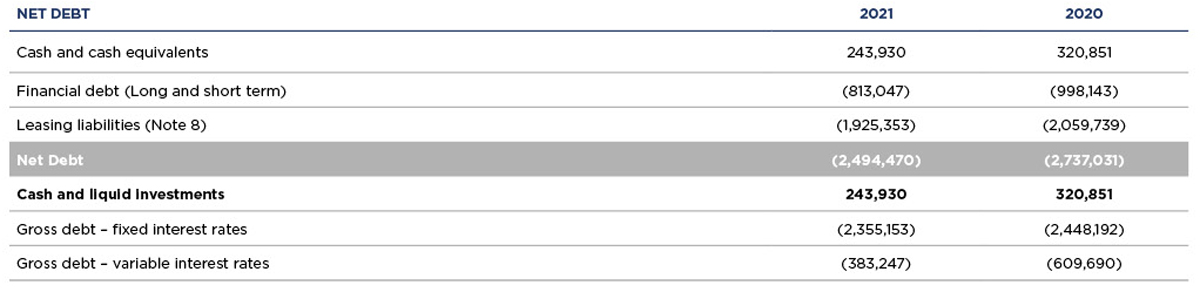

The balances of the “Bonds and other negotiable securities” and “Debts with credit institutions” items for the financial year were as follows:

The effect of debt movement on the Group’s cash flows as reflected in the cash flow statement is affected by non-cash movements generated by exchange rate differences as the group has debts in currencies other than the euro.

For the purpose of strengthening the Group’s capital structure and liquidity, the following financing measures were entered into during 2021:

– April 2021 the extension for an additional period of 3 years was formalised for the syndicated loan of 250,000 thousand euros with a partial guarantee from the Instituto de Crédito Oficial (ICO), taking its original expiry date of 2023 to 2026. Furthermore, the waiver on compliance with financial covenants was extended for the whole of 2022.

– In May 2021, the Parent Company received a loan convertible into shares of 100,000 thousand euros from its majority shareholder, Minor International, which was capitalised with a capital increase for all the shareholders in September 2021 (Note 16).

– In June 2021, the renegotiation of the syndicated credit facility (RCF) was formalised, increasing its total from 236,000 thousand euros to 242,000 thousand euros and extending its expiry from 2023 to 2026. Furthermore, the waiver on compliance with financial covenants was extended for the whole of 2022.

– In June 2021, the Parent Company placed a senior bonds issue on the market, guaranteed for a total of 400,000 thousand euros maturing in 2026, the funds from which were mainly used to repay senior bonds guaranteed for a total of 356,850 thousand euros maturing in 2023.

These transactions have strengthened capital structure and liquidity, giving the company a stable financial position, without significant maturities until 2026, to address the recovery of its activity.

Secured senior bonds maturing in 2026

On 14 June 2021 the Parent Company offered guaranteed senior bonds, which mature in 2026, at the nominal value of 400,000 thousand euros. The nominal annual interest rate for the issue is 4% and the arrangement expenses the issue of the bond was 6,896 thousand euros.

After the issue was paid up and closed on 28 June, using the funds received from the issue, the Parent Company paid off the total guaranteed senior notes (the “Bonds”) in the amount of 356,850 thousand euros maturing in 2023 early, with a payment of 100.938% of the nominal value of the Bonds subject to repayment.

The outstanding nominal amount at 31 December 2021 was 400,000 thousand euros.

Secured credit line

On 22 September 2016, the Parent Company and NH Finance, S.A. entered into a revolving business credit with credit institutions amounting to 250,000 thousand euros (“syndicated credit line”) with a maturity of three years, extendable to five years at the time of the refinancing of the guaranteed senior notes maturing in 2019. As a consequence of the refinancing of the guaranteed senior notes maturing in 2019, which took place in 2017, the maturity date of said financing was extended to 29 September 2021.

On 16 October 2020, the Parent Company and NH Finance, S.A. agreed the extension of the maturity of the finance to 29 March 2023, with a limit of 236,000 thousand euros.

