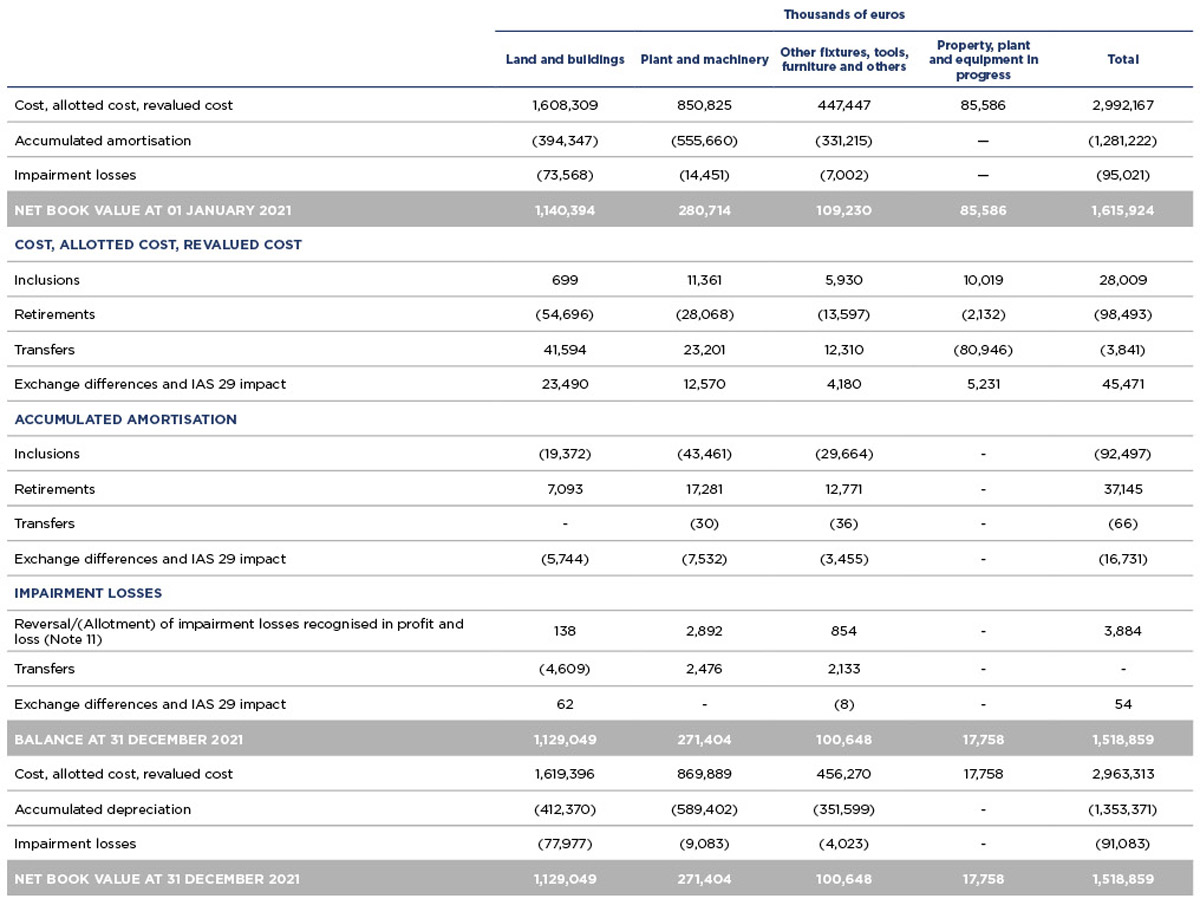

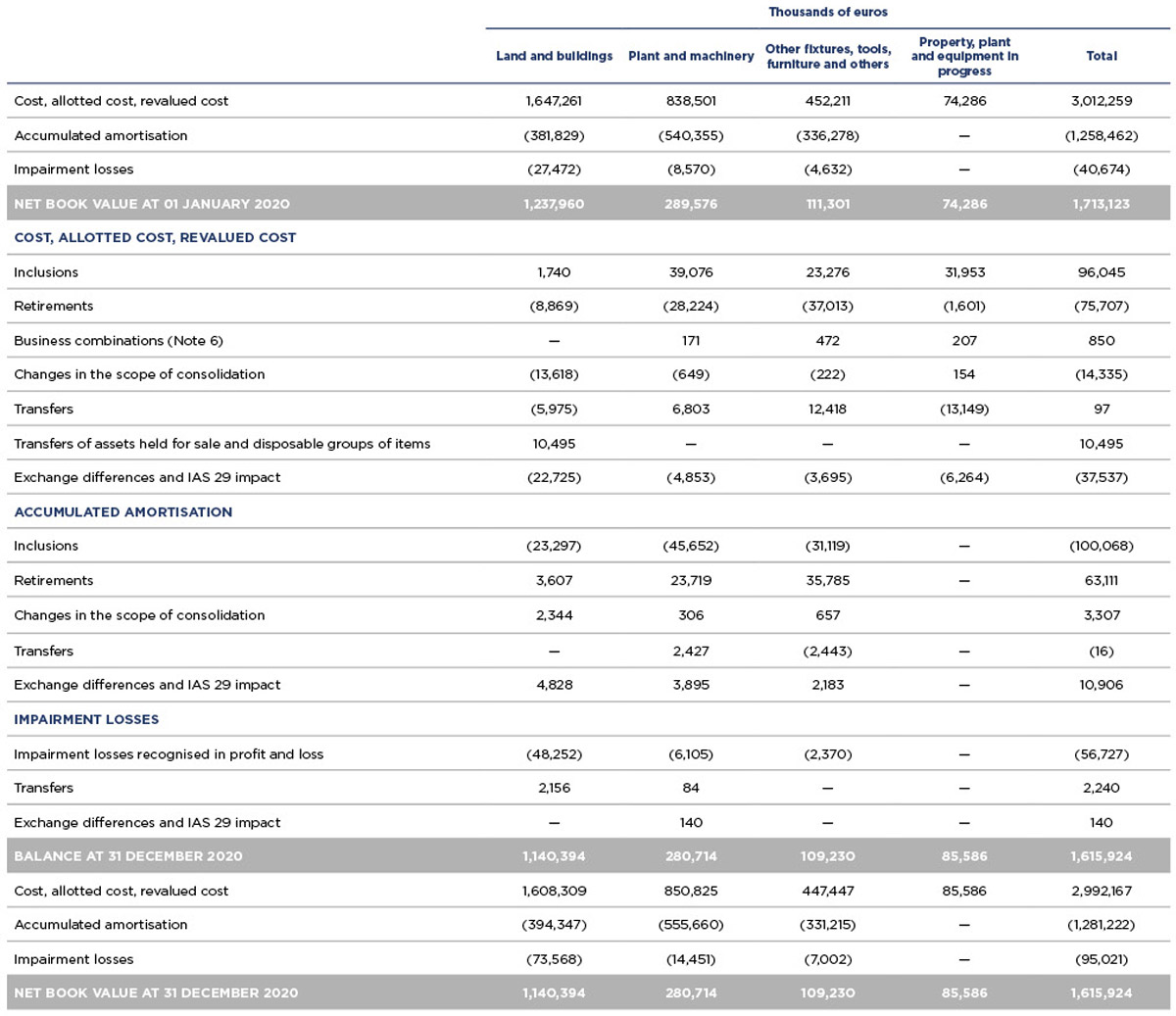

The breakdown and movements in the year were as follows (in thousands of euros):

The main additions occurring during the financial year relate to hotel refurbishment and opening new hotels. The highlights in Spain are the works at the NH Collection Madrid Abascal, in France the refurbishment of the NH Lyon Airport, in Italy the refurbishment of the NH Trieste and NH Collection Roma Centro, in Central Europe the opening of the NH Hannover, in Benelux the works at the NHOW Brussels Bloom hotel, in Latin America the works at the NH Mexico City Reforma (Mexico) and the NH Ciudad de Santiago (Chile). Finally, it should be noted that the works on the NH Collection New York Madison Avenue have concluded and the hotel opened during the financial year.

The main derecognition in the period relates to the sale of the NH Collection Barcelona Gran Hotel Calderón in Spain with a sale and leaseback transaction. The hotel was sold for 125.5 million euros with a linked 20 year lease agreement, with NH having the option of additional extensions (Note 1).

