Tax consolidation scheme

The Group operates in many countries and is therefore subject to the regulations of different tax jurisdictions regarding taxation and Corporate Income Tax.

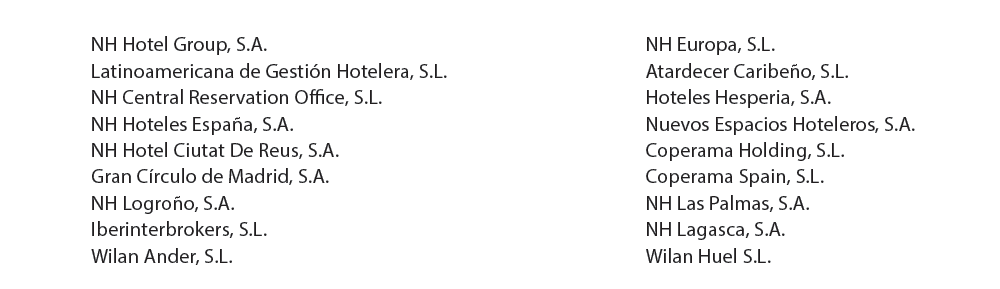

NH Hotel Group, S.A. and another 17 companies with tax domicile in Spain in which it held a direct or indirect stake of at least 75% during the 2018 tax period are subject to the tax consolidation scheme governed by Title VII, Chapter VI of Law 27/2014 on Corporate Income Tax.

The companies belonging to the tax group have signed an agreement to share the tax burden. Hence, the Parent Company settles any credits and debts which arise with subsidiary companies due to the negative and positive tax bases these contribute to the tax group.

The companies that make up the tax consolidation group are the following:

Corporation tax is calculated on the financial or accounting profit or loss resulting from the application of generally accepted accounted standards in each country, and does not necessarily coincide with the tax result, this being construed as the tax base.

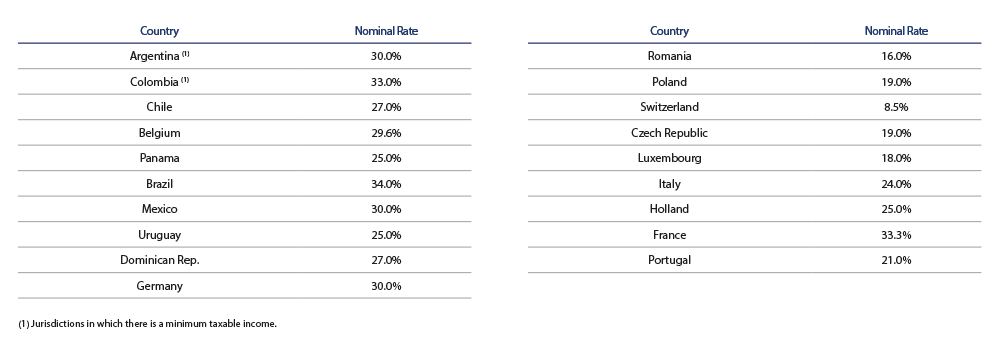

In 2018, Spanish companies pay taxes at the general tax rate of 25% irrespective of whether they apply the consolidated or separate taxation schemes. The foreign companies are subject to the prevailing tax rate in the countries where they are domiciled. In addition, taxes are recognised in some countries at the estimated minimum profit on a complementary basis to Corporation Tax.

The prevailing corporation tax rates applicable to Group companies in the different jurisdictions where the Group has significant operations are as follows:

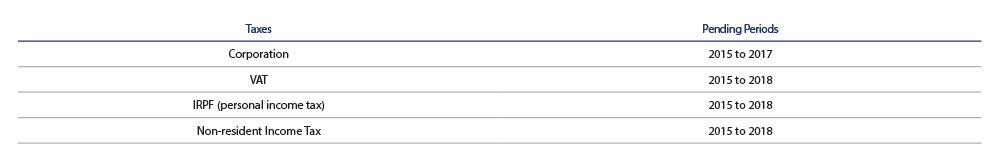

Financial years subject to tax inspection

In accordance with Spanish tax legislation, the years open for review to the Consolidated Tax Group are:

During 2018, in Spain there were no open tax inspections in progress in relation to the taxes included in the previous table.

In Germany, an inspection procedure has been opened which is reviewing the amount of negative tax bases still to be offset by the companies in Germany.

Another inspection procedure has been opened in Austria by the Austrian authorities who are checking the overall tax position of the subsidiary in that country.

