 Explain the different actions taken by the company in relation to the remuneration system and how they have contributed to reducing exposure to excessive risks, aligning it with the long-term objectives, values and interests of the company, including a reference to the measures adopted to ensure that the long-term results of the company have been taken into consideration in the remuneration accrued. Ensure that an appropriate balance has been attained between the fixed and variable components of the remuneration, the measures adopted in relation to those categories of personnel whose professional activities have a material effect on the company’s risk profile and the measures in place to avoid any possible conflicts of interest.

The actions carried out by the company related to the remuneration system to reduce exposure to excessive risks and adapt it to the company’s long-term objectives, values and interests have been explained in sections A.1.6 and A.1.7 of this Report. It is explained below how these actions were carried out in 2021:

A) Clawback clauses:

The claw-back clauses referred to in the section B.7. are applicable to the Performance Shares Plan 2017-2022.

B) Minimum period for holding the shares:

The Performance Shares Plan 2017-2022 determines a minimum period for holding the shares delivered as at least one year for the Executive Directors and Executive Committee.

C) Additional requirements for holding shares:

The Executive Directors must hold at least the equivalent of one year of their fixed remuneration in shares and, if this obligation has been fulfilled, the price must be the one determined as the share price on the date the shares were delivered.

D) Formulating the variable remuneration objectives:

For the variable remuneration accrued in 2021, a binary scheme was applied so that failure to achieve the Group EBITDA resulted in a 0% payout.

Regarding the multi-annual variable remuneration, the third cycle of the Performance Shares Plan 2017-2022 that was in force in 2021 included objectives in line with the company’s long-term economic and financial targets and creation of value for the shareholder.

In addition, as a prudent measure, no long-term incentive plan cycle was granted during 2021 in light of the uncertain economic environment caused by the pandemic.

E) Balance of the total remuneration:

The remuneration package of the Executive Directors includes a short- and long-term variable part, both parts being balanced.

In this respect, the percentage that the (annual and multi-annual) variable remuneration represented of the total remuneration in 2021, in a situation in which 100% of the objectives are achieved, was approximately 57% for the CEO and 47% for the COO.

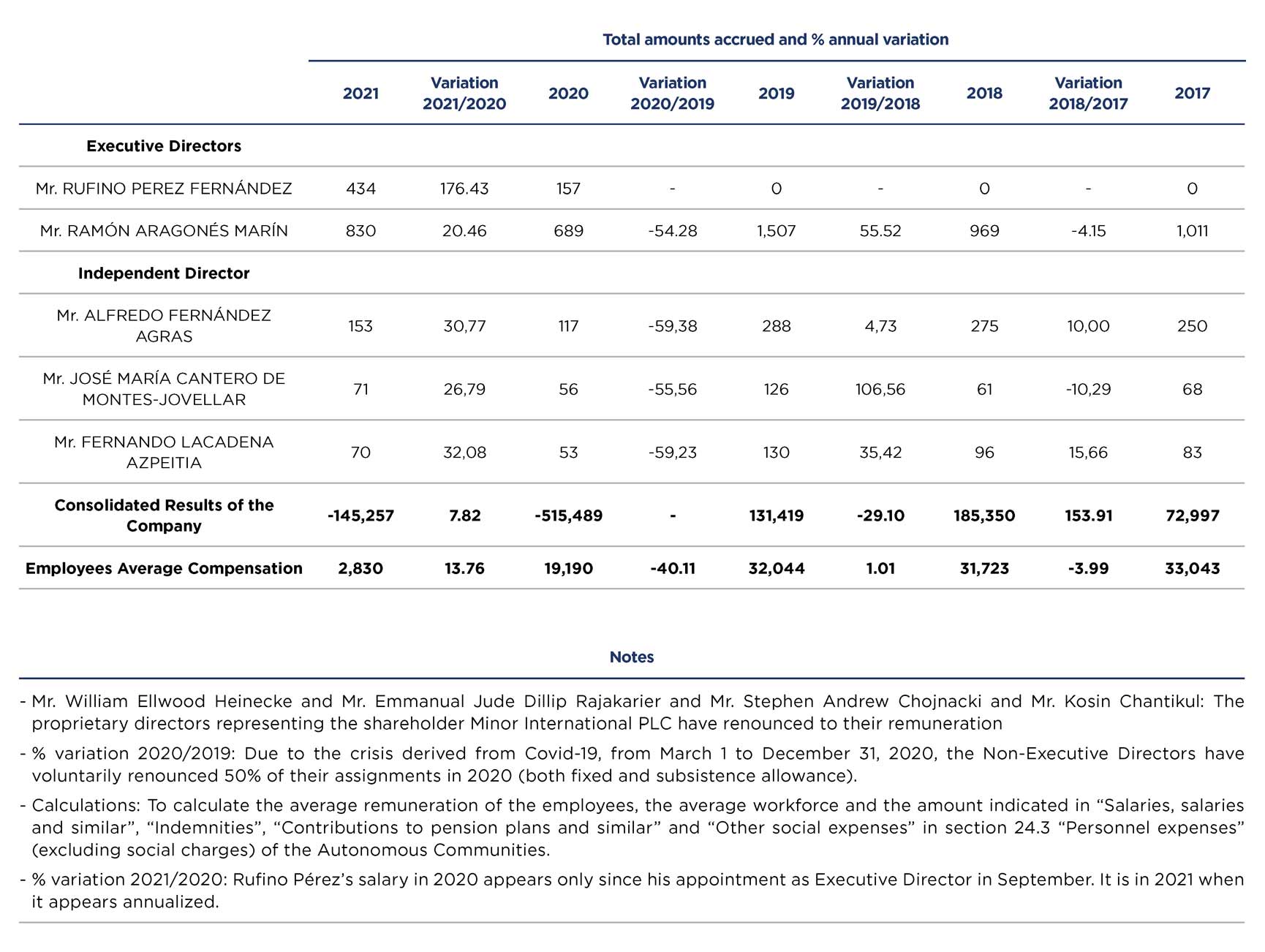

Lastly, the variable remuneration accrued in 2021 was 22% for the CEO and 16% for the COO for the following reasons:

- The short-term variable remuneration was 0% in both cases because the EBITDA budgeted for the second half was not reached.

- The 2019-2021 cycle of the Long-Term Incentive Plan has had a payout percentage of 39.27%.

B.3 Explain how the remuneration accrued and consolidated over the financial the year complies with the provisions of the current remuneration policy and, in particular, how it contributes to the company’s long-term and sustainable performance.

Furthermore, report on the relationship between the remuneration obtained by the directors and the results or other performance measures of the company in the short and long term, explaining, if applicable, how variations in the company’s performance have influenced changes in directors’ remuneration, including any accrued remuneration payment of which has been deferred, and how such remuneration contributes to the short- and long-term results of the company.

The items included in the directors’ remuneration package in the financial year 2021 are summarised below. Similarly, the details of these items can be found in the following paragraphs of this section B:

Remuneration of the Non-Executive Directors:

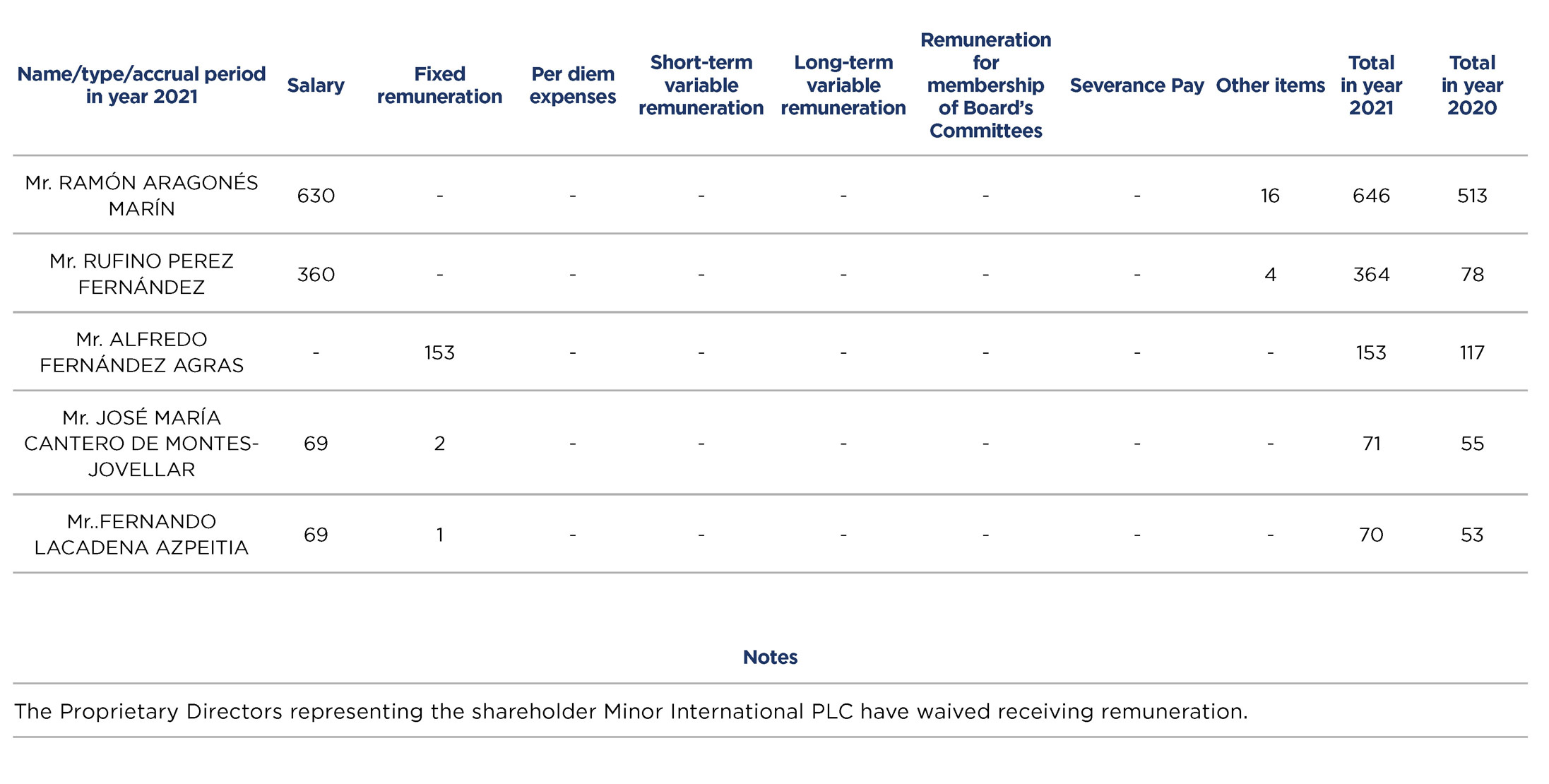

In 2021, the Non-Executive Directors’ remuneration was once again affected by the worldwide crisis caused by COVID-19. This remuneration consisted of fixed amounts and expenses for attending the meetings as described in section B.5.

The Non-Executive Directors voluntarily waived 20% of their remuneration (both fixed and expenses) from 1 January 2021 until 30 April 2021. They also waived 100% of their remuneration for the months of May and June.

In addition, at the first meeting of the ARCGC held in 2022 it was proposed to the Board of Directors to extraordinarily increase, with a charge to 2021, the fixed allowance to the member of the Board Fernando Lacadena, due to his additional dedication throughout the year 2021, especially in the process of transferring the chairmanship.

The maximum gross annual amount payable to the directors in their positions as members of the Board of Directors observed the limit stipulated by the General Shareholders’ Meeting held on 30 June 2021 (€800,000), a total of €294,133.33 being paid out as fixed remuneration and expenses.

Executive Directors:

The Executive Directors voluntarily had their fixed remuneration reduced by 20% from January to June 2021, which coincided with the termination of the Temporary Layoff Plan (ERTE).

The remuneration items of the Executive Directors in 2021 were as follows:

CEO:

• Fixed Remuneration: €630,000, with a reduction of 10% on €700,000.

• Short-term variable remuneration accrued in 2021: €0, bearing in mind an achievement level of the corporate EBITDA vs Budget target in the second half below the minimum threshold and therefore the non-achievement of the MBO 2021.

• Multi-annual variable remuneration (the second cycle of the second Performance Shares Plan 20172022 that began on 1 January 2019 and ended on 31 December 2021): 38,675 gross shares bearing in mind the overall target achievement level of 39.27%.

• Other remuneration (company car, health care insurance policy and life and accident insurance policy): €59,491.

COO:

• Fixed Remuneration: €360,000, with a reduction of 10% on €400,000.

• Short-term variable remuneration accrued in 2021: €0, bearing in mind an achievement level of the corporate EBITDA vs Budget target below the minimum threshold and therefore the non-achievement of the MBO 2021.

• Multi-annual variable remuneration (the second cycle of the second Performance Shares Plan 20172022 that began on 1 January 2019 and ended on 31 December 2021): 17,850 gross shares bearing in mind the overall target achievement level of 39.27%.

• Other remuneration (company car, health care insurance policy and life and accident insurance policy): €22,156.

A breakdown of the annual variable remuneration and of the third cycle of the third Performance Shares Plan is provided in section B.7.

As explained in the previous sections, the Executive Directors are not paid any additional remuneration for their positions as members of the Board of Directors.

57% (CEO) and 47% (COO) of their total remuneration is linked, as previously specified, to both short- and long-term variable remuneration. The aim of this remuneration mix is to reward the performance of both directors’ bearing in mind the achievement of the company’s quantitative objectives, linking the achievement of the annual and multi-annual targets set by the company to its medium- and long-term strategy and aligning the individual objectives with those of the company, creating value for the stakeholders. Similarly, it is endeavoured to reduce the exposure to excessive risks and to adjust it to the company’s long-term targets, values and interests.