The effect on the profit and loss account of assets de-recognised, replaced or disposed of to third parties outside the Group was a profit of 66,402 thousand euros (a loss of 1,668 thousand euros in 2020), recognised under “Profit/(loss) on the disposal of non-current assets” in the 2021 consolidated comprehensive profit and loss statement.

The net entries for the 2020 financial year included in the “Changes in the scope of consolidation” and “Business combinations” rows come, on the one hand, from the sales of the companies Onroerend Goed Beheer Maatschappij Maas Best, B.V., owner of the NH Best hotel, and Onroerend Goed Beheer Maatschappij Bogardeind Geldrop, B.V., owner of the NH Geldrop hotel, both in Holland (Note 2.9.5), and the acquisition of the Boscolo Hotels Group comes under business combinations (Note 6).

At 31 December 2021, there were mortgages on tangible fixed asset elements with a net book value of 158 million euros (208 million euros in 2020) (Note 17).

The Group has taken out insurance policies to cover any possible risks to which the different elements of its tangible fixed assets are subject, and to cover any possible claims that may be filed against it in the course of its activities. These policies sufficiently cover the risks to which the Group is exposed.

At 31 December 2021, firm investment undertakings amounted to 26.8 million euros. These investments will be made between 2022 and 2023 (17.3 million euros in 2020).