Finally, an inspection procedure has been opened in Colombia focused on the deductions of certain Corporation Tax expenses.

The Group’s Directors do not expect any significant contingencies to arise from the conclusions of the inspections.

Regarding the financial years open to inspection in the rest of the group, contingent liabilities not susceptible to objective quantification may exist, which are not significant in the opinion of the Group’s Directors.

Balances with Public Administrations

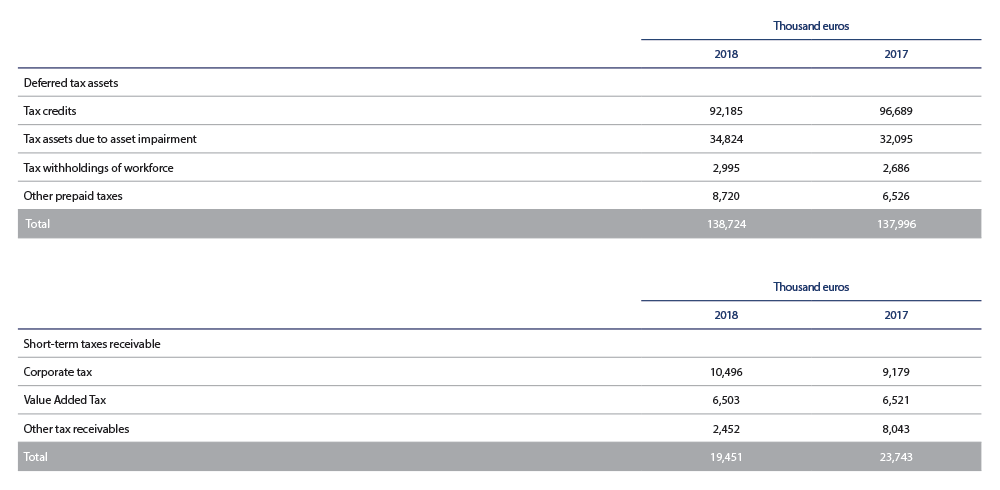

The composition of the debit balances with Public Administrations at 31 December 2018 and 2017 is as follows:

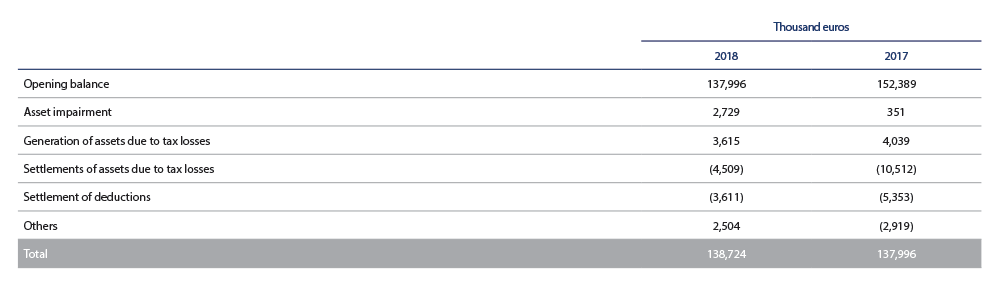

The movements of the “Deferred tax assets” item in 2018 and 2017 were as follows:

The recognition of assets is mainly due to the activation of tax losses in Germany and the Benelux amounting to 2,253 and 1,155 thousand euros respectively, as a result of the positive results expected in future years.

The cancellation of assets is mainly due to the cancellation of tax losses to offset the positive tax bases generated in 2018, in Spain, Belgium and Germany, amounting to 2,456, 173 and 1,841 thousand euros, respectively. Additionally, the cancellation of deductions in Spain has been made in the amount of 3,611 thousand euros as a result of their use to offset the positive share resulting in 2018.

At 31 December 2018, the Group had assets resulting from tax losses and deductions amounting to 92,185 thousand euros (96,689 thousand euros in 2017). At 31 December 2018, the tax credit recovery plan that supports the recognition of these tax credits had been updated. Given that the results of the tax credit recovery plan are satisfactory, the Parent Company’s Directors have decided to maintain the tax credits recognised in the consolidated balance sheet.