In addition, the Executive Directors’ remuneration package supports the sustainable performance of the Company, in that a minimum recurring EBITDA performance is required for the annual variable remuneration to accrue. The level of stringency in the two variable elements of the remuneration package remains clear given that the final payout percentages obtained (0% in the case of the annual variable remuneration and 39.27% in the case of the third cycle of the 2017-2022 Long-Term Incentive Plan).

In this respect, the accrued remuneration (fixed, annual and multi-year and variable remuneration) in 2021 was 48% for the CEO compared with his target remuneration and 55% for the COO.

B.4 Report on the result of the consultative vote at the General Shareholders’ Meeting on remuneration in the previous year, indicating the number of votes in favour, votes against, abstentions and blank ballots:

B.5 Explain how the fixed components accrued and vested during the year by the directors in their capacity as such were determined, their relative proportion with regard to each director and how they changed with respect to the previous year:

The directors, in their positions as such, to whom fixed remuneration was payable in 2021 were Non-Executive Directors that do not represent the shareholder, Minor International PLC. The latter have waived all remuneration payable to them due to being members of the Board of Directors

However, due to the crisis caused by COVID-19, the Non-Executive Directors voluntarily waived 20% of their remuneration (both fixed and expenses) from 1 January until 30 April 2021. They also waived 100% of their remuneration during the months of May and June. The remuneration effectively received in the financial year 2021 was as follows:

- Annual fixed amount:

− Chairperson of the Board of Directors: €153,333 (compared to the €116,666.67 received in 2020 and the €200,000 received in 2019).

− Chairperson of the Auditing Committee and the ARCGC: €69,000 (compared to the €52,500 received in 2020 and the €90,000 received in 2019).

− Member of the Auditing Committee: €51,903.3 (not comparable with previous years when they were Chairman of the Auditing Committee).

Additionally, in view of the additional dedication of Mr. Fernando Lacadena in relation to the transfer of powers to the new Chairman of the Auditing Committee, his fixed allowance has been extraordinarily increased by €17,096.67 with a charge to 2021.

- Attendance expenses of the members

− Expenses for attending the Audit and Supervisory Committee Meetings: €800 per meeting from January to June, €0 for meetings in May and June and €1,000 per meeting from September to December.

− Expenses for attending the ARCGC Meetings: €800 per meeting from January to June, €0 for meetings in May and June and €1,000 per meeting from September to December.

B.6 Explain how the salaries accrued and vested by each of the executive directors over the past financial year for the performance of management duties were determined, and how they changed with respect to the previous year.

The CEO’s fixed remuneration for the performance of his senior management duties, which amounts to €700,000 in accordance with the Remuneration Policy, has been reduced by 20% from January to June 2021. As a result, this remuneration amounts to €630,000 in 2021. In 2020, this remuneration totalled €498,750, since the fixed remuneration was reduced by 20% to 50% depending on the month during the period from March to December.

In the same way, COO’s fixed remuneration for the performance of his senior management duties, amounted to €360,000 in 2021, resulting from a fixed salary of €400.000. In 2020 this remuneration totalled €285,000 (the reductions to the fixed remuneration described for the CEO were also applied in this case).

As mentioned above, the Executive Directors are not paid any remuneration whatsoever for their positions as directors.

B.7 Explain the nature and the main characteristics of the variable components of the remuneration systems accrued and vested in the year last ended.

In particular:

a) Identify each of the remuneration plans that determined the different types of variable remuneration accrued by each of the directors in the year last ended, including information on their scope, date of approval, date of implementation, any vesting conditions that apply, periods of accrual and validity, criteria used to evaluate performance and how this affected the establishment of the variable amount accrued, as well as the measurement criteria used and the time needed to be able to adequately measure all the conditions and criteria stipulated, explaining the criteria and factors applied in regard to the time required and the methods of verifying that the performance or any other kind of conditions linked to the accrual and vesting of each component of variable remuneration have effectively been met.

b) In the case of share options and other financial instruments, the general characteristics of each plan must include information on the conditions both for acquiring unconditional ownership (vesting) of these options or financial instruments and for exercising them, including the exercise price and period.

c) Each director that is a beneficiary of remunerations systems or plans that include variable remuneration, and his or her category (executive director, external proprietary director, external independent director or other external director).

d) Information is to be provided on any periods for accrual, vesting or deferment of payment of vested amounts applied and/or the periods for retention/unavailability of shares or other financial instruments, if any.

Explain the short-term variable components of the remuneration systems

As explained above, the only directors entitled to payment of variable remuneration are those assigned executive duties.

An overall framework for annual variable remuneration for Executive Directors was agreed at the ARCGC meeting held on 24 February 2021. The features of this annual variable remuneration were outlined in section A.1 of last year’s Annual Remuneration Report.

