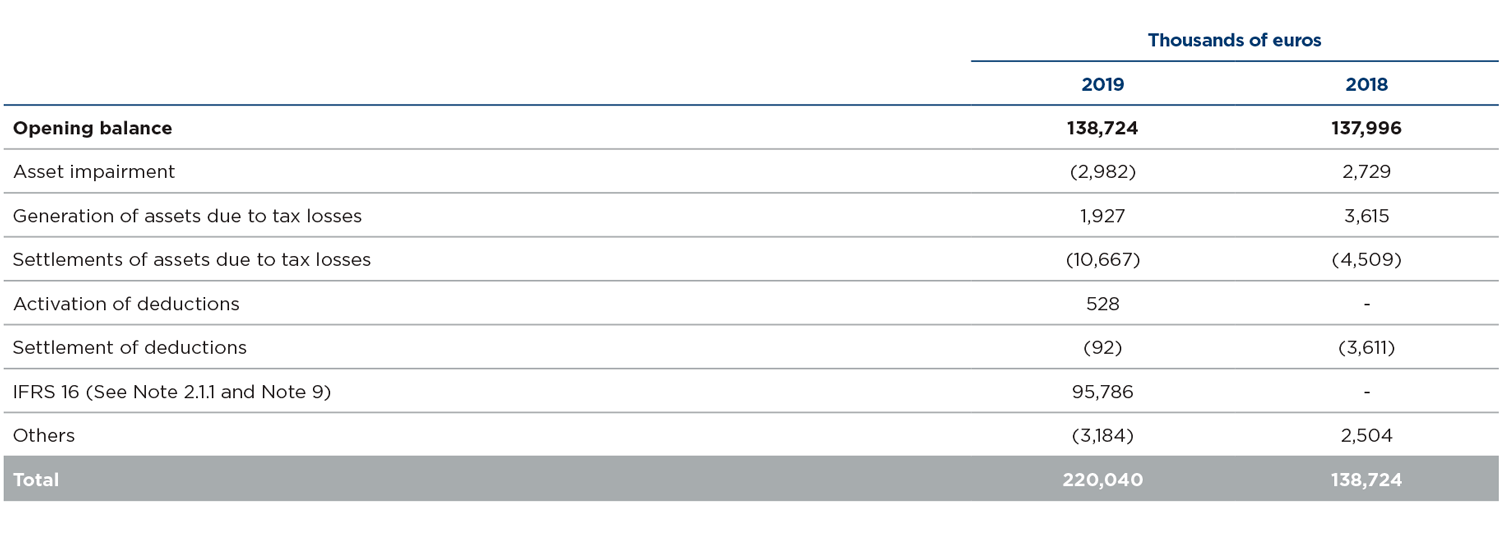

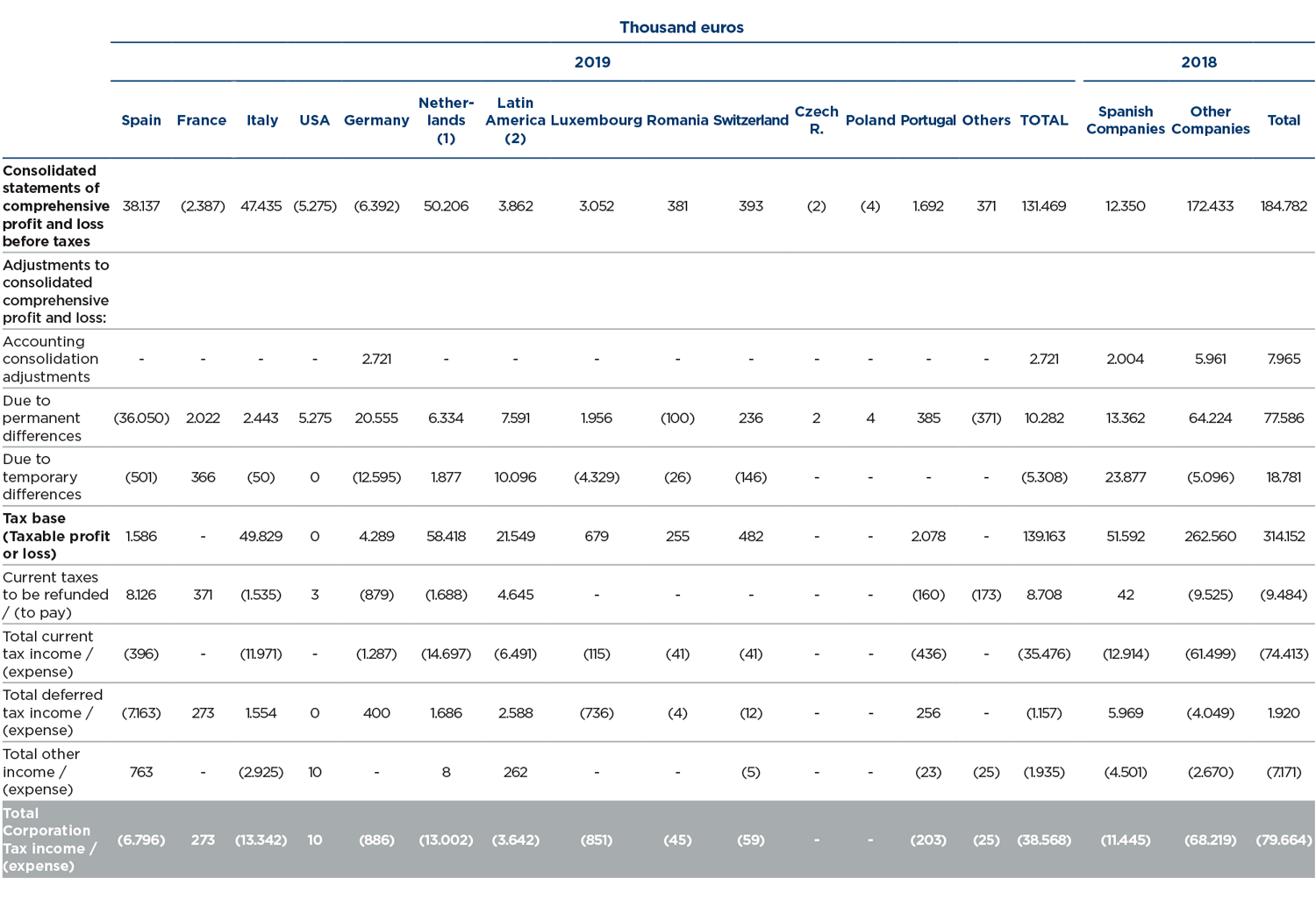

All these impacts have had an effect on the Consolidated Profit and Loss Statement except for the initial impact from the first application of IFRS 16 and other non-significant ones that have resulted in changes to the consolidated statement of changes in equity.

