2.6.1 Functional currency and presentation currency

The consolidated annual accounts are presented in thousands of euros, rounded to the nearest thousand, which is the Parent company’s working and presentation currency.

2.6.2 Foreign currency transactions, balances and cash flows

Transactions in foreign currencies are converted to the functional currency using the exchange rates for the functional currency and the foreign currency on the dates on which the transactions are carried out.

Cash assets and liabilities in foreign currencies have been converted into euros using the rate at the end of the financial year, while non-cash valued at historic cost are converted using the exchange rates applicable on the date the transaction took place. The conversion to euros of non-cash assets which are valued at fair value has been carried out using the exchange rate on the date when they were quantified.

In the presentation of the consolidated cash flow statements, the flows from transactions in foreign currencies were converted to euros using the exchange rates on the date they occurred. The effect of exchange rate change on cash and other cash equivalents in foreign currency is presented separately in the cash flow statement as “The effect of exchange rate differences on cash”.

The differences appearing in settling transactions in foreign currency and the conversion of foreign currency cash assets and liabilities to euros is recognised in profit and loss. Nevertheless, exchange rate differences occurring in cash entries forming a part of the net business investment abroad are recorded as conversion differences in other global profit and loss.

Losses or gains from exchange rate differences relating to foreign currency cash financial assets or liabilities are also recognised in profit and loss.

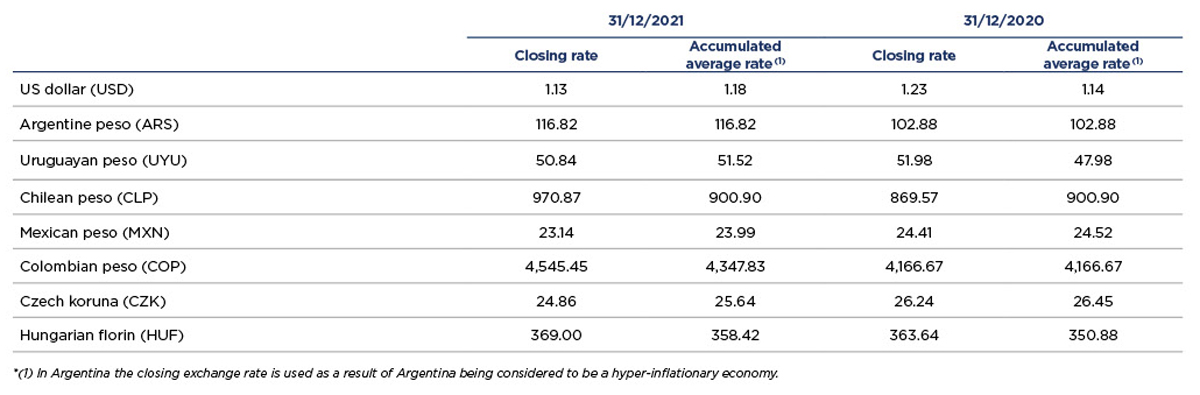

The exchange rates for the euro (EUR) for the main Group company currencies at 31 December 2021 and 2020 were as follows:

2.6.3 Conversion of business abroad

The following criteria have been different applied for converting into euros the different items of the consolidated balance sheet and the consolidated comprehensive profit and loss statement of foreign companies included within the scope of consolidation:

- Assets and liabilities have been converted by applying the effective exchange rate prevailing at year-end.

- Equity has been converted by applying the historical exchange rate. The historical exchange rate existing at 31 December 2003 of any companies included within the scope of consolidation prior to the transitional date has been considered as the historical exchange rate.

- The consolidated comprehensive profit and loss statement was translated at the average exchange rate for the year, except for the companies in Argentina whose economy was declared hyperinflationary and therefore, in accordance with IAS 29, their consolidated comprehensive profit and loss statement was translated at the year-end exchange rate.

Any difference resulting from the application these criteria have been included in the “Translation differences” item under the “Equity” heading.

Any adjustments arising from the application of IFRS at the time of acquisition of a foreign company with regard to market value and goodwill are considered as assets and liabilities of such company and are therefore converted using the exchange rate prevailing at year-end.

2.6.4 Foreign operations in hyper-inflationary economies

In 2018, Argentina was declared a hyperinflationary economy due, among other causes, to the fact that the accumulated inflation rate of its economy exceeded 100% over a continuous period of three years.

As a result, the Group began to apply IAS 29 to the financial statements of Argentine companies with retroactive effect from 1 January 2018. Applying the standard involves the following exceptions:

- Adjusting the historical cost of non-monetary assets and liabilities and the different equity items from the acquisition date or inclusion on the consolidated balance sheet until year-end to reflect the changes in currency’s purchasing power resulting from the inflation.

- Reflecting the loss or gain corresponding to the impact of inflation for the year on the net monetary position in the profit and loss account.

- Adjusting the various items of the profit and loss account and the cash flow statement for the inflationary index since its generation, with a counterpart in financial results and in a reconciliation item on the cash flow statement, respectively.

- Converting all components of the financial statements of Argentine companies at the closing exchange rate; the exchange rate at 31 December 2021 was 116.82 pesos per euro (102.88 pesos per euro at 31 December 2020).