The overall framework was designed on the basis of very strong signs of recovery at the beginning of 2021. As a result of the length of the pandemic and a much slower and lower than expected recovery, the Board of Directors, at the proposal of the ARCGC, approved a new annual variable remuneration scheme on 27 July with the following features:

Timeframe: The annual EBITDA targets were reformulated as half-yearly targets, and therefore the measurement of EBITDA was limited to the second half of the year.

Amount: Following the same logic, the benchmark annual variable remuneration was reformulated into a half-yearly amount, which implies multiplying the target variable remuneration by 0.5. This means 32.5% of fixed remuneration for the CEO and 22.5% for the COO.

Target: The second-half adjusted corporate EBITDA was the sole target of the scheme.

Performance scale: The calculation process was simplified and a binary scheme was established whereby if 100% of the target was reached, 100% of the new target variable remuneration would be paid, and if not reached, no payment would be made.

Final result of the 2021 variable remuneration scheme: Bearing in mind that the level of EBITDA achievement has been below the minimum level during the second half of the year, no amount has been paid as annual variable remuneration.

Explain the long-term variable components of the remuneration systems

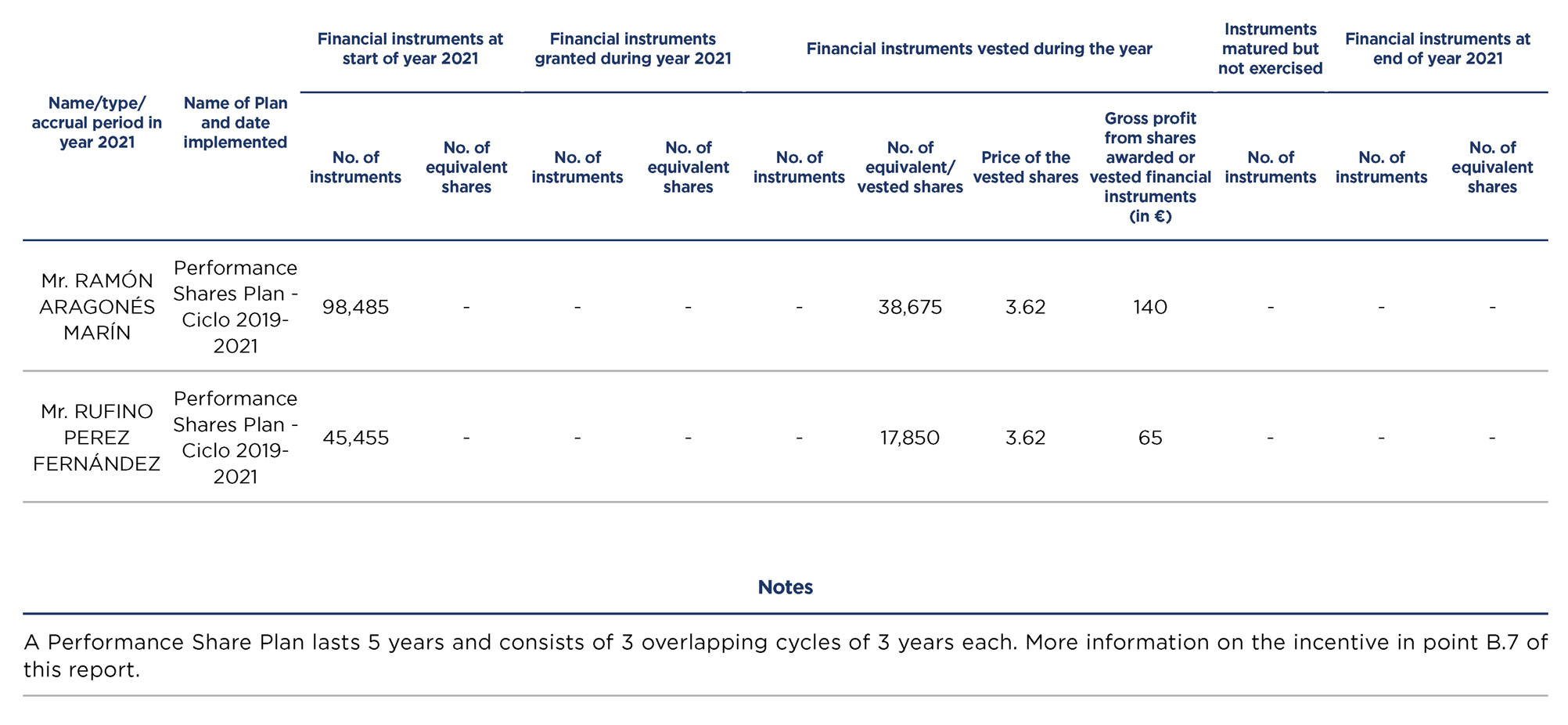

As mentioned above, the General Shareholders’ Meeting held on 29 June 2017 approved the launch of the Long-Term Bonus Plan or “Performance Shares Plan 2017-2022”. The Plan had a term of five years, divided into three cycles of three years each one:

a. First cycle 2017-2019. Ended with delivery of shares in 2020.

b. Second cycle 2018-2020. Ended with delivery of shares in 2021.

c. Third cycle 2019-2021. Ended with delivery of shares in 2022.

