For the financial year ending 31 December 2018

EVOLUTION OF BUSINESS AND GROUP’S SITUATION

NH Hotel Group is an international hotel operator and one of the leading urban hotel companies worldwide in terms of number of rooms. The Group operates 350 hotels and 54,374 rooms in 28 countries, and has a significant presence in Europe.

The centralised business model allows it to offer a consistent level of service to its customers in different hotels in different regions. The corporate headquarters and regional offices offer hotels a wide range of functions such as support on distribution channels, reservations call centre, marketing strategy and systems development.

In 2018, world economic activity grew at a pace of +3.7% (Data and estimates provided by the E.C. “European Economic Forecast Autumn 2018” November 2018), greater than the previous year (+3.5%). More specifically in the Eurozone, the provisional growth rate for 2018 was 2.1%, slightly lower than 2017 (+2.2%). Global growth has maintained a positive cycle of trade and investment. In addition, European economies continue to grow, although some signs of a slowdown are beginning to appear, with more moderate growth rates. In line with the above data, when comparing the growth rates of the four countries that bring together the largest proportion of sales and results of the Group, it is observed that in the Netherlands (+2.8% in 2018 vs. +3.2% in 2017), and Spain (+2.6% in 2018 vs. +3.1% in 2017), Germany (+1.7% in 2018 vs. +2.2% in 2017), and Italy (+1.1% in 2018 vs. +1.5% in 2017) lower growth rates than the previous year were recorded. On the other hand, growth in emerging countries is expected to remain stable, albeit with greater divergences between countries. In Latin America, growth is expected to be +1.0% in 2018 (vs. +1.2% in 2017), affected by worse financing conditions with Argentina suffering currency depreciation and having declared hyperinflationary economy and Mexico with a grow slightly lower than expected.

According to the World Tourism Organization (“UNWTO”) in 2018, international tourist arrivals globally reached 1,400 million, representing an increase of +6% over the previous year, clearly above the growth of 3.7% of the world economy, thus consolidating the strong results of 2017 and proving to be the second strongest year since 2010. More specifically, international tourist arrivals in Europe reached 713 million in 2018, a remarkable increase of 6% compared with an exceptionally strong 2017. Tourist growth was driven by Southern and Mediterranean Europe (+7%), Central and Eastern Europe (+6%) and Western Europe (+6%). In this European context, Spain has established itself as the tourist power in the world, along with France and the United States, and managed to break its record with 82.6 million foreign tourists, an increase of 1% in the number of international arrivals. For their part, the Americas (+3%) received 217 million international arrivals in 2018, with mixed results in all destinations. Growth was led by North America (+4%), followed by South America (+3%).

In this context, in 2018, the Group, as a result of the favourable evolution of hotel activity throughout the year, surpassed the targets set thanks to greater positioning in the top brand segment, an improved customer experience, an increase in operating and commercial efficiency, a strategy of asset rotation and a reduction in debt.

During 2018, the value of the price strategy continues to be enhanced, greater Group growth being obtained in the top cities compared to direct competitors, where there are market measures in place*. The evolution of Group’s RevPar in main destinations was superior to its direct competitors.

In 2018 new selective repositioning opportunities were identified to be executed in the period 2018-2020, with only a part of them having been invested in 2018. In this new phase there will also be contributions from the owners of hotels under a rental regime.

At the beginning of 2018, an agreement was entered into with the German asset manager Deka Immobilien for the sale and subsequent rental of the property in which the NH Collection Barbizon Palace Amsterdam is located. The transaction involves the sale of the building for a gross price of 155.5 million euros (584.5 thousand euros/room), which brought an accounting gain net of taxes of more than 55 million euros in 2018 and a net cash flow of 122 million euros. The sustainable variable income lease of the property will allow the Group to keep operating the hotel for an initial period of 20 years, with the option of exercising two extensions of 20 years each.

Among the main milestones reached over the last years of transformation, the appearance of a new NH Hotel Group value proposition stands out based on the improvement of the quality, experience and the new brand architecture with the NH Collection, NH Hotel and nhow brands. In this vein, the Group improved the customer experience thanks to implementing a solid operational vision, including the new elements making up the hotels’ basic product range, known as Brilliant Basics, which are already in place in all of the establishments and which are contributing to a better experience and higher average score of the customers. In this ongoing improvement of the customer experience, worthy of note in 2018 was the launch of FASTPASS, a combination of three innovative services (Check-in Online, Choose Your Room and Check-out Online), which gives the customer full control over their stay. In this respect, NH Hotel Group has become the first European chain to offer these three services simultaneously.

In its use of quality indicators, NH Hotel Group focuses on measuring quality using new sources of information and surveys with a significant increase in the volume of reviews and number of assessments received. Its average score on TripAdvisor in 2018 was 8.4, the same level as in December 2017. Additionally, its average Google Reviews score was 8.5, compared with 8.3 in December 2017. These average scores show the high level of quality perceived by customers.

Also, the NH Rewards loyalty programme, exceeded 8.6 million members (8.4 million members in 2017), of whom 13% joined in 2018 and 18% of the total are active.

Meanwhile, in 2018, the Group began operating 10 hotels in Havana, Marseilles, Brussels, Monterrey, Venice, Madrid, Graz, Essen and Toulouse with a total of 1,604 rooms, with a total 350 hotels operating with 54,374 rooms at 31 December 2018.

In addition, the Group signed-up 5 hotels with 580 bedrooms in 2018. All firms have been under rental and management formulas, under the NH and NH Collection brands and in major cities (Havana, Hanover, Hamburg, Porto and Guadalajara).

In relation to the Master Agreement for Global Hotel Transaction and Management entered into by NH with Grupo Inversor Hesperia, S.A. (“GIHSA”) relating to the management of NH of 28 GIHSA hotels, in September, GIHSA sent NH the “Notification of Termination through Takeover” on the occasion of the takeover bid made by MHG Continental Holding (Singapore) Pte. Ltd., a company wholly owned by Minor International Public Company Limited, for the shares representing 100% of the capital of NH. Thus, following the result of the takeover bid in October, in which Minor International obtained the “Effective Takeover” by reaching a 94.13% stake in NH, on 30 November 2018, the effective termination of all management contracts between GIHSA and NH was formalised, with GIHSA having paid NH all amounts due, including the “Net Price Refund Amount”.

Revenues in 2018 totalled 1,613.4 million euros, an increase of +4.4% (+67.8 million euros) with respect to 2017. The Profit for the year attributable to the Parent was 117.8 million euros compared with 35 million euros in 2017.

Noteworthy is the application of accounting standards NIC 29 after the declaration of Argentina as a hyperinflationary economy, affecting to the accounting result of the Company (see Note 2.2).

In this year gross borrowing decreased from 716.9 million euros in December 2018 to 418.9 million euros in December 2018. At 31 December 2018, cash and cash equivalents amounted to 265.9 million euros (80.2 million euros at 31 December 2017). Additionally, this liquidity was complemented by credit lines at the end of the year amounting to 350.4 million euros, of which 250 million euros corresponded to a long-term syndicated credit line, compared to 316.3 million euros at 31 December 2017.

As indicated in Note 15, the reduction in gross debt in the period is mainly explained by the early conversion of the 250-million-euro convertible bond in June 2018 and the voluntary partial repayment of the 40-million-euro Bonds maturing in 2023.

The Bond conversion took place through the delivery to the bond-holders who requested the early conversion (248.3 million euros of the total face value of 250 million euros) of 8.6 million treasury shares and 41.9 million new issue shares. Meanwhile, bond-holders who did not request conversion received 1.7 million euros face value plus the corresponding accrued interest.

As a consequence of the change of control in the Company’s shareholder structure, in September 2018 the creditors of the Syndicated Credit Facility unanimously waived the amount of 250 million euros, maintaining its maturity until 2021. In addition, and in line with the change of control, the Company offered the Bondholders the repurchase of 101% of the 2023 Bond for an amount of 400 million euros. The amount requested reached only 3.2 million euros of the total nominal amount.

In December 2018, the Company also announced the partial voluntary early redemption, for a nominal amount of 40 million euros (representing 10% of its total nominal amount), of its issue of senior secured bonds maturing in 2023. The redemption was carried out through the payment of approximately 103.76% of the nominal value of the Bonds subject to redemption with a charge to the Company’s available cash.

The Company’s operating improvement has recently been reflected in the improvement of the corporate credit outlooks assigned by the main rating agencies. Fitch upgraded the corporate rating to ‘B+’ from ‘B’ while maintaining the positive outlook for improved operating performance and leverage metrics. In May Moody’s improved their rating from ‘B2’ to ‘B1’, reflecting excellent results, a significant improvement in indebtedness, and greater liquidity. At last, Feburary 12th, S&P revised the outlook from positive to stable.

For its part, the Average Period of Payment to Suppliers (MTP) amounted to 61 days in 2018 (54 days in 2017), with a total amount of payments made of 289.7 million euros (293.0 million euros in 2017). As regards pending payments, they have been reduced from 31.3 million euros in December 2017 to 7.9 million euros in December 2018.

At the General Shareholders’ Meeting in June 2018, shareholders approved the payment of an interim dividend from 2017 results amounting to 40 million euros, representing ten cents gross per outstanding share. For 2018, it foresees a dividend proposal of fifteen cents per share in 2019.

Given the Company’s service sector component, it should be noted that there are no relevant research and development activities.

With regard to the new shareholding situation, between May and September 2018, MINT acquired the shares of the shareholders HNA and Oceanwood. As a result of these transactions, as of 30 September 2018, MINT held 179,772,214 shares in NH Hotel Group, S.A., representing 45.84% of its share capital.

In addition, on 11 June 2018, MINT made a prior announcement of a public offering to acquire 100% of the shares of NH Hotel Group, S.A. at a purchase price of 6.30 euros per share (post dividend 2017). This application was officially submitted on 10 July 2018 by means of a significant event to the CNMV, an application which was admitted for consideration by the CNMV on 19 July 2018.

MINT obtained the corresponding authorisations in competition matters (Spain’s National Authority for Markets and Competition, the CNMC, and Autoridade da Concorrência) in mid-July 2018, as well as the approval by its General Shareholders’ Meeting on 9 August, confirming that, from then on, the public offering was not subject to any additional conditions.

Following the submission of the prospectus to the CNMV on 25 September 2018, the public offering was authorised by the CNMV on 2 October 2018. In addition, once the period for acceptance of the tender offer expired on 26 October 2018, the CNMV announced that the tender offer had been accepted for 88.85% of the target shares, representing 47.76% of the shares in NH Hotel Group, S.A.

As a result of the settlement of the public offering on 31 October 2018, MINT currently owns 369,165,609 shares in NH Hotel Group, S.A. representing 94.13% of its share capital.

Since then, both companies have begun to explore joint value creation opportunities for the coming years.

Minor Hotels and NH Hotel Group will integrate their trademarks under a single corporate umbrella present in more than 50 countries around the world. In this way, a portfolio of more than 500 hotels under eight brands is organised: NH Hotels, NH Collection, nhow, Tivoli, Anantara, Avani, Elewana and Oaks, which completes a wide and diverse spectrum of hotel proposals connected to the needs and desires of global travellers.

Both groups currently share their knowledge base and experience in the sector in order to materialise short-term opportunities, taking advantage of the complementarity of their hotel portfolios, the implementation of economies of scale with a broader customer base and exploring development pathways for all their brands in different geographical areas. On February 7th 2019 a Master Agreement was signed with the aim to establish a transparent framework of relations between the Company and Minor.

Analysis of IFRS 16 first application

IFRS 16 establishes the principles for the recognition, measurement, presentation and disaggregation of leases and requires lessees to account for all leases under a balance sheet recognition model similar to the accounting for finance leases. Low-value asset leases and short-term leases (periods of less than 12 months) are excluded. IFRS 16 came into force on 1 January 2019 and the Group decided not to apply it early.

The standard provides that at the inception of the lease, the lessee must record a liability equal to the present value of the fixed lease payments. An asset that represents the right to use the underlying asset during the lease term (the right of use) is recognised. Lessees are required to record separately the interest expense of the lease liability from the amortisation expense of the right of use.

Transition to IFRS 16

The Group decided to apply the modified retrospective method as the transition method to IFRS 16, calculating the asset at the commencement date of each identified contract and the liability at the transition date, using for the calculation of both the incremental interest rate at the transition date and recognising the difference between the two items as an adjustment to the opening balance of the consolidated reserves.

In order to determine the term of the lease contracts, the Group has taken as non-cancellable the initial term of each contract, taking the possible unilateral extensions at the option of the Group only in those cases in which it has been reasonably considered certain that they will be exercised, and only the cancellation options whose exercise has been reasonably considered certain have been taken into account.

The impact of IFRS 16 on the Group’s consolidated financial statements is significant, due to the weight of the Group’s rented rooms, close to 62%, as well as the duration of these contracts.

The estimated impact at 1 January 2019 will result in an increase in assets for usage rights of approximately 1.7 billion euros, an increase in liabilities for operating leases of approximately 2.1 billion euros and a decrease in reserves of 0.4 billion euros.

The Group estimates that the net profit before tax will decrease by approximately 5 million euros, taking into account the portfolio at the transition date, without considering additions, deletions or amendments to contracts that might occur after that date.

It should be noted that the higher operational lease liability impacts indicated above is in line with average of the calculations published by the rating agencies.

ETHICS

Compliance System

Since 2014, NH Hotel Group has deployed a Compliance unit whose scope includes the following key areas:

- Code of Conduct.

- Criminal Risk Prevention Plan.

- Internal Rules of Conduct.

- Procedure for Conflicts of Interest.

Code of conduct

In line with its ethical commitment and the best practices of corporate governance, NH Hotel Group has carried out communication, awareness and training campaigns on Compliance since the last update to the Code of Conduct in 2015. The Group’s Board of Directors is responsible for approving the Code of Conduct.

