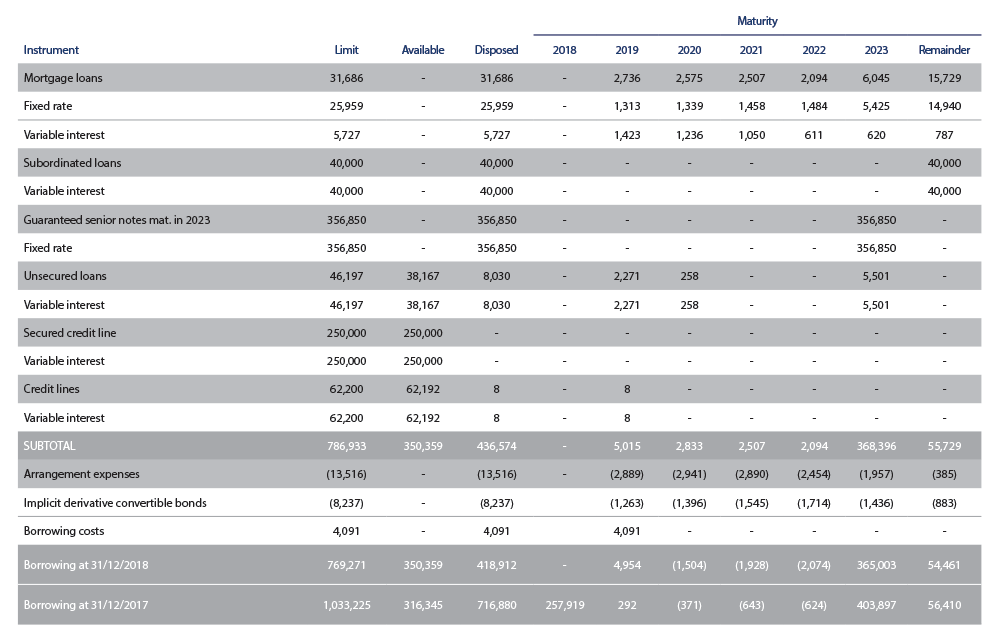

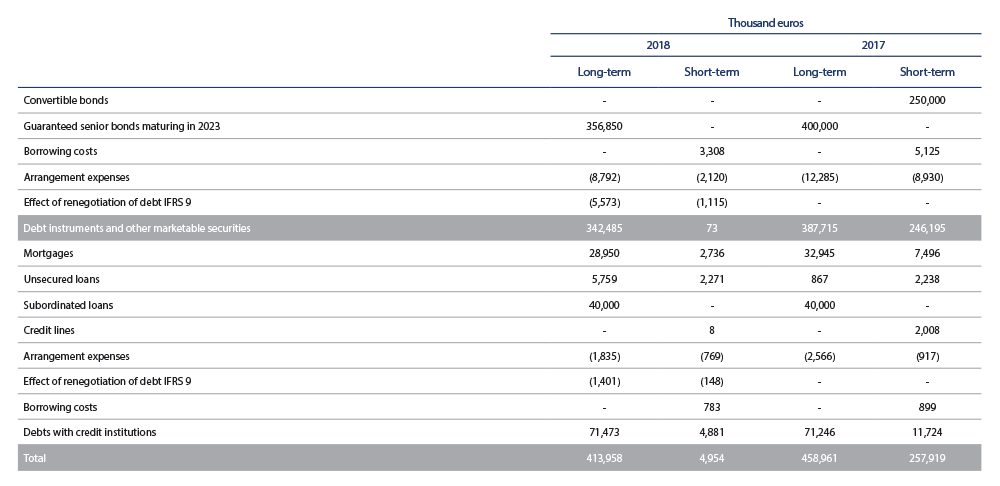

The balances of the “Bonds and other negotiable securities” and “Debts with credit institutions” items at 31 December 2018 and 2017 were as follows:

The effect of debt movement on the Group’s cash flows as reflected in the cash flow statement is affected by non-cash movements generated by exchange rate differences as the group has debts in currencies other than the euro.