Below are the main features of the third cycle of the 2017-2022 Performance Shares Plan that ended on 31 December 2021, as well as the incentive that was ultimately paid out.

Targets: The number of shares to be awarded was initially subject to the fulfilment of the following four targets:

a. Net Recurrent Profit (weighting: 25%).

b. The Group’s Recurrent EBITDA (weighting: 25%).

c. TSR (“Total Shareholder Return”) related to NH’s shares compared with the changes in the STOXX® Europe 600 Travel & Leisure stock exchange index (weighting: 25%).

d. Share price rise (weighting: 25%).

Bearing in mind the corporate transaction carried out within NH in 2018 and the impact of such transaction on the share value, the Board of Directors adopted a resolution to neutralise the result of the metrics associated with the share value (according to the provisions in the Remuneration Policy and the adjustment clause in the Plan’s Regulations explained in section A of the previous year’s Annual Remuneration Policy): Relative TSR and Share Price Rise.

Therefore, the targets to which the Performance Shares Plan was subject were Recurring Net Profit (50%) and Recurring Group EBITDA (50%).

Performance scale: The target achievement scales were as follows:

a) Net Recurrent Profit:

− Minimum threshold: Achievement of 80% of the target implied a payment of 50% of the bonus. A level of achievement lower than 80% implied a payment level of 0%.

− Target: Achievement of 100% of the target implied payment of 100% of the target bonus.

− Maximum: Achievement of 120% or more of the target implied payment of 150% of the target bonus.

If the level of achievement were positioned between the minimum threshold and the target or between the target and the maximum, the level of payment would be calculated by linear interpolation.

b) Recurrent EBITDA:

− Minimum threshold: Achievement of 90% of the target implied payment of 50% of the bonus. A level of achievement lower than 90% implies a payment level of 0%.

− Target: Achievement of 100% of the target implied payment of 100% of the target bonus.

− Maximum: Achievement of 110% or higher of the target implied payment of 150% of the target bonus.

If the level of achievement were positioned between the minimum threshold and the target or between the target and the maximum, the level of payment would be calculated by linear interpolation.

Level of target achievement:

a) Net Recurrent Profit: The achievement level in each of the measurement years was as follows:

− 2019: Between the target level and the maximum level.

− 2020: Achievement below the minimum threshold.

− 2021: Achievement below the minimum threshold.

b) Recurrent EBITDA: The achievement level in each of the measurement years was as follows:

− 2019: Between the target level and the maximum level.

− 2020: Achievement below the minimum threshold.

− 2021: Achievement below the minimum threshold.

Incentive amount: If the target achievement level had been 100%, the Executive Directors would have been entitled to receive the target number of shares (98,485 shares for the CEO and 45,455 for the COO); whose reference value at the award date would be equivalent to 65% and 45% of the fixed remuneration on such date respectively. In this respect, the reference value was calculated as the average closing price of NH’s shares in the last 10 stock exchange sessions before 1 January 2019.

Lastly, the overall achievement level was 39.27%, meaning that the CEO receives 38,675 gross shares, and the COO receives 17,850 gross shares.

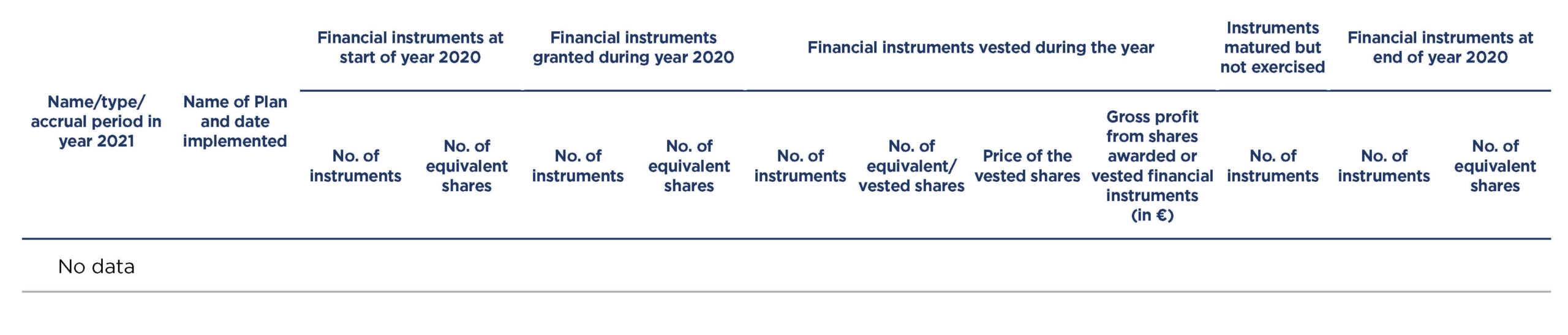

This number of shares is shown in table C.1.a) ii).