This document affects everybody working at NH Hotel Group, applicable to employees, managers and members of the Board of Directors, and also in certain cases to other stakeholders such as customers, suppliers, competitors and shareholders, and to the communities where NH operates its hotels.

The Code of Conduct summarises the professional behaviour expected of NH Hotel Group employees, who commit to acting with integrity, honesty, respect and professionalism in the performance of their work.

The NH Group is committed to compliance with the laws and regulations of the countries and jurisdictions where it operates. This includes, amongst other things, laws and regulations on health and safety, discrimination, taxation, data privacy, competition, prevention of corruption and money laundering, and commitment to the environment.

The Code of Conduct is published in six languages on the official website of the NH Hotel Group, available to all stakeholders. Also, since 2017, NH employees can use the “My NH” app to access the code of conduct from their mobile devices. The staff at centres operating under NH Hotel Group brands also have a handbook and an FAQs document.

Compliance Committee

In 2014 the NH Hotel Group created a Compliance Committee consisting of certain members of the Management Committee and senior directors. This body is empowered to supervise compliance with the Group’s Internal Rules of Conduct, Procedure for Conflicts of Interest, Code of Conduct and Criminal Risk Prevention Plan.

The Compliance Committee supervises the management of the Compliance Office, provides detailed reports of activities to the Board’s Audit and Control Committee, and is empowered to impose disciplinary measures on employees in matters within its scope.

In the course of 2018, there were six meetings of the Compliance Committee.

Compliance Office

The Compliance Office, led by the Group’s head of Compliance, is responsible for disseminating and supervising compliance with the Code of Conduct and for drafting the Criminal Risk Prevention Plan. The Compliance Office reports directly to the Compliance Committee. On the other hand, the head of Internal Audit manages the Confidential Channel for Complaints and Queries relating to the Code of Conduct.

The procedure for managing complaints received via the complaints channel are specified in detail in the Code of Conduct. This procedure guarantees confidentiality and respect in every phase, and protects against retaliation.

Over the course of 2018, there were 81 reports of alleged breaches of the Code of Conduct, all of which were investigated, with appropriate disciplinary measures being taken in 60 cases.

Meanwhile, in 2018 the Criminal Risk Prevention Matrix in Spain was rationalised to provide a more efficient model for the company. Over the year, the Compliance Office deployed the Criminal Risk Prevention Plan in the seven most important countries where the Group operates.

Drafting the anti-corruption and anti-fraud policy

On 31 January 2018, NH’s Board of Directors approved the Anti-Corruption Policy, in its commitment to detect and prevent the commission of corruption offences in business within the company. In order to reduce exposure to regulatory risks of a criminal nature, specifically to the risk of crimes related to corruption, bribery and fraud, in December 2018, the Compliance Committee approved an update of the Anti-Corruption and Fraud Policy, which will be submitted to the Board for approval during the first quarter of 2019.

The general principles of the Anti-Corruption and Fraud Policy are:

- Zero tolerance of bribery and corruption in the private and public sectors

- Behaviour must be appropriate and legal

- Transparency, integrity and accuracy in financial information

- Regular internal control

- Local legislation shall take precedence if stricter

Drawing up of the anti-money laundering policy

NH’s Code of Conduct reflects a commitment to respect the applicable regulations on anti-money laundering policy, with special attention to diligence and care in the processes of evaluating and selecting suppliers, and in payments and collections in cash. Therefore, the Compliance Committee meeting of 19 December 2018 approved a policy that reinforces NH Hotel Group’s commitment to anti-money laundering and combating the financing of terrorism, with the aim of detecting and preventing NH Hotel Group, S.A. and its group companies from being used in money laundering or terrorist financing operations. This policy will be submitted for approval to the Board of Directors of NH Hotel Group, S.A. during the first quarter of 2019; once approved, it will be disclosed to all employees and will be accompanied by specific supplementary training.

The Non-Financial Information Statement, issued by the Board of Directors on 25 February 2019, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This report is available on the NH Hotel Group corporate website (https://www.nh-hoteles.es/corporate/es) in the annual reports included under financial information in the shareholders and investors section, with more detail on the subject.

RISK MANAGEMENT MODEL

The NH Hotel Group’s Risk Management reflects the company’s operations and culture, and impacts the implementation of its management actions, including risk identification, approval and management. The Board of Directors is responsible for defining the Risk Control and Management Policy of the NH Hotel Group, and regularly supervises the Risk Control and Management System through the Board’s Audit and Control Committee.

Since November 2015, the NH Hotel Group has had a risk policy approved by the Board of Directors. The aim of this corporate policy is to define the basic principles and the general framework of action to identify and control risks of any nature which may affect NH. This policy applies to all companies over which the NH Hotel Group has effective control.

