For the financial year ending 31 December 2021

EVOLUTION OF BUSINESS AND GROUP’S SITUATION

NH Hotel Group is an international hotel operator and one of the leading urban hotel companies worldwide in terms of number of rooms. The Group operates 353 hotels and 55,063 rooms in 30 countries, and has a significant presence in Europe.

The centralised business model allows it to offer a consistent level of service to its customers in different hotels in different regions. The corporate headquarters and regional offices offer hotels a wide range of functions such as sales, revenue management, reservations, marketing, human resources, financial management and systems development.

This flexible operational and financial structure has enabled the Group to overcome the huge challenges of the past two years. Although the challenges will continue in the first months of 2022, the Group will benefit from brand recognition, excellent locations and strong market positioning in Europe in the medium and long term.

During 2021, as a result of the start of recovery after the economic crisis caused by the COVID-19 pandemic, the global economy increased by +5.9%, compared to a decrease of -3.1% in the previous year (Data and estimates from IMF “World Economic Outlook”, January 2022). GDP growth in 2021 was in line with expectations, showing continuous adaptation of economic activity to the pandemic and its associated restrictions, as well as continuous support from institutions in many countries. However, the continuous recovery was weakened during the year, hindered by the increase of infections from new strains and interruptions to the supply chains. At the end of the year, as a result of the omicron strain, many countries went back into partial lockdown which had an impact on global economic recovery.

The four countries that bring the greatest proportion of the Group’s sales and profits show rates of decline in 2021: Spain (+4.9% in 2021 vs. -10.8% in 2020), Holland (+4.5% in 2021 vs. -3.8% in 2020), Germany (+2.7% in 2021 vs. -4.6% in 2020), and Italy (+6.2% in 2021 vs. -8.9% in 2020). On the other hand, growth in Latin America is expected to be +6.8% in 2021 (vs. -6.9% in 2020) as all the economies as a whole have continued to suffer the consequences created by COVID-19.

For the global economy, 2022 began with some uncertainty in the short term. As the new omicron variant of the COVID-19 virus advances, countries have once again imposed restrictions on mobility. Due to the rising price of energy and disruptions to supplies, inflation is higher and more generalised than forecast. The unforeseen sluggishness of private consumption recovery has limited the prospects for growth.

Therefore, the estimate is for +4.4% growth of world economic activity in 2022 (+5.9% in 2021 vs. -3.1% in 2020). More specifically, in the Euro zone growth of +3.9% is forecast in 2022 (+5.2% in 2021 vs. -6.4% in 2020).

Global tourism experienced an increase of 4% in 2021 compared to 2020 (415 million against 400 million). Nevertheless, international tourist arrivals (visitors who stay overnight) remained 72% lower than in 2019, the year prior to the pandemic, according to the OMT’s preliminary estimates. These figures follow those in 2020, the worst year in the history of tourism, when a 73% decrease in international arrivals was recorded.

The speed of recovery continues to be slow and inconsistent in the various regions of the world, due to the different levels of mobility restrictions, the vaccination rates and traveller confidence. Europe and the Americas recorded a significant improvement in 2021 compared to 2020 (+19% and +17%, respectively), but both are still at 63% below pre-pandemic levels. By sub-regions, Mediterranean Southern Europe (+57%) and Central and Eastern Europe (+18%), Central America (+54%) and North America (+17%) also surpassed 2020 levels.

The first publication of the OMT World Tourism Barometer indicates that, in 2022, the increase in the vaccination rate, combined with the decrease in travel restrictions due to better cross border coordination and new protocols, have helped to liberate the suppressed demand. International tourism moderately upturned in the second half of 2021, with arrivals in the third and fourth quarters being 62% lower than those before the pandemic. According to limited data, international tourist arrivals in December were 65% lower than in 2019. The true impact of the omicron strain and the wave of infections with COVID-19 remains to be seen.

The recent increase in cases of COVID-19 and the omicron strain are going to disrupt recovery and affect confidence until the beginning of 2022, as some countries have reintroduced travel prohibitions and restrictions for certain markets. At the same time, vaccination roll outs continue to be inconsistent. A difficult economic environment may place additional pressure on the effective recovery of international tourism, with the rises in petrol prices, increased inflation, the possible rise in interest rates, high volumes of debt and continuous interruption to the supply chains. However, the recovery of tourism that is occurring in many markets, above all in Europe and the Americas, along with the general roll out of vaccinations and a significant coordinated lifting of travel restrictions, could contribute to reinstating consumer confidence and accelerating the recovery of international tourism in 2022.

While international tourism recovers, domestic tourism continues to drive sector recovery in an increasing number of destinations, particularly those with a large domestic market. According to the experts, domestic tourism and travel closer to home will continue to make up tourism in 2022.

Business traveller behaviour habits could be affected in the short and medium term. This involves less trips on business, given the gradual adoption of digital solutions and hybrid formulas, which are affecting the evolution of some specific segments of business tourism.

It is worth noting the Company’s solid position with which to deal with the current situation after its operational and financial transformation in previous years. The excellent performance of the group in the years prior to the pandemic is the result of a complete transformation within the group, particularly brand segmentation, portfolio optimisation, significant investment in repositioning and systems, the focus on efficiency and cost control, and the reduction of financial indebtedness.

Continuous improvement to the customer experience was boosted in 2019 with the launch of various initiatives: “Fastpass”, a combination of three innovative services (Check-in Online, Choose Your Room and Check-out Online), which gives customers full control over their stay. Also a new service, “City Connection”, where you can enjoy the city without limits. Under the slogan “Stay in one hotel, enjoy them all”, the NH Hotel Group offered a range of services that allow customers to enjoy them in any hotel in the city they are in, regardless of the hotel they are staying in for the duration of their stay.

The embodiment of an NH Hotel Group value proposition based on the improvement of quality, experience and brand architecture with the NH Collection, NH Hotel and nhow brands are a reality today in the Group. With the integration of the Minor Hotels commercial brands, NH Hotel Group is currently operating hotels in Europe under the Tivoli, Anatara and Avani flags.

During the first part of 2021, and in order to adapt to the new trends in business travellers, the Group launched a series of initiatives:

-

- Extended Stay, with up to 35% discount on stays of more than 7 days for working away from home for an extended period.

- Smart Spaces, a new B2B offer, with exclusive spaces for working and organising small business meetings making the most of all the advantages of our hotels.