The benchmark value for tax purposes of the assessment of the shares will be the closing price of NH’s shares in the stock exchange session on the date in which the assessment is approved and the shares are delivered by the Audit Committee.

Clawback: his plan includes a clawback clause, the basic conditions of which have been explained above.

Shareholding commitment: The Executive Directors must continue holding a number of company shares resulting from having invested an amount equivalent to once their gross fixed remuneration in the purchase thereof. For such purpose, these will have the value of the shares according to the price paid at the time of delivery or, in the case of shares previously acquired, according to the average weighted market price of the shares on the date this incentive regulation is approved.

The aforementioned investment level must be reached by the end of a five-year term counted from the date this incentive regulation is approved.

Once the required investment level has been reached, a share holding period the shares will remain in force for one year after the assessment of each of the Long-term Bonus Plan’s cycles.

B.8 Indicate whether certain variable components have been reduced or clawed back when, in the former case, payment of non-vested amounts has been deferred or, in the latter case, they have vested and been paid, on the basis of data that have subsequently been clearly shown to be inaccurate. Describe the amounts reduced or clawed back through the application of the “malus” (reduction) or clawback clauses, why they were implemented and the years to which they refer.

No clause of this kind was applied in 2021.

B.9 Explain the main characteristics of the long-term savings schemes where the amount or equivalent annual cost appears in the tables in Section C, including retirement and any other survivor benefit, whether financed in whole or in part by the company or through internal or external contributions, indicating the type of plan, whether it is a defined contribution or defined benefit plan, the contingencies covered, the conditions on which the economic rights vest in favour of the directors and their compatibility with any type of indemnification for early termination or cessation of the contractual relationship between the company and the director.

In 2021, the company did not undertake any obligation or commitment related to pensions, retirement or similar items.

B.10 Explain, where applicable, the indemnification or any other type of payment deriving from the early cessation, whether at the company’s or the director’s initiative, or from the termination of the contract in the terms provided therein, accrued and/or received by directors during the year last ended.

The Company has not undertaken any commitment or obligation to make any severance payment or other payments arising from early termination, whether by the Company or the director, or from the termination of the contract.

B.11 Indicate whether there have been any significant changes in the contracts of persons exercising senior management functions, such as executive directors, and, if so, explain them. In addition, explain the main conditions of the new contracts signed with executive directors during the year, unless these have already been explained in Section A.1.

In 2021, no modifications were made to the Executive Directors’ contract.

B.12 Explain any supplementary remuneration accrued by directors in consideration of the provision of services other than those inherent in their position.

The Remuneration Policy does not include any supplementary remuneration other than that previously specified.

On the date this Report is issued, there was no supplementary remuneration payable to the directors as consideration for services rendered other than those related to their posts.

B.13 Explain any remuneration deriving from advances, loans or guarantees granted, indicating the interest rate, their key characteristics and any amounts returned, as well as the obligations assumed on their behalf by way of guarantee.

The Remuneration Policy does not include any possibility to grant advance payments, loans or guarantees to the directors.

On the date this Report is issued, no advance payments, loans or guarantees have been granted to any of the directors.

B.14 Itemise the remuneration in kind accrued by the directors during the year, briefly explaining the nature of the various salary components.

The directors, in their positions as such, do not receive remuneration in kind.

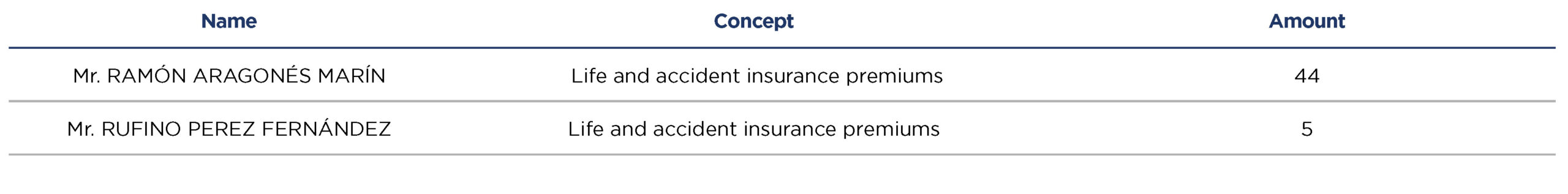

Apart from the shares they receive related to the Performance Shares Plan, the Executive Directors accrued the following remuneration in kind for their executive duties:

- A health care insurance policy for each Executive Director and their first-degree relatives.