NH Hotel Group’s risk management system aims to identify events that may negatively affect achievement of the objectives of the Company’s Strategic Plan, providing the maximum level of assurance to shareholders and stakeholders and protecting the group’s revenue and reputation.

The model set up to manage risks is based on the ERM (Enterprise Risk Management) methodology and includes a set of methodologies, procedures and support tools which enable the NH Hotel Group to:

- Identify the most significant risks that could affect achievement of strategic objectives To this end, each risk assessor within the Company can propose new risks within the SAP GRC tool for subsequent assessment.

- Analyse, measure and assess such risks depending on their probability of occurrence along with their impact, which is assessed from a financial and reputational point of view.

- Prioritise such risks.

- Identify measures to mitigate such risks based on the group’s risk appetite. This is firmed up by defining risk managers and setting up action plans agreed by the Management Committee.

- Monitor mitigation measures set up for the main risks.

- Periodically update risks and their assessment.

The Company’s Risk Map is updated annually and, after validation by the Audit and Control Committee, approved by the Board of Directors. The 2018 Risk Map was validated by the Audit and Control Committee at its meeting held on 18 December 2018 and was approved by the Board of Directors on February 7th 2019.

For the first time, the exercise was performed using the SAP GRC tool, which significantly reduced the time spent planning and evaluating risks and controls, in addition to becoming a single point of information at the Company, at global level, in relation to Risk Management.

In addition, each of the main risks on the Company’s Risk Map is assigned to a Risk Owner, who in turn is a member of the Management Committee. Each risk manager reports periodically to the Audit and Control Committee (according to an established schedule) to present the existing or ongoing mitigation measures for its risks, the state of implementation of action plans and the measurement of key indicators. Over the course of 2018, risk managers turned to the Audit and Control Committee to present their corresponding risks.

In general, the risks to which the Group is exposed can be classified into the following categories.

- Financial Risks, such as fluctuation of interest rates, exchange rates, inflation, liquidity, non-compliance with financing undertakings, restrictions on financing and credit management.

- Compliance Risks, arising from possible regulatory changes, interpretation of legislation, regulations and contracts, and non-compliance with internal and external regulations. Tax and environmental risks are included under this heading. It also covers Reputational Risks, arising from the company’s behaviour which negatively affects fulfilment of the expectations of one or more of its stakeholders (shareholders, customers, suppliers, employees, the environment and society in general).

- Business Risks generated by inadequate management of procedures and resources, whether human, material or technological. This category encompasses difficulty in adapting to changes in customer demand, including those caused by

- External Risks, arising from natural disasters, political instability or terrorist attacks.

- Systems Risks, produced by attacks or faults in infrastructures, communications networks and applications that may affect security (physical and logical) and the integrity, availability or reliability of operational and financial information. This heading also includes business interruption risk.

- Strategic Risks, produced by difficulty accessing markets and difficulties in asset disinvestment.

Finally, the Company has an Executive Risk Committee to support the periodic monitoring of risks (monitoring of action plans and key indicators), support initiatives and activities related to the implementation of action plans, as well as creating a culture of risks in the Company. This Committee met twice during the year.

New data protection plan

Due to the mandatory application of the General Data Protection Regulation (GDPR) in the European Union from May 2018, NH Hotel Group has launched a plan to guarantee compliance with the regulation, included in and aligned with the Transformation Plan.

This new plan includes general privacy measures by default, so that all the company’s activities, applications, processes, and projects will take privacy matters into account. The plan includes key initiatives such as the effective management of personal data infringements, the data subject’s consent to the gathering and use of their data, and a policy for the destruction of physical or virtual data. The plan also provides for the creation of a Data Protection Officer within the NH Hotel Group.

The Non-Financial Information Statement, issued by the Board of Directors on 25 February 2019, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This report is available on the NH Hotel Group corporate website (https://www.nh-hoteles.es/corporate/es) in the annual reports included under financial information in the shareholders and investors section, with more detail on the subject.

CORNERSTONES AND COMMITMENTS OF THE CSR PLAN

In 2018, with the aim of leading responsible behaviour in the sector, NH Hotel Group continued with the implementation of its 2017-2019 Strategic Corporate Social Responsibility Plan, establishing the main objectives and initiatives for the different responsibility commitments defined by the Company for this year.

The Company’s CSR Plan has a clear purpose with the generation of a positive economic, social and environmental impact wherever it is present. The innovative “Room 4” concept represents these goals, linked to the business of the NH Hotel Group and its key stakeholders. This cross-department three-year plan was approved by the company’s main governing bodies and has the commitment of all areas of the Group. As the starting point for the creation of the Plan, on the one hand a materiality analysis was performed to determine the key aspects for the NH Hotel Group according to its strategy and stakeholders, and on the other, the company’s Corporate Social Responsibility policy. It was also linked to the United Nations’ Sustainable Development Goals (SDGs).

