2.5.1 Subsidiaries (See Appendix I)

Subsidiaries are considered as any company included within the scope of consolidation in which the Parent Company directly or indirectly controls their management due to holding the majority of voting rights in the governance and decision-making body, with the ability to exercise control. This ability is shown when the Parent Company has the power to direct an investee entity’s financial and operating policy in order to obtain profits from its activities.

The financial statements of subsidiaries are consolidated with those of the Parent Company by applying the full consolidation method. Consequently, all significant balances and effects of any transactions taking place between them have been eliminated in the consolidation process. If necessary, adjustments are made to the financial statements of the subsidiaries to adapt the accounting policies used to those used by the Group.

Stakes held by non-controlling shareholders in the Group’s equity and results are respectively presented in the “Non-controlling interests” item of the consolidated balance sheet and of the consolidated comprehensive profit and loss statement.

The profit or loss of any subsidiaries acquired or disposed of during the financial year are included in the consolidated comprehensive profit and loss statement from the effective date of acquisition or until to the effective date of disposal, as appropriate.

2.5.2 Associates (See Appendix II)

Associates are considered as any companies in which the Parent Company has the ability to exercise significant influence, though it does not exercise either control or joint control. In general terms, it is assumed that significant influence exists when the percentage stake (direct or indirect) held by the Group exceeds 20% of the voting rights, as long as it does not exceed 50%.

Associates are valued in the consolidated financial statements using the equity method; in other words, through the fraction of their net equity value the Group’s stake in their capital represents once any dividends received and other equity retirements have been considered. In the case of transactions with an associated company, the corresponding losses or gains are eliminated in the percentage of the Group’s stake in its capital.

The profit (loss) net of tax of the associate companies is included in the Group’s consolidated comprehensive profit and loss statement, in the item “Profit (Loss) from entities valued through the equity method”, according to the percentage of the Group’s stake.

If, as a result of the losses incurred by an associate company, its equity were negative, in the Group’s consolidated balance sheet it would be nil; unless there were an obligation on the part of the Group to support it financially

2.5.3 Foreign currency translation

The following criteria have been different applied for converting into euros the different items of the consolidated balance sheet and the consolidated comprehensive profit and loss statement of foreign companies included within the scope of consolidation:

- Assets and liabilities have been converted by applying the effective exchange rate prevailing at year-end.

- Equity has been converted by applying the historical exchange rate. The historical exchange rate existing at 31 December 2003 of any companies included within the scope of consolidation prior to the transitional date has been considered as the historical exchange rate.

- The consolidated comprehensive profit and loss statement was translated at the average exchange rate for the year, except for the companies in Argentina whose economy was declared hyperinflationary in 2018 and therefore, in accordance with IAS 29, their consolidated comprehensive profit and loss statement was translated at the end-of-period exchange rate (see Note 4.23).

Any difference resulting from the application these criteria have been included in the “Translation differences” item under the “Equity” heading (except for those arising from the translation of hyperinflationary economies).

Any adjustments arising from the application of IFRS at the time of acquisition of a foreign company with regard to market value and goodwill are considered as assets and liabilities of such company and are therefore converted using the exchange rate prevailing at year-end.

2.5.4 Changes in the scope of consolidation

The most significant changes in the scope of consolidation during 2018 and 2017 that affect the comparison between financial years were the following:

a.1 Changes in the scope of consolidation in 2018

a.1.1 Additions to the consolidation scope

On 5 July 2018, the Group acquired 16,693 shares with a par value of 60.1 euros/share of Grupo Palacio de la Merced, S.A. for 1,000 thousand euros. The Group already had control of this company with an ownership interest of 72%; after the acquisition, the ownership interest amounts to 88%. The effect of the acquisition has been to reduce the value of minority interests by 1,568 thousand euros and to improve consolidated reserves by 568 thousand euros (see Note 14.4).

In the first half of 2018, the Group acquired 23.53% of NH Logroño, S.A. for 500 thousand euros, and now owns 100% of this company; the effect on minority interests has led to a reduction of 578 thousand euros as a minority interest (see Note 14.4) and higher consolidated reserves of 78 thousand euros.

a.1.2 Disposals to the consolidated scope

During the first six months of 2018, the Group liquidated Hotel&Congress Technology, S.L. and Hoteleira Brasil LTDA, in which it held 50% and 100% of equity, respectively. The net result of these liquidations produced a consolidated negative result of 40 and 45 thousand euros respectively.

In addition, in May 2018, the company belonging to the consolidated group Fast Good Islas Canarias, S.L. was liquidated. This liquidation had no impact on consolidated profit for the year.

a.2 Changes in the scope of consolidation in 2017

a.2.1 Additions to the consolidation scope

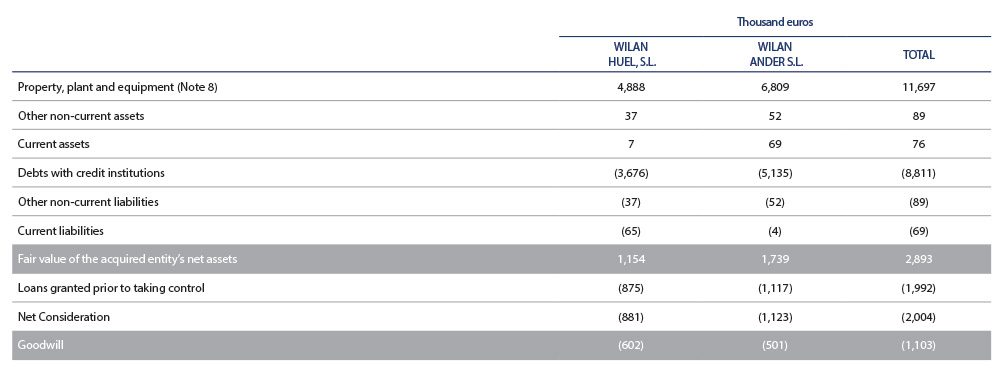

On 17 November 2017, the Group acquired 100% of the share capital of Wilan Ander S.L. and Wilan Huel, S.L., as well as the assignment of the credit which the seller had with these companies. These companies owned the properties operated by NH Hoteles España, such as the hotels NH Ciudad de Santander and NH Luz de Huelva, until the date of taking control under the lease.

Said acquisition was carried out in accordance with that stipulated in IFRS 3 Business Combinations. The effect of the acquisition on the consolidated financial position statement due to their fair values at 31 December 2017 was as follows:

The Group had granted subordinated loans amounting to 1,117 thousand euros to Wilan Ander, S.L. and 875 thousand euros to Wilan Huel, S.L. which the Group capitalised in the respective subsidiaries; the difference of 1,103 thousand euros corresponds to the Goodwill arising from the operation (see Note 6) and has been recorded against results.

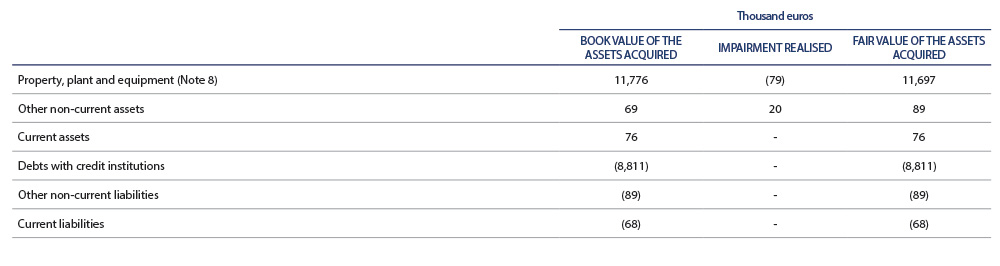

In addition, the detail of the book value of the assets acquired and the revaluation carried out is as follows:

a.2.2 Disposals

On 19 April 2017 the Group sold 400,000 registered shares making up the equity capital of the commercial company Hesperia Enterprises de Venezuela, S.A. for 70,000 US dollars. The net result of the transaction was a consolidated profit of 3 thousand euros. An expenditure of 5,785 thousand euros was also recorded owing to the conversion differences associated with the aforementioned shareholding, which is entered in the net exchange differences item of the abridged consolidated comprehensive results.

2.5.5 Intra-group eliminations

All accounts receivable and accounts payable, and transactions performed between subsidiaries, with associate companies and joint ventures, and among each other, have been eliminated in the consolidation process.

2.5.6 Valuation uniformity

The consolidation of the entities included in the scope of consolidation has been performed based on their individual financial statements, which are prepared in accordance with the Spanish General Accounting Plan for companies resident in Spain and in accordance with their own local regulations for foreign companies. All significant adjustments necessary to adapt them to International Financial Reporting Standards and/or homogenise them with the accounting principles of the parent company have been considered in the consolidation process.