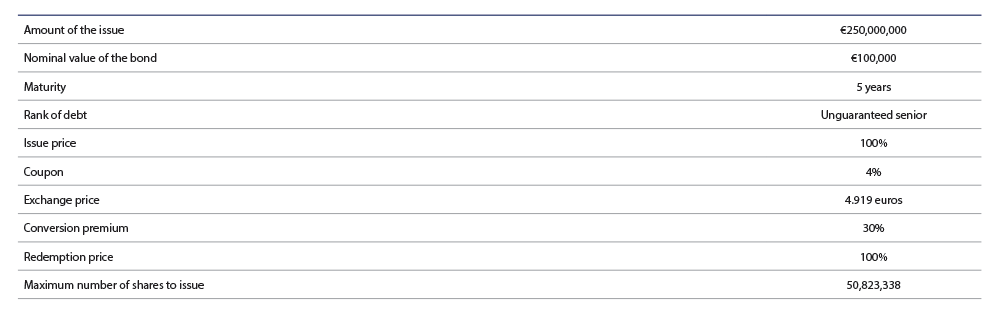

Convertible bonds

On 31 October 2013, the Parent Company placed convertible bonds among institutional investors, for a total of 250,000 thousand euros, with the following characteristics:

In 2018 the Group announced the early conversion, at the bondholders’ choice, of the convertible bonds whose execution period ended on 11 June 2018. The result of the early conversion was the delivery of 248.3 million euros of the total nominal amount of 250 million euros to the bondholders who requested the early conversion. This delivery was made by the Group through the delivery of 8.6 million treasury shares and 41.9 million newly issued shares (see Note 14). Meanwhile, bond-holders who did not request early conversion received 1.7 million euros face value plus the corresponding accrued interest.

Due to this conversion, the loan of 9,000,000 shares associated with the issue was permanently cancelled, and the 1,384,473 shares held by one of the entities participating in the loan of securities were returned; these shares were used for the early conversion of the bond (see Note 14).

Secured senior bonds maturing in 2023

On 23 September 2016 the Parent Company placed guaranteed senior bonds, which mature in 2023, at the nominal value of 285,000 thousand euros. The nominal yearly interest rate for said issuance of notes is 3.75%. On 4 April 2017, the parent company issued an extension of guaranteed senior bonds maturing in 2023 for a nominal amount of 115,000 thousand euros with an implicit cost until maturity of 3.17%. The outstanding nominal amount at 31 December 2018 is 356,850 thousand euros (see the heading “Depreciation and Amortisation 2018”).

Depreciation and Amortisation 2018

As a result of the change of control (see Note 14) and as established in the voluntary repurchase and early redemption offer for the issue of senior secured bonds maturing in 2023 (the “Bonds”) due to the change of control, requests were received for the repurchase and redemption of bonds for a nominal amount of 3,150 thousand euros.

The bond repurchase offer was settled on 12 November 2018, the date on which the Company paid an aggregate amount of 3,195 thousand euros to the bondholders, who accepted the offer as a whole:

• Nominal paid in advance: 3,150 thousand euros

• Unpaid accrued interest: 13.5 thousand euros

• Amount of the repurchase premium: 31.5 thousand euros

On 14 December 2018, the Company carried out the partial voluntary early redemption, for a nominal amount of 40,000 thousand euros (representing 10% of its original total amount), of the issue of senior secured bonds maturing in 2023 (the “Bonds”), by means of a linear pro rata reduction of the nominal value of all the bonds in circulation. The Bonds were redeemed early through the payment of approximately 103.760% of the nominal value of the Bonds being redeemed, including:

• Nominal paid in advance: 40,000 thousand euros

• Unpaid accrued interest: 304.2 thousand euros

• Amount of the repurchase premium: 1,200 thousand euros

The Company paid the partial redemptions from available cash.

Secured credit line

On 22 September 2016, the Parent Company and NH Finance, S.A. entered into a revolving business credit with credit institutions amounting to 250,000 thousand euros (“syndicated credit line”) with a maturity of three years, extendable to five years at the time of the refinancing of the guaranteed senior notes maturing in 2019. As a consequence of the refinancing and early payments of the guaranteed senior notes maturing in 2019 which took place in 2017, the maturity date of said financing was extended to 29 September 2021. At 31 December 2018, this financing was not available.

Obligations required in the senior note indentures maturing in 2023 and in the syndicated credit line

The senior notes maturing in 2023 and the syndicated credit line require the fulfilment of a series of obligations and limitations of essentially homogeneous content as regards the assumption of additional borrowing or provision of guarantees in favour of third parties, the granting of real guarantees on assets, the sale of assets, investments that are permitted, restricted payments (including the distribution of dividends to shareholders), transactions between related parties, corporate transactions and disclosure obligations. These obligations are detailed in the issue prospectus for the aforementioned notes, as well as in the credit agreement of the syndicated credit line.