The Plan, which is deployed alongside the Group’s global strategy, includes its main commitments on responsibility and the development of lines of action in the priority areas for the company: commercial, employee commitment, investment, brand purpose, corporate governance, and supplier assessment.

It also specifies the annual progress report on the Plan, both for the Group as a whole and by business unit, to the Board of Directors and Management Committee.

The Corporate Social Responsibility Plan is based on three core areas for action: People, Planet, and Responsible Business.

More specifically, in its responsible commitment to the Planet, NH Hotel Group works to minimise its impact on climate change, increase the efficiency of resources and develop more sustainable products. All this minimises its environmental footprint, with responsible consumption of natural resources.

The Non-Financial Information Statement, issued by the Board of Directors on 25 February 2019, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This report is available on the NH Hotel Group corporate website (https://www.nh-hoteles.es/corporate/es) in the annual reports included under financial information in the shareholders and investors section, with more detail on the subject.

Human Resources strategy

The average number of people employed by the Parent Company and consolidated companies in 2018 is 10,956 employees.

The corporate culture of the NH Hotel is also based on the cornerstones of diversity and equality. At 31 December 2018, women made up 50.9% of the total workforce.

Also, the average age of employees at 31 December 2018 is 38.8 years old, and their average time with the company is 9 years.

Over this year, as part of the company’s 2017-2019 Strategic Plan, the Human Resources strategy has continued, based on three main commitments:

- Global leadership and talent management: Ensuring the company’s future by involving the best employees, and identifying and developing the most talented people in the NH Hotel Group, using competitive tools and mechanisms to ensure their retention and commitment.

- Maximum performance and better workplaces: Becoming a company recognised as a Best Place to Work, based on the high level of commitmentamongst employees, active contribution to this goal, rigour in differentiating and recognising high performance, and increasing its recognition as an attractive employer.

- Transformation and reinvention: Searching for, assessing and leveraging opportunities to be more efficient (outsourcing, digitisation, etc.), evolving working environment and acquiring advanced analytical and predictive skills.

All the above must be based on and solidly backed by Operational Excellence in Human Resources and Internal Communication, with clear policies and processes, meeting commitments proactively, continuing to support, develop and implement the operational model of the NH Hotel Group, and controlling payroll costs and related budget items.

Environment

For the NH Hotel Group, sustainability drives innovation, seeking to surprise our guests as well as achieving efficiencies in the use of water and energy. In the responsible commitment to the Planet, NH Group works to minimise the impact on Climate Change, increase the efficiency of resources and develop more sustainable products. All this minimises the environmental footprint with responsible consumption of natural resources.In 2018, the implementation of the sustainability initiative continued. This initiative gives continuity to the environmental achievements of recent years. Thus, compared to 2007, per Average Daily Room energy consumption has been reduced by 31%, water consumption by 27% and our carbon footprint by 67%. NH Hotel Group is committed to renewable energy, which reduces its carbon footprint. This consumption of green energy, certified as renewable, is available in 79% of our hotels in Spain, Italy, Germany, the Netherlands, Belgium and Luxembourg, covering 90% of the total electricity consumed in Europe.

NH Hotel Group holds certificates ISO 14001 for environmental management and ISO 50001 for energy efficiency in accommodation, catering, meetings and events. As well as the overall certificates held by the company, 137 of its hotels hold certificates including BREEAM, LEED, Green Key, Hoteles+Verdes, ISO 14001 and ISO 50001, all recognised by the GSTC (Global Sustainable Tourism Council).

NH Hotel Group has reported its climate change commitment and strategy to the Carbon Disclosure Project (CDP) since 2010. In 2018, the Company obtained an A- rating on the Climate Index, placing NH Hotel Group among the leading companies in the adoption of measures to effectively reduce emissions, which is indicative of advanced environmental management. This result positions the company above the average for its sector and region.

Likewise, the NH Hotel Group forms part of FTSE4 Good, an index on the London Stock Exchange which recognises the socially responsible behaviour of companies worldwide.

The Non-Financial Information Statement, issued by the Board of Directors on 25 February 2019, contains all the non-financial information required by Law 11/2018 of 28 December 2018. This report is available on the NH Hotel Group corporate website (https://www.nh-hoteles.es/corporate/es) in the annual reports included under financial information in the shareholders and investors section, with more detail on the subject.

SHARES AND SHAREHOLDERS

NH Hotel Group, S.A. share capital at the end of 2018 comprised 392,180,243 fully subscribed and paid up bearer shares with a par value of €2 each. All these shares carry identical voting and economic rights and are traded on the Continuous Market of the Spanish Stock Exchanges.