On 29 June 2021, the Parent Company and NH Finance, S.A. agreed an additional extension of the maturity of the finance to 31 March 2026, with a limit of 242,000 thousand euros.

On 8 July 2021 the amount drawn down from this syndicated credit facility was reduced from 236,000 thousand euros to 36,000 thousand euros.

On 8 December 2021, the amount of 36,000 thousand euros drawn down was completely cut.

At 31 December 2021, the entire 242,000 thousand euros of this financing were available.

Subordinate loan convertible into shares

On 24 May 2021, the Parent Company received a loan convertible into shares of 100,000 thousand euros from its majority shareholder, Minor International, which was capitalised with a capital increase for all the shareholders in September 2021 (Note 16.1).

Unsecured loans

Syndicated ICO backed loan maturing in 2026

On 29 April 2020, the Group entered into a loan for 250,000 thousand euros over 3 years, with no repayments until maturity.

The contract, within the legal framework established by the Spanish government to mitigate the economic impact of COVID-19, received a guarantee granted by the Spanish state.

On 29 April 2021, on the basis of Royal Decree Law 34/2020 approved in November 2020, the Parent Company agreed the extension of this financing with the loan institutions until 2026, with no partial repayments until maturity.

At 31 December 2021, this financing was available in full.

Other non-guaranteed loans

In addition to the ICO backed syndicated loan for 250,000 thousand euros, as a result of the crisis caused by COVID-19, throughout 2020 the Parent Company and its subsidiaries took advantage of government aid in the various countries to take out several loans. Throughout 2021 extensions to their terms were agreed, with the grant of a guarantee from the Spanish State:

- In May 2020, the Parent Company signed a bilateral loan for 10,000 thousand euros over two years, within the legal framework established by the Spanish state to mitigate the economic impact of COVID-19 and thus receiving the ICO guarantee. In May 2021, on the basis of Royal Decree Law 34/2020, the Parent Company agreed the extension of the maturity of this loan for a further 3 years, with a new maturity date of May 2025.

- In July 2020, the Parent Company signed a bilateral loan for 7,500 thousand euros over three years, within the legal framework established by the Spanish state to mitigate the economic impact of COVID-19 and thus receiving the ICO guarantee. In April 2021, on the basis of Royal Decree Law 34/2020, the Parent Company agreed the extension of the maturity of this loan for a further 3 years, with a new maturity date of July 2026.

- In October 2020 the Italian subsidiary NH Italia Spa signed a bilateral loan for 15,000 thousand euros over 6 years, within the legal framework provided by the Italian state to mitigate the economic impact of COVID-19 and, in this way, receiving the State guarantee (SEPE).

- Furthermore, various bilateral loans were signed between June and September 2020 in different regions (Portugal, Argentina and Chile) to mitigate the economic impact of the pandemic. At 31 December 2021 the total amount drawn down from these loans was 3,199 thousand euros.

Subsidiaries of the Parent Company have other unsecured bilateral loans, including a loan from the American subsidiary of 50,000 thousand dollars (44,146 thousand euros at December 2021) signed in 2018, fully drawn down at 31 December 2021 and maturing in July 2023. These funds were used to finance the New York hotel’s capex. The remaining bilateral loans are distributed amongst the companies in Colombia and, at 31 December 2021, the amount drawn down was 1,363 thousand euros.

Subordinated loan

A loan amounting to 40,000 thousand euros fully drawn at 31 December 2021 and with a single maturity and repayment in 2037, are included in this item. The interest rate on this loan is the 3-month Euribor plus a spread.

Mortgages

The detail of the mortgage loans and credits is as follows (in thousands of euros):

Bilateral credit lines

At 31 December 2021, the balances under this item include the amount drawn down from credit facilities. The joint limit of these loan agreements and credit facilities at 31 December 2021 amounted to 42,000 thousand euros, of which 17,000 thousand euros had been drawn down at that date.

Obligations required in the senior notes contracts maturing in 2026, the syndicated credit line and the syndicated loan with ICO guarantee maturing in 2026

The senior notes maturing in 2026, the syndicated credit line maturing in 2026 and the syndicated loan guaranteed by ICO maturing in 2026 require the fulfilment of a series of obligations and limitations of essentially homogeneous content as regards the assumption of additional borrowing or provision of guarantees in favour of third parties, the granting of real guarantees on assets, the sale of assets, investments that are permitted, restricted payments (including the distribution of dividends to shareholders), transactions between related parties, corporate transactions and disclosure obligations. These obligations are detailed in the issue prospectus for the aforementioned notes, as well as in the credit agreement of the syndicated credit line.

The syndicated credit line and the syndicated loan with the ICO guarantee require compliance with financial ratios (financial covenants); in particular, (i) an interest coverage ratio of > 2.00x, (ii) a net indebtedness ratio of < 5.50x.

Furthermore, the senior notes maturing in 2026 and the syndicated credit line require fulfilment of a Loan to Value (“LTV”) ratio that depends on NH’s net debt level at any time as shown below:

– Net debt-to-income ratio ˃ 4.00x: LTV ratio = 70%

– Net debt-to-income ratios ≤ 4.00x: LTV ratio = 85%

– Net debt-to-income ratio ≤ 3.50x: LTV ratio = 100%

The maximum permitted LTV at 31 December 2021 is 70%.

At 31 December 2021, the Parent Company has a waiver on compliance with the financial covenants for the syndicated credit line and the syndicated loan with the ICO guarantee for the whole of 2022.

Package of guaranteed senior bonds maturing in 2026 and syndicated credit line maturing in 2026

The guaranteed senior notes maturing in 2026 and syndicated credit line maturing in 2026 share the following guarantees: (i) pledge of shares: 100% of the share capital of (A) Diegem, (B) Immo Hotel Brugge NV, (C) Immo Hotel Diegem NV, (D) Immo Hotel Mechelen NV, (E) Immo Hotel Stephanie NV, (F) Onroerend Goed Beheer Maatschappij Van Alphenstraat Zandvoort, B.V. and (G) NH Italia, S.p.A.; (ii) first-tier mortgage guarantee on the following hotels located in the Netherlands: NH Conference Centre Koningshof owned by Koningshof, B.V.; NH Conference Centre Leeuwenhorst owned by Leeuwenhorst Congres Center, B.V.; NH Zoetermeer owned by Onroerend Goed Beheer Maatschappij Danny Kayelaan Zoetermeer, B.V.; NH Conference Centre SparreNHorst owned by SparreNHorst, B.V.; NH Capelle owed by Onroerend Goed Beheer Maatschappij Capelle aan den IJssel, B.V.; y NH Naarden owned by Onroerend Goed Beheer Maatschappij IJsselmeerweg Naarden, B.V. and the joint guarantee on first demand of the main operating companies in the group wholly owned by the Parent Company.

The net book value of the assets granted as mortgage security against the syndicated credit line (242,000 thousand euros fully drawn down at 31 December 2021) and guaranteed senior notes in the amount of 400,000 thousand euros, maturing in 2026, can be broken down as follows (in thousands of euros):

Limitation on the distribution of Dividends

The guaranteed “senior” bonds maturing in 2026, the syndicated revolving credit line maturing in 2026 and the ICO backed syndicated loan and bilateral loan maturing in 2026 described above contain clauses limiting the distribution of dividends.

In the case of the senior bonds maturing in 2026, in general, distribution of dividends is allowed as long as (a) there is no current non-compliance and one is not produced as a result of the distribution; (b) the interest coverage ratio pro forma taking into account the planned distribution would be > 2,0x; and (c) the total restricted payments (including, amongst others, certain restricted investments, early repayments of subordinated debt, share buy-backs, payments in cash for subordinated debt to controlling shareholders, or persons associated with them, and other forms of remuneration to shareholders in their position as such) made from the offer date (14 June 2021) must be lower than the total of, amongst other entries, (i) 50% of NH Group’s consolidated net income from the first day of the full quarter immediately prior to the offer date up to the date of the full quarter nearest to the distribution date for which the quarterly accounts are available, although when calculating the net income, 100% of the consolidated net losses for that period must be deducted, with the exception of losses prior to 31 March 2022 (this is what is known as the “CNI builder basket”), and (ii) 100% of the net contributions to NH Group’s capital since the offer date.

