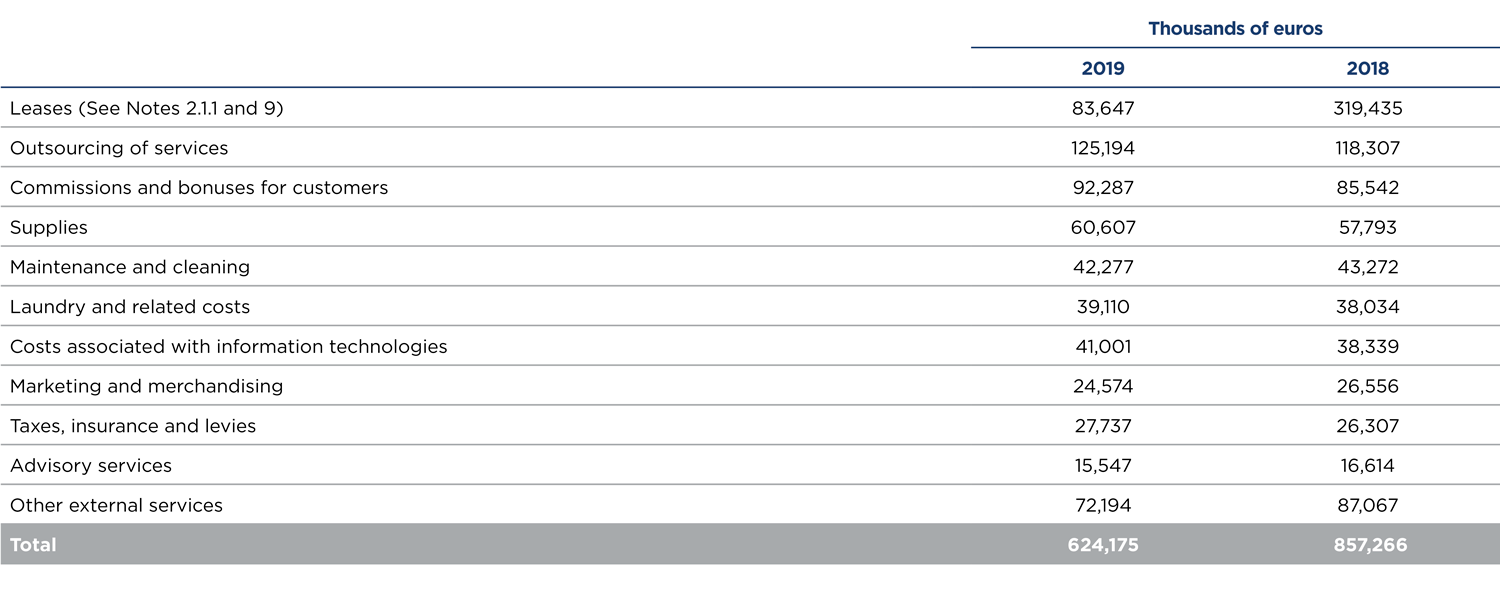

The detail of “Other Operating Expenses” of the consolidated comprehensive income for 2019 and 2018 is as follows:

In 2019, the Group experienced a higher level of activity in its hotel business, which led to an increase in some operational expenses directly related to the level of activity, such as the supplies and laundry service, among others. Also, the increase recorded in revenue per available room explains the increase in associated agency commission expenses. However, savings were achieved in other items such as marketing and merchandising, among others.

The heading on leases has reduced due to the new accounting on leases from the application of IFRS 16 (See Note 2.1 and Note 9). The expense recorded for this item in 2019 corresponds to the variable income of these contracts. On the other hand, there is no significant lease expense for contracts with a duration of less than one year or that, due to a reduced value, have ceased to be considered under IFRS 16.