In addition, the syndicated credit line requires compliance with financial ratios; in particular (i) an interest coverage ratio of ≥ 2.00x, (ii) a debt coverage ratio of ≤ 5.50x, and (iii) a Loan to Value (“LTV”) ratio which, as a result of the redemption of the 2019 senior secured obligations due in 2017, depends on the level of NH’s net indebtedness at any given time as indicated below:

– Debt-to-income ratio > 4.00x: LTV ratio = 70%

– Debt-to-income ratio ≤ 4.00x: LTV ratio = 85%

– Debt-to-income ratio ≤ 3.50x: LTV ratio = 100%

As a result of the early redemption of the convertible bonds and of the Group’s reduced net debt-to-income ratio, the maximum LTV permitted at 31 December 2018 is 100%.

At 31 December 2018 these ratios were completely adhered to.

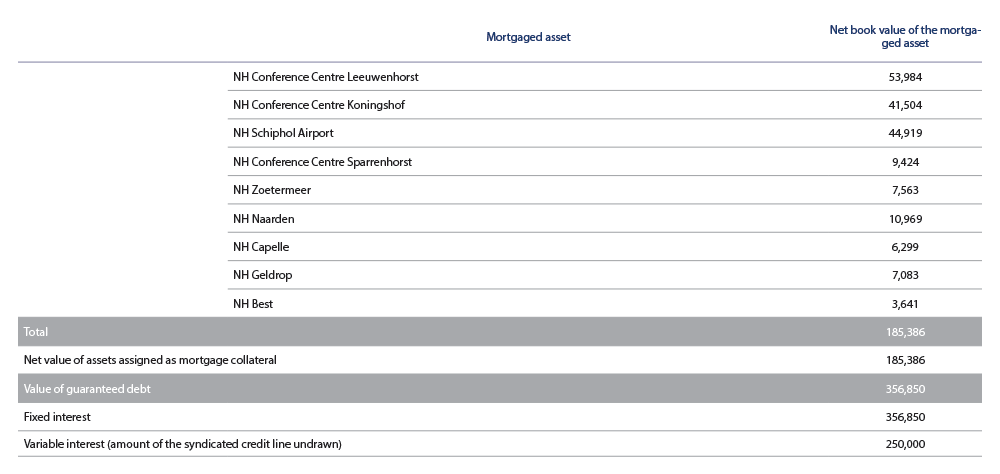

Package of guaranteed senior notes maturing in 2023 and syndicated credit line

The guaranteed senior notes maturing in 2023 and syndicated credit line (undrawn at 31 December 2018) share the following guarantees: (i) pledge of shares: 100% of the share capital of (A) Diegem, (B) Immo Hotel BCC NV, (C) Immo Hotel Brugge NV, (D) Immo Hotel Diegem NV, (E) Immo Hotel GP NV, (F) Immo Hotel Mechelen NV, (G) Immo Hotel Stephanie NV, (H) Onroerend Goed Beheer Maatschappij Van Alphenstraat Zandvoort, B.V. and (I) NH Italia, S.p.A. (ii) first-tier mortgage guarantee on the following hotels located in the Netherlands: NH Conference Centre Koningshof, owned by Koningshof, B.V.; NH Conference Centre LeeuweNHorst, owned by LeeuweNHorst Congres Center, B.V.; NH Schiphol Airport, owned by Onroerend Goed Beheer Maatschappij Kruisweg Hoofddorp, B.V.; NH Zoetermeer, owned by Onroerend Goed Beheer Maatschappij Danny Kayelaan Zoetermeer, B.V.; NH Conference Centre SparreNHorst, owned by SparreNHorst, B.V.; NH Best, owned by Onroerend Goed Beheer Maatschappij Maas Best, B.V.; NH Capelle, owned by Onroerend Goed Beheer Maatschappij Capelle aan den IJssel, B.V.; NH Geldrop, owned by Onroerend Goed Beheer Maatschappij Bogardeind Geldrop, B.V.; and NH Naarden, owned by Onroerend Goed Beheer Maatschappij IJsselmeerweg Naarden, B.V. and the joint guarantee on first demand of the main operating companies in the group wholly owned by the Parent Company.

