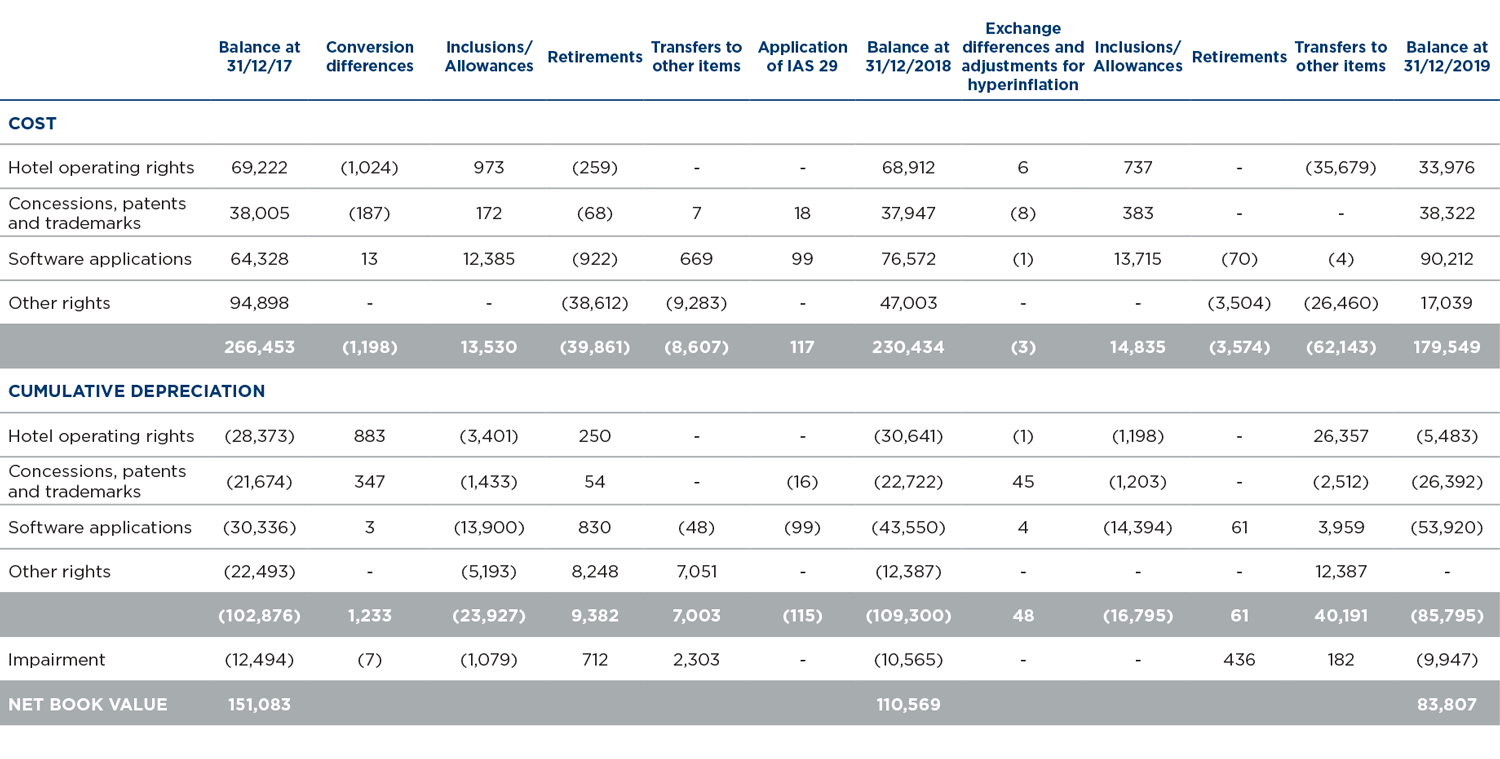

The breakdown and movements under this heading during 2019 and 2018 were as follows (in thousands of euros):

7.1 Hotel operating rights

The main movement in 2019 corresponds to the classification of various assets related to lease contracts which, at 1 January 2019, are considered as a higher value of the right-of-use assets in accordance with the application of IFRS 16 (See note 9).

7.2 Software applications

The most significant inclusions in the current year were in Spain, as a result of the investments made to develop the corporate WEBSITE and implement front office systems of the hotels and IT transformation plan projects.

7.3 Other rights

The main movement in 2019 corresponds to the classification of various assets related to lease contracts which, at 1 January 2019, are considered as a higher value of the right-of-use assets in accordance with the application of IFRS 16 (See note 9).

As a result of the change of control of the NH Group (see Note 14.1) on 30 November 2018, the effective termination of all the management contracts defined in the framework contract entered into in 2017 with Grupo Inversor Hesperia, S.A. (“GIHSA”) was formalised, the latter being a former shareholder of the NH Group, for the management of 28 hotels for a period of nine years, which until then had been managed by the NH Group as this contract included an early termination clause in the event of a change of control of the NH Group.

As a result of this termination, the Group has de-recognised the net book value of the activated management contracts amounting to 30.4 million euros. In the same way, a revenue of 33 million euros has been recorded corresponding to the “Net Price Refund Amount” defined in the framework contract, which includes the receipt of an advance indemnity revenue amounting to 20 million euros, the settlement of the pending payment by NH related to the premiums for contracts amounting to 11,560 thousand euros, which was recognised under “Other Financial Liabilities” in the consolidated balance sheet at 31 December 2017, and the sale of the Hesperia brand, the net book value of which amounted to 45 thousand euros, for an amount of 1.4 million euros. The net effect of 2.6 million euros of revenue arising from the early cancellation of the contract entered into with GIHSA, before its tax impact, is recognised under “Net result on disposal of assets” of the 2019 consolidated comprehensive profit and loss statement.

During 2018, reversals of 436 thousand euros and transfers of 182 thousand euros were recognised under “Net Profits/(Losses) from asset impairment” of the consolidated comprehensive profit and loss statement (See note 8).