- Hybrid Meetings, to boost the value of events reaching a bigger audience from various destinations with a combination of in-person and virtual attendance.

- NH+, a new corporate segment focus on SMEs, which are the first to restart their activity.

Digitisation will be key to the sector’s evolution. The customer experience is improved and efficiency increased using technology and digitisation. The digital component will be key in responding to travellers’ security needs and experience. Technology should be a facilitator that complements our employees’ work, freeing them up from administrative tasks so they can give more personal attention to customers.

It is worth highlighting that the NH Hotel Group continues to be at the forefront of innovation. The Group’s Digital Transformation has allowed processes and systems to be made more efficient, increasing the capacity to be different from the competition, and continue improving the Company’s basic processes. One of the greatest achievements therefore has been to centralise all its properties and functions into a single integrated system. This allows the NH Hotel Group to have a fully-integrated digital platform: NH Digital Core Platform. A pioneering technological solution in the sector that has allowed all the Group’s hotel’s systems to be integrated which has become the basis for the NH Hotel Group to expand its customer knowledge, maximise its efficiency and innovate on a large scale in all its value areas.

For the first time, hotel businesses are experiencing difficulties finding staff, which suggests that the sector must go back to attracting talent with attractive professional career plans that boost training and job flexibility.

In its use of quality indicators, the NH Hotel Group focuses on measuring quality using new sources of information and surveys with a significant increase in the volume of reviews and number of assessments received. Its average score on TripAdvisor in 2021 was 8.4, compared to 8.5 in December 2020. Additionally, its average Google Reviews score was 8.7, compared with 8.7 in December 2020. These average scores demonstrate the high levels of quality perceived by customers and the positive growth trend that the NH Hotel Group has had throughout the year.

The NH Rewards loyalty programme had more than 10 million members in 2021 and is one of the most comprehensive rewards schemes worldwide. With four categories (Blue, Silver, Gold and Platinum), the Company’s programme recognised and rewards its habitual customers’ loyalty for each stay, with benefits from earning points – equivalent to euros – which are redeemable, with no date restrictions, for free nights or extra services at the hotel. NH Rewards also always gives flexibility in paying with points and cash, special pricing, exclusive privileges when booking on the web site, etc, as well as a series of differential services enriching the experience in all brands of the NH Hotel Group’s hotels.

NH Rewards is an important commercial lever, as members contribute 32% of the total nights at the Company, and have been the loyal, repeat customers who, during the pandemic, contributed most to the recover of booking numbers. The incentive of earning extra points stimulates bookings on direct channels, up to the point that more than 69.4% of the bookings on the NH web site are made by NH Rewards members, who also spend and visit more than guests who are not members.

During 2021, NH Hotel Group announced it was jointing the Global Hotel Alliance (GHA), which runs the award winning Discovery loyalty programme for multi-brand hotels. As a part of the agreement, NH Rewards will take part in GHA’s GHA Discovery programme in 2022, with it becoming one of the ten largest loyalty programmes in the hotel sector, with more than 900 hotels taking part and accessing new source markets. Minor’s hotels are already members of this alliance.

On the other hand, in 2021, the Group started operating 3 new hotels in Hannover, Murano and Copenhagen with 589 rooms. The Group, therefore, reached a total of 353 hotels with 55,063 rooms at 31 December 2021.

The Group also signed-up 2 new hotels with 145 bedrooms in 2021. These sign ups were on an under management basis in Santiago del Estero and in Cali. Both sign ups were under the NH brand.

Revenues in 2021 totalled 746.5 million euros, an increase of 39.2% (+210.3 million euros). The Profit for the year attributable to the Parent was -133.7 million euros compared with -437.2 million euros in 2020. This increase is explained by the increase in activity after the impact of COVID-19 during 2021.

In this year gross borrowing decreased from 998.1 million euros in December 2020 to 813.0 million euros in December 2021. At 31 December 2021, cash and cash equivalents amounted to 243.9 million euros (320.9 million euros at 31 December 2020). Furthermore, this liquidity is complemented by the syndicated credit line for 242.0 million euros (fully drawn down at the close of the 2020 financial year) and some credit lines at the close of the 2021 financial year of 25.0 million euros, against 25.0 million euros at 31 December 2020.

In June 2021, the rating agencies confirmed NH Hotel Group’s rating within the issue of the new bond for 400 million euros maturing in 2026 which occurred in June. On 14 June 2021, Fitch confirmed NH Hotel Group’s rating at ‘B-’ with a negative outlook. On 15 June 2021, Moody’s confirmed NH Hotel Group’s corporate rating at ‘B3’ with a negative outlook. It should be noted that both agencies have stated that NH is managing the recovery with satisfactory financial flexibility and deleveraging capacity, with a significant portfolio of owned assets. In turn, Moody’s reconfirmed NH Hotel Group’s corporate rating at “B3”, with a negative outlook, in its last publication on 29 December 2021.

As a result of the public offering on 31 October 2018, along with the capital increase in September 2021, Minor currently owns 410,183,997 shares in NH Hotel Group, S.A. representing 94.13% of its share capital. Since 2018, both companies have begun to explore joint value creation opportunities for the coming years.

Minor Hotels and NH Hotel Group have integrated their brands under a single corporate umbrella present in more than 50 countries around the world. In this way, a portfolio of more than 500 hotels under eight brands is organised: NH Hotels, NH Collection, nhow, Tivoli, Anantara, Avani, Elewana and Oaks, which completes a wide and diverse spectrum of hotel proposals connected to the needs and desires of global travellers.

Both groups currently share their knowledge base and experience in the sector in order to materialise short-term opportunities, taking advantage of the complementarity of their hotel portfolios to define a global sales strategy, the implementation of economies of scale with a broader customer base, explore development pathways for all their brands in different geographical areas and access to shared talent.

Covid-19 impact and the measures implemented

After the start of the COVID-19 pandemic in the middle of March 2020 in Europe, demand for hotels dropped drastically due to lockdowns, travel restrictions and social distancing, which drastically affected mobility.

The gradual reopening of hotels was made possible by the flexible costing structure and began in the middle of 2020, progressively, depending on recovery of domestic demand and with a focus on optimising profitability.

With the gradual roll out of vaccines since the beginning of 2021, a turning point was beginning to be seen that – together with the progressive lifting of restrictions in some European countries – allowed a faster reopening of the portfolio once again. Therefore, at the end of 2021, around 90% of the hotels were open, compared to 60% at the beginning of the year.

In 2020 NH Hotel Group put “Feel Safe at NH” into place in all its hotels. This is a new plan, with measures approved by experts, to face up to the health crisis caused by the SARS-CoV-2 coronavirus. The Company has reviewed all its procedures and made nearly 700 adaptations to its operating standards to preserve the health and safety of travellers and employees worldwide. Grouped into 10 main lines of action and backed by specialists in different fields, the measures implemented cover the digitisation of hotel services, adapting sanitation processes, including social distancing regulations in operations and the application of personal protective equipment, among others. We also reached a collaboration agreement with SGS, the world leader in inspection, analysis and certification, which allows us to follow up on the measurement and diagnostics protocol established to verify that the Group’s hotels are clean and safe environments.

In spite of the low level of demand, its flexible operational and financial structure has enabled the Group to overcome the major challenges in 2020 and 2021. The Group will benefit in the first stage of recovery from brand recognition, excellent locations and strong market positioning, once recovery accelerates in Europe.

Contingency Plan

As a result of the exceptional circumstances that occurred after the start of the global pandemic (COVID-19), the Group implemented different measures and plans to adapt the business and ensure its sustainability with the aim of minimising costs, preserving the Company’s liquidity to meet operational needs and ensure that the recovery of the hotel activity is carried out efficiently and under maximum guarantees in terms of health and safety.

The following costs discipline and control measures to ensure minimisation of operational costs and preserve liquidity continue to be implemented:

-

- Personnel: The Group carried out adjustments, temporary lay-offs and reductions in hours and wages in hotels and central offices caused by force majeure or production reasons. Some of these processes continued during 2021. In addition, a collective redundancy process was carried out in Corporate Services in Spain as part of a global plan.

- Operational costs:

– Negotiations with suppliers to reduce purchase costs, seek alternative, cheaper products and attain improvements to payment terms.

– Suspension of non-priority third party advisory services.

– Significant reduction in marketing and advertising costs despite the need to boost income.

-

- Leases: The temporary reduction in fixed leases continued during the first part of 2021 and, to a lesser extent, during the second half of the year, after recovery began.

- Capex: Capex decreased by more than 50% during 2020, and during 2021 continued to be limited to a figure of around 36.8 million euros.

- Strengthening liquidity: during 2021 NH Hotel Group proactively carried out a battery of initiatives to reinforce the Group’s capital structure:

– In May 2021 a €100 million capital investment was agreed by Minor International (94% shareholding) through an unsecured subordinated loan that was drawn down in May and capitalised in September 2021 through a capital increase process directed towards all shareholders. This agreement provided immediate liquidity and demonstrated the support of the main shareholder in the recovery. The capital increase was approved at the Shareholders’ meeting held on 30 June. At the same time as the capital increase, the Board started up the cash capital increase under the same economic conditions and with preferential subscription rights for the other shareholders to prevent diffusive effects in the shareholdings.

– In addition, during April, in order to continue to optimise the debt profile, the expiry of the ICO syndicated loan of 250 million euros was extended from 2023 to 2026. Furthermore, the waiver on compliance with financial covenants was extended for the whole of 2022.

– In June, NH Hotel Group successfully launched a senior bonds issue on the market, guaranteed for the amount of 400 million euros and maturing in July 2026. The funds obtained have been used to repay the senior bond for 357 million euros expiring in 2023. The new issue, which was significantly oversubscribed, has an annual interest of 4%.

– Furthermore, NH Hotel Group has agreed to extend its revolving syndicated credit facility (RCF) for 242 million euros, which will now expire in March 2026, instead of March 2023. It is worth pointing out the support shown by the loan institutions taking part in this financing, with the extension of the waiver on the financial covenants during all of 2022. - On 30 June 2021, the sale & leaseback transaction on the NH Collection Barcelona Gran Hotel Calderón was announced, for 125.5 million euros with a linked 20 year lease agreement, with NH having the option to exercise additional extensions. The Group generated a book net capital gain of 46.7 million euros with this transaction.

These milestones reached in 2021 strengthen the Company’s capital and liquidity with a solid financial base, with no significant debts maturing until 2026, with which it can face the imminent recovery of the sector from a better position from the financial and capital structure point of view. Furthermore, they have enabled initiation of the reduction in gross debt in 2021.

The rebound in demand for domestic leisure was enhanced as vaccination rates across Europe increased and restrictions on mobility were eased. The Group will take advantage of its strong positioning in Europe, with excellent locations and high brand recognition, alongside the high weight of domestic demand.

The recovery stage, which began in the second half of 2021, was initially driven by European domestic demand, as international mobility continued to be low in this first stage. The smaller business and corporate segment began to recover after the summer months, although it was still affected by the macroeconomic environment and social distancing restricting the size of events.

During 2022, once the Company has a better view of how demand recovers, a long-term strategic planning process will be addressed. The Company’s excellent performance over the past few years (pre-covid) was the result of a process of deep transformation of the Group. In the first stage of this transformation, which began in 2014, the strategic plan focussed on brand segmentation, portfolio optimisation, heavy investment in repositioning and systems and an updated pricing policy. This led NH Hotel Group to a second phase, which began in 2017, based on the Company’s strengths and boosting the key drivers in creating value in the business. This Plan prioritised boosting the Company’s income, increasing its efficiency and, at the same time, taking advantage of its strengths for new repositioning opportunities and organic expansion as an additional path to growth.

With the entrance of Minor International into the share capital at the end of 2018, a new era of opportunity opened up with the creation of a global hotel platform operating on five continents. In this way, a new stage began where additional opportunities arose, such as:

-

- The possibility of increasing the current customer base, attracting the growing Asian demand to the European markets.

- Economies of scale with business partners, travel agencies and suppliers.

- The ability to use a larger brand umbrella in new geographical areas, that is to say, take the NH brands into Minor geographical areas and vice versa.

- Access the luxury segment with new opportunities for brand change and opening and signing up new hotels in the segment.

- Boost the segment diversification strategy, integrating the resorts market into our cornerstones for growth.

- Integrate Tivoli operations in Europe under NH management.

- Contact the best teams, driving an exchange of talent.

ETHICS

Compliance System

Since 2014, NH Hotel Group has boosted the Compliance function, not just with the implementation of its Code of Conduct and the Criminal Risk Prevention Plan, but also with continuous implementation of corporate measures, processes and policies to foster and place value on compliance culture and the importance of consolidating an ethical business culture. It promotes awareness amongst all its employees about the importance of compliance, not just with applicable regulations but also to behave ethically and in accordance with the company’s principles and values.

Code of conduct

In line with its ethics commitment and Corporate Government best practices, NH Hotel Group has carried out communication, awareness and training campaigns on Compliance, with the aim that all NH Hotel Group employees are aware of the content of the Code of Conduct and the company’s main value and principles. The Group’s Board of Directors is responsible for approving the Code of Conduct.

This document affects everybody working at the NH Hotel Group, applicable to employees, managers and members of the Board of Directors of both the Company and its group of companies, and also in certain cases to other stakeholders such as customers, suppliers and shareholders, and to the communities where NH operates its hotels.

The Code of Conduct summarises the professional behaviour expected of employees, senior management and Board Members of the NH Hotel Group and its group of companies, who commit to acting with integrity, honesty, respect and professionalism in the performance of their work.

The NH Group is committed to compliance with the laws and regulations of the countries and jurisdictions where it operates. This includes, amongst other things, laws and regulations on health and safety, discrimination, taxation, data privacy, competition, prevention of corruption and money laundering, and commitment to the environment.

The Code of Conduct has been translated in-house into ten languages and published in six of them on the official website of the NH Hotel Group, available to all stakeholders. Also, since 2017, NH employees can use the “My NH” app to access the code of conduct from their mobile devices. The staff at centres operating under NH Hotel Group brands also have a handbook and an FAQs document.

The head of Internal Audit manages the Channel for Complaints. The procedure for managing complaints received via the complaints channel are specified in detail in the Code of Conduct. This procedure guarantees confidentiality and respect in every phase, and protects against retaliation. NH Hotel Group has also defined an internal process for notification and processing possible breaches and complaints under the Code of Conduct. The procedure includes the principles governing the Channel, the description of the parties involved in the complaint, deadlines and the penalty proceedings. In 2021, NH Hotel Group also approved the recruitment of an external platform to ensure compliance with Directive (EU) 2019/1937 of the European Parliament and of the Council, of 23 October 2019, on protection of people who report breaches of Union Law, known as the “Whistleblower” directive.

In 2021 there were 47 reports of alleged breaches of the Code of Conduct, all of which were investigated, with appropriate disciplinary measures being taken in the 69 cases received.

Compliance Committee

NH Hotel Group’s Compliance Committee is made up of members of the Management Committee and senior management who have appropriate knowledge about NH Hotel Group’s activities and, at the same time, have the authority, autonomy and independence needed to ensure the credibility and binding nature of the decisions made. This body is empowered to supervise compliance in key areas of the Compliance System: the Group’s Internal Rules of Conduct, Procedure for Conflicts of Interest, Code of Conduct and Criminal Risk Prevention Plan, among others.

The Compliance Committee supervises the management of the Compliance Office and is empowered to impose disciplinary measures on employees in matters within its scope. In the course of 2021, there were 3 meetings of the Compliance Committee, in accordance with the planned schedule.

The Company has decided to initiate development and roll out of its crime prevention plan in other countries (Germany, Holland, Belgium, United Kingdom, Colombia, Mexico and Argentina) and, as a result, has set up Compliance Committees in the Business Units covering those countries. The Compliance Committees that are already set up are called on to ensure effective roll out of the crime prevention plan in the countries they are responsible for.

Compliance Office

The Compliance Office, led by the Compliance manager, reports directly to the Chief Legal & Compliance Officer at NH Hotel Group and to the Compliance Committee. It is in charge of disseminating and supervising compliance with the Code of Conduct, regular monitoring and supervising of the Criminal Risk Prevention Plan, creating and updating corporate policies and monitoring compliance with them, and managing queries about the Code of Conduct, amongst other duties.

Anti-Corruption and Fraud Policy

NH Hotel Group has an anti-corruption and fraud policy which was initially approved by the Board of Directors in January 2018 and amended in May 2019. The general principles of the Anti-Corruption and Fraud Policy are:

-

- Zero tolerance of bribery and corruption in the private and public sectors

- Behaviour must be appropriate and legal

- Transparency, integrity and accuracy in financial information

- Regular internal control

- Local legislation shall take precedence if stricter

Anti-money laundering policy

NH’s Code of Conduct reflects a commitment to respect the applicable regulations on anti-money laundering policy, with special attention to diligence and care in the processes of evaluating and selecting suppliers, and in payments and collections in cash. Therefore, the Compliance Committee approved a policy that reinforces NH Hotel Group’s commitment to anti-money laundering and combating the financing of terrorism, with the aim of detecting and preventing NH Hotel Group, S.A. and its group companies from being used in money laundering or terrorist financing operations. The Policy was approved by the Board in May 2019. In 2021 the corporate anti-money laundering and the financing of terrorism policy was amended and updated. In November 2021 the update was approved by the Board of Directors, after it was reviewed and validated by the Compliance Committee and the Audit and Control Committee.

The aforementioned Policies have been duly communicated to all Group employees and the corresponding online training has been made available to ensure their disclosure and understanding.

Environmental policy and Human Rights policy

In 2020 NH Hotel Group’s Board of Directors approved an environmental policy that included the company’s commitments to preventing and anticipating possible environmental contingencies, integrating sustainability in all its processes in order to reduce its impact and incorporating environmental aspects into the company’s decision making process.

Furthermore, in 2020, the Company’s Board of Directors approved the Human Rights policy, in order to reflect that respect for, and protection of, human rights are principles that are ingrained into NH Hotel Group’s culture and applicable to all the activities carried out by the group’s professionals, regardless of the country or region. The Company is committed to complying with Human Rights at the highest internationally recognised levels and standards, in order to protect, respect and correct (prevention and management) risks associated with breach of those rights.

RISK MANAGEMENT

Risk management governance

The Company’s Board of Directors is responsible for overseeing the risk management system, in line with the provisions of Article 5 of the Regulation of the Board of Directors. As regulated by Section 3 of article 25 b) of the Regulation of the Company’s Board of Directors, the Audit and Control Committee supports the Board of Directors in supervising the effectiveness of the internal control, internal audit and the risk management systems, including tax risks. In this sense, during 2021, a control and monitoring process of the Company’s main risks has been carried out.

On the other hand, amongst other functions, the Company’s Management Committee manages and controls risks based on risk tolerance, assigns ownership of the main risks, periodically monitors their evolution, identifies mitigation actions as well as defining response plans. For these purposes, the Executive Risk Committee, made up from members of the Management Committee and Senior Executives, supports the Management Committee in such oversight, as well as promoting a culture of risks in the Company. For them, the Company has an internal risk management manual (updated this year) that details the principles, processes and controls in place.

Risk Management, integrated into the Internal Audit department, is responsible for ensuring the risk management and control system in the Company functions properly and is linked to the strategic objectives. To ensure that there are no conflicts of independence and that the NH risk management and control system works as set out in the Corporate Risk Management Policy, an independent third party periodically reviews its operation.

As an additional guarantee of independence, Risk Management is independent of the Business Units and, as with Internal Audit, it maintains a functional reporting line to the Audit and Control Committee.

In line with the above, NH follows the Three Lines model published in July 2020 by the Global IIA:

-

- First line: carried out by each function (business and corporate units) that owns the risk and its management (Operations, Commercial, Marketing, etc.).

- Second line: performed by the functions responsible for risk supervision (Risk Management, Compliance, Data Protection, Internal Control, etc.)

- Third line: carried out by Internal Audit that affords independent assurance.

The NH Hotel Group’s Corporate Risk Management Policy (approved by the Board of Directors in 2015), as well as the internal manual that implements it, aim to define the basic principles and the general framework of action to identify and control all types of risks that may affect the companies over which the NH Hotel Group has effective control, as well as ensuring alignment with the Company’s strategy.

Risk management model

NH Hotel Group’s risk management system, rolled out at Group level, aims to identify events that may negatively affect achievement of the objectives of the Company’s Strategic Plan, providing the maximum level of assurance to shareholders and stakeholders and protecting the group’s revenue and reputation.

The risk management model is based on the integrated COSO IV ERM (Enterprise Risk Management) framework, and includes a set of methodologies, procedures and support tools that allow the NH Hotel Group:

1. To adopt adequate governance in relation to the Company’s risk management, as well as promoting an appropriate risk management culture.

2. To ensure that the Company’s defined objectives are aligned with its strategy and risk profile.

3. To identify, evaluate and prioritise the most significant risks that could affect achievement of strategic objectives To identify measures to mitigate these risks, as well as establish action plans based on the Company’s tolerance to risk.

4. To follow-up on the action plans established for the main risks, within a continuous improvement model framework.

The Group’s Risk Map is updated annually and approved by the Board of Directors once reviewed and validated by the Audit and Control Committee. In 2021, the Company updated its risk catalogue (78 risks) and its Risk Map, which was approved by the Board of Directors on 28 July 2021.

Each of the main risks on the Company’s Risk Map is assigned a Risk Owner who, in turn, is a member of the Management Committee. Each risk owner is responsible for mitigation measures, either existing or in progress, for their risks and the implementation status of action plans.

Each year, coinciding with the update of the Risk Map, Risk Management is responsible for reassessing the risk catalogue, both financial and non-financial. The final catalogue is validated with the Senior Executives who take part in the process, as well as with the bodies involved in its validation (Management Committee, Executive Risk Committee and Audit and Control Committee) and approval (Board of Directors). Additionally, Risk Owners can report/suggest a new risk to the Risk Office during the year.

In general, the risks to which the Group is exposed can be classified into the following categories.

a. Financial Risks: events that affect financial variables (interest rates, exchange rates, inflation, liquidity, debt, credit, etc.).

b. Compliance Risks: arising from possible regulatory changes as well as non-compliance with internal and external regulations.

c. Business Risks: generated by inadequate management of procedures and resources, whether human, material or technological.

d. Risks from External Factors: arising from natural disasters, pandemics, political instability or terrorist attacks.

e. Systems Risks: events that could affect the integrity, availability or reliability of operational and financial information (including cyber).

f. Strategic Risks: produced by difficulty accessing markets and difficulties in asset disinvestment.

Apart from this classification, the Company has identified emerging risks and ESG (Environment, Social, Governance) risks that it particularly monitors (described in the annual non-financial information report). At the start of 2021, NH Hotel Group strengthened its analysis of risks associated with Human Rights, the Environment and Fraud by the Sustainable Business and Risks Departments.

Data protection plan

Due to the mandatory application of the General Data Protection Regulation (GDPR) in the European Union from May 2018, together with the later approval at national level of Organic Law 3/2018 of 5 December on data protection and the guarantee on digital rights, the NH Hotel Group implemented a plan to guarantee compliance with the regulation, included in and aligned with the Transformation Plan.

This new plan includes general privacy measures by default and from the design of any activity carried out by NH Hotel Group, so that all the company’s activities, applications, processes, and projects will take privacy matters and their compliance into account. The plan includes key initiatives such as integration of privacy principles by design and by default, effective management of personal data breaches, explicit consent from the data subject for data gathering and use, and the legality of the different data processing carried out, and a physical and virtual data destruction policy. It also includes management of the data protection rights that may be requested by the data subjects, and training employees so that they are aware of the protection policies set up and how to process personal data. The plan already includes the post of Data Protection Officer (DPO) within NH Hotel Group, who is duly declared at the various Data Protection Agencies where NH Hotel Group operates.

NH ROOM 4 SUSTAINABLE BUSINESS

The NH Hotel Group performs its hotel activity with the ambition of leading responsible behaviours, and creating shared value at an economic, social and environmental level wherever it operates. With this philosophy, in 2021 the Company continued with its strategy, in which one of the pillars is NH ROOM4 Sustainable Business; a key part of the Company’s global strategy.

The strategic vision of NH ROOM4 Sustainable Business is, in turn, based on three fundamental management levers: NH ROOM4 People, NH ROOM4 Planet and NH ROOM4 Responsible Shared Success, all of which are framed under the same premise of sustainable and ethical principles, responsible culture and spirit of citizenship.

A noteworthy milestone for NH Hotel Group was obtaining Bronze Class recognition in “The Sustainability Yearbook 2022”, consolidating it as the third most sustainable hotel chain in the world, after been assessed by the sustainable investment agency at Standard & Poor’s, which assesses companies on the Dow Jones Sustainability Index.

Since 2013, the NH Hotel Group has been listed on the FTSE4GOOD index and renews its presence year after year thanks to the responsible management of the business and the improvements implemented. The index was created by the London Stock Exchange to help investors include environmental, social and governance (ESG) factors into their decision making.

The NH Hotel Group has reported its commitment to and strategy against climate change to CDP Climate Change since 2010 and received a B in its annual ranking. With this rating, the NH Hotel Group once again recognises its vision of positioning climate change as a strategic value of the corporation, which has acted as a lever of value for the Group for over a decade.

As a demonstration of its commitment to gender equality, NH Hotel Group has been included on the Bloomberg gender equality index for the third time in 2022 and is the only Spanish hotel group on the index. The Company has achieved its best results in the cornerstone of wages equality and parity, due to its remuneration policies based on gender equality and the fight against the wage gap.

Convinced it is moving in the right direction to achieve the next sustainability challenges, the Company is aligned with the Sustainable Development Goals (SDGs) to which it can contribute and undertakes to continue creating long-term and global value within the framework of the 2030 Agenda.

NH ROOM 4 PEOPLE

Employees

NH Hotel Group looks after its employees and seeks their commitment and involvement in the Company’s sustainable business, in such a way that this is an integral part of their daily work. This is achieved with fluid communication and recognition of their responsible commitment.

Within NH Hotel Group’s business strategy, corporate culture is key. The Company considers human capital to be its main asset and understands that, to build a leading corporate culture, it is essential to manage attracting and developing talent, and sustain their motivation and pride in belonging to the NH Hotel Group.

In 2021, within a particularly sensitive context regarding the health and economy circumstances, the Company focussed on three fundamental aspects within team member management:

-

- Connect with them, keeping them informed about the company’s reality at all times and ensuring two-way communication via the Managers.

- Care for and ensure their safety, health and well-being.

- Give a response to business demands as a business partner.

Along this line, the leaders of the various areas worked with their teams on adaptation to the various circumstances that arose during 2021, including the transition to re-joining on-site, managing their emotions, commitment and performance, and trying to respond to the various personal and professional realities.

During 2021 the Company had to make adjustment its staff at global level, to adapt to the reality in each country and business operation, retaining the maxim of protecting employment in the long term as far as possible and adjusting staff costs to the Company’s reality. The departure processes were notified individually, in an attempt to listen to each employee actively, respecting and valuing the work done during their time at NH Hotel Group. The Human Resources department also carried out a “reboarding” for employees who stayed at the Company, encouraging active listening and empathy in such difficult times, working to foster good adaptation to the new reality.

Even in such an adverse context, NH Hotel Group has maintained its corporate culture and commitment to its values, in line with its current People strategy, with the conviction that coherence is what is needed to gain the credibility and trust of its team members, who are the Company’s greatest asset.

Under these circumstance, NH Hotel Group, throughout the year, maintained the focus on its strategic cornerstones, ensuring, in this way, that it continues to sustain its long-term vision, but adapting the initiative launched to give them sense and usefulness within an individual, social and company context as complex as the one caused by the pandemic.

-

- Global leadership and talent management: Continue promoting and transmitting leadership within the NH Hotel Group, focusing efforts and investment on internal talent that has the potential to make a difference in the Company’s strategy and to become models of our culture.

- Maximum performance and better workplaces: All employees are encouraged to develop and do their best, where high performance is differentiated, recognised and rewarded. Making our employees our best brand ambassadors.

- Transformation and reinvention: develop our working environment to make it increasingly agile, connected and productive. All this, with clear policies and processes, meeting commitments proactively, supporting, developing and implementing the Company’s operational model.

With this working framework, this year NH Hotel Group continued with its “With You” initiative to care for its employees in these challenging times. Using “With You”, and amongst other actions, NH employees have received content aimed at stress management, have accessed digital kiosks free-of-charge, have had language classes within reach, have been able to collect office material to improve their remote working experience.

It is worth pointing out that in 2021 the Company has resumed some highly important processes within the People strategy, which had come to a halt due to the pandemic, such as the MBO and Time for You, as well as talent calibrations and recognition and training programmes which are all adapted to the Company’s new reality.

In this way, NH Hotel Group has continued to care for its teams, giving them tools to manage the stress and uncertainty brought by the pandemic during 2021 as best as possible, by focussing on identifying, developing and retaining talent and continue to strengthen commitment, creating optimal workplaces to maximised its employees contribution.

Our human capital

The average number of employees belonging to the Parent Company and consolidated companies at the close on 31 December 2021 was 10,072 employees. The corporate culture of the NH Hotel is also based on the cornerstones of diversity, equality and inclusion. Therefore, employees are 133 different nationalities and 51% of all staff were women.

Also, the average age of employees is 41.1 years old, and their average time with the company is 10.5 years.

NH Hotel Group uses its Code of Conduct to formalise its commitment to promoting non-discrimination due to the race, colour, nationality, social origin, age, gender, civil status, sexual orientation, ideology, political opinions, religion or any other personal, physical or social condition of its professionals, along with equal opportunities for all of them.

The policies and actions for recruiting, employing, training and internal promotion of employees are based on criteria of ability, skills and professional merit., In 2021 2,936 new staff were recruited, of which 66% are employees under 35 years old and 53% are women.

NH ROOM4 PLANET

NH Hotel Group is a company that is committed to the well-being of its guests and to efficient management of the resources available in the environment the Group’s hotels are in. The Company is aware of the effects of its activity on the environment and works to prevent and anticipate possible environmental contingencies, as well as to integrate sustainability into all its processes. It is constantly working on reducing their impact.

The Company’s environmental strategy is channelled through NH ROOM4 Planet, which defines the roadmap to comply with the commitments acquired to fight climate change and progress towards decarbonisation, efficient management and responsible consumption of resources and a circular economy, the development of more sustainable products, but also the involvement of employees, suppliers, partners and customers as key actors to achieve this.

Fight against climate change is a fundamental strategic value. In order to progress the definition of its climate strategy, an analysis was made during the year to determine where the Company is in relation to the TCFD (Task Force on Climate-Related Financial Disclosures) recommendations and what steps should be taken to be in line with it in 2023.

NH Hotel Group hotels have and ISO 14001 environmental management system and an ISO 50001 energy efficiency system, certified for accommodation, catering, meetings and events services. At the close of 2021, 47% of the hotels in Germany, Spain and Italy already had ISO 14001 – a total of 96 hotels – and/or ISO 50001 certification – 30 hotels. There are Group hotels that also have other environmental certifications, such as: BREEAM, LEED, Green Key, Hoteles+Verdes. The aim is to have an increasingly large number of hotels with globally recognised environmental certifications and approved by the Global Sustainable Tourism Council, the most important body of reference.

As a demonstration of our environmental commitment, 163 hotels in the portfolio have obtained the Green Leaders mark on TripAdvisor, with 46% of the Company’s hotels having this recognition. In addition, during the year 294 of the company’s hotels achieved the environmental distinction on Booking and the entire portfolio got the GreenStay from HRS. It is worth pointing out that, in September 2021, NH Hotel Group signed an alliance with Bioscore for independent classification of the behaviour of all the hotels in the portfolio on six pillars (emissions, energy, water, waste, catering and social responsibility).

These actions and commitments allow the NH Hotel Group to position itself as a sustainable and environmentally friendly company, thereby increasing the value of its brands.

SHARES AND SHAREHOLDERS

NH Hotel Group, S.A. share capital at the end of 2021 comprised 435,745,670 fully subscribed and paid up bearer shares with a par value of 2 euros each. All these shares carry identical voting and economic rights and are traded on the Continuous Market of the Spanish Stock Exchanges.

According to the latest notifications received by the Company and the notices given to the National Securities Market Commission before the end of every financial year, the most significant shareholdings at 31 December 2021 and 2020 were as follows:

The aforementioned (indirect) shareholding of MINT in NH Hotel Group, S.A. is the result of the IPO made by MHG Continental Holding (Singapore) Pte Ltd. on 11 June 2018 for 100% of the shares that were part of the share capital of NH Hotel Group, S.A., the result of which was that MINT acquired, through its wholly owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd, shares representing 94.13% of the share capital of NH Hotel Group, S.A.

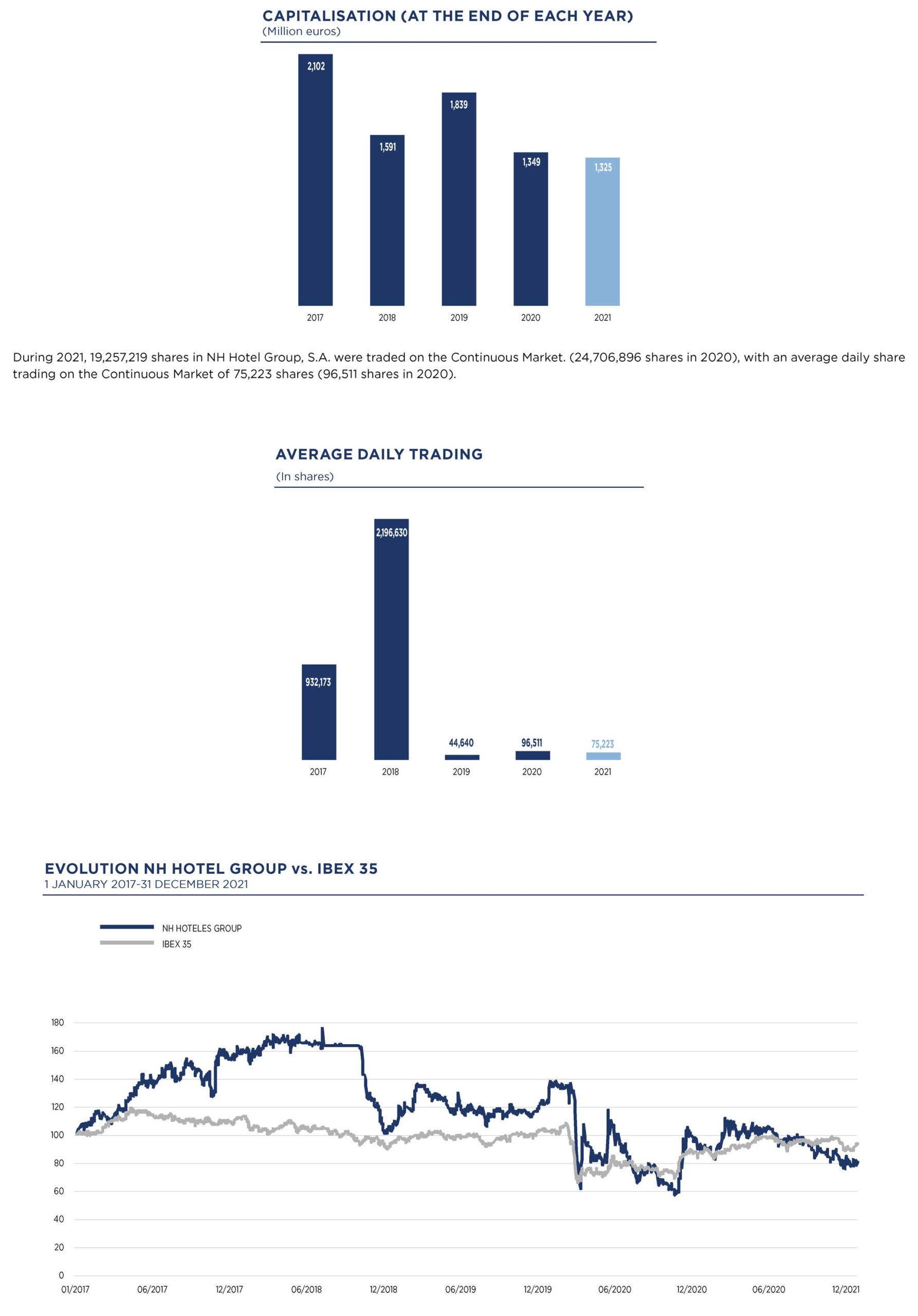

The average share price of NH Hotel Group, S.A. in 2021 was 3.61 euros per share (3.58 euros in 2020). The lowest share price of 2.82 euros per share (2.10 euros in October 2020) was recorded in December and the highest share price of 4.35 euros per share in February (5.34 euros in January 2020). The market capitalisation of the Group at the close of 2021 stood at 1,324.66 million euros.

At 31 December 2021, the Group had 96,246 own shares (all referring to the liquidity contract), compared to 103,947 own shares at 31 December 2020. The reduction in treasury shares in the period is wholly explained by the liquidity contract operation.

Liquidity contract for treasury shares management

On 10 April 2019, the NH Board of Directors entered into a liquidity contract to manage its treasury shares with Banco Santander, S.A. The Contract became effective on 11 April 2019.

This contract is in accordance with the liquidity contract model in Circular 1/2017 of 26 April from the National Securities Market Commission on liquidity contracts for the purpose of its acceptance as a market practice.

The total number of shares allocated to the securities account associated with the Liquidity Contract at 31 December 2021 is 96,246 shares and the current amount allocated to the cash account is 333,543 euros.

The Liquidity Contract was agreed upon by the Board of Directors at the proposal of the Proprietary Directors on behalf of the shareholder Minor as a measure to encourage and favour the liquidity of the Company’s shares taking the current market conditions into account.

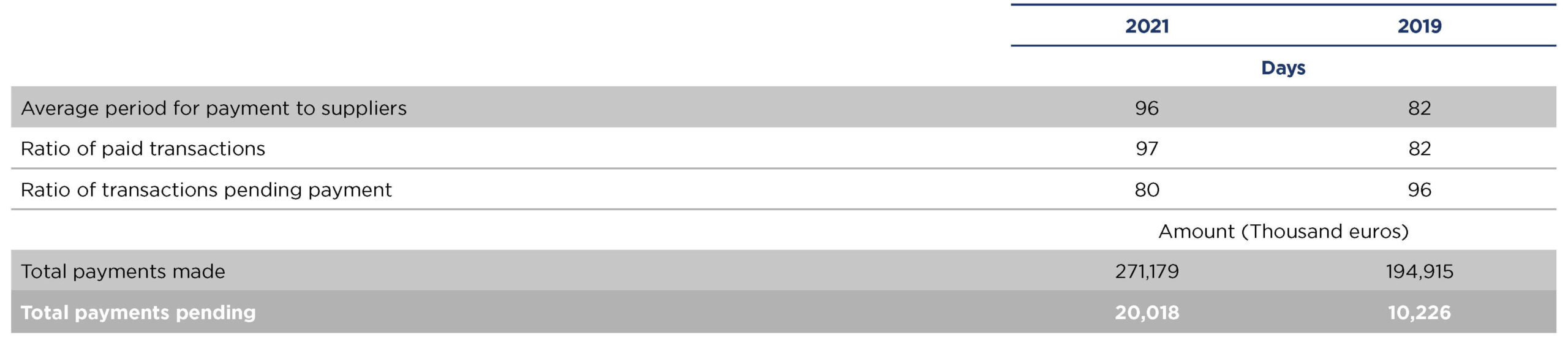

Average period for payment to suppliers

Below is the information required by Additional Provision Three of Law 15/2010 of 5 July and modified according to the Resolution of 29 January 2016, of the Institute of Accounting and Auditing, on the information to be incorporated in the record of annual financial statements relating to the average period for payment to suppliers in commercial transactions of Spanish companies.

The above information on payments to suppliers of Spanish companies refer to those which by their nature are trade creditors due to debts with suppliers of goods and services. The table includes, therefore, the “Commercial Creditors and Other Accounts Payable” item in current liabilities of the consolidated balance sheet.

The average period for payment to suppliers has been calculated using the weighted average of the two ratios explained below:

– Ratio of paid transactions: average payment period of transactions paid in each year weighted by the amount of each transaction.

– Ratio of transactions pending payment: average period between the invoice date and the end of the year weighted by the amount of each transaction.

The maximum period for payment to suppliers of the Company has been higher than the legal period stablished of 60 days due to the impact of COVID-19 pandemic on hotel demand. This situation is remediable as long as several measures are taken focused on temporary resizing of existing resources, such as renegotiation of rent contracts and other different actions focused on minimizing COVID-19 impacts, which jointly with the progressive recovery of hotel activity will contribute to meet the stablished legal ratio.

FUTURE OUTLOOK

It is forecast that high inflation may continue for longer than expected and that the cuts in the supply chains and high energy prices will persist in 2022. It is expected that inflation should decrease little by little as the imbalance between supply and demand dissipate in 2022 and that the monetary policy of the large economies responds.

The appearance of new strains of the virus causing COVID-19 may prolong the pandemic and once again pose economic problems. In addition, disruptions to the supply chains, volatile energy prices and specific wages pressures create huge uncertainty about the path of inflation and politics. As the monetary policy rates in advanced economies rise, risks to financial stability may appear, as well as to capital flows, currencies and the tax position of the economies of emerging and developing markets, particularly taking into account that debt levels increased significantly during the last two years. On the other hand, other global risks may materialise given that geopolitical tensions continue to be acute.

According the OMT’s last Group of Experts, the majority of tourism professionals (61%) see better prospects for 2022. While 58% expect an upturn in 2022, above all in the third quarter, 42% only foresee a possible upturn in 2023. A majority of experts (64%) now expect that international arrivals will not return to 2019 levels until 2024, or later, as against 45% in the September survey.

The OMT’s Confidence Index shows a slight drop in January-April 2022. A rapid, more generalised roll out of vaccinations, followed by a significant lifting of travel restrictions, along with better coordination and clearer information on travel protocols, are the main factors indicated by the experts for effective recovery of international tourism.

The OMT scenarios show that international tourist arrivals may grow between 30% and 78% compared to 2021. Nevertheless, these are percentages that are still 50% and 63% lower than the levels prior to the pandemic.

Non-financial Information Statement

The 2021 consolidated Non-Financial Information Statement, issued by the Board of Directors on 24 February 2022, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This document is presented as a separate report, is part of this Consolidated Management Report and is available on the corporate website of the NH Group (https://www.nh-hoteles.es/corporate), within the section on Annual reports included in financial information in the shareholders and investors section and as an annex to this document.

Annual Corporate Governance report

The Annual Corporate Governance report, which is a part of this consolidated management report, was prepared according to the provisions of article 49.4 of the Commercial Code. In addition, the report will be available from publication of these accounts on NH Group’s corporate web site (https://www.nh-hoteles.es/corporate/es) and on the CNMV web site (www.cnmv.es).

Annual directors’ remuneration report

The annual directors’ remuneration report for 2021, prepared by the Board of Directors on 24 February 2022, is presented as a separate report, forms a part of this Consolidated Management Report and is available as an annex to this document as required by article 538 of the Royal Legislative Decree 1/2010 of 2 July 2010.

SUBSEQUENT EVENTS

The Company is planning to put the 2022-2027 Long-Term Incentive Plan (“Performance Cash Plan”) in place in 2022. This grants a cash amount payable in the event of fulfilling the targets set for that purpose. The Plan is explained in an annual report on listed public company directors’ remuneration, prepared by the Board of Directors on 24 February 2021, which is presented as a separate report, forming part of the Management Report in the Consolidated Annual Statements.