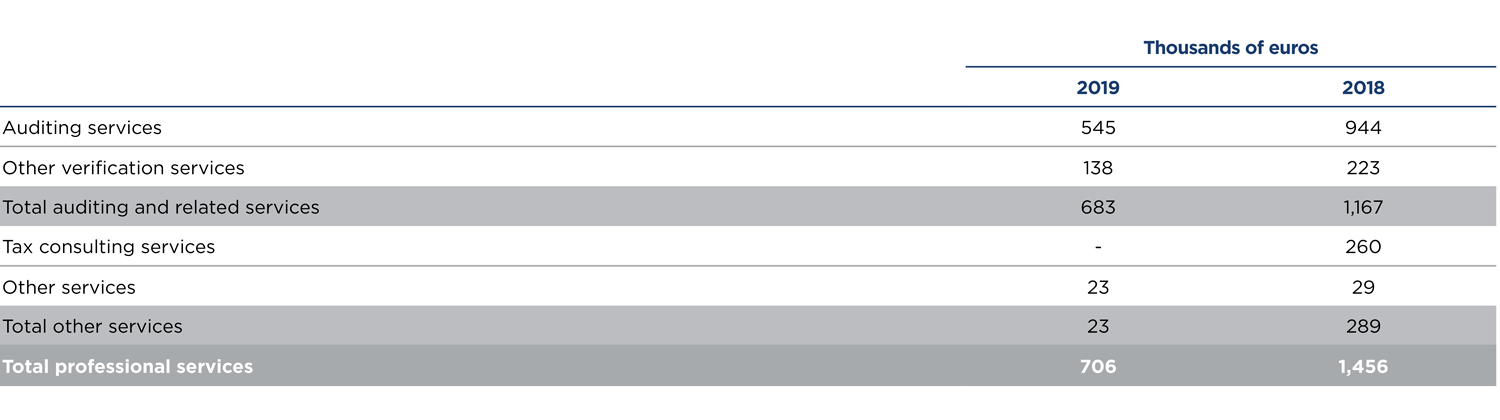

During 2019 and 2018, the fees for account auditing and other services provided by the auditor of the Group’s consolidated annual accounts and the fees for services invoiced by the entities related to it by control, shared ownership or management, were as follows:

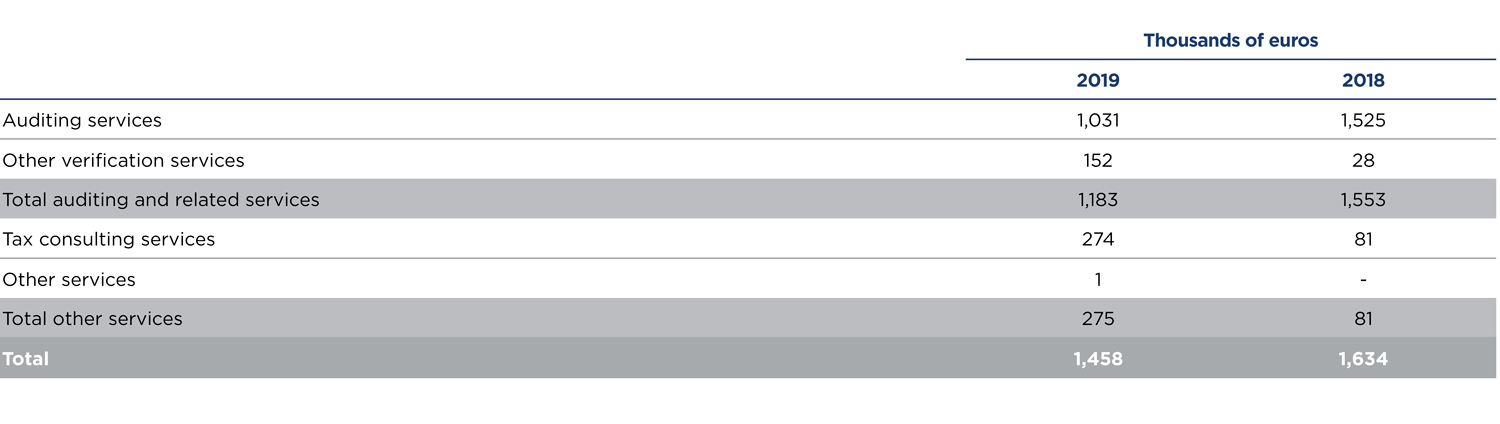

Additionally, entities associated with the international network of the consolidated annual accounts auditor have invoiced the Group for the following services:

During 2019, other auditing firms apart from the auditor of the consolidated annual accounts or entities associated with this company by control, shared ownership or management, have provided account auditing services to the companies making up the Group, for fees totalling 50 thousand euros (66 thousand euros in 2018). The fees accrued in 2019 by these firms for tax advice services were 244 thousand euros (209 thousand euros in 2018) and for other services, 80 thousand euros (396 thousand euros in 2018).