Corresponding to the 2021 financial year

1. Introduction

The Audit and Control Committee of NH Hotel Group, S.A. (“NH”) issues this report on the activity of the Committee and compliance with its goals during the year 2021 (hereinafter the “Report”).

The object of the Report is to give a summary of the activity carried out by this Committee to the Board of Directors in accordance with the provisions of Recommendation 6 of the Code of Good Governance for Listed Companies, approved by a Resolution of the Board of the CNMV dated February 18th, 2015 (and revised in June 2020).

The composition, competences and activity of the Audit and Control Committee are regulated in article 48 of the Company’s Bylaws and article 25 of the Board Regulations, that have recently been amended by the NH General Shareholders’ Meeting on June 30, 2021, and at the Board of Directors meeting on 22 December 2020 for the purpose of adapting the provisions regarding the composition and competences of this Committee to Law 5/2021, of April 12, which modifies the revised text of the Capital Companies Law, approved by Royal Legislative Decree 1/2010, of July 2, and other financial regulations, regarding the promotion of long-term involvement of shareholders in listed companies and to adapt its content to the best practices of good corporate governance.

2. Composition of the Audit and Control Committee

As of December 31st, 2021, the Audit and Control Committee was made up of 3 members, together with the Secretary who is not a member.

Chairman:

Mr. José Maria Cantero de Montes-Jovellar (Independent)

Members:

Mr. Fernando Lacadena Azpeitia (Independent)

Mr. Stephen Andrew Chojnacki (Proprietary)

Secretary:

Mr. Carlos Ulecia Palacios

The aforementioned composition is the result of the changes that occurred during the 2021 financial year, since within the Company’s Audit and Control Committee held on July 27, 2021, Mr. Lacadena Azpeitia has placed his position as Chairman at the disposal of the Audit and Control Committee, in accordance with the provisions of article 529 quaterdecies of the LSC and article 48.2 of the Bylaws of NH, and the members of the Audit and Control Committee unanimously agreed to appoint Chairman of the Audit and Control Committee to Mr. Jose María Cantero Montes-Jovellar.

The provisions of the applicable regulations are met, which require that the Audit and Control Committee be made up of a minimum of three and a maximum of six Directors appointed by the Board of Directors and that all the members of this Committee should be External Directors, at least a majority of whom must be Independent Directors.

The members of the Audit and Control Committee as a whole, and especially its Chairman, will be appointed taking into account their knowledge and experience in accounting, auditing and risk management, both financial and non-financial.

The Chairman of the Audit and Control Committee shall be appointed out of the Independent Directors who form part of the Committee and must be replaced every four years, and may be re-elected one year after being replaced.

3. Competences

The principal function of the Audit and Control Committee is to provide support to the Board of Directors in its supervision and control functions, the most important manifestation of which is the duty to assure the effectiveness of the Company’s internal control and supervise the process of drawing up and presenting regulatory financial and non financial information.

In compliance with the provisions of the Recommendation 42 of the Code of Good Governance, recently amended on June 26, 2020 and duly included in article 25 of the NH Board Regulations and article 48 of the NH Bylaws, the Audit Committee shall have at least the following competences:

-

- Report to the General Meeting on matters raised within its sphere of competence.

- Supervise the efficiency of the Company’s internal control, internal audit, as the case may be, and the risk management systems, including tax risks, and discuss with the accounts auditors or audit firms any significant weaknesses in the internal control system that may have been detected in the course of the audit.

- Supervise and evaluate the process of preparation and the integrity of financial and non-financial information, as well as the control and management systems of financial and non-financial risks related to the company and, where appropriate, the group – including operational, technological , legal, social, environmental, political and reputational or related to corruption – reviewing compliance with regulatory requirements, the adequate delimitation of the consolidation perimeter and the correct application of accounting criteria.

- Make proposals to the Board of Directors for the selection, appointment, re-election and replacement of the external auditor, as well as the contracting conditions, and obtain information regularly from the external auditor concerning the audit plan and its execution, as well as preserving its independence in exercising its functions.

- With regard to the external auditor:

5.1 Establish the pertinent relations with the accounts auditors or audit firms in order to receive information on any matters that may put their independence at risk, so that they can be examined by the Committee, and any other matters related to the audit process, and other communications established in auditing legislation and technical auditing standards. In any case, it must receive written confirmation each year from the external auditors of their independence of the Company or companies related to it directly or indirectly, and information on the additional services of any kind provided to and the corresponding fees received from such companies by the aforesaid auditors or companies, or by persons or entities related to them in accordance with the provisions of legislation on auditing.