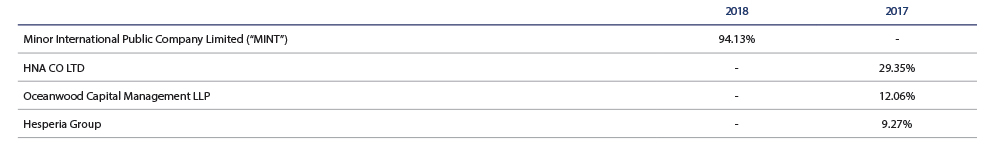

According to the latest notifications received by the Company and the notices given to the National Securities Market Commission before the end of every financial year, the most significant shareholdings at 31 December 2018 and 2017 were as follows:

Changes in the shareholder structure:

Between the months of May and September 2018, various purchase and sale contracts were entered into by Minor International Public Company Limited (“MINT”), as Buyer, and the HNA Group and with funds managed by Oceanwood, all of which as Sellers. As a result of these transactions, MINT acquired all the Sellers’ interests in NH Hotel Group, S.A. In addition to these transactions, MINT acquired several non-significant shareholdings, as a result of which on 30 September 2018 MINT owned 179,772,214 shares in NH Hotel Group, S.A., representing 45.84% of its share capital.

On 11 June 2018, MHG International Holding (Singapore) Pte (a company wholly owned by MINT) launched a takeover bid (“OPA”) for 100% of the shares of NH Hotel Group, S.A., which, once the acceptance period was approved and opened, was accepted, among others, by the Hesperia Group.

As a consequence of the takeover bid, the result of which was notified by the CNMV through a significant event on 26 October 2018, and of the purchase and sale transactions described above, (i) the funds managed by Oceanwood, the HNA Group and the Hesperia Group lost their status as significant shareholders of NH Hotel Group, S.A.; and (ii) MINT acquired, through its wholly-owned subsidiary MHG Continental Holding (Singapore) Pte. Ltd., shares representing 94.13% of the share capital of NH Hotel Group, S.A.