- A life insurance policy with insured capital of €2,100,000 (CEO) and €1,200,000 (COO).

- An accident insurance policy with insured capital of €2,100,000 (CEO) and €1,200,000 (COO).

- A company car in the case of the CEO. The COO has chosen to receive economic compensation instead of a company car.

The amount for such remuneration was €59,491 for the CEO and €22,156 for the COO (including the company car).

B.15 Explain the remuneration accrued by any director by virtue of payments made by the listed company to a third company in which the director provides services when these payments seek to remunerate the director’s services to the company.

On the date this Report is approved, no amounts have been paid to third-party enterprises due to possible services being rendered by the directors.

B.16 Explain and detail the amounts accrued in the year in relation to any other remuneration concept other than that set forth above, whatever its nature or the group entity that pays it, including all benefits in any form, such as when it is considered a related-party transaction or, especially, when it significantly affects the true image of the total remuneration accrued by the director. Explain the amount granted or pending payment, the nature of the consideration received and the reasons for those that would have been considered, if applicable, that do not constitute remuneration to the director or in consideration for the performance of their executive functions and whether or not has been considered appropriate to be included among the amounts accrued under the “Other concepts” heading in Section C.

On the date this Report is approved, there are no other items of remuneration apart from those explained in the previous sections.

C -ITEMISED INDIVIDUAL REMUNERATION PAYABLE TO EACH DIRECTOR

C.1 Complete the following tables regarding the individual remuneration of each director (including the remuneration paid for performing their executive duties) payable during the financial year.

a) Remuneration of the company covered by this report:

i) Remuneration in cash (in thousands of euros)

ii) Table of changes in share-based remuneration schemes and gross profit from vested shares or financial instruments

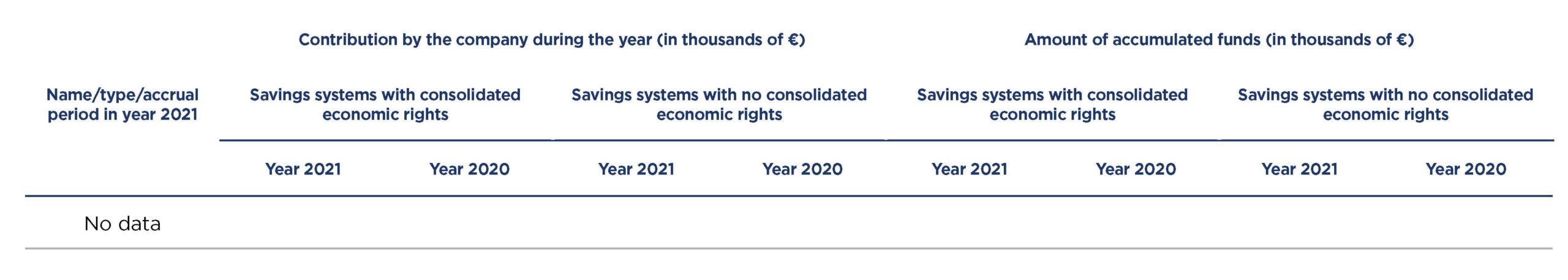

iii) Long-term saving schemes

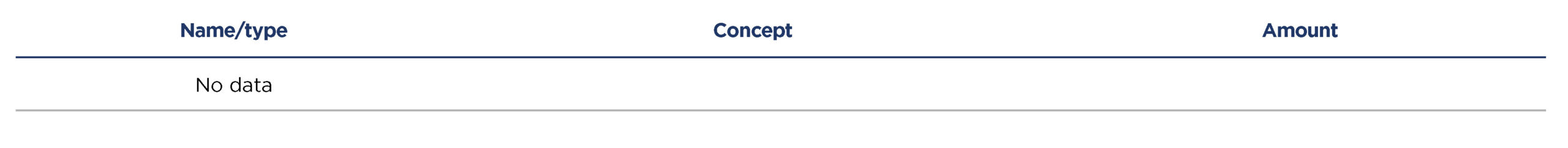

iv) Details of other items

b) Remuneration paid to the company’s directors for being members on the boards of other group companies:

i) Remuneration in cash (in thousands of euros)

ii) Table of changes in share-based remuneration schemes and gross profit from vested shares or financial instruments

iii) Long-term saving schemes

iv) Details of other items

c) Summary of remuneration (in thousands of €):

The summary should include the amounts corresponding to all the remuneration items included in this report that are payable to each director (in thousands of €).