5.2 Issue each year, prior to the issue of the auditors’ report, a report in which an opinion will be expressed on the independence of the accounts auditors or audit firms. This report must, in any case, contain a valuation of the provision of additional services as referred to in the preceding section, individually considered and regarded as a whole, other than statutory audit and in relation to the regime of independence or to auditing legislation.

5.3 In the event of the resignation of the external auditor, examine the circumstances that led to it.

5.4 Ensure that the remuneration of the external auditor for their work does not compromise their quality or their independence.

5.5 Supervise that the company communicates the change of auditor through the CNMV and accompanies it with a statement on the eventual existence of disagreements with the outgoing auditor and, if there were any, their content.

5.6 Ensure that the external auditor holds an annual meeting with the full Board of Directors to inform it about the work carried out and about the evolution of the accounting and risk situation of the company.

5.7 Ensure that the company and the external auditor respect the current regulations on the provision of services other than auditing, the limits to the concentration of the auditor’s business and, in general, the other regulations on the independence of auditors.

- Report, in advance, to the Board of Directors on all the matters established by law, the Articles of Association and the Board Regulations, in particular, on:

1. the financial information which the company must publish periodically,

2. the creation or acquisition of shares in entities with a special purpose or domiciled in countries or territories considered to be tax havens and

3. operations with related parties.

- Safeguard the independence and efficiency of the internal audit functions; propose the selection, appointment and removal of the head of the internal audit service; propose the budget for this service; approve or propose approval to the Board of the guidance and annual work plan for internal audit, ensuring that the activity is primarily focused on relevant risks (including reputational risks; receive periodic

information on its activities; and verify that senior management takes into account the conclusions and recommendations of its reports. - Establish and supervise a mechanism that will allow employees, and other people related to the company, such as directors, shareholders, suppliers, contractors or subcontractors,to report, irregularities of potential importance, including financial and accounting irregularities or of any other nature related to the company that they notice within the company or its group. Said mechanism must guarantee confidentiality and, in any case, foresee cases in which communications can be made anonymously, respecting the rights of the complainant and the accused.

- Generally ensure that established internal control policies and systems are effectively applied in practice. Supervise compliance with internal codes of conduct and the rules of corporate governance.

4. Operation

The Audit and Control Committee will meet at least once a quarter, and as often as appropriate, on being convened by its Chairman, on his/her own decision or in response to the request of two of its members or of the Board of Directors.

The Audit and Control Committee may require the attendance at its meetings of any employee or executive of the company, as well as the Company’s Auditor.

Through its Chairman, the Audit and Control Committee will report to the Board on its activity and the work carried out, at the meetings established for this purpose or at the immediately following meeting when the Chairman of the Audit and Control Committee considers it necessary. The minutes of its meetings will be available to any member of the Board who requests them.

The Audit and Control Committee met 5 times in 2021.

Furthermore, Board members who are not members of the Committee and executives of NH may attend the meetings of the Audit and Control Committee, at the Chairman’s invitation.

5. Relations with External Auditors

NH Hotel Group, S.A. has been audited since fiscal year 1986 by prestigious audit companies. During the period 1986-1992 the company was audited by Peat Marwick and between 1993-2001 by Arthur Andersen. Since 2002 and until fiscal year 2018 the Audit has been realized by Deloitte. The General Shareholders meeting held on 13th May 2019 approved, among others, the appointment of PricewaterhouseCoopers Auditores, S.L. as new auditor of the Company and its group companies for fiscal years 2019, 2020 and 2021. The appointment has been done in compliance with Regulation (UE) No 537/2014 EuropeanParliament of 16th April 2014 regarding requirements for legal audits of companies. The Audit and Control Audit has submitted to the Board following article 16.5 of the referred Regulation.