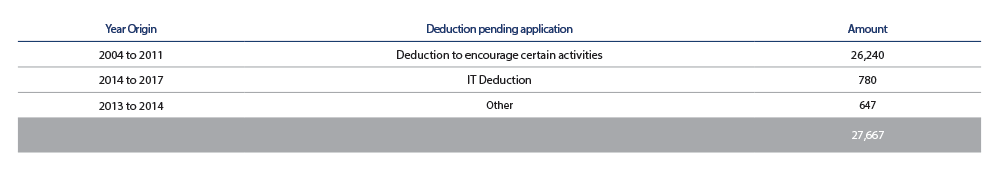

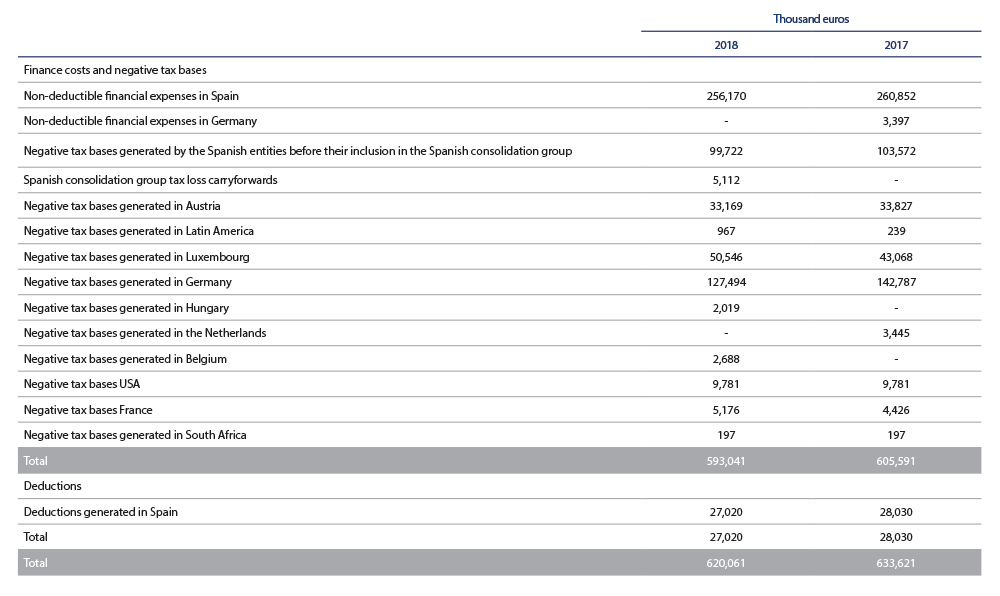

At 31 December 2018, the Group had tax loss carryforwards worth 593,041 thousand euros (605,591 thousand euros at 31 December 2017) and deductions amounting to 27,020 thousand euros (28,030 thousand euros in 2017) that had not been entered in the accompanying consolidated balance sheet because the Directors considered they did not meet accounting standard requirements. These assets are grouped as follows (base amount):

The accumulated amount of financial expenses, which are not considered deductible in the Spanish corporate income tax when exceeding 30% of the operating revenue of the tax group calculated in accordance with Article 16 of Law 27/2014 of 27 December, on Corporate Income Tax, amount to 256,170 thousand euros in 2018 (260,852 thousand euros in 2017). There is no deadline for offsetting non-deductible finance costs.

The changes in non-recorded credits in 2018 were mainly due to the fact that in Spain finance costs not deducted in prior periods were deducted owing to the application of the aforementioned regulations, and losses and deductions were offset against the profit generated in the year. In Germany finance costs were deducted and losses which had passed the tax credit recovery test were recognised.

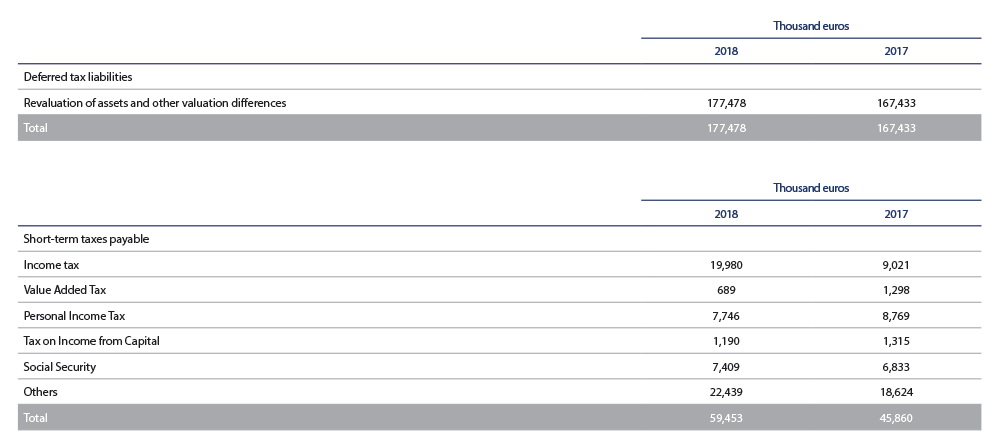

The composition of the credit balances with Public Administrations at 31 December 2018 and 2017 is as follows:

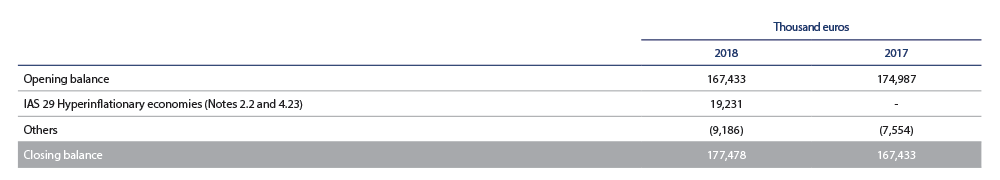

The movements in deferred tax liabilities during 2018 and 2017 are as follows:

The reduction in deferred tax liabilities is mainly due to the reversal of impairment on revalued assets. In addition, a deferred tax liability associated with the conversion of Argentina into a hyperinflationary economy has been recorded, giving rise to the recognition of a deferred tax liability amounting to 19,231 thousand euros (see Notes 2.2. and 4.23).

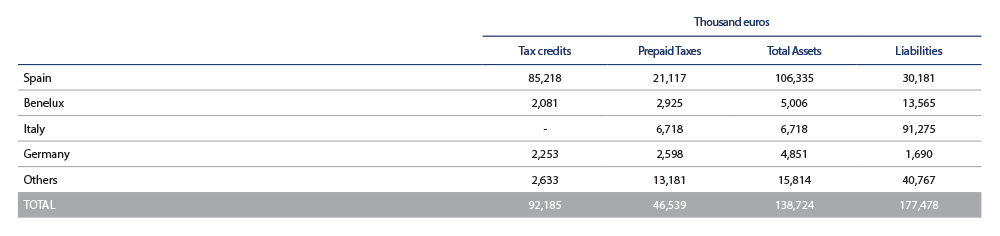

The detail, by country and item, of these deferred taxes is as follows:

Reconciliation of the accounting result to the tax result

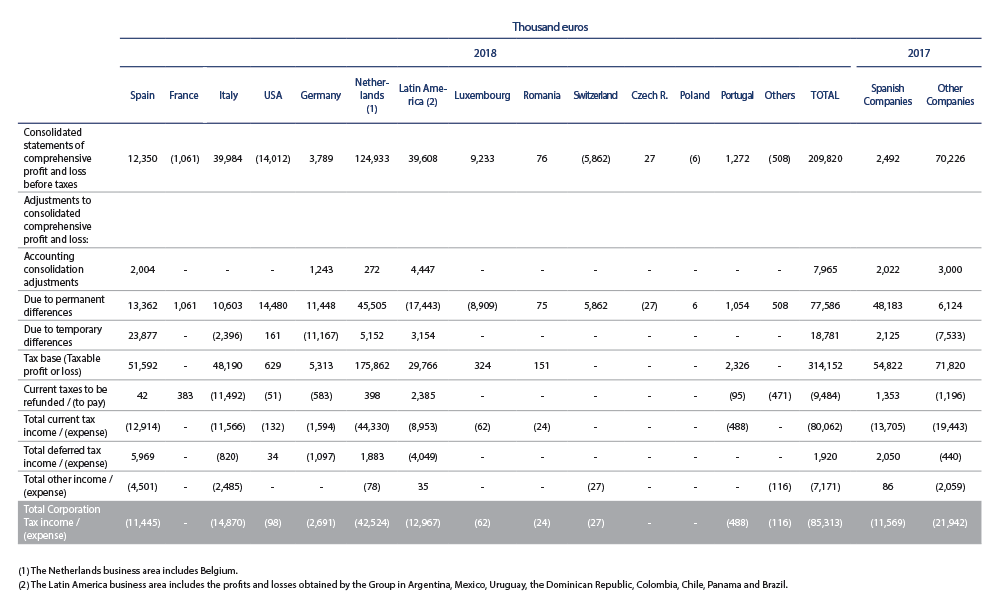

The reconciliation between the consolidated comprehensive profit or loss statements, the corporation tax base, current and deferred tax for the year, is as follows:

Deductions generated by the consolidated tax group of the Parent Company

At 31 December 2018, the Tax Group held the following tax credits carryforward (thousand euros):