In accordance with IFRS 5, Non-current assets classified as held for sale and discontinued operations (see Note 4.7), the group has classified non-strategic assets under this heading which, pursuant to the Strategic Plan, are undergoing divestment with committed sales plans.

The assets classified as held for sale, after deducting their liabilities, were measured at the lower of their carrying amount and the expected sales price minus costs.

Specifically, Sotocaribe, S.L and Capredo Investments GmbH are classified as discontinued operations; these companies represented the entirety of the Group’s property activity.

In addition, in 2017 the Group classified the property in which the NH Collection Barbizon Palace hotel is located as non-current assets held for sale. This was sold in January 2018, resulting in a net asset de-recognition of 66,633 thousand euros and a positive pre-tax result of 87,315 thousand euros recorded under “Net result on disposal of assets” in the consolidated comprehensive profit and loss statement.

Also, at 2018 year-end, the land and property in which the NH Málaga II hotel is located, the sale of which is expected to take place at the beginning of 2019, was recognised as available for sale.

Sotocaribe, S.L. was consolidated by the equity method, while Capredo Investments, GmbH was changed to the global method following the acquisition of the remaining 50% of the company by the Group Company on 28 December 2016.

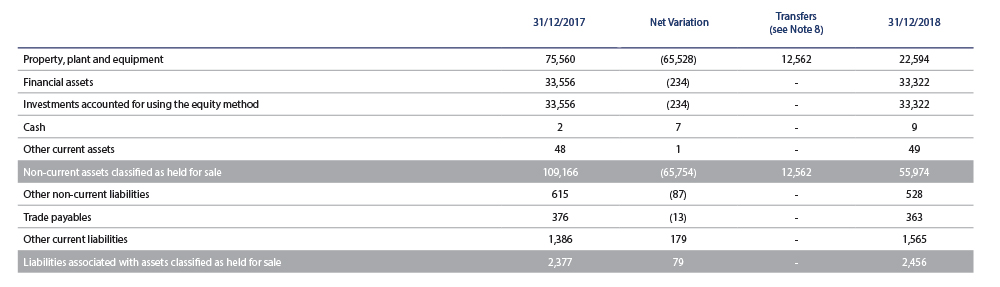

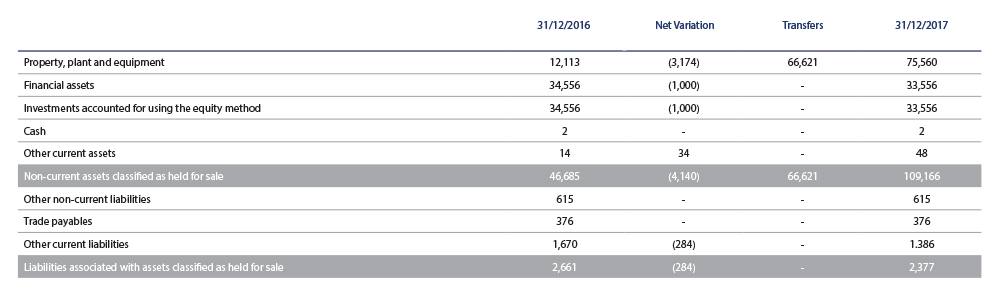

Consolidated balance sheets . Headings of Non-current assets and liabilities classified as held for sale:

A movement by balance headings of the assets and liabilities presented under the corresponding Held for Sale headings at 31 December 2018 and 2017 is shown below (in thousand euros):

The net changes column includes impairments associated with investments accounted for using the equity method.

Consolidated comprehensive profit and loss statements

The profit and loss of the discontinued operations shown in the accompanying consolidated comprehensive profit and loss statement is broken down by company as follows (in thousand euros):

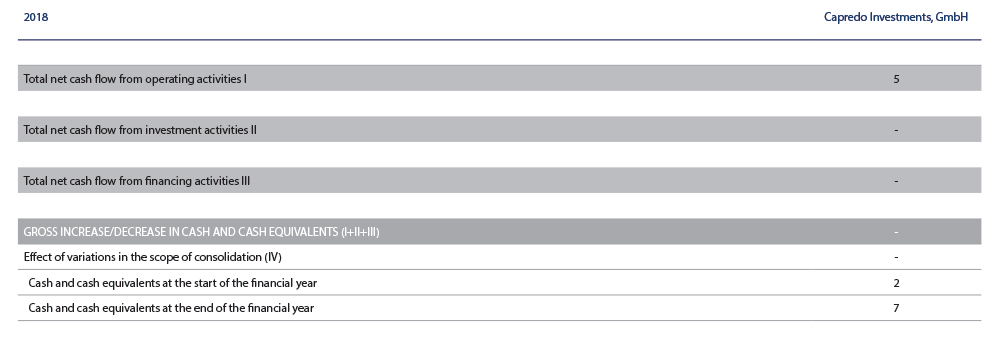

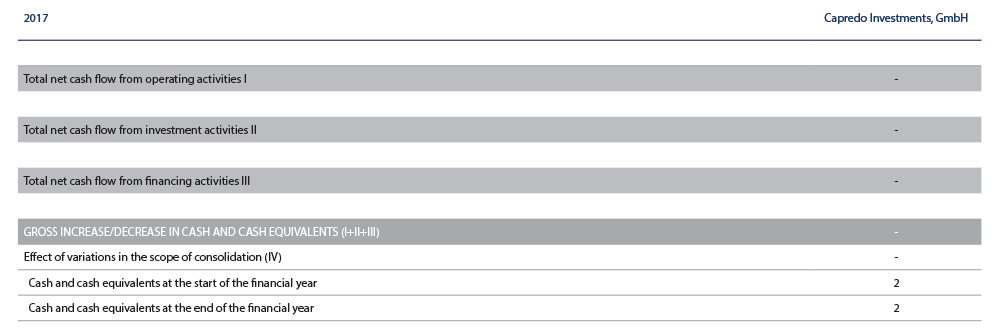

Consolidated cash flow statements

The consolidated cash flow statements for the fully consolidated companies in 2018 and 2017 are detailed below (in thousand euros):