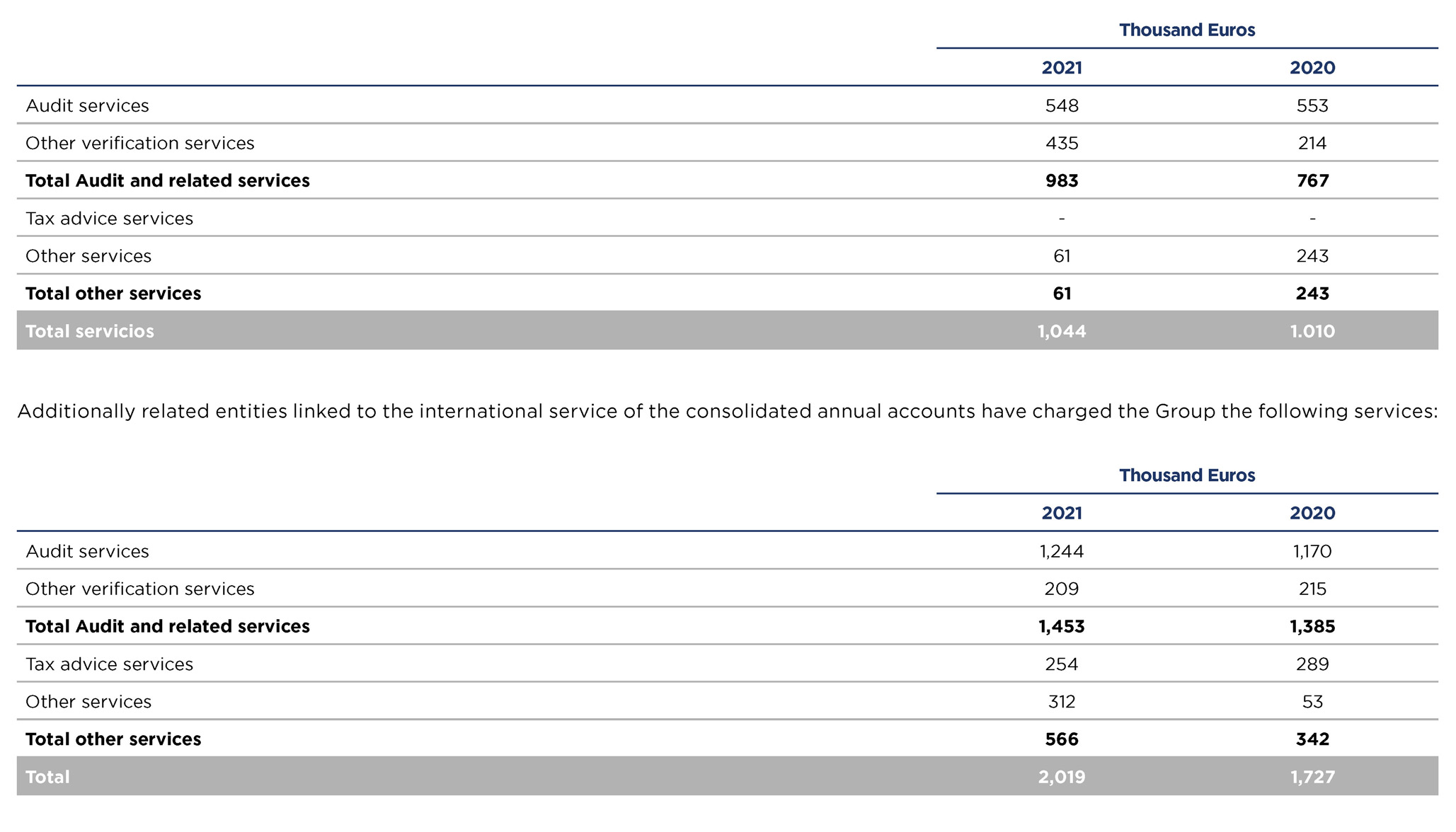

During fiscal years 2021 and 2020, the remunerations regarding audit services and other services rendered to NH Hotel Group, as well as related companies are the following:

6. Content and results of the work of the Audit Committee in 2021

The Audit Committee held 5 meetings in 2021 at which it dealt with the following matters:

a) Analysis and evaluation, in conjunction with the external auditors, of the Financial Statements and Annual Report for the year 2020, checking that their audit opinion has been issued under conditions of absolute independence.

b) Review of information on matters that could jeopardize the auditors’ independence. Issue of the Report on the auditors’ independence.

c) Review of periodic financial information for 2021 prior to its analysis and approval by the Board of Directors to ensure that it is reliable, transparent and has been prepared by applying uniform accounting principles and policies.

d) Supervision of the preparation and integrity of non-financial information.

e) Approval of the External Auditor’s fees for the 2021 Audit.