Additionally, as an alternative and without having to be in compliance with the previous condition, NH Group may distribute dividends and make other restricted payments without any limit on the amount as long as the leverage ratio (gross debt/EBITDA) pro forma taking into account the intended restricted payment should not be higher than 4.5x.

Finally, and also alternatively and without having to be concurrent with the previous ones, the notes maturing in 2026 establish a franchise to be able to make restricted payments (including dividends) without needing to comply with any specific requirement, for a total aggregate amount of 25,000,000 euros from the issue date.

In the case of the syndicated credit line, the distribution of dividends or other forms of remuneration to shareholders are not allowed while the waiver on complying with financial ratios (financial covenants) is in still in force. Once the waiver ceases to be in force, according to the syndicated credit line, the distribution of a percentage of the NH Group’s consolidated net profit from the previous year is allowed, provided that there has been no breach of the relevant financing agreement and the net financial debt (through the dividend payment or other type of distribution)/EBITDA ratio is less than 4.0x. The amount that may be distributed depends on the net financial debt/EBITDA ratio (pro forma taking into account the dividend payment or other type of distribution) in accordance with the following breakdown:

– Net Financial Debt /EBITDA ≤ 4.0x: Percentage of consolidated net profit: 75%

– Net Financial Debt /EBITDA ≤ 3.5x: Percentage of consolidated net profit: 100%

– Net Financial Debt /EBITDA ≤ 3.0x: Percentage of consolidated net profit: unlimited

All these metrics are calculated using consolidated data.

At 31 December 2021, the requirements for the distribution of dividends that year were not met.

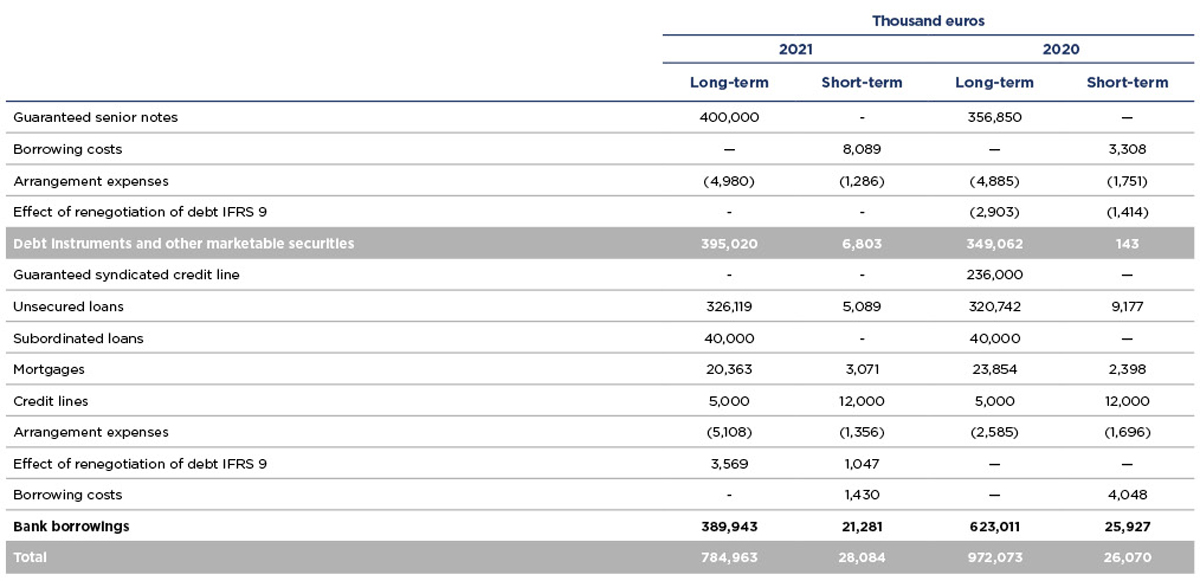

Detail of current and non-current debts

The detail, by maturity, of the items included under “Non-Current and Current Debts” is as follows (in thousands of euros):

At 31 December 2021, the average cost of the gross drawdown amount of the Group was 3.5%.

