On 29 June 2017, the Company’s General Shareholders Meeting approved a long-term share-based incentive plan (“the plan”) for the Group’s executives and employees. The Plan was approved retroactively from 1 January 2017, it will have a total duration of five years, divided into three – independent of each other – three-year cycles.

The plan consisted of the grant of ordinary shares of NH Hotel Group, S.A. to the beneficiaries calculated as a percentage of the fixed salary, according to their level of responsibility. The number of shares to be granted was subject to the degree of fulfilment of the following objectives:

-

- TSR (total shareholder return) at the end of each of the Plan’s cycles, comparing the performance of NH Hotel Group, S.A. shares with the STOXX® Europe 600 Travel & Leisure share index

- Revaluation of the Share

- Recurring Net Profit

- Recurring EBITDA

The beneficiaries must remain in the Group at the end of each cycle, notwithstanding the exceptions deemed appropriate, as well as achieving the minimum thresholds for each of the objectives.

The Plan targeted approximately 100 beneficiaries.

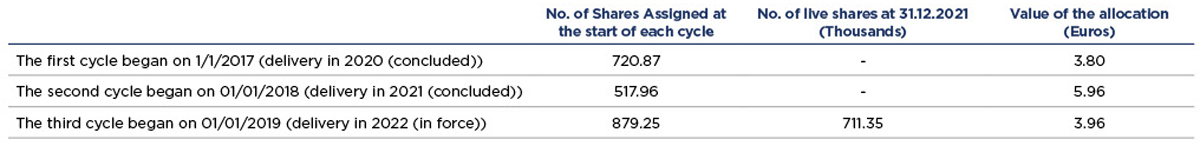

The current cycles at 31 December 2021 are: