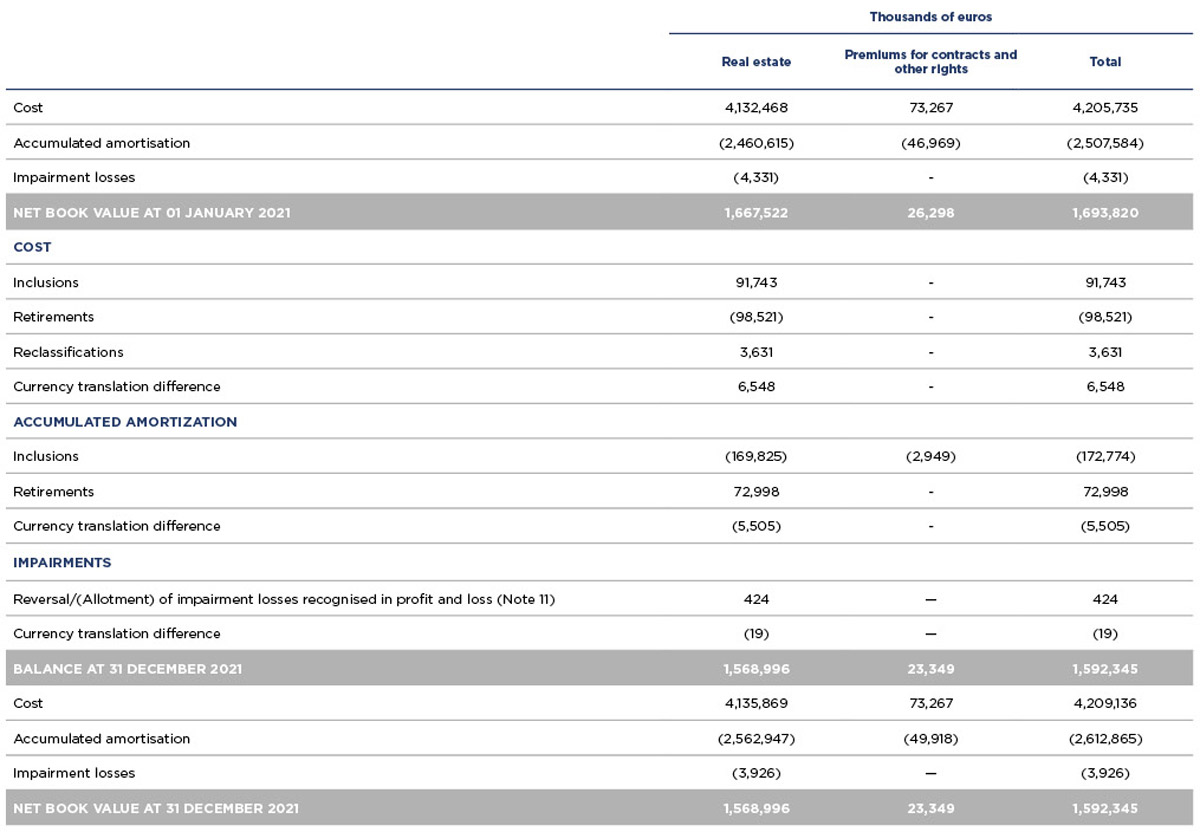

The breakdown and movements under this heading were as follows (in thousands of euros):

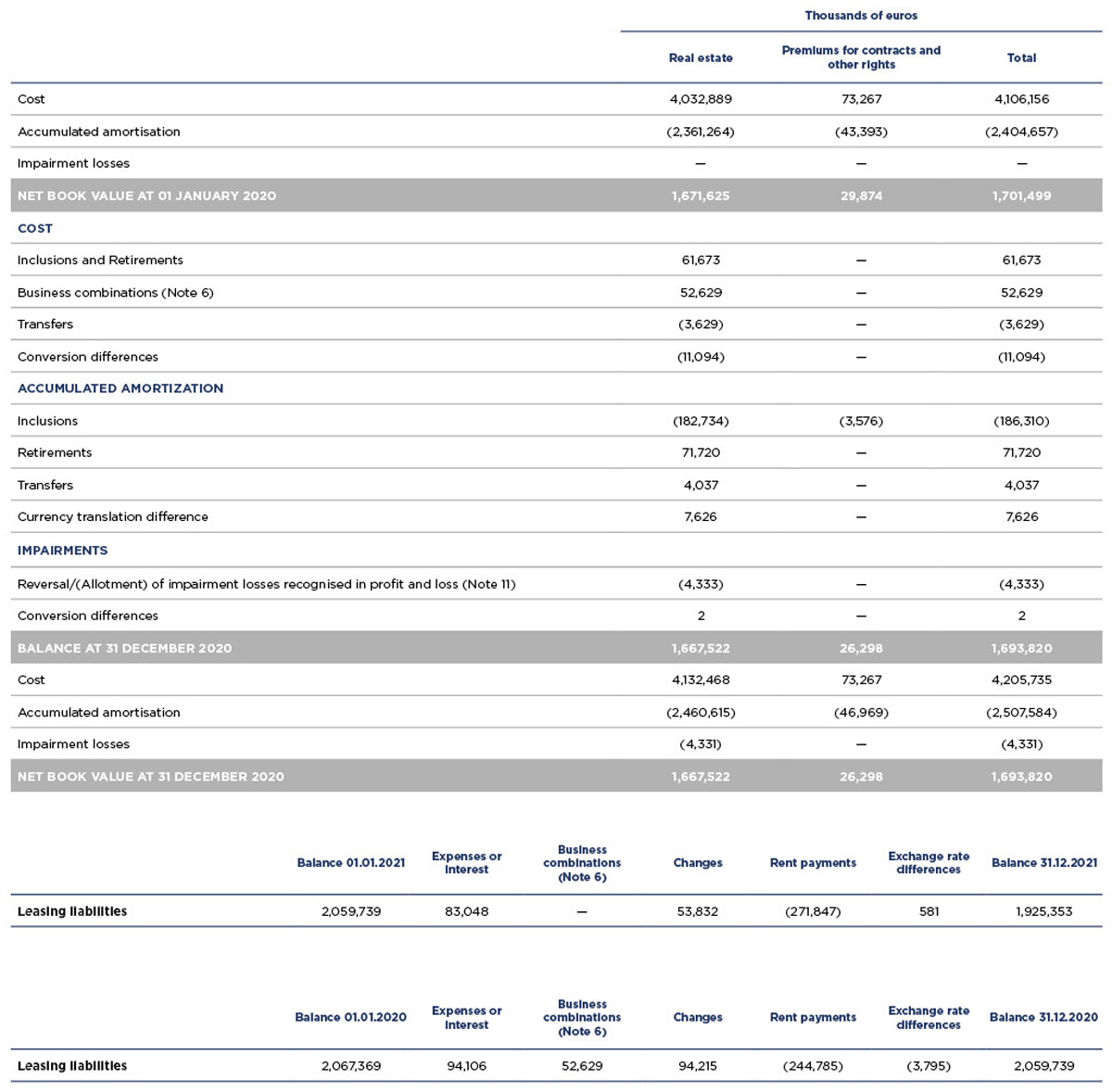

The main movements mainly correspond to the closure of four hotels under leases, as well as the amendment to the term of some contracts and the change to the essentially fixed component in various contracts with a variable structure. During the financial year, NH Collection Venezia Palazzo Barocci and NH Firenze Anglo American in Italy, NH Cornellá and NH Ciudad de Almería and NH Sant Boi in Spain were closed, NH Hannover in Germany and NH Collection Copenhagen in Denmark were opened and NH Collection Barcelona Gran Hotel Calderón in Spain was sold and subsequently leased.

Likewise, the business combination includes the acquisition of the Boscolo Hotels Group in 2020 through the companies Roco Hospitality Group S.R.L., New York Palace, Kft. and Agaga, S.R.O.; hotel leasing operators in Italy, Hungary and the Czech Republic (Note 6).

The main impacts on the statement on the consolidated comprehensive profit and loss statement related to the application of IFRS 16 are a higher financial expense of 83,048 thousand euros (94,106 thousand euros in 2020), a net loss on the disposal of non-current assets of 1,294 thousand euros (a gain of 624 thousand euros in 2020), due mainly to cancellations of contracts that had no cash impact and a reversal for asset impairment of 424 thousand euros (allotment for impairment of 4,333 thousand euros in 2020).

The amounts recorded as right-of-use assets correspond to properties where the NH Group is a lessee for its operation as a hotel.

Short-term leases and low-value leases are recognised as an expense in the consolidated comprehensive profit and loss account on a straight line basis. A short-term lease contract is one where the period is less than or equal to 12 months. A “low value contract” is one whose underlying asset assigned in use would have a new value of under 5 thousand euros. The impact recorded on the attached consolidated comprehensive profit and loss statements for the leases totals an income of 16,692 thousand euros (31,374 thousand euros income in 2020) (Note 25.4). This income is a result of applying the exemption introduced in IFRS 16 on 28 May 2020, and extended until 30 August 2021, which meant the Group recorded savings of 28,625 thousand euros (46,195 thousand euros in 2020) (Note 2.2).

Furthermore, in the lease agreements, there are no restrictions or imposed clauses and no sales transactions with subsequent leasing were carried out during the financial year.

Future cash output that the lessee is potentially exposed to, and which are not shown in the valuation of leasing liabilities, exclusively relate to payments for variable leasing.

Therefore, future gross payments estimated for the next 5 years total 664 million euros. Nevertheless, these expenses will result in higher income and produce higher profits.

The Group has not granted any options to extend and terminate, or guarantees of residual value. There do exist leases that have not commenced, for which the Group has undertaken gross lease payments of 39,276 thousand euros in a period of 1 to 5 years, and 198,715 thousand euros in a period of over 5 years.