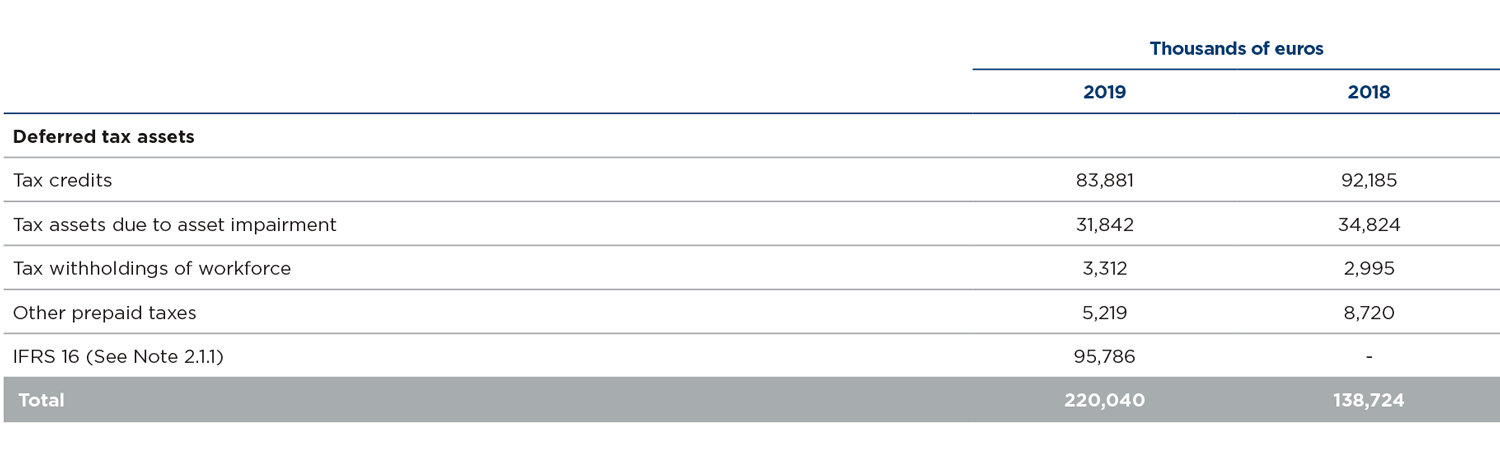

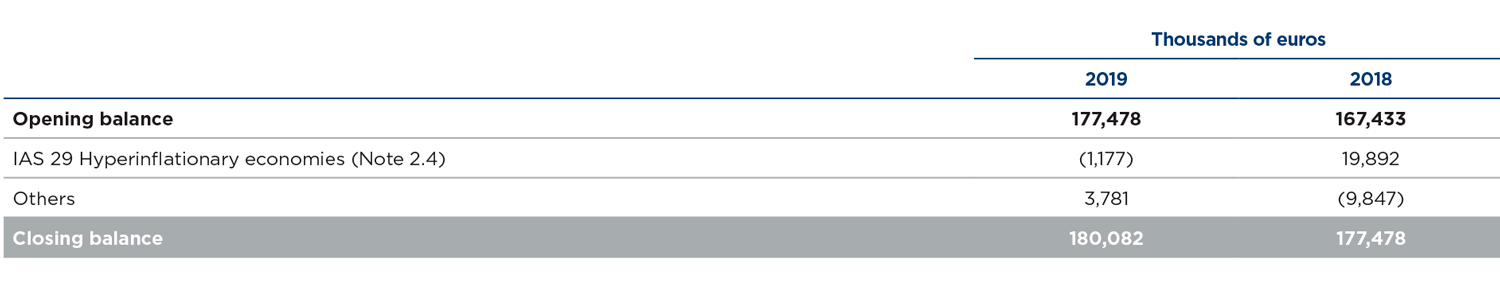

The increase in deferred tax assets is mainly due to IFRS 16 on leases being adopted in 2019 (See Note 2.1.1 and Note 9).

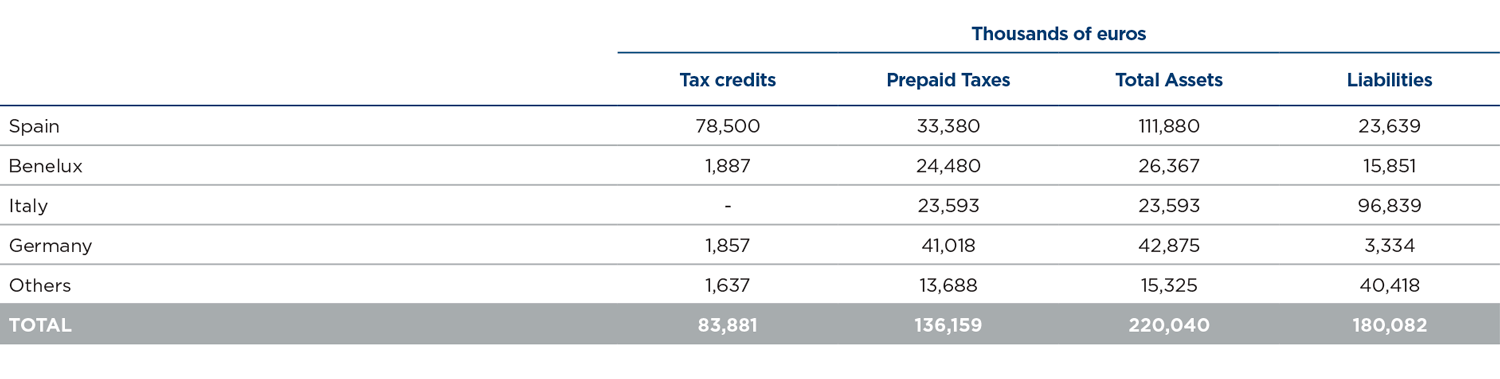

Additionally, in 2019 there were assets recognised due to the activation of tax losses in Germany and Ireland amounting to 1,857 and 70 thousand euros respectively, as a result of the positive results expected in future years.

The cancellation of assets is mainly due to the cancellation of tax losses to offset the positive tax bases generated in 2019, in Luxembourg, Belgium, Germany and Latin America, amounting to 906, 94, 2,253 and 260 thousand euros, respectively. Additionally, in Spain, at 31 December 2019, it has been updated the recovery plan for tax credits, which back up the capitalization of such tax credits. As a consequence of the aforementioned, the Directors of the Parent Company has decided to impair tax assets for 7,153 thousand euros. However, this impact has been offset by the recovery during the year of part of the financial burden not deducted in previous years, which has led to a less current tax expense in the Group.

At 31 December 2019, the Group had assets resulting from tax losses and deductions amounting to 83,881 thousand euros (92,185 thousand euros in 2018). At 31 December 2019, the tax credit recovery plan that supports the recognition of these tax credits had been updated. As a result of said update, and pursuant to that previously stated, the Directors of the Parent Company decided to impair the asset by 7,153 thousand euros.