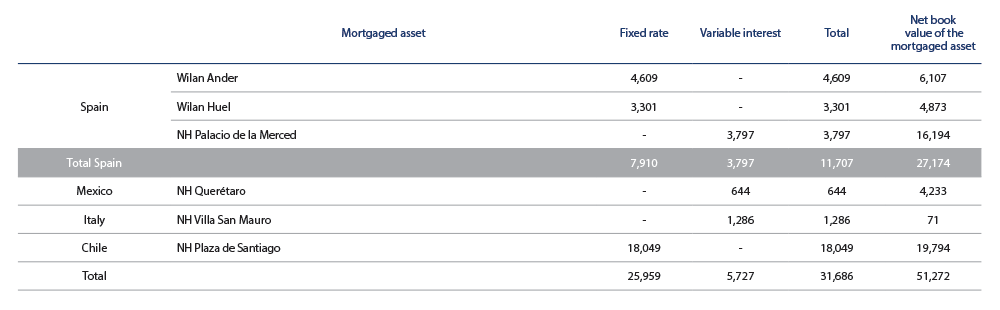

Additionally, there are assets granted as mortgage security against the syndicated credit line of 250,000 thousand euros (undrawn at 31 December 2018) and guaranteed senior notes in the joint amount of 356,850 thousand euros, maturing in 2023, can be broken down as follows (in thousand euros):

Limitation on the distribution of Dividends

The guaranteed senior notes maturing in 2023 and the syndicated credit line described above contain clauses limiting the distribution of dividends.

In the case of the senior notes maturing in 2023, the distribution of dividends is generally permitted provided that (a) the interest coverage ratio is > 2.0x and (b) the sum of restricted payments (including dividends and repayment of subordinated debt) made since 8 November 2013 is less than the sum of, amongst other items, (I) 50% of NH’s consolidated net income (even though in the calculation of net income, 100% of consolidated net losses must be deducted) from 1 July 2013 to the date of the last quarterly accounts available (this is what is known as the CNI Builder) and, (ii) 100% of the net contributions to NH’s capital from 8 November 2013.

Additionally, as an alternative and without having to be in compliance with the previous condition: (i) in the case of bonds maturing in 2023, NH may distribute dividends provided that the leverage ratio (gross debt/EBITDA) does not exceed 4.5x.

Finally, and also alternatively and without having to be concurrent with the previous ones, the notes maturing in 2023 establish a franchise to be able to make restricted payments (including dividends) without needing to comply with any specific requirement, for a total aggregate amount of 25,000,000 euros as of November 2013.

In the case of the syndicated credit line, the distribution of a percentage of the NH Group’s consolidated net profit from the previous year is allowed, provided that there has been no breach of the financing agreement and the Net Financial Debt (through the Dividend payment) / EBITDA Ratio is less than 4.0x.

The maximum percentage of the consolidated net profit to be distributed will depend on the Debt Ratio.

Net Financial (through the payment of the Dividend) / EBITDA according to the following breakdown:

– Net Financial Debt / EBITDA ≤ 4.0x: Percentage of consolidated net profit: 75%

– Net Financial Debt / EBITDA ≤ 3.5x: Percentage of consolidated net profit: 100%

– Net Financial Debt / EBITDA ≤ 3.0x: Percentage of consolidated net profit: unlimited

Mortgage loans

The detail of the mortgage loans and credits is as follows (in thousand euros):

Subordinated loan

A loan amounting to 40,000 thousand euros fully drawn at 31 December 2018 and with a single maturity and repayment in 2037, are included in this item. The interest rate of these loans is the 3-month Euribor plus a differential.

Credit lines

At 31 December 2018, the balances under this item include the amount drawn down from credit facilities. The joint limit of these loan agreements and credit facilities at 31 December 2018 amounted to 62,200 thousand euros, of which 8 thousand euros had been drawn down at that date. Additionally, at 31 December 2018, the Parent Company had an undrawn guaranteed syndicated credit line amounting to 250,000 thousand euros, maturing on 29 September 2021 (see caption “Secured credit line”).

Detail of current and non-current payables

The detail, by maturity, of the items included under “Non-Current and Current Payables” is as follows (in thousand euros):