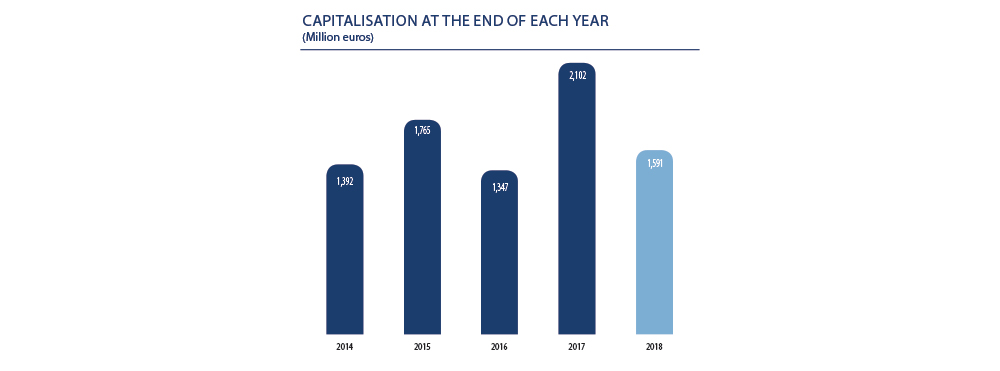

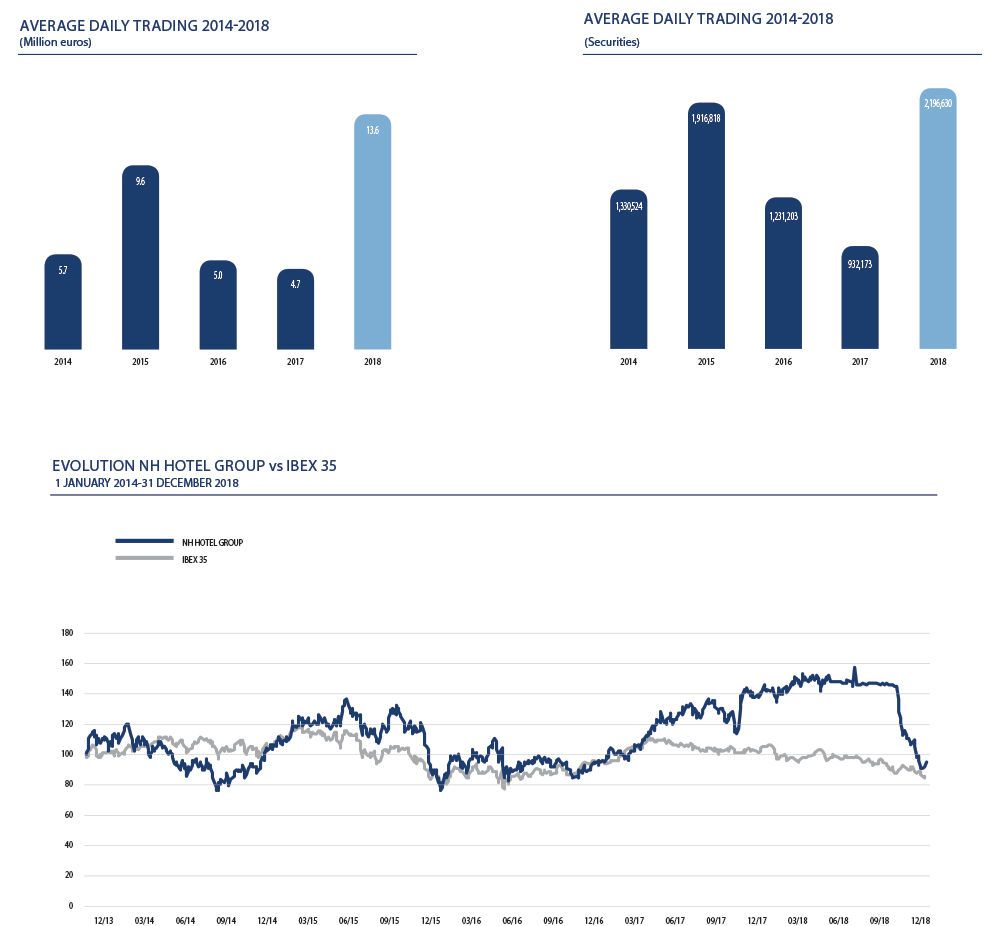

The average share price of NH Hotel Group, S.A. in 2018 was 6.18 euros per share (5.05 euros in 2017). The lowest share price of 3.82 euros per share (3.84 euros in December 2017) was recorded in July and the highest share price of 6.82 euros per share in December (6.26 euros in March 2017). The market capitalisation of the Group at the close of 2018 stood at 1.59068 billion euros (2.10163 billion euros at the close of 2017).

At 31 December 2018, the Group had 600,000 own shares, 9,416,368 own shares at 31 December 2017. The reduction in treasury shares over the period can be explained by the following movements:

- Due to the early conversion of convertible bonds in June 2018, the loan of 9,000,000 shares associated with the issue was permanently cancelled, and the 1,384,473 shares held by one of the entities participating in the loan of securities were returned.

- In 2018, NH employees were given 247,106 shares as part of the 2015-2017 Incentive Plan, with a total of 430,738 gifted shares.

- In June 2018 the Group delivered 8,569,262 own shares to bond-holders for the early conversion of convertible bonds worth 250 million euros.

A total of 560,140,781 shares in NH Hotel Group, S.A. were traded on the Continuous Market over the course of 2018 (237,704,360 shares in 2017), which accounted for 1.43 times (0.68 times in 2017) the total number of shares into which the Company’s share capital is divided. Average daily share trading on the Continuous Market amounted to 2,196,630 securities (932,173 in 2017).

FUTURE OUTLOOK

Forecasts indicate that this strong momentum will continue in 2019, although at a more sustainable pace after nine years of constant expansion after the economic and financial crisis of 2009. Based on current trends, the economic outlook and the UNWTO tourism confidence index, international arrivals are expected to grow by between 3% and 4% in 2019, more in line with historical growth trends.

On the other hand, GDP growth in Europe is expected to be +1.9% in 2019 (Data and estimates provided by the E.C. “European Economic Forecast – Autumn 2018” November 2018).

It is noteworthy the volatility that Latin-American currencies may have during 2019 that may have an impact on the economic growth of such region and in the consolidated results of the group.

In this economic environment, the Group expects to benefit from the increase in sales associated with GDP growth expectations in 2019, together with the positive impact of the repositioning investments made in the last two years and supported by the implementation of price management tools which will allow us to continue to optimise this strategy.

EVENTS AFTER THE REPORTING PERIOD

On February 7, 2019 NH Hotel Group has subscribed with Minor IPC i) a Framework Agreement that aims to establish a transparent framework of relations between the Company and Minor and its group companies, which, among others, includes criteria for the allocation of expenses between both Companies, all in compliance with the Recommendation Two of the Code of Good Governance of Listed Companies and ii) a reciprocal agreement of trademark license, by which both parties are licensed the use of their respective trademarks in the geographical areas where the other party operates. The subscription of the mentioned agreements was duly approved by the Board of Directors, after a favorable report from the Audit and Control Committee and communicated by Relevant Event on February 7, 2019.

On January 15, 2019, the sale of its 49% stake in the company Beijing NH Grand China Hotel Management CO, Ltd. was executed, this sale was a cash inflow of 1.9 million euros.