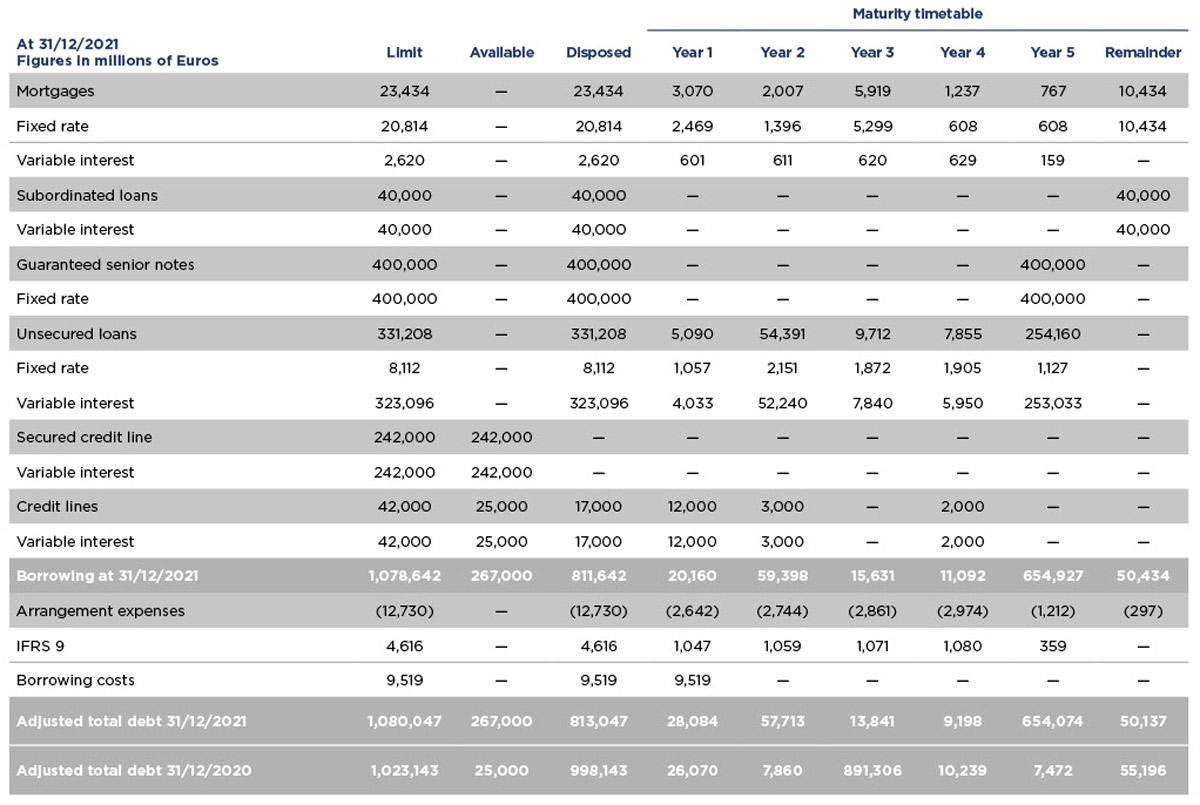

The detail for maturities of the debt for operating leases without discounting is as follows (in thousands of euros):

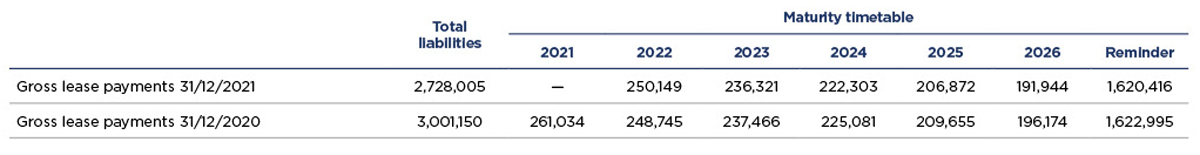

Net Debt

The detail of net debt at 31 December is as follows (in thousands of euros):