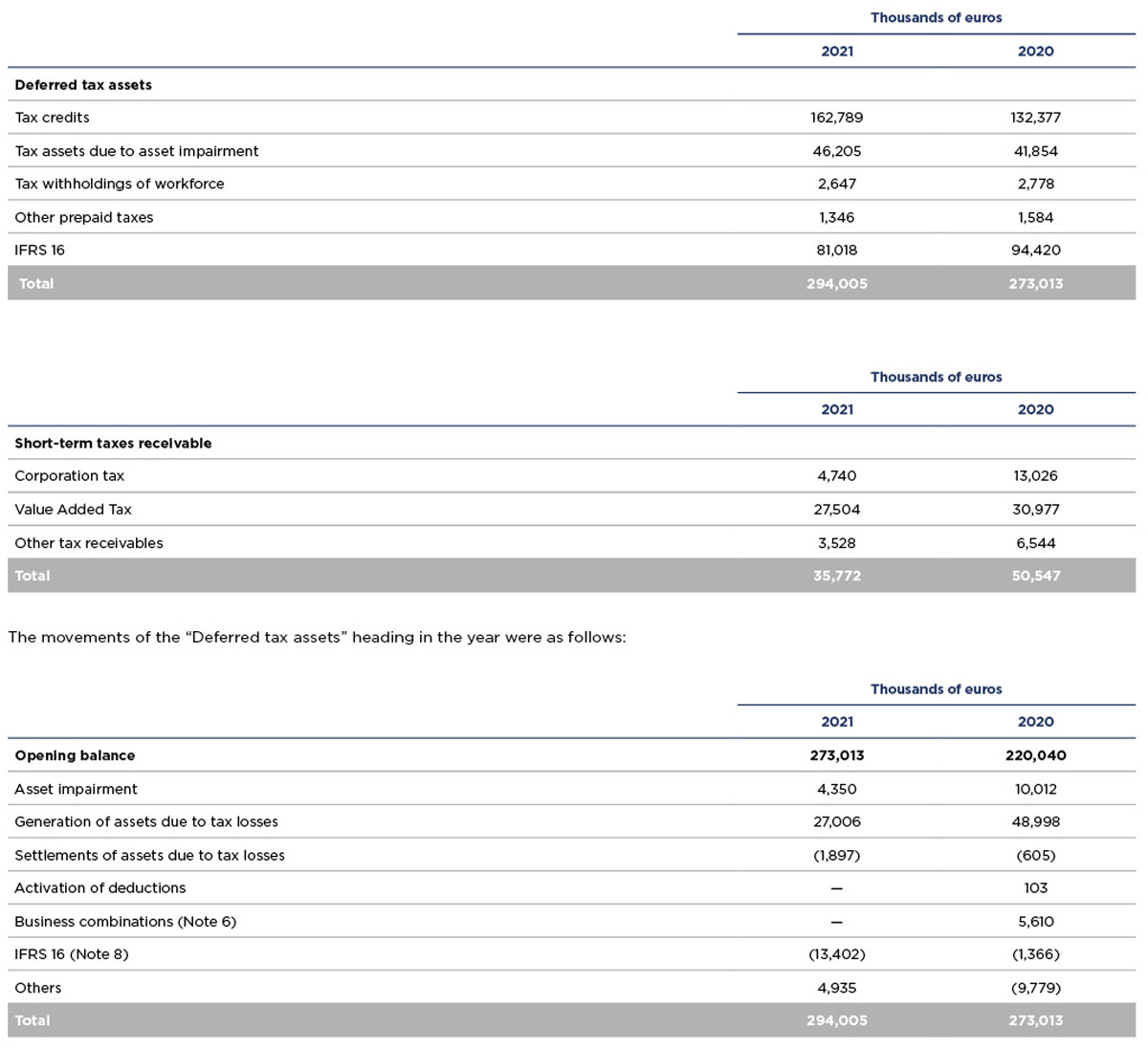

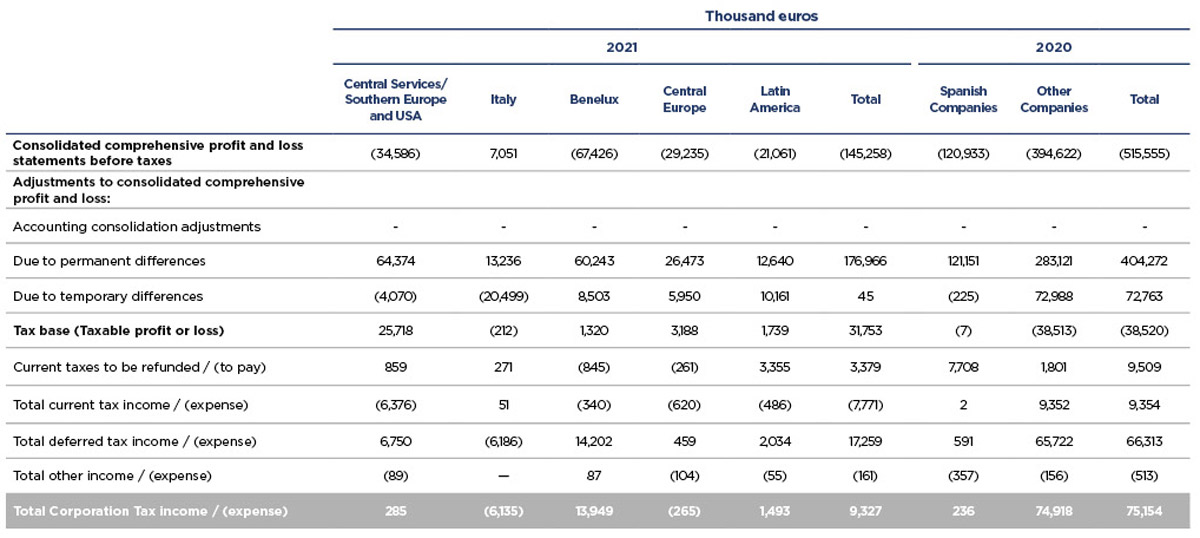

All these impacts have had an effect on the Consolidated Profit and Loss Statement except for some non-significant impacts that have resulted in changes to the consolidated statement of changes in equity.

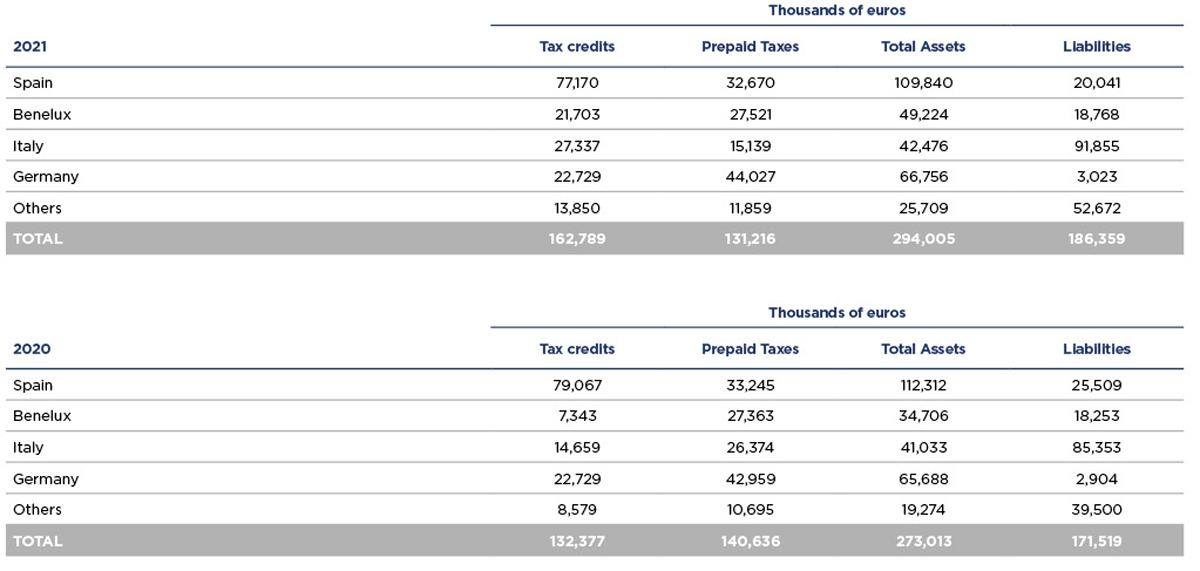

The increase in deferred tax assets is mainly due to the generation of assets due to tax losses. Furthermore, in 2020, under the business combinations heading, a balance of 5,303 thousand euros was reported for tax loss assets of the companies within the NH Group as a result of the Boscolo Hotels business combination. In 2021, this balance was reported as a tax credits asset.

