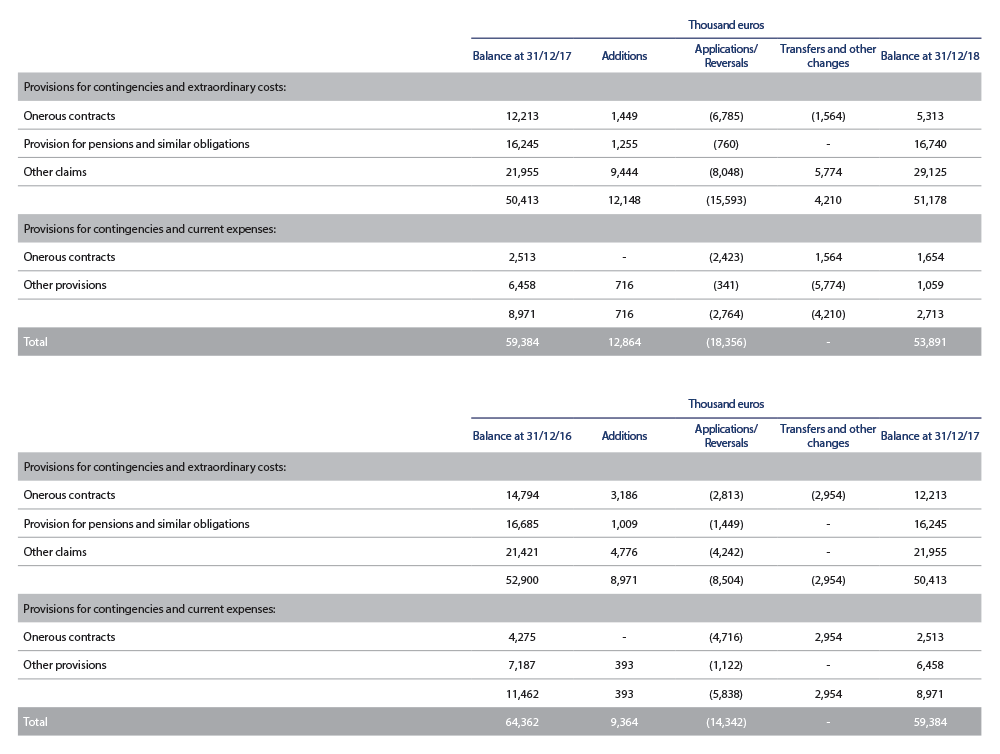

The breakdown of “Provisions for risks and charges” at 31 December 2018 and 2017, together with the main movements recognised in those years were as follows:

Onerous contracts

The Group considers onerous agreements to be those in which the inevitable costs of fulfilling the obligations that such agreements entail exceed the economic benefits expected from them.

The Group records as a provision for onerous contracts the present value of the net losses derived from the contract or the compensation foreseen for abandonment of the contract, if such were decided. These provisions are reversed at the time that either of the above two events is fulfilled.

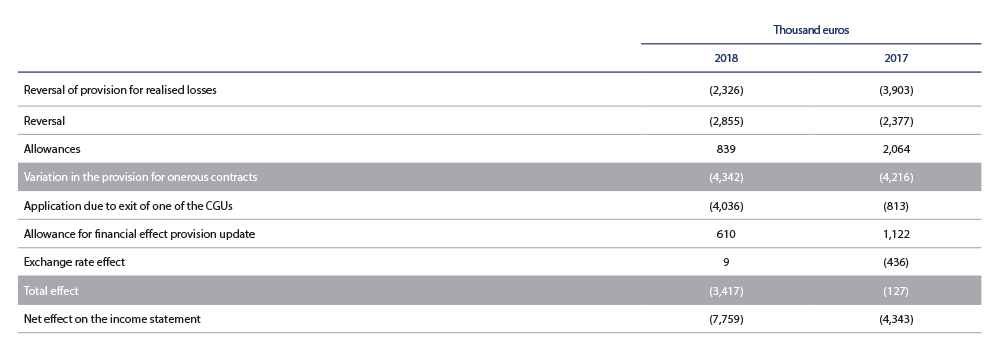

The reversal of the provision for onerous contracts for the year includes, on the one hand, the amount of the provision overdue during the year, and on the other, the re-estimation of the necessary provision at the end of the year. The part of the provision overdue in the year corresponds to the losses recorded by the CGUs in the income statements, while the re-estimation of the provision is due to the improvement in the activity of the CGUs.

The methodology, assumptions and discount rates used to make such estimates follow the same criteria as described in Note 4.4.

The reconciliation between the amount recorded in the income statement and the changes in the provision for onerous contracts for the years ended 31 December 2018 and 2017 is as follows:

Provision for pensions and similar obligations

The “Provisions for pensions and similar obligations” account mainly includes the pension fund of a certain number of employees of the Netherlands business unit, and the T.F.R. “Trattamento di fine rapporto” in Italy, an amount paid to all workers in Italy at the moment they leave the company for any reason. This is another remuneration element, whose payment is deferred and annually allocated in proportion to fixed and variable remuneration both in kind and in cash, which is valued on a regular basis. The annual amount to be reserved is equivalent to the remuneration amount divided by 13.5. The annual cumulative fund is reviewed at a fixed interest rate of 1.5% plus 75% of the increase in the consumer price index (CPI).

In addition, within this line, there are included various retirement and / or permanence prizes that are contemplated in the Collective Labour Agreements which is applicable in Spain.

At the end of 2018, the liabilities entered against this item were of 16,740 thousand euros (16,245 thousand euros at 31 December 2017).

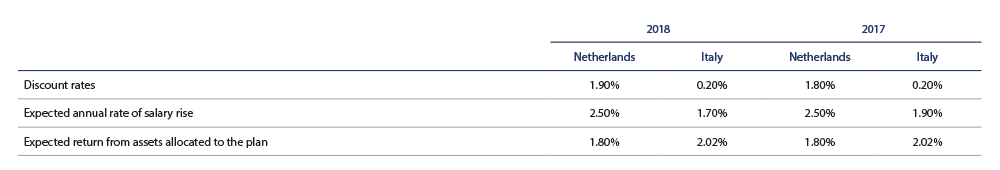

The breakdown of the main assumptions used to calculate actuarial liabilities is as follows:

Other claims

The “Other claims” item includes provisions for disputes and risks that the Group considers likely to occur. Among the most significant are the provisions created on the basis of the action brought in the proceedings claiming breach of contract in a property development, as well as other claims received in relation to the termination of certain leases where certain amounts are claimed. No decision on these claims is expected in the short term (see Note 22).