f) Monitoring of the Internal Audit Plan for 2021, examining its conclusions and implementing any necessary corrective measures.

g) Monitoring of the most significant projects carried out by the Internal Audit team.

h) Supervision of the Update of the Group’s Risk Map 2021 and monitoring controls of risks and action plan for the Top 10 risks.

i) Supervision of System of Internal Controls over Financial Reporting (ICFR).

j) Examination of the Annual Corporate Governance Report, prior to sending it to the Board of Directors for study and approval, with special emphasis on the analysis of the register of situations of directors and executives (membership of other Management bodies, involvement in legal proceedings, related-party transactions, etc.).

k) Analysis and validation of (i) the Company’s tax organization, (ii) how the tax policy is determined and (iii) certain corporate restructuring operations.

l) Summary of Compliance activities.

7. Analysis of related-party operations

In 2021 the Audit and Control Committee has analysed the following related-party operations:

a) Signing of the Subordinated Convertible Term Loan Agreement for an amount of 100,000,000 euros between MHG Continental Holding (Singapore) as lender and NH as borrower.

b) Novation of the License Agreement by which NH has authorized Minor to execute its right to use NH trademarks in certain territories (China, Hong-Kong, Macao, Taiwan), through a joint venture.

c) Subscription of a membership and outsourcing contract between GHA Loyalty Program (subsidiary of the Minor group) and NH for the transition to the loyalty program managed by the former (Discovery).

d) The Chairman of the Board of Directors made a request to subscribe senior secured notes, issued in 2021, up to a maximum of 1,000,000 euros (in relation with the 400,000,000 euros issued), having finally subscribed 100,000 euros and being able to participate as a qualified investor.

The subscription of all Related Party Transactions haven been realized in strict compliance with the rules established by the Company both in its Bylaws and the Board Regulations, as well as in the Procedure for Related-Party Operations and Conflicts of Interest, whose last update was approved by the Board of Directors on 11 November 2021. All transactions signed with Minor (and/or its group companies) have had the previous favorable report of the Audit and Control Committee, have been signed upon market condition and with the involvement of external advisors and in compliance with the Framework Agreement signed between the parties the 7th February 2019, that regulates, among others, the scope of action of the respective hotel groups of NH and Minor by identifying MINT’s and NH’s preferred business geographical areas are defined and the necessary mechanisms to prevent and solve possible conflicts of interest, as well as related party transactions and development of business opportunities are regulated. The Framework Agreement has been duly informed to the Market and published in NH´s website.

During all meetings of the Board and the Audit and Control Committee dealing with matters related to Minor, the proprietary Directors have been absent from the meetings during the time these matters haven been dealed, without having participated in the resolution of these matters. In the same way, in the meetings of the Board and the Audit and Control Committee dealing the operation summarized in section d) above, the Director involved was absent from the meetings when said matters was discussed, without having participated in the resolution of the matter.

8. Priorities for 2022

Independently of the customary tasks required by general regulations and by the regulations of NH in relation to financial information to be reported to the market and the supervision of the external auditors’ independence, the Audit and Control Committee examined and approved the Internal Audit Department’s work plan for 2022, which envisages the following priorities:

1. Operational and financial audits of the Company’s key processes and relevant hotels remotely with the use of massive data processing tools.

2. Supervision of adequate implementation of processes and internal controls to guarantee attainment of the objectives included in the strategic lines Plan approved by the Board of Directors.

3. Monitoring of incidents detected in the audits carried out in previous years and of the execution of the action plans drawn up by the different Departments and Business Units.

4. Within the function of risk Management: (i) update of Risk Map, (ii) definition and follow up of action plan for Top 10 risks, and (iii) collaboration with other departments of the second line of defense so that the Company can benefit from combined assurance.

5. In exercising the fraud prevention/detection and investigation function: (i) adaptation of the NH Hotel Group Whistleblowing Channel to Directive (EU) 2019/1937, (ii) identification of possible breaches of the principles set out in the Code of Conduct and (iii) investigation of possible fraudulent acts.

To conclude this Report, it should be noted that in carrying out all the tasks mentioned in it, the Committee has had access, whenever considered useful, to all the external professionals (auditors, experts or consultants) or members of Economic and Financial Management, Legal and Internal Audit Management it has considered necessary, as well as contacts with the external Audit.

Madrid, February 23rd, 2022