At 31 December 2021, the Group had assets resulting from tax losses and deductions amounting to 162,789 thousand euros (132,377 thousand euros in 2020). Out of the total tax credits, 77,170 thousand euros (79,067 thousand euros in 2020) relate to credits activated in Spain.

In the 2021 financial year, the movement of tax credit assets impacting the consolidated comprehensive profit and loss statement was 25,109 thousand euros. The increase in tax credits was due to the activation of the loss for the financial year, mainly in Holland (12,568 thousand euros), Italy (8,134 thousand euros), Portugal (2,358 thousand euros) and Latin America (2,153 thousand euros). To record these credits, the relevant plans for tax credit recovery were prepared to support their activation. Furthermore, in Spain tax credits of 1,897 thousand euros were derecognised.

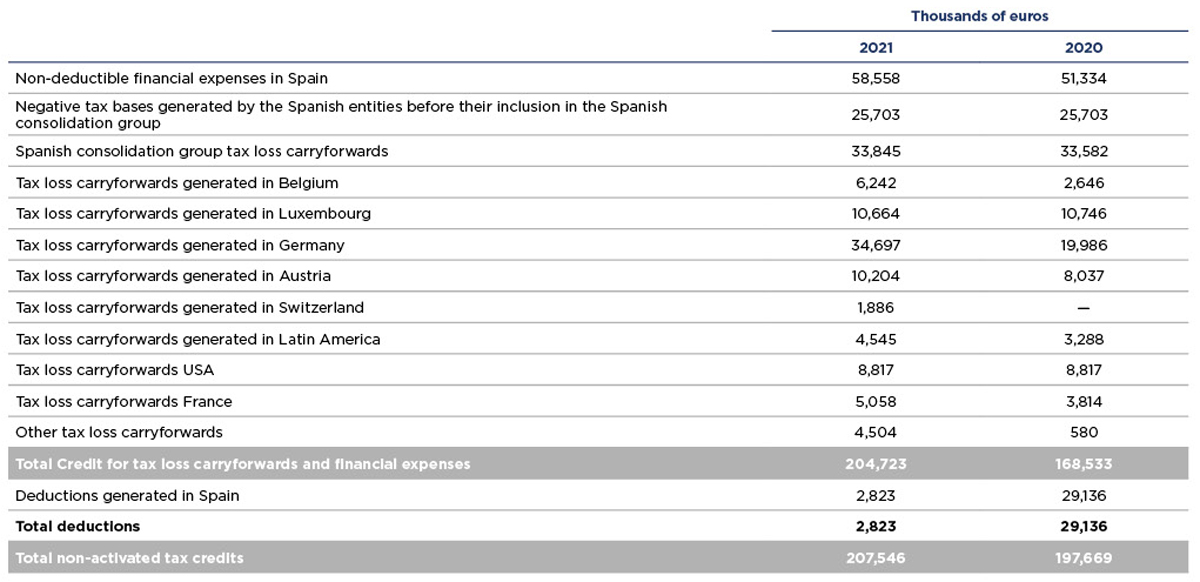

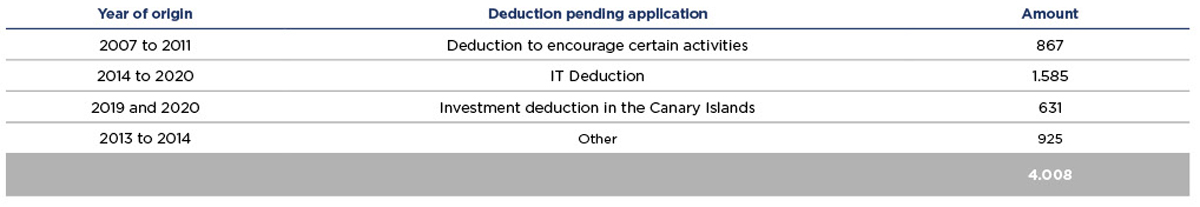

At 31 December 2021, the Group had tax loss and non-deductible financial expenses carryforwards worth 204,723 thousand euros (168,533 thousand euros at 31 December 2020) and deductions amounting to 2,823 thousand euros (29,136 thousand euros in 2020) that had not been entered in the accompanying consolidated balance sheet because the Directors considered they did not meet accounting standard requirements. These assets are grouped as follows (rate amount):