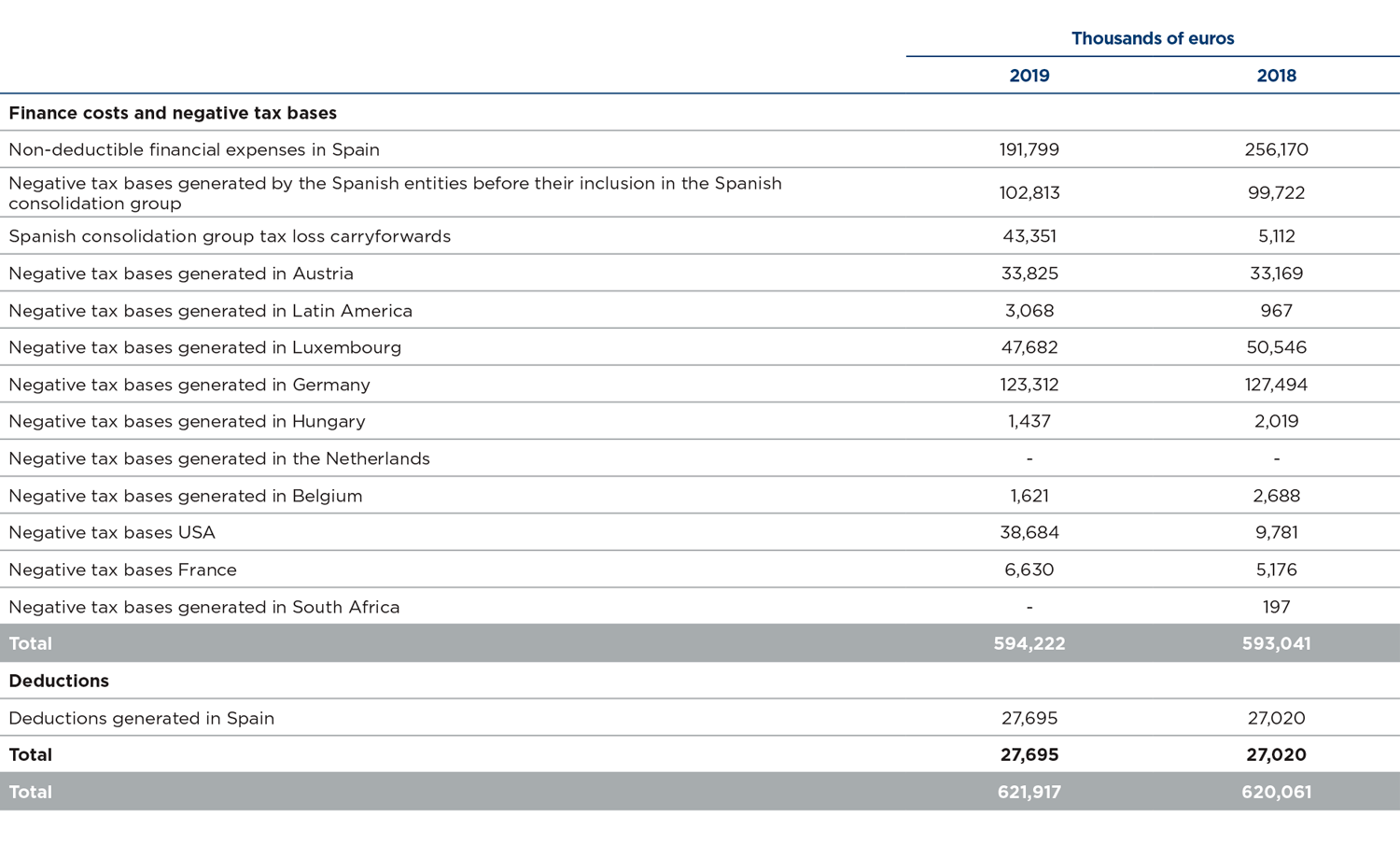

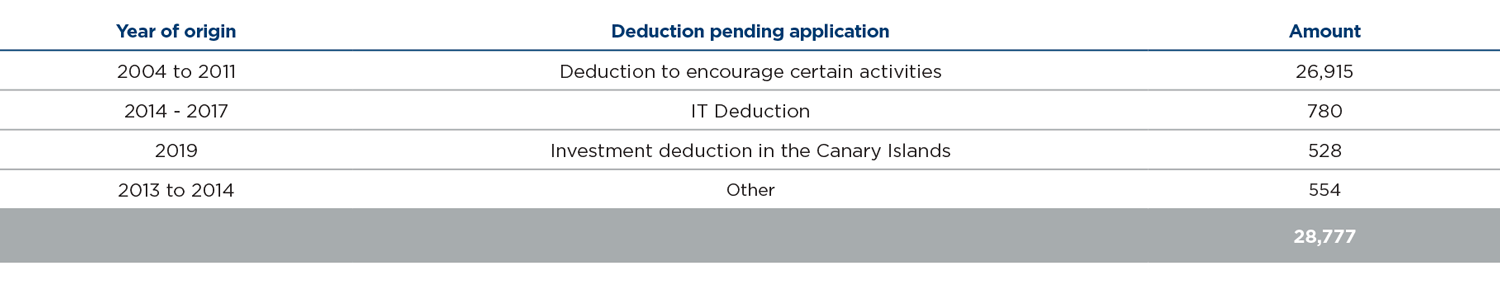

At 31 December 2019, the Group had tax loss carryforwards worth 594,222 thousand euros (593,041 thousand euros at 31 December 2018) and deductions amounting to 27,695 thousand euros (27,020 thousand euros in 2018) that had not been entered in the accompanying consolidated balance sheet because the Directors considered they did not meet accounting standard requirements. These assets are grouped as follows (base amount):