Tangible fixed assets are valued at their original cost. They are subsequently valued at their reduced cost resulting from cumulative depreciation and, as appropriate, from any impairment losses they may have suffered.

Due to the transition to IFRS, the Group reappraised the value of some land to its market value on the basis of appraisals made by an independent expert for a total amount of 217 million euros. The reappraised cost of such land was considered as a cost attributed to the transition to the IFRS. The Group followed the criterion of not re-valuing any of its tangible fixed assets at subsequent year-ends.

Enlargement, modernisation and improvement costs entailing an increase in productivity, capacity or efficiency or a lengthening of the assets’ useful life are recognised as increases in the cost of such assets. Conservation and maintenance costs are charged against the consolidated comprehensive profit and loss statement for the year in which they are incurred.

Withdrawn assets and items, whether arising as a result of a modernisation process or due to any other cause, are accounted for by derecognising the balances presented in the corresponding cost and accumulated depreciation accounts.

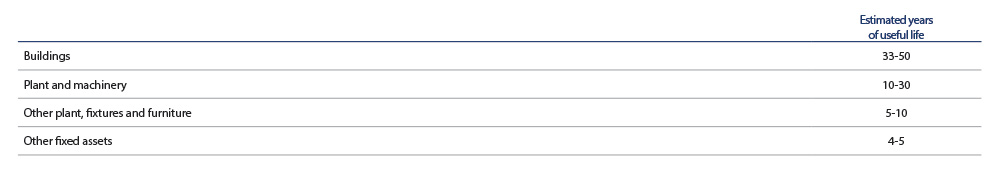

The Group depreciates its property, plant and equipment following the straight line method, distributing the cost of the assets over their estimated useful lives, in accordance with the following table:

These items are depreciated based on their estimated useful life or the remaining term of the lease, if this is less than the useful life.

The profit or loss resulting from the disposal or withdrawal of an asset is calculated as the difference between the profit from the sale and the asset’s book value, and is recognised in the consolidated